2004 - Asianbanks.net

2004 - Asianbanks.net

2004 - Asianbanks.net

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

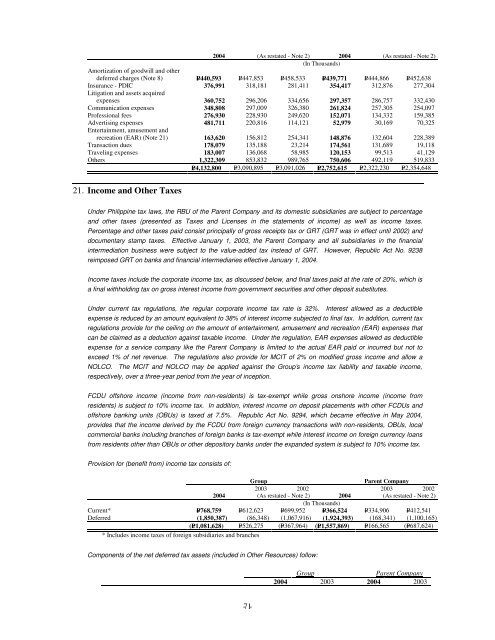

<strong>2004</strong> (As restated - Note 2) <strong>2004</strong> (As restated - Note 2)(In Thousands)Amortization of goodwill and otherdeferred charges (Note 8) P=440,593 P=447,853 P=458,533 P=439,771 P=444,866 P=452,638Insurance - PDIC 376,991 318,181 281,411 354,417 312,876 277,304Litigation and assets acquiredexpenses 360,752 296,206 334,656 297,357 286,757 332,430Communication expenses 348,808 297,009 326,380 261,824 257,305 254,097Professional fees 276,930 228,930 249,620 152,071 134,332 159,385Advertising expenses 481,711 220,816 114,121 52,979 30,169 70,325Entertainment, amusement andrecreation (EAR) (Note 21) 163,620 156,812 254,341 148,876 132,604 228,389Transaction dues 178,079 135,188 23,214 174,561 131,689 19,118Traveling expenses 183,007 136,068 58,985 120,153 99,513 41,129Others 1,322,309 853,832 989,765 750,606 492,119 519,833P=4,132,800 P=3,090,895 P=3,091,026 P=2,752,615 P=2,322,230 P=2,354,64821. Income and Other TaxesUnder Philippine tax laws, the RBU of the Parent Company and its domestic subsidiaries are subject to percentageand other taxes (presented as Taxes and Licenses in the statements of income) as well as income taxes.Percentage and other taxes paid consist principally of gross receipts tax or GRT (GRT was in effect until 2002) anddocumentary stamp taxes. Effective January 1, 2003, the Parent Company and all subsidiaries in the financialintermediation business were subject to the value-added tax instead of GRT. However, Republic Act No. 9238reimposed GRT on banks and financial intermediaries effective January 1, <strong>2004</strong>.Income taxes include the corporate income tax, as discussed below, and final taxes paid at the rate of 20%, which isa final withholding tax on gross interest income from government securities and other deposit substitutes.Under current tax regulations, the regular corporate income tax rate is 32%. Interest allowed as a deductibleexpense is reduced by an amount equivalent to 38% of interest income subjected to final tax. In addition, current taxregulations provide for the ceiling on the amount of entertainment, amusement and recreation (EAR) expenses thatcan be claimed as a deduction against taxable income. Under the regulation, EAR expenses allowed as deductibleexpense for a service company like the Parent Company is limited to the actual EAR paid or incurred but not toexceed 1% of <strong>net</strong> revenue. The regulations also provide for MCIT of 2% on modified gross income and allow aNOLCO. The MCIT and NOLCO may be applied against the Group’s income tax liability and taxable income,respectively, over a three-year period from the year of inception.FCDU offshore income (income from non-residents) is tax-exempt while gross onshore income (income fromresidents) is subject to 10% income tax. In addition, interest income on deposit placements with other FCDUs andoffshore banking units (OBUs) is taxed at 7.5%. Republic Act No. 9294, which became effective in May <strong>2004</strong>,provides that the income derived by the FCDU from foreign currency transactions with non-residents, OBUs, localcommercial banks including branches of foreign banks is tax-exempt while interest income on foreign currency loansfrom residents other than OBUs or other depository banks under the expanded system is subject to 10% income tax.Provision for (benefit from) income tax consists of:GroupParent Company2003 2002 2003 2002<strong>2004</strong> (As restated - Note 2) <strong>2004</strong> (As restated - Note 2)(In Thousands)Current* P=768,759 P=612,623 P=699,952 P=366,524 P=334,906 P=412,541Deferred (1,850,387) (86,348) (1,067,916) (1,924,393) (168,341) (1,100,165)(P=1,081,628) P=526,275 (P=367,964) (P=1,557,869) P=166,565 (P=687,624)* Includes income taxes of foreign subsidiaries and branchesComponents of the <strong>net</strong> deferred tax assets (included in Other Resources) follow:GroupParent Company<strong>2004</strong> 2003 <strong>2004</strong> 2003- 71-