Annual Report 2012 - Tivoli

Annual Report 2012 - Tivoli

Annual Report 2012 - Tivoli

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

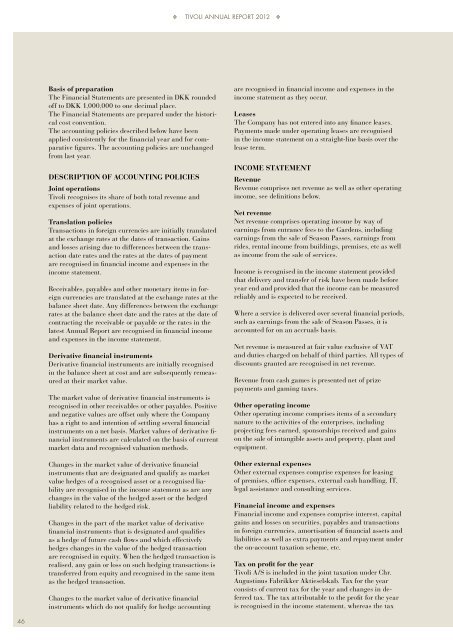

❖tivoli ANNUAL REPORT <strong>2012</strong> ❖Basis of preparationThe Financial Statements are presented in DKK roundedoff to DKK 1,000,000 to one decimal place.The Financial Statements are prepared under the historicalcost convention.The accounting policies described below have beenapplied consistently for the financial year and for comparativefigures. The accounting policies are unchangedfrom last year.DESCRIPTION OF ACCOUNTING POLICIESJoint operations<strong>Tivoli</strong> recognises its share of both total revenue andexpenses of joint operations.Translation policiesTransactions in foreign currencies are initially translatedat the exchange rates at the dates of transaction. Gainsand losses arising due to differences between the transactiondate rates and the rates at the dates of paymentare recognised in financial income and expenses in theincome statement.Receivables, payables and other monetary items in foreigncurrencies are translated at the exchange rates at thebalance sheet date. Any differences between the exchangerates at the balance sheet date and the rates at the date ofcontracting the receivable or payable or the rates in thelatest <strong>Annual</strong> <strong>Report</strong> are recognised in financial incomeand expenses in the income statement.Derivative financial instrumentsDerivative financial instruments are initially recognisedin the balance sheet at cost and are subsequently remeasuredat their market value.The market value of derivative financial instruments isrecognised in other receivables or other payables. Positiveand negative values are offset only where the Companyhas a right to and intention of settling several financialinstruments on a net basis. Market values of derivative financialinstruments are calculated on the basis of currentmarket data and recognised valuation methods.Changes in the market value of derivative financialinstruments that are designated and qualify as marketvalue hedges of a recognised asset or a recognised liabilityare recognised in the income statement as are anychanges in the value of the hedged asset or the hedgedliability related to the hedged risk.Changes in the part of the market value of derivativefinancial instruments that is designated and qualifiesas a hedge of future cash flows and which effectivelyhedges changes in the value of the hedged transactionare recognised in equity. When the hedged transaction isrealised, any gain or loss on such hedging transactions istransferred from equity and recognised in the same itemas the hedged transaction.Changes to the market value of derivative financialinstruments which do not qualify for hedge accountingare recognised in financial income and expenses in theincome statement as they occur.LeasesThe Company has not entered into any finance leases.Payments made under operating leases are recognisedin the income statement on a straight-line basis over thelease term.INCOME STATEMENTRevenueRevenue comprises net revenue as well as other operatingincome, see definitions below.Net revenueNet revenue comprises operating income by way ofearnings from entrance fees to the Gardens, includingearnings from the sale of Season Passes, earnings fromrides, rental income from buildings, premises, etc as wellas income from the sale of services.Income is recognised in the income statement providedthat delivery and transfer of risk have been made beforeyear end and provided that the income can be measuredreliably and is expected to be received.Where a service is delivered over several financial periods,such as earnings from the sale of Season Passes, it isaccounted for on an accruals basis.Net revenue is measured at fair value exclusive of VATand duties charged on behalf of third parties. All types ofdiscounts granted are recognised in net revenue.Revenue from cash games is presented net of prizepayments and gaming taxes.Other operating incomeOther operating income comprises items of a secondarynature to the activities of the enterprises, includingprojecting fees earned, sponsorships received and gainson the sale of intangible assets and property, plant andequipment.Other external expensesOther external expenses comprise expenses for leasingof premises, office expenses, external cash handling, IT,legal assistance and consulting services.Financial income and expensesFinancial income and expenses comprise interest, capitalgains and losses on securities, payables and transactionsin foreign currencies, amortisation of financial assets andliabilities as well as extra payments and repayment underthe on-account taxation scheme, etc.Tax on profit for the year<strong>Tivoli</strong> A/S is included in the joint taxation under Chr.Augustinus Fabrikker Aktieselskab. Tax for the yearconsists of current tax for the year and changes in deferredtax. The tax attributable to the profit for the yearis recognised in the income statement, whereas the tax46