- Page 1 and 2: Overview for Politicians/Government

- Page 3 and 4: WELCOME TO THE2013 EDITION OFTAXATI

- Page 5: CONTENTS01 SUMMARY OF AUSTRALIANTAX

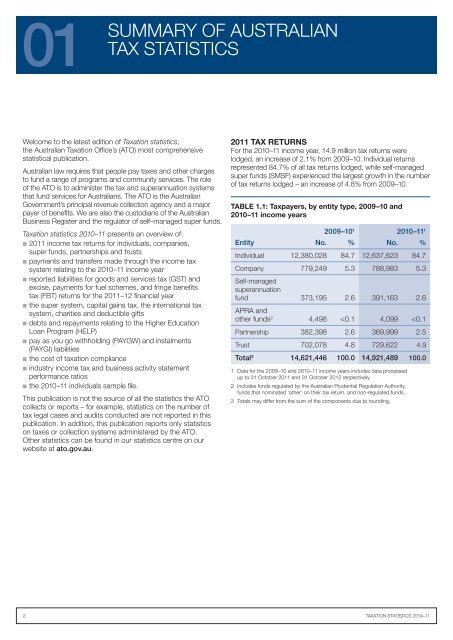

- Page 9 and 10: 01 SUMMARY OF AUSTRALIAN TAX STATIS

- Page 11 and 12: 01 SUMMARY OF AUSTRALIAN TAX STATIS

- Page 13 and 14: 01 SUMMARY OF AUSTRALIAN TAX STATIS

- Page 15 and 16: 02 IndividualS’ taxTABLE 2.1: Ind

- Page 17 and 18: 02 IndividualS’ taxSalary and wag

- Page 19 and 20: 02 IndividualS’ taxMost individua

- Page 21 and 22: 02 IndividualS’ taxIndividuals ca

- Page 23 and 24: 02 IndividualS’ taxIndividuals cl

- Page 25 and 26: 02 IndividualS’ taxTABLE 2.11: Se

- Page 27 and 28: 02 IndividualS’ taxTABLE 2.14: No

- Page 29 and 30: 02 IndividualS’ taxWITHHOLDING TA

- Page 31 and 32: 02 IndividualS’ taxSOURCE OF INDI

- Page 33 and 34: COMPANIES AND PETROLEUMRESOURCE REN

- Page 35 and 36: 3 COMPANIES AND PETROLEUM RESOURCE

- Page 37 and 38: 3 COMPANIES AND PETROLEUM RESOURCE

- Page 39 and 40: 3 COMPANIES AND PETROLEUM RESOURCE

- Page 41 and 42: 3 COMPANIES AND PETROLEUM RESOURCE

- Page 43 and 44: 3 COMPANIES AND PETROLEUM RESOURCE

- Page 45 and 46: 3 COMPANIES AND PETROLEUM RESOURCE

- Page 47 and 48: 3 COMPANIES AND PETROLEUM RESOURCE

- Page 49 and 50: 3 COMPANIES AND PETROLEUM RESOURCE

- Page 51 and 52: SUPERANNUATION FUNDS04OVERVIEWFor t

- Page 53 and 54: 04 SUPERANNUATION FUNDSBOX 4.1: Fun

- Page 55 and 56: 04 SUPERANNUATION FUNDSThe total in

- Page 57 and 58:

04 SUPERANNUATION FUNDSFUND DEDUCTI

- Page 59 and 60:

04 SUPERANNUATION FUNDSExempt curre

- Page 61 and 62:

04 SUPERANNUATION FUNDSBOX 4.2: Cal

- Page 63 and 64:

PARTNERSHIPS05OVERVIEWFor the 2010-

- Page 65 and 66:

05 PARTNERSHIPSPARTNERSHIP INCOMEPa

- Page 67 and 68:

05 PARTNERSHIPSBOX 5.1: Partnership

- Page 69 and 70:

05 PARTNERSHIPSSOURCE OF PARTNERSHI

- Page 71 and 72:

06 TRUSTSTRUST RETURNSFor the 2010-

- Page 73 and 74:

06 TRUSTSTRUST INCOMETotal net inco

- Page 75 and 76:

06 TRUSTSBOX 6.1: Trust size, by to

- Page 77 and 78:

06 TRUSTSSOURCE OF TRUST STATISTICS

- Page 79 and 80:

07 CAPITAL GAINS TAXNET CAPITAL GAI

- Page 81 and 82:

07 CAPITAL GAINS TAXAmong taxable i

- Page 83 and 84:

07 CAPITAL GAINS TAXTOTAL CAPITAL G

- Page 85 and 86:

07 CAPITAL GAINS TAXCAPITAL LOSSESF

- Page 87 and 88:

07 CAPITAL GAINS TAXSOURCE OF CGT S

- Page 89 and 90:

