T-Card Reconciliation Business Process

T-Card Reconciliation Business Process

T-Card Reconciliation Business Process

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

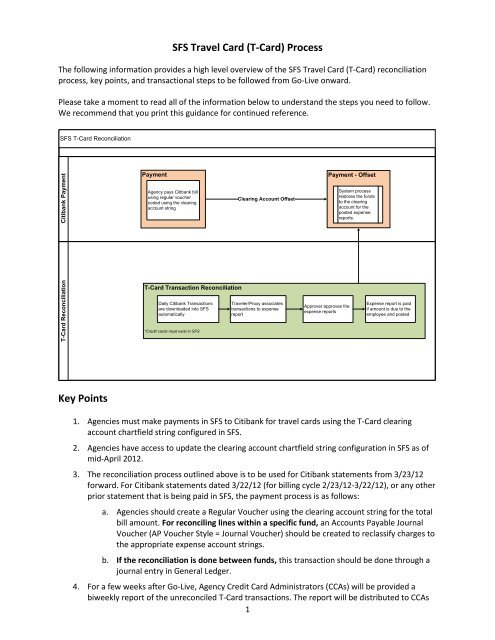

SFS Travel <strong>Card</strong> (T-<strong>Card</strong>) <strong>Process</strong>The following information provides a high level overview of the SFS Travel <strong>Card</strong> (T-<strong>Card</strong>) reconciliationprocess, key points, and transactional steps to be followed from Go-Live onward.Please take a moment to read all of the information below to understand the steps you need to follow.We recommend that you print this guidance for continued reference.SFS T-<strong>Card</strong> <strong>Reconciliation</strong>T-<strong>Card</strong> <strong>Reconciliation</strong> Citibank PaymentPaymentAgency pays Citibank billusing regular vouchercoded using the clearingaccount stringT-<strong>Card</strong> Transaction <strong>Reconciliation</strong>Daily Citibank Transactionsare downloaded into SFSautomatically*Credit cards must exist in SFSClearing Account OffsetTraveler/Proxy associatestransactions to expensereportApprover approves theexpense reportsPayment - OffsetSystem processrestores the fundsto the clearingaccount for theposted expensereports.Expense report is paidif amount is due to theemployee and postedKey Points1. Agencies must make payments in SFS to Citibank for travel cards using the T-<strong>Card</strong> clearingaccount chartfield string configured in SFS.2. Agencies have access to update the clearing account chartfield string configuration in SFS as ofmid-April 2012.3. The reconciliation process outlined above is to be used for Citibank statements from 3/23/12forward. For Citibank statements dated 3/22/12 (for billing cycle 2/23/12-3/22/12), or any otherprior statement that is being paid in SFS, the payment process is as follows:a. Agencies should create a Regular Voucher using the clearing account string for the totalbill amount. For reconciling lines within a specific fund, an Accounts Payable JournalVoucher (AP Voucher Style = Journal Voucher) should be created to reclassify charges tothe appropriate expense account strings.b. If the reconciliation is done between funds, this transaction should be done through ajournal entry in General Ledger.4. For a few weeks after Go-Live, Agency Credit <strong>Card</strong> Administrators (CCAs) will be provided abiweekly report of the unreconciled T-<strong>Card</strong> transactions. The report will be distributed to CCAs1

through Report Manager. Eventually, a new report will be made available to CCAs which theycan run themselves as needed.T-<strong>Card</strong> Transaction <strong>Process</strong>ing1. As indicated in the 4/11/12 communication on the Unreconciled T-<strong>Card</strong> Transaction <strong>Process</strong>,any transactions posted prior to 3/23/12 must be reconciled outside of SFS, and the net amountdue to the employees should be entered in SFS. For example, an employee who traveledovernight and incurred $104 in lodging on his travel card would reconcile the $104 outside ofSFS and submit an expense report for his remaining expenses.2. The first T-<strong>Card</strong> transactions loaded into SFS will be for transactions dated 3/23/12 and after.3. Travelers will be able to submit expense reports beginning 4/13/12 for the T-<strong>Card</strong> transactionsin the billing period 3/23/12-4/22/12.4. The travel card statement bill must be paid using a “Regular Voucher,” Citibank T-<strong>Card</strong> vendorID 1000031857, and the T-<strong>Card</strong> clearing account chartfield string that was configured for yourAgency.5. After the payment is posted, the total amount of funds on approved expense reports is creditedback to the T-<strong>Card</strong> clearing account string.Important Note: Agencies should be aware that payment of the bill for each statement is the triggerthat replenishes the funds in the clearing account to allow for continued reconciliation of charges.2