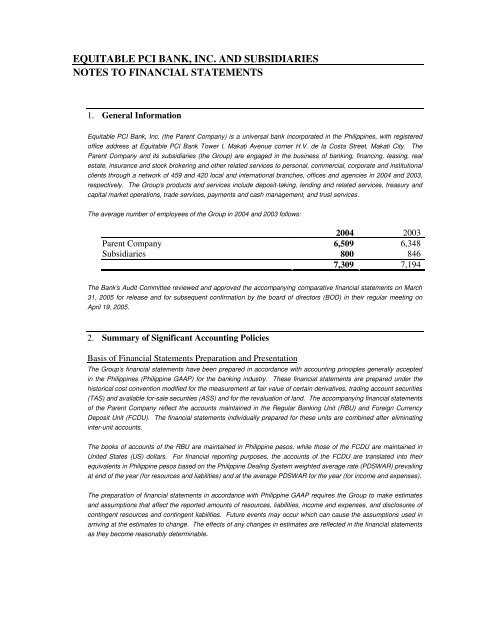

EQUITABLE PCI BANK, INC. AND SUBSIDIARIESNOTES TO FINANCIAL STATEMENTS1. General InformationEquitable PCI Bank, Inc. (the Parent Company) is a universal bank incorporated in the Philippines, with registeredoffice address at Equitable PCI Bank Tower I, Makati Avenue corner H.V. de la Costa Street, Makati City. TheParent Company and its subsidiaries (the Group) are engaged in the business of banking, financing, leasing, realestate, insurance and stock brokering and other related services to personal, commercial, corporate and institutionalclients through a <strong>net</strong>work of 459 and 420 local and international branches, offices and agencies in <strong>2004</strong> and 2003,respectively. The Group’s products and services include deposit-taking, lending and related services, treasury andcapital market operations, trade services, payments and cash management, and trust services.The average number of employees of the Group in <strong>2004</strong> and 2003 follows:<strong>2004</strong> 2003Parent Company 6,509 6,348Subsidiaries 800 8467,309 7,194The Bank’s Audit Committee reviewed and approved the accompanying comparative financial statements on March31, 2005 for release and for subsequent confirmation by the board of directors (BOD) in their regular meeting onApril 19, 2005.2. Summary of Significant Accounting PoliciesBasis of Financial Statements Preparation and PresentationThe Group’s financial statements have been prepared in accordance with accounting principles generally acceptedin the Philippines (Philippine GAAP) for the banking industry. These financial statements are prepared under thehistorical cost convention modified for the measurement at fair value of certain derivatives, trading account securities(TAS) and available for-sale securities (ASS) and for the revaluation of land. The accompanying financial statementsof the Parent Company reflect the accounts maintained in the Regular Banking Unit (RBU) and Foreign CurrencyDeposit Unit (FCDU). The financial statements individually prepared for these units are combined after eliminatinginter-unit accounts.The books of accounts of the RBU are maintained in Philippine pesos, while those of the FCDU are maintained inUnited States (US) dollars. For financial reporting purposes, the accounts of the FCDU are translated into theirequivalents in Philippine pesos based on the Philippine Dealing System weighted average rate (PDSWAR) prevailingat end of the year (for resources and liabilities) and at the average PDSWAR for the year (for income and expenses).The preparation of financial statements in accordance with Philippine GAAP requires the Group to make estimatesand assumptions that affect the reported amounts of resources, liabilities, income and expenses, and disclosures ofcontingent resources and contingent liabilities. Future events may occur which can cause the assumptions used inarriving at the estimates to change. The effects of any changes in estimates are reflected in the financial statementsas they become reasonably determinable.

Changes in Accounting PoliciesOn January 1, <strong>2004</strong>, the following new accounting standards became effective and were adopted by the Group:Statement of Financial Accounting Standards (SFAS) 12/International Accounting Standard (IAS) 12, Income Taxes,requires deferred income taxes to be determined using the balance sheet liability method. The adoption of thisstandard resulted in a retroactive downward adjustment to surplus as of December 31, 2003, 2002 and 2001amounting to P=1.9 billion, P=2.1 billion and P=2.2 billion, respectively. Net income increased by P=165.8 million in 2003and P=166.7 million in 2002.In accordance with this new standard, deferred income tax liability is provided on revaluation increment of property,plant and equipment on a retroactive basis, which decreased capital funds by P=628.0 million, P=627.7 million and P=616.2 million as of December 31, 2003, 2002 and 2001, respectively.• SFAS 17/IAS 17, Leases, prescribes the accounting policies and disclosures applicable to finance andoperating leases. The adoption of the standard resulted in the recognition of lease income and expense underoperating leases on a straight-line basis. Previously, all leases were recognized in the statements of income onthe basis of the terms of the lease agreements. The adoption of this accounting standard resulted in aretroactive downward adjustment to surplus as of December 31, 2003, 2002 and 2001 amounting to P=206.6million, P=177.4 million and P=158.9 million, respectively. Net income decreased by P=29.1 million in 2003 andP=18.5 million in 2002.Additional disclosures required by the new standards have been included in the financial statements, whereapplicable.New accounting standards based on IAS and International Financial Reporting Standards, referred to as PhilippineAccounting Standards (PAS) and Philippine Financial Reporting Standards (PFRS), respectively, will becomeeffective in 2005. The Group will adopt the following new accounting standards approved by the AccountingStandards Council, to the extent that they are applicable, effective January 1, 2005:• PAS 19, Employee Benefits, provides for the accounting for long-term and other employee benefits. Thestandard requires the projected unit credit method in determining the retirement benefits of the employees anda change in the manner of computing benefit expense relating to past service cost and actuarial gains andlosses. It requires the Group to determine the present value of defined benefit obligations and the fair value ofany plan assets with sufficient regularity that the amounts recognized in the financial statements do not differmaterially from the amounts that would be determined at the statement of condition date.The effect of adopting this standard will result in either a transition liability or an asset with a correspondingadjustment to surplus as of January 1, 2005. The Group will engage the services of professionally qualified actuaryto determine the quantitative impact of adopting this standard in 2005.• PAS 21, The Effects of Changes in Foreign Exchange Rates, prohibits the capitalization of foreign exchangelosses. The standard also addresses the accounting for transactions in foreign currency and translating thefinancial statements of foreign operations that are included in those of the reporting enterprise by consolidation,proportionate consolidation and equity method. The adoption of this standard will have no material impact onthe financial statements.• PAS 30, Disclosures in the Financial Statements of Banks and Similar Financial Institutions, provides for therequired disclosure and presentation in respect of the accounts of banks and similar financial institutions. It alsoprovides that provision for general banking risk is treated as appropriation of surplus and should not be includedin the determination of <strong>net</strong> income for the period. The Group has yet to determine the effect of this standard inthe context of the need to reallocate the general reserve to cover any increase in specific loan loss reservesrequired under PAS 39 (see discussion on PAS 39 below). The required new disclosures will be included in thefinancial statements upon adoption of this new standard in 2005.- 41-