Evidence from Firm-level Data in Vietnam

Evidence from Firm-level Data in Vietnam

Evidence from Firm-level Data in Vietnam

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

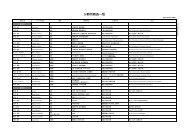

APPENDIX(1) Estimation of total factor productivity.The basic framework of the approach is as follows. The production function to be estimated is assumed tohave the form of Cobb- Douglas type, with labor and capital as <strong>in</strong>put factors and value-added as output. Theestimation will be run across <strong>in</strong>dustries. The estimation equation of firm i at time t (<strong>in</strong> logarithmic form)isvt= β + β l + β k + ε(A.1)ol tkttwherevt, ltand k tare log of value-added, labor (the freely variable <strong>in</strong>put) and capital (state variable<strong>in</strong>put) at time t , respectively, andεtis the error term whose explanation will come soon later. We drop thesubscript i for ease of expression. To produce, the firm uses also <strong>in</strong>termediate <strong>in</strong>put, which is subtracted outof the total production to calculate the value-added. The predicted productivity is the exponent of the sum ofconstant coefficient and the error term. Stat<strong>in</strong>g differently, it is calculated as:TFPˆt= exp( v − ˆ β l − ˆ β k ) . (A.2)tl tktThe key po<strong>in</strong>t that is different <strong>from</strong> OLS estimation is that the error term has two components,ωtand ηt, where ωtis the transmitted productivity component that may be correlated with <strong>in</strong>put choices andηtthe <strong>in</strong>dependently and identically distributed (iid) one that is uncorrelated with the choice of <strong>in</strong>puts.is not observable to econometricians, which leads to the problem of simultaneity stated <strong>in</strong> the ma<strong>in</strong> text.Those estimators that ignore this problem (like OLS) will have <strong>in</strong>consistent results.ωtIn the framework of Lev<strong>in</strong>sohn and Petr<strong>in</strong> (2003), the demand for <strong>in</strong>termediate <strong>in</strong>putm tis assumedto depend on the firm’s state variablektandωt:mt= m k , ω )(A.3)t(t tWith the assumption that this demand function is monotonically <strong>in</strong>creas<strong>in</strong>g <strong>in</strong>ωt, we have ωtas a functionofktandmt:Now, the estimation equation can be rewritten asω = ω k , m )(A.4)tt(t tvt= β l + φ ( k , m ) + η(A.5)l ttttt25