Solution - York University

Solution - York University

Solution - York University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

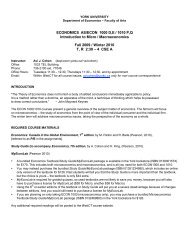

<strong>York</strong> <strong>University</strong>Department of EconomicsFaculty of ArtsAS/ECON 3140NMonetary EconomicsProfessor Tasso AdamopoulosAnswers to Assignment 2April 12, 20061. The statement is false. According to the principle of rate of return equality for any setof assets to co-exist (be held concurrently by individuals), they must share the same rateof return. The inherent assumption for this statement is that these assets are viewedas perfect substitutes by the individuals who hold them. If money has a lower rate ofreturn than other assets then we should not expect people to hold money. In the realworld, the rate of return to money is dominated by the returns of other assets. Yetmoney is held extensively. People might hold money even though it has a lower rate ofreturn for several reasons. We looked at two in class. (1) It could be the case that otherassets are riskier and therefore risk averse individuals require additional compensation(risk premium) in order to hold those assets relative to money. (2) Money could be heldfor the short-run while other assets (e.g. capital) could be held in the long-run. Underthis scenario, money serves as a medium of exchange that eases transactions betweenindividuals. Capital on the other hand offers a good return only if it is held over a longerhorizon.2. The statement is true regarding the slope of the Phillips Curve but false about the policyadvice. The policy recommendation fails to account for the Lucas critique: when policychanges, individuals change their behavior in response to that policy. Thus reduced formcorrelations such as the ones mentioned in the question are subject to change when the“rules of the game” under which people make decisions change. When the monetaryauthority causes surprise inflation it can manage to increase output because individualsare confused about the true state of the world. They mis-interpret the increase in the pricelevel, caused by the money stock increase, as an increase in the demand for their product,and thus produce more. If the monetary authority tries to exploit this, by permanentlyswitching to an inflationary policy, rational individuals will realize this and will not befooled about the true state of the world. When inflation is anticipated then individuals1

will choose to produce less to avoid the implicit taxation. Thus, if the monetary authoritycontinues to inflate it will end up reducing output rather than increasing it.3. (a) The budget constraints for the individual are the following.When young (first period of life):c 1,t + v t m t + k t ≤ y (1)When middle-aged (second period of life):c 2,t+1 ≤ v t+1 m t (2)When old (third period of life):c 3,t+2 ≤ ψy + Θk t (3)Combining these three constraints we can derive the individual’s lifetime budgetconstraint:c 1,t +v tv t+1c 2,t+1 + c 3,t+2Θ ≤ y[1 + ψ Θ ] (4)The one-period equilibrium rate of return to money when there is population growthis: v t+1v t= n. Therefore the rate of return to money, if money is held for two periods,is n 2 . The rate of return to capital is Θ over a two-period horizon. Since byassumption, Θ > n 2 , capital offers a better return over the long-run. Thus rationalagents will hold only capital to provide for their consumption when old. The rateof return on capital over the a one-period horizon is 0 since capital pays returnonly after two periods.consumption when middle-aged.Thus people will hold only money to provide for their(b) Rate of return equality does not hold in the usual sense, since the two assets paydifferent rates of return across each horizon. According to the rate of return equalityprinciple if two assets have different rates of return individuals should be holdingonly one of the two: the one that offers the highest rate of return. Therefore therate of return equality principle still holds but in a modified sense: it holds foreach horizon. In the short-run, money has the highest rate of return and thus onlymoney is held. In the long-run, capital dominates in the rate of return, and thusonly capital is held.(c) If I am the only one who can issue IOUs over one-period intervals then I can executethe following arbitrage plan: I can borrow one unit of the consumption good in2

period t from a young individual in that period and invest it in capital. Given thatI am borrowing for one period, in t + 1 I will have to return to the individual fromwhom I borrowed n goods (recall: I have to give him at least as much as he would getfrom using fiat money to transfer purchasing power over time). Since the capital inwhich I invested is not going to pay back until period t+2, when period t+1 arrivesI have to borrow from a young individual in that period n consumption goods topay back the young of period t. In period t+2 I will owe to the young from t+1, n 2goods. But that is not a problem because I will receive by that time the return tocapital: Θ > n 2 . This is how I can make a profit by exploiting differences in rates ofreturn across different horizons (arbitrage). If I am not the only one issuing IOUsthen in equilibrium the real interest rate will be r ∗ = √ Θ. The reason is that newfinancial intermediaries will enter the industry until all profits are exhausted.(d) The expected return on a two-period IOU would be E(r) = σΘ + (1 − σ). Since,σΘ + (1 − σ)Θ > σΘ + (1 − σ), it follows that E(r) < Θ. Thus, a risk neutralindividual will not hold two-period IOUs. If the individual is risk averse he wantsadditional compensation for the extra risk, i.e., he wants a risk premium on hisreturn. If RP is the risk premium then the total return from going with the IOUis E(r) + RP . If the rate of return on capital is taxed then you earn Θ(1 − τ).Depending on the size of RP and τ, the net returns can differ or not.4. (a) The feasibility constraint is:N t c 1,t + N t−1 c 2,t ≤ N t yIf we have a stationary allocation, in per young person terms the resource constraintis:c 1 + c 2n ≤ y(b) The budget constraints for the individual in the first (when young) and second(when old) periods of his life are:The lifetime budget constraint is then:c 1,t +c 2,t+1 ≤ v t+1 m t + a t+1v tc 2,t+1 ≤ y +v ta t+1v t+1 v t+1Use the market clearing condition for money to solve for the equilibrium rate ofreturn: v t M t = (y − c 1,t )N t . Solve this for v t and forward it one period to get the3

