- Page 1 and 2:

OHIO RULES OF CIVIL PROCEDURETitle

- Page 3 and 4:

Title VII JUDGMENTRule54 Judgments;

- Page 5 and 6:

TITLE I. SCOPE OF RULES--ONE FORM O

- Page 10 and 11:

(2) After final judgment, or upon d

- Page 12 and 13:

Nonsubstantive grammatical revision

- Page 14 and 15:

Staff Note (July 1, 2008 Amendment)

- Page 16 and 17:

(B) Personal service. When the plai

- Page 18 and 19:

RULE 4.2Process: Who May be ServedS

- Page 20 and 21:

Division (G) is inserted into Civ.R

- Page 22 and 23:

(10) Causing tortious injury to any

- Page 24 and 25:

RULE 4.4Process: Service by Publica

- Page 26 and 27:

RULE 4.5Process: Alternative Provis

- Page 28 and 29:

RULE 4.6Process: Limits; Amendment;

- Page 30 and 31:

RULE 5.Original ComplaintService an

- Page 32 and 33:

Staff Note (July 1, 2012 Amendment)

- Page 34 and 35:

Staff Note (July 1, 2012 Amendment)

- Page 36 and 37:

RULE 8.General Rules of Pleading(A)

- Page 38 and 39:

RULE 9.Pleading Special Matters(A)

- Page 40 and 41:

(b) The plaintiff may file a motion

- Page 42 and 43:

Staff Note (July 1, 2005 Amendment)

- Page 44 and 45:

equires that courts submit any loca

- Page 46 and 47:

(D) Preliminary hearings. The defen

- Page 48 and 49:

(I) Separate trials; separate judgm

- Page 50 and 51:

RULE 15.Amended and Supplemental Pl

- Page 52 and 53:

RULE 16.Pretrial ProcedureIn any ac

- Page 54 and 55:

TITLE IV. PARTIESRULE 17.Parties Pl

- Page 56 and 57:

RULE 19. Joinder of Persons Needed

- Page 58 and 59:

Staff Note (July 1, 1996 Amendment)

- Page 60 and 61:

RULE 21.Misjoinder and Nonjoinder o

- Page 62 and 63:

RULE 23.Class Actions(A) Prerequisi

- Page 64 and 65:

RULE 23.1. Derivative Actions by Sh

- Page 66 and 67:

RULE 25.Substitution of Parties(A)D

- Page 68 and 69:

(4) Electronically stored informati

- Page 70 and 71:

e conducted with on one present exc

- Page 72 and 73:

RULE 27.AppealPerpetuation of Testi

- Page 74 and 75:

(G) Construction of rule. This rule

- Page 76 and 77:

Staff Note (July 1, 2001 Amendment)

- Page 78 and 79:

RULE 30.Depositions upon oral exami

- Page 80 and 81:

The deposition shall then be signed

- Page 82 and 83:

Staff Note (July 1, 1997 Amendment)

- Page 84:

RULE 32.Use of Depositions in Court

- Page 87 and 88:

RULE 33.Interrogatories to Parties(

- Page 89 and 90:

Similar amendments have been made t

- Page 91 and 92:

RULE 34. Producing documents, elect

- Page 93 and 94:

(b)The petitioner is otherwise unab

- Page 95 and 96:

RULE 35.Physical and Mental Examina

- Page 97 and 98:

(B) Effect of admission. Any matter

- Page 99 and 100:

The Rules Advisory Committee is awa

- Page 101 and 102:

(2) If any party or an officer, dir

- Page 103 and 104:

Staff Note (July 1, 2008 Amendment)

- Page 105 and 106:

RULE 39.Trial by Jury or by the Cou

- Page 107 and 108:

RULE 41.Dismissal of Actions(A)Volu

- Page 109 and 110:

RULE 42.Consolidation; Separate Tri

- Page 111 and 112:

RULE 43.[RESERVED]

- Page 113 and 114:

RULE 44.1. Judicial Notice of Certa

- Page 115 and 116:

(2) The clerk shall issue a subpoen

- Page 117 and 118:

form that is reasonably useable. Un

- Page 119 and 120:

Staff Note (July 1, 2012 Amendment)

- Page 121 and 122:

RULE 46.Exceptions UnnecessaryAn ex

- Page 123 and 124:

against an alternate juror only, an

- Page 125 and 126:

challenge waives that challenge but

- Page 127 and 128:

RULE 48.Juries: Majority Verdict; S

- Page 129 and 130:

RULE 50.VerdictMotion for a Directe

- Page 131 and 132:

RULE 51.Instructions to the Jury; O

- Page 133 and 134:

