Course outline - York University

Course outline - York University

Course outline - York University

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

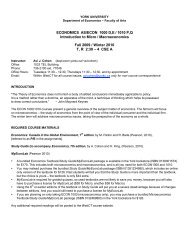

<strong>York</strong> <strong>University</strong>AP Economics 4083 3.00 W MEconomics of Information and IncentivesWinter 2011Time and Location: T 16:00-19:00, CC 211.Instructor: Adam Wilczynski, VH 1054, tel.416-736-2100, ext. 20577.Email: adamw at econ.yorku.ca. Any online class material will be posted at http://econ.yorku.ca/~adamw/Econ4083.htmOffi ce Hours: Tu, Th 10:20-11:40am, T 3-3:45pm or by appointmentTextbook and Readings: .There is no required textbook, lectures will be based on material from a numberof articles and books. The four books the class will draw on the most are:[FR] Freixas, X, and Rochet, J.-C., "Microeconomics of Banking", 2nd edition, The MIT Press 2007.[S] Salanie, B., "The Theory of Contracts", 2nd edition, The MIT Press, 2006.[T-IO] Tirole, J., "Industrial Organization" The MIT Press 1988.[T-CF] Tirole, J., "The Theory of Corporate Finance" The MIT Press 2006[V] Vives, X., "Information and Learning in Markets" Princeton <strong>University</strong> Press, 2008.Class folder with additional readings will be placed on reserve in Scott Library.Prerequisites: Intermediate microeconomics is the only required prerequisite. The class will rely heavilyon theory of strategic interactions, so some familiarity with game theory and/or advanced microeconomicsis strongly recommended. There will be a brief game theory introduction/refresher in first two weeks of thecourse.Outline: In many settings– markets for labor, insurance, credit, among others—trade between two partiesdoes not take the form of a one-off spot transaction. Instead, parties engage in a sequence of interactions. Inthis class we study economic issues specific to such relationships: informational asymmetries, misalignmentof incentives, enforcement, renegotiation. We will focus on models rich enough to discuss optimal contractdesign as well as the effects of, and need for, external regulation. Examples and applications will mainlyinvolve firm theory, organizational economics, corporate finance, insurance and labor. The detailed topicslist follows. We will not stick to the list linearly: for time - see class log on course website for each week’smaterial..0. Introduction and Motivation.0.1 Organizational economics and the theory of firm. The f = (k, l) model versus reality. Why doesfirm’s capital structure matter in real world?0.2. Advantages and drawbacks of debt and equity financing. Advantages and drawbacks of debt andequity claims concentration.Readings: Lecture notes from class folder in library.1. Noncooperative game theory refresher1.1 Strategies in normal and extensive form; mixed strategies1.2 Solving games: Nash Equilibrium; Perfect Bayesian Equilibrium1.3 Signalling Games: pooling and separating equilibriaReadings: T-IO, chapter 11 (appendix on Game Theory).2. Industrial organization of markets with informational asymmetries.2.1 First, second and third-order price discrimination.2.2 Application: Insurance.Readings: T-IO, chapter 33. Intermediaries in markets with informational frictions (6 weeks)

3.1 Banks as coalitions of depositors with liquidity insurance. The Diamond-Dybvig model.3.2 Banks as delegated monitors.3.3. The tradeoff between competition among intermediaries and stability; modelling the subprimelending crisis.Readings: FR, sections 2.2, 2.4, 3.5.4.Trade in markets with asymmetric information and adverse selection.4.1 The basic model with two risk types; pooling and separating equilibria.4.2 Insurance markets. The Rothschild-Stiglitz equilibrium.4.3 Auctions.4.4 Corporate Debt Financing under Asymmetric Information.4.5 Corporate Equity Financing under Asymmetric Information.Readings: 4.1-4.3: S, sections 2.2, 2.3, 3.1.3, 3.2, 3.2.3. 4.4-4.5: T-CF, sections 6.2, 6.3; FR, section 2.35.Contracting under moral hazard5.1. The basic model with risk-averse agent and unobservable effort5.2 The model based on limited liability.5.3 Dynamic moral hazard. Intertemporal incentive tie-ins. Career concerns.5.4. Insurance and moral hazard.5.5 Moral hazard and corporate financing. Role of monitoringReadings: S, sections 5.1, 5.2, 5.3.3; T-CF sections 3.2, 3.36.Information aggregation in markets (if time permits)Readings: V, sections 1.1-1.6.7.Empirical studies (if time permits)Readings: TBA. Articles will be placed in class folder.Grading: There will be a midterm exam (40% of final grade) on February 15, and a final (60%) in April.Class participation and activity may count in marginal cases.Makeup Exam Policy: A student absent from writing an exam(s) will receive a mark of ’0’for the missedexam.There will be no opportunity for make-up or deferred exam(s) regardless of the circumstances.Academic Honesty Policy: Conduct that violates the ethical or legal standards of the <strong>University</strong> communityor of one’s program or specialization may result in serious consequences. Students should look at theSENATE POLICY ON ACADEMIC HONESTY found in the following locations: 1. The New Students’Handbook (p. 33): http://www.arts.yorku.ca/pdfs/NSH_0607.pdf 2. The <strong>York</strong> <strong>University</strong> Secretariat:http://www.yorku.ca/secretariat/policies/document.php?document=692