Rates of Payment 2010 - Welfare.ie

Rates of Payment 2010 - Welfare.ie

Rates of Payment 2010 - Welfare.ie

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

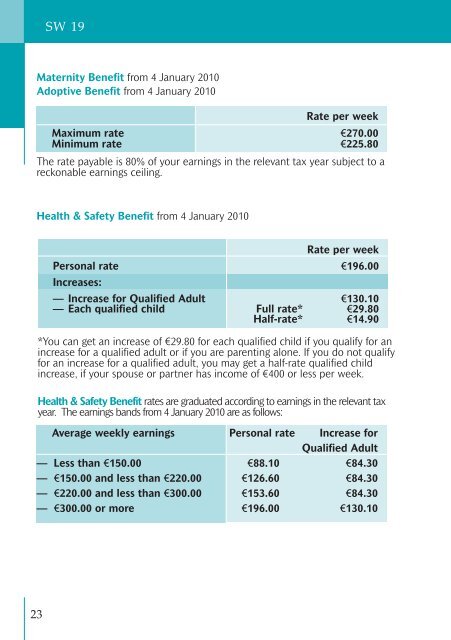

SW 19Maternity Benefit from 4 January <strong>2010</strong>Adoptive Benefit from 4 January <strong>2010</strong>Rate per weekMaximum rate €270.00Minimum rate €225.80The rate payable is 80% <strong>of</strong> your earnings in the relevant tax year subject to areckonable earnings ceiling.Health & Safety Benefit from 4 January <strong>2010</strong>Rate per weekPersonal rate €196.00Increases:— Increase for Qualif<strong>ie</strong>d Adult €130.10— Each qualif<strong>ie</strong>d child Full rate* €29.80Half-rate* €14.90*You can get an increase <strong>of</strong> €29.80 for each qualif<strong>ie</strong>d child if you qualify for anincrease for a qualif<strong>ie</strong>d adult or if you are parenting alone. If you do not qualifyfor an increase for a qualif<strong>ie</strong>d adult, you may get a half-rate qualif<strong>ie</strong>d childincrease, if your spouse or partner has income <strong>of</strong> €400 or less per week.Health & Safety Benefit rates are graduated according to earnings in the relevant taxyear. The earnings bands from 4 January <strong>2010</strong> are as follows:Average weekly earnings Personal rate Increase forQualif<strong>ie</strong>d Adult— Less than €150.00 €88.10 €84.30— €150.00 and less than €220.00 €126.60 €84.30— €220.00 and less than €300.00 €153.60 €84.30— €300.00 or more €196.00 €130.1023