equilibrium rate of return to fiat money:budget constraint in equilibrium is:v t+1v t= n z> 1. Thus the resulting lifetimec 1 + z n c 2 ≤ y + z n aCompare the lifetime budget constraint to the resource constraint. Since z > 1, theyare different and thus the decentralized solution does not obey the golden rule. Thereason is that inflation makes people hold less money than they otherwise would.The graph you have to put down is in Fig.1. Clearly money is not superneutralbecause the growth rate of money affects real allocations.(c) A policy of fixing the price level means setting z = n. If the money supply is setto grow at the same rate as the economy (population growth rate) then the rate ofreturn to fiat and the price level will both be constant. In this case the resourceconstraint is the same as before: c 1 + c 2n≤ y. The lifetime budget constraint thoughbecomes: c 1 + c 2 ≤ y + a. The golden rule allocation is still not achieved. Theargument is similar as before. See pp. 57-59 for the details. The graph you needis provided in Fig.2. Note that the initial old still prefer the golden rule over thispolicy too.(d) The first and second period budget constraints are:c 1,t + v t m t + k + t ≤ yc 2,t+1 ≤ v t+1 m t + αk t + a t+1The rate of return to money in a stationary allocation is:v t+1v t= n z> 1, while therate of return to capital is α < 1. Since, α < n , according the principle of rate ofzreturn equality, only fiat money will be held and thus k = 0 in equilibrium.(e) (8 marks) Recall that in part (d) we showed that money will be held only. Since thereis no capital, we have to show the effects of these policies in a monetary economyonly. With government expenditures you can show that the resource constraint peryoung person is:c 1 + c 2n + g n ≤ y.If the government decides to finance the expenditures through seignorage then thelifetime budget constraint for an individual is:c 1 + c 2zn ≤ y4

If the government uses lump-sum taxes instead and balances its budget (g = τ)then the lifetime budget constraint for an individual is:c 1 + c 2n ≤ y − τ nwhich is identical to the resource constraint.Therefore the policy of lump-sumtaxation is welfare superior, because it does not lead to any distortion. This canalso be shown graphically. See Fig.3.(f) The expected inflation rate is: E(z) = 0.6(1) + 0.4(2) = 1.4. The expected rate of5. (28 marks)return to money is: E( v t+1v t) = 0.6( n) + 0.4( n ). In this environment people are not1 2confused about the sources of inflation. They know that if the price level rises itis because the monetary authority increased the growth rate of the money supply.They can infer this directly from the market clearing condition for money. Thus anincrease in z here means that people will hold less money, they will work less, andthus will produce less.(a) The resource constraint is:N t c 1,t + N t−1 c 2,t + N t k t ≤ θk t−1 N t−1 + (1 − δ)k t−1 N t−1In per young person terms this becomes (within the set of stationary allocations)c 1 + c 2n + k ≤ k [θ + 1 − δ]n(b) The individual’s budget constraints when young and old are:c 1,t + k t ≤ yc 2,t+1 ≤ θk t + (1 − δ)k tThe lifetime budget constraint (with a stationary allocation) isc 1 +c 21 + θ − δ ≤ yThis is the budget constraint in equilibrium too because we know the rate of returnto capital is constant. See Fig.4 for graph.(c) The golden rule level of the capital stock is that which maximizes net output, i.e.,the total stock of goods available for the consumption of the young and the old.This occurs where MB = MC from increasing the capital stock. This occurs whereMP Kn= 1 or where 1 + θ = δ + n.5

(d) When capital exhibits diminishing MPK the resource constraint in per young personterms is:c 1 + c 2n+ k ≤ y +f(k) + (1 − δ)knThe optimal level of the capital stock, ̂k, must satisfy again MB = MC. In thiscase the condition boils down to: f ′ (k)+(1−δ)n(e) The rate of return to money is:v t+1v t= n z= 1. See Fig.5.interest rate, r t . If all three assets are held that means that:. The rate of return to IOUs is the realv t+1v t= r t = f ′ (k)+(1−δ)n. Then an increase in z causes a decrease inor equivalently that, n zthe return to money and thus a decrease in the MP K, inducing an increase in the= f ′ (k)+(1−δ)ncapital stock. This is the Tobin Effect. The nominal interest rate is: R t = r t ( p t+1p t).A rise in z increases p t+1p t= z . This will cause an increase in R n t but this will not beone for one because at the same time we showed that r t falls (since the MPK falls).6

Figure 1c 2Feasibility constraintc 1yy(n/z) + aASMEc 2*Budget constraintc 1*yy + (z/n)a

Figure 2c 2Feasibility constraintc 1yy + aASMEc 2*Budget constraintc 1*yy + a

Figure 3c 2 Feasibility constraintc 1ny(n/z)yBudget constraintwith seigniorageyBudget constraintwith lump sum tax

Figure 4c 2c 1y(1+θ-δ)c 2*Stationary equmc 1*y

MB, MCFigure 51 MCMB = (f’(k) + 1- δ)/nk