Computing & internet software global report 2010.pdf - IMAP

Computing & internet software global report 2010.pdf - IMAP

Computing & internet software global report 2010.pdf - IMAP

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

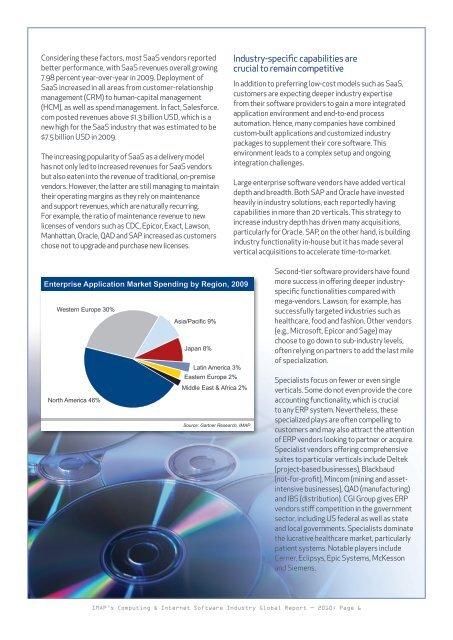

Considering these factors, most SaaS vendors <strong>report</strong>edbetter performance, with SaaS revenues overall growing7.98 percent year-over-year in 2009. Deployment ofSaaS increased in all areas from customer-relationshipmanagement (CRM) to human-capital management(HCM), as well as spend management. In fact, Salesforce.com posted revenues above $1.3 billion USD, which is anew high for the SaaS industry that was estimated to be$7.5 billion USD in 2009.The increasing popularity of SaaS as a delivery modelhas not only led to increased revenues for SaaS vendorsbut also eaten into the revenue of traditional, on-premisevendors. However, the latter are still managing to maintaintheir operating margins as they rely on maintenanceand support revenues, which are naturally recurring.For example, the ratio of maintenance revenue to newlicenses of vendors such as CDC, Epicor, Exact, Lawson,Manhattan, Oracle, QAD and SAP increased as customerschose not to upgrade and purchase new licenses.Industry-specific capabilities arecrucial to remain competitiveIn addition to preferring low-cost models such as SaaS,customers are expecting deeper industry expertisefrom their <strong>software</strong> providers to gain a more integratedapplication environment and end-to-end processautomation. Hence, many companies have combinedcustom-built applications and customized industrypackages to supplement their core <strong>software</strong>. Thisenvironment leads to a complex setup and ongoingintegration challenges.Large enterprise <strong>software</strong> vendors have added verticaldepth and breadth. Both SAP and Oracle have investedheavily in industry solutions, each <strong>report</strong>edly havingcapabilities in more than 20 verticals. This strategy toincrease industry depth has driven many acquisitions,particularly for Oracle. SAP, on the other hand, is buildingindustry functionality in-house but it has made severalvertical acquisitions to accelerate time-to-market.Enterprise Application Market Spending by Region, 2009Western Europe 30%Asia/Pacific 9%Japan 8%Latin America 3%Eastern Europe 2%Middle East & Africa 2%North America 46%Source: Gartner Research, <strong>IMAP</strong>Second-tier <strong>software</strong> providers have foundmore success in offering deeper industryspecificfunctionalities compared withmega-vendors. Lawson, for example, hassuccessfully targeted industries such ashealthcare, food and fashion. Other vendors(e.g., Microsoft, Epicor and Sage) maychoose to go down to sub-industry levels,often relying on partners to add the last mileof specialization.Specialists focus on fewer or even singleverticals. Some do not even provide the coreaccounting functionality, which is crucialto any ERP system. Nevertheless, thesespecialized plays are often compelling tocustomers and may also attract the attentionof ERP vendors looking to partner or acquire.Specialist vendors offering comprehensivesuites to particular verticals include Deltek(project-based businesses), Blackbaud(not-for-profit), Mincom (mining and assetintensivebusinesses), QAD (manufacturing)and IBS (distribution). CGI Group gives ERPvendors stiff competition in the governmentsector, including US federal as well as stateand local governments. Specialists dominatethe lucrative healthcare market, particularlypatient systems. Notable players includeCerner, Eclipsys, Epic Systems, McKessonand Siemens.<strong>IMAP</strong>’s <strong>Computing</strong> & Internet Software Industry Global Report — 2010: Page 6