Operational Notice - South African Reserve Bank

Operational Notice - South African Reserve Bank

Operational Notice - South African Reserve Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

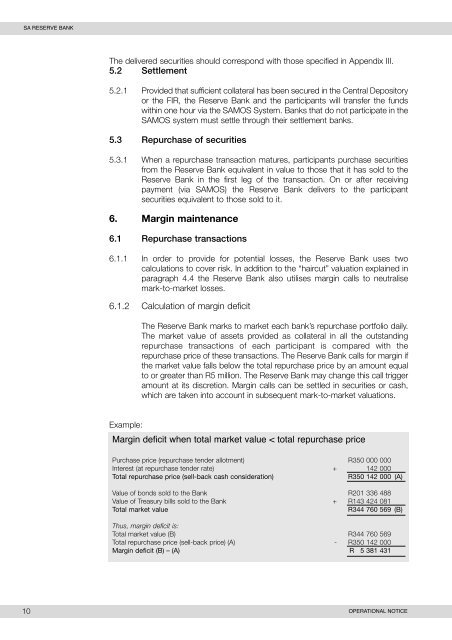

SA RESERVE BANKThe delivered securities should correspond with those specified in Appendix III.5.2 Settlement5.2.1 Provided that sufficient collateral has been secured in the Central Depositoryor the FIR, the <strong>Reserve</strong> <strong>Bank</strong> and the participants will transfer the fundswithin one hour via the SAMOS System. <strong>Bank</strong>s that do not participate in theSAMOS system must settle through their settlement banks.5.3 Repurchase of securities5.3.1 When a repurchase transaction matures, participants purchase securitiesfrom the <strong>Reserve</strong> <strong>Bank</strong> equivalent in value to those that it has sold to the<strong>Reserve</strong> <strong>Bank</strong> in the first leg of the transaction. On or after receivingpayment (via SAMOS) the <strong>Reserve</strong> <strong>Bank</strong> delivers to the participantsecurities equivalent to those sold to it.6. Margin maintenance6.1 Repurchase transactions6.1.1 In order to provide for potential losses, the <strong>Reserve</strong> <strong>Bank</strong> uses twocalculations to cover risk. In addition to the “haircut” valuation explained inparagraph 4.4 the <strong>Reserve</strong> <strong>Bank</strong> also utilises margin calls to neutralisemark-to-market losses.6.1.2 Calculation of margin deficitThe <strong>Reserve</strong> <strong>Bank</strong> marks to market each bank’s repurchase portfolio daily.The market value of assets provided as collateral in all the outstandingrepurchase transactions of each participant is compared with therepurchase price of these transactions. The <strong>Reserve</strong> <strong>Bank</strong> calls for margin ifthe market value falls below the total repurchase price by an amount equalto or greater than R5 million. The <strong>Reserve</strong> <strong>Bank</strong> may change this call triggeramount at its discretion. Margin calls can be settled in securities or cash,which are taken into account in subsequent mark-to-market valuations.Example:Margin deficit when total market value < total repurchase pricePurchase price (repurchase tender allotment) R350 000 000Interest (at repurchase tender rate) + 142 000Total repurchase price (sell-back cash consideration)R350 142 000 (A)Value of bonds sold to the <strong>Bank</strong> R201 336 488Value of Treasury bills sold to the <strong>Bank</strong> + R143 424 081Total market valueR344 760 569 (B)Thus, margin deficit is:Total market value (B) R344 760 569Total repurchase price (sell-back price) (A) - R350 142 000Margin deficit (B) – (A) R 5 381 43110 OPERATIONAL NOTICE