Computing & internet software global report 2010.pdf - IMAP

Computing & internet software global report 2010.pdf - IMAP

Computing & internet software global report 2010.pdf - IMAP

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

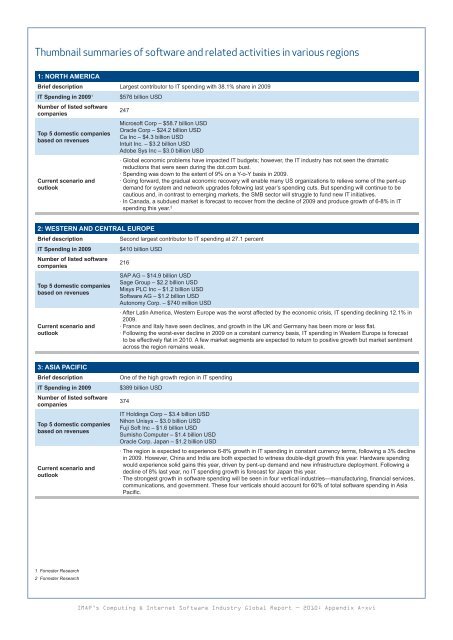

Thumbnail summaries of <strong>software</strong> and related activities in various regions1: NORTH AMERICABrief description Largest contributor to IT spending with 38.1% share in 2009IT Spending in 2009 1Number of listed <strong>software</strong>companiesTop 5 domestic companiesbased on revenuesCurrent scenario andoutlook$576 billion USD247Microsoft Corp – $58.7 billion USDOracle Corp – $24.2 billion USDCa Inc – $4.3 billion USDIntuit Inc. – $3.2 billion USDAdobe Sys Inc – $3.0 billion USD· Global economic problems have impacted IT budgets; however, the IT industry has not seen the dramaticreductions that were seen during the dot.com bust.· Spending was down to the extent of 9% on a Y-o-Y basis in 2009.· Going forward, the gradual economic recovery will enable many US organizations to relieve some of the pent-updemand for system and network upgrades following last year’s spending cuts. But spending will continue to becautious and, in contrast to emerging markets, the SMB sector will struggle to fund new IT initiatives.· In Canada, a subdued market is forecast to recover from the decline of 2009 and produce growth of 6-8% in ITspending this year. 22: WESTERN AND CENTRAL EUROPEBrief descriptionIT Spending in 2009Number of listed <strong>software</strong>companiesTop 5 domestic companiesbased on revenuesCurrent scenario andoutlookSecond largest contributor to IT spending at 27.1 percent$410 billion USD216SAP AG – $14.9 billion USDSage Group – $2.2 billion USDMisys PLC Inc – $1.2 billion USDSoftware AG – $1.2 billion USDAutonomy Corp. – $740 million USD· After Latin America, Western Europe was the worst affected by the economic crisis, IT spending declining 12.1% in2009.· France and Italy have seen declines, and growth in the UK and Germany has been more or less flat.· Following the worst-ever decline in 2009 on a constant currency basis, IT spending in Western Europe is forecastto be effectively flat in 2010. A few market segments are expected to return to positive growth but market sentimentacross the region remains weak.3: ASIA PACIFICBrief descriptionIT Spending in 2009Number of listed <strong>software</strong>companiesTop 5 domestic companiesbased on revenuesCurrent scenario andoutlookOne of the high growth region in IT spending$389 billion USD374IT Holdings Corp – $3.4 billion USDNihon Unisys – $3.0 billion USDFuji Soft Inc – $1.6 billion USDSumisho Computer – $1.4 billion USDOracle Corp. Japan – $1.2 billion USD· The region is expected to experience 6-8% growth in IT spending in constant currency terms, following a 3% declinein 2009. However, China and India are both expected to witness double-digit growth this year. Hardware spendingwould experience solid gains this year, driven by pent-up demand and new infrastructure deployment. Following adecline of 8% last year, no IT spending growth is forecast for Japan this year.· The strongest growth in <strong>software</strong> spending will be seen in four vertical industries—manufacturing, financial services,communications, and government. These four verticals should account for 60% of total <strong>software</strong> spending in AsiaPacific.1 Forrester Research2 Forrester Research<strong>IMAP</strong>’s <strong>Computing</strong> & Internet Software Industry Global Report — 2010: Appendix A-xvi