Rates of Payment 2010 - Welfare.ie

Rates of Payment 2010 - Welfare.ie

Rates of Payment 2010 - Welfare.ie

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

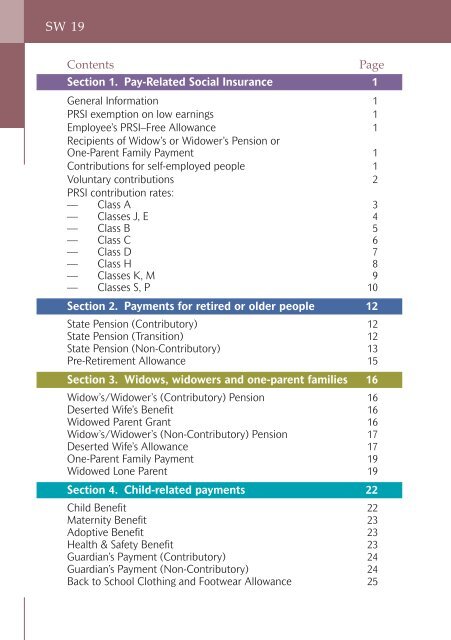

SW 19ContentsPageSection 1. Pay-Related Social Insurance 1General Information 1PRSI exemption on low earnings 1Employee’s PRSI–Free Allowance 1Recip<strong>ie</strong>nts <strong>of</strong> Widow’s or Widower’s Pension orOne-Parent Family <strong>Payment</strong> 1Contributions for self-employed people 1Voluntary contributions 2PRSI contribution rates:— Class A 3— Classes J, E 4— Class B 5— Class C 6— Class D 7— Class H 8— Classes K, M 9— Classes S, P 10Section 2. <strong>Payment</strong>s for retired or older people 12State Pension (Contributory) 12State Pension (Transition) 12State Pension (Non-Contributory) 13Pre-Retirement Allowance 15Section 3. Widows, widowers and one-parent famil<strong>ie</strong>s 16Widow’s/Widower’s (Contributory) Pension 16Deserted Wife’s Benefit 16Widowed Parent Grant 16Widow’s/Widower’s (Non-Contributory) Pension 17Deserted Wife’s Allowance 17One-Parent Family <strong>Payment</strong> 19Widowed Lone Parent 19Section 4. Child-related payments 22Child Benefit 22Maternity Benefit 23Adoptive Benefit 23Health & Safety Benefit 23Guardian’s <strong>Payment</strong> (Contributory) 24Guardian’s <strong>Payment</strong> (Non-Contributory) 24Back to School Clothing and Footwear Allowance 25