RULE 52.Findings by the CourtWhen q

- Page 135 and 136:

(f) Imposing, subject to Civ. R. 53

- Page 137 and 138:

(4) Action of court on magistrate

- Page 139 and 140:

for the judicial functions but only

- Page 141 and 142:

Action of court on magistrate’s d

- Page 143 and 144:

In re Disqualification of Light (19

- Page 145 and 146:

[now division (E)(3)(d)]. First, th

- Page 147 and 148:

Rule 53(D) ProceedingsPrior languag

- Page 149 and 150:

RULE 55.Default(A) Entry of judgmen

- Page 151 and 152:

to in an affidavit shall be attache

- Page 153 and 154:

RULE 57.Declaratory JudgmentsThe pr

- Page 155 and 156:

RULE 59.New Trials(A) Grounds. A ne

- Page 157 and 158:

RULE 60.Relief From Judgment or Ord

- Page 159 and 160:

RULE 62.Stay of Proceedings to Enfo

- Page 161 and 162:

TITLE VIII. PROVISIONAL AND FINAL R

- Page 163 and 164:

(C) Security. No temporary restrain

- Page 165 and 166:

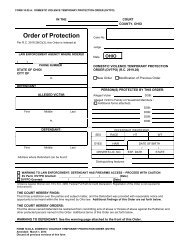

RULE 65.1. Civil Protection Orders(

- Page 167 and 168:

(i) A magistrate’s denial or gran

- Page 169 and 170:

Division (E): Appointed counsel for

- Page 171 and 172:

RULE 67.[RESERVED]

- Page 173 and 174:

RULE 69.ExecutionProcess to enforce

- Page 175 and 176:

RULE 71.Process in Behalf of and Ag

- Page 177 and 178:

TITLE IX. PROBATE, JUVENILE, ANDDOM

- Page 179 and 180:

No pleading, application, acknowled

- Page 181 and 182:

RULE 74.[RESERVED][Former Rule 74,

- Page 183 and 184:

(F) Judgment. The provisions of Civ

- Page 185:

for the care of children is journal

- Page 188 and 189:

Rule 75(G) Relief pending appeal.St

- Page 190 and 191:

RULE 77 TO 80.[RESERVED]

- Page 192 and 193:

TITLE X. GENERAL PROVISIONSRULE 82.

- Page 194 and 195:

RULE 84.FormsThe forms contained in

- Page 196 and 197:

RULE 86.Effective Date(A) Effective

- Page 198 and 199:

(M) Effective date of amendments. T

- Page 200 and 201:

(Y) Effective date of amendments. T

- Page 202 and 203:

(LL) Effective date of amendments.

- Page 204 and 205:

FORM 1. CAPTION AND SUMMONSCOURT OF

- Page 206 and 207:

INSTRUCTIONS FOR PERSONAL OR RESIDE

- Page 208 and 209:

RETURN OF SERVICE OF SUMMONS(RESIDE

- Page 210 and 211:

FORM 2. COMPLAINT ON A PROMISSORY N

- Page 212 and 213:

FORM 3. COMPLAINT ON AN ACCOUNTDefe

- Page 214 and 215:

FORM 5. COMPLAINT FOR MONEY LENTDef

- Page 216 and 217:

FORM 7. COMPLAINT FOR MONEY HAD AND

- Page 218 and 219:

FORM 9. COMPLAINT FOR NEGLIGENCE WH

- Page 220 and 221:

FORM 11. COMPLAINT FOR SPECIFIC PER

- Page 222 and 223:

FORM 13. COMPLAINT FOR INTERPLEADER

- Page 224 and 225:

SERVICE OF COPYA copy hereof was se

- Page 226 and 227:

CROSS-CLAIM AGAINST DEFENDANT M.N.[

- Page 228 and 229:

FORM 16A. COMPLAINT AGAINST THIRD-P

- Page 230 and 231:

FORM 18. JUDGMENT ON JURY VERDICTCO

- Page 232 and 233:

NoteThis form is illustrative of th

- Page 234 and 235:

B. COMPUTATION OF CURRENT INCOMEHus

- Page 236 and 237:

B. OTHER MONTHLY LIVING EXPENSESFoo

- Page 238 and 239:

Charitable contributions $Membershi

- Page 240 and 241:

COURT OF COMMON PLEASCOUNTY, OHIOPl

- Page 242 and 243: CategoryDescription(List who has po

- Page 244 and 245: 1.2.3.4.1.2.I. Transfer of Assets E

- Page 246 and 247: V. BANKRUPTCYFiled by: Wife,Husband

- Page 248 and 249: . Child’s Name: Place of Birth:Da

- Page 250 and 251: 6. Persons not a party to this case

- Page 252 and 253: MotherFatherUnder the available ins

- Page 254 and 255: Complete the following information,

- Page 256 and 257: OATH(Do not sign until notary is pr

- Page 258 and 259: IN THE COURT OF COMMON PLEASDivisio

- Page 260 and 261: IN THE COURT OF COMMON PLEASDivisio

- Page 262 and 263: child(ren):The non-residential pare

- Page 264 and 265: 4. I state regarding children (chec

- Page 266 and 267: IN THE COURT OF COMMON PLEASDivisio

- Page 268 and 269: CERTIFICATE OF SERVICEI delivered a

- Page 270 and 271: The dates of birth of children who

- Page 272 and 273: IN THE COURT OF COMMON PLEASDivisio

- Page 274 and 275: J. The parties that appeared have h

- Page 276 and 277: E. Other orders regarding property

- Page 278 and 279: 2E. Deductibility of Spousal Suppor

- Page 280 and 281: B. Present at the hearing were the:

- Page 282 and 283: The Defendant or Plaintiff is guilt

- Page 284 and 285: B. The Defendant shall pay the foll

- Page 286 and 287: Mother shall be the residential par

- Page 288 and 289: SEVENTH: HEALTH INSURANCE COVERAGEA

- Page 290 and 291: The total of child support and cash

- Page 294 and 295: 2claim the minor child(ren).TENTH:

- Page 296 and 297: IN THE COURT OF COMMON PLEASDivisio

- Page 298 and 299: 1The Petitioners request the Court

- Page 300 and 301: 4. Check all that apply:The Wife is

- Page 302 and 303: IN THE COURT OF COMMON PLEASDivisio

- Page 304 and 305: 2. Marital Real EstateThe parties o

- Page 306 and 307: The parties shall make arrangements

- Page 308 and 309: 3. One or both parties has/have bus

- Page 310 and 311: and Wife shall receive the followin

- Page 312 and 313: theat his/her place of employment.C

- Page 314 and 315: Each party waives all rights of inh

- Page 316 and 317: FIRST: PARENTS’ RIGHTSThe parents

- Page 318 and 319: F. Other orders:G. Public BenefitsF

- Page 320 and 321: N. School Activities Access NoticeP

- Page 322 and 323: FOURTH: CHILD SUPPORTAs required by

- Page 324 and 325: The relative financial resources, o

- Page 326 and 327: for the child(ren) is also required

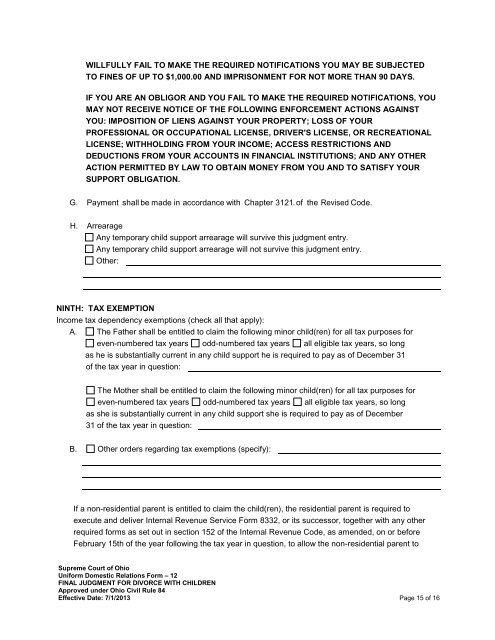

- Page 328 and 329: in question:B. Other orders regardi

- Page 330 and 331: FIRST: PARENTS’ RIGHTSWe, the par

- Page 332 and 333: with notice to both parents to dete

- Page 334 and 335: policy, contract, or plan to either

- Page 336 and 337: Extended parenting time or extraord

- Page 338 and 339: • Child’s death• Child’s ma

- Page 340 and 341: H. ArrearageAny temporary child sup

- Page 342 and 343:

IN THE COURT OF COMMON PLEASDivisio

- Page 344 and 345:

IN THE MATTER OF:IN THE COURT OF CO

- Page 346 and 347:

IN THE COURT OF COMMON PLEASDivisio

- Page 348 and 349:

1INSTRUCTIONS TO THE CLERKYou are d

- Page 350 and 351:

2. Select one:parent and/or legal c

- Page 352 and 353:

2. Select one:(name) is currently d

- Page 354 and 355:

2. The person responsible for provi

- Page 356 and 357:

IN THE COURT OF COMMON PLEASDivisio

- Page 358 and 359:

IN THE COURT OF COMMON PLEASDivisio