Operational Notice - South African Reserve Bank

Operational Notice - South African Reserve Bank

Operational Notice - South African Reserve Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

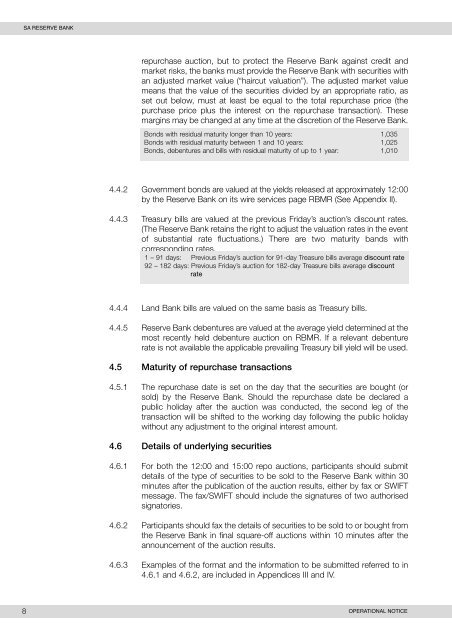

SA RESERVE BANKrepurchase auction, but to protect the <strong>Reserve</strong> <strong>Bank</strong> against credit andmarket risks, the banks must provide the <strong>Reserve</strong> <strong>Bank</strong> with securities withan adjusted market value (“haircut valuation”). The adjusted market valuemeans that the value of the securities divided by an appropriate ratio, asset out below, must at least be equal to the total repurchase price (thepurchase price plus the interest on the repurchase transaction). Thesemargins may be changed at any time at the discretion of the <strong>Reserve</strong> <strong>Bank</strong>.Bonds with residual maturity longer than 10 years: 1,035Bonds with residual maturity between 1 and 10 years: 1,025Bonds, debentures and bills with residual maturity of up to 1 year: 1,0104.4.2 Government bonds are valued at the yields released at approximately 12:00by the <strong>Reserve</strong> <strong>Bank</strong> on its wire services page RBMR (See Appendix II).4.4.3 Treasury bills are valued at the previous Friday’s auction’s discount rates.(The <strong>Reserve</strong> <strong>Bank</strong> retains the right to adjust the valuation rates in the eventof substantial rate fluctuations.) There are two maturity bands withcorresponding rates.1 – 91 days: Previous Friday’s auction for 91-day Treasure bills average discount rate92 – 182 days: Previous Friday’s auction for 182-day Treasure bills average discountrate4.4.4 Land <strong>Bank</strong> bills are valued on the same basis as Treasury bills.4.4.5 <strong>Reserve</strong> <strong>Bank</strong> debentures are valued at the average yield determined at themost recently held debenture auction on RBMR. If a relevant debenturerate is not available the applicable prevailing Treasury bill yield will be used.4.5 Maturity of repurchase transactions4.5.1 The repurchase date is set on the day that the securities are bought (orsold) by the <strong>Reserve</strong> <strong>Bank</strong>. Should the repurchase date be declared apublic holiday after the auction was conducted, the second leg of thetransaction will be shifted to the working day following the public holidaywithout any adjustment to the original interest amount.4.6 Details of underlying securities4.6.1 For both the 12:00 and 15:00 repo auctions, participants should submitdetails of the type of securities to be sold to the <strong>Reserve</strong> <strong>Bank</strong> within 30minutes after the publication of the auction results, either by fax or SWIFTmessage. The fax/SWIFT should include the signatures of two authorisedsignatories.4.6.2 Participants should fax the details of securities to be sold to or bought fromthe <strong>Reserve</strong> <strong>Bank</strong> in final square-off auctions within 10 minutes after theannouncement of the auction results.4.6.3 Examples of the format and the information to be submitted referred to in4.6.1 and 4.6.2, are included in Appendices III and IV.8 OPERATIONAL NOTICE