08 FRINGE BENEFITS TAXFBT RETURNSTh

- Page 91 and 92:

08 FRINGE BENEFITS TAXFringe benefi

- Page 93 and 94:

08 FRINGE BENEFITS TAXEMPLOYEE CONT

- Page 95 and 96:

08 FRINGE BENEFITS TAXEmployee cont

- Page 97 and 98:

PAYMENTS AND TRANSFERS09THROUGH THE

- Page 99 and 100:

09 Payments and Transfers Through t

- Page 101 and 102:

09 Payments and Transfers Through t

- Page 103 and 104:

10 CHARITIES AND DEDUCTIBLE GIFTSTh

- Page 105 and 106:

10 CHARITIES AND DEDUCTIBLE GIFTSTA

- Page 107 and 108:

INTERNATIONAL TAXATION11OVERVIEWFor

- Page 109 and 110:

11 INTERNATIONAL TAXATIONA company

- Page 111 and 112:

11 INTERNATIONAL TAXATIONSUPERANNUA

- Page 113 and 114:

GST AND OTHER TAXES12OVERVIEWFor th

- Page 115 and 116:

12 GST AND OTHER TAXESIn 2011-12, t

- Page 117 and 118:

12 GST AND OTHER TAXESWINE EQUALISA

- Page 119 and 120:

12 GST AND OTHER TAXESPrimary produ

- Page 121 and 122:

13 EXCISEEXCISE LIABILITIESExcise l

- Page 123 and 124:

FUEL SCHEMES14OVERVIEWFor the 2011-

- Page 125 and 126:

14 FUEL SCHEMESFrom an industry per

- Page 127 and 128:

14 FUEL SCHEMESCLEANER FUELS GRANTS

- Page 129 and 130:

15 THE SUPERANNUATION SYSTEMSUPERAN

- Page 131 and 132:

15 THE SUPERANNUATION SYSTEMSUPERAN

- Page 133 and 134:

PAY AS YOU GO16OVERVIEWFor the 2011

- Page 135 and 136:

16 Pay as you goPAY AS YOU GO WITHH

- Page 137 and 138:

16 Pay as you goPAY AS YOU GO INSTA

- Page 139 and 140:

COST OF TAXATION COMPLIANCE17OVERVI

- Page 141 and 142:

17 COST OF TAXATION COMPLIANCEFRING

- Page 143 and 144:

INDUSTRY BENCHMARKS18INTRODUCTIONTh

- Page 145 and 146:

18 INDUSTRY BENCHMARKSLIST OF ACTIV

- Page 147 and 148:

APPENDICES20Individual tax return 1

- Page 149 and 150:

20 APPENDICESINDIVIDUAL TAX RETURN

- Page 151 and 152:

20 APPENDICESINDIVIDUAL TAX RETURN

- Page 153 and 154:

20 APPENDICESINDIVIDUAL TAX RETURN

- Page 155 and 156:

20 APPENDICESINDIVIDUAL TAX RETURN

- Page 157 and 158:

20 APPENDICESINDIVIDUAL TAX RETURN

- Page 159 and 160:

20 APPENDICESINDIVIDUAL TAX RETURN

- Page 161 and 162:

20 APPENDICESINDIVIDUAL TAX RETURN

- Page 163 and 164:

20 APPENDICESCOMPANY TAX RETURN (CO

- Page 165 and 166:

20 APPENDICESCOMPANY TAX RETURN (CO

- Page 167 and 168:

20 APPENDICESCOMPANY TAX RETURN (CO

- Page 169 and 170:

20 APPENDICESCOMPANY TAX RETURN (CO

- Page 171 and 172:

20 APPENDICESCOMPANY TAX RETURN (CO

- Page 173 and 174:

20 APPENDICESFUND INCOME TAX RETURN

- Page 175 and 176:

20 APPENDICESFUND INCOME TAX RETURN

- Page 177 and 178:

20 APPENDICESFUND INCOME TAX RETURN

- Page 179 and 180:

20 APPENDICESFUND INCOME TAX RETURN

- Page 181 and 182:

20 APPENDICESSELF-MANAGED SUPERANNU

- Page 183 and 184:

20 APPENDICESSELF-MANAGED SUPERANNU

- Page 185 and 186:

20 APPENDICESSELF-MANAGED SUPERANNU

- Page 187 and 188:

20 APPENDICESSELF-MANAGED SUPERANNU

- Page 189 and 190:

20 APPENDICESSELF-MANAGED SUPERANNU

- Page 191 and 192:

20 APPENDICESSELF-MANAGED SUPERANNU

- Page 193 and 194:

20 APPENDICESSELF-MANAGED SUPERANNU

- Page 195 and 196:

20 APPENDICESPARTNERSHIP TAX RETURN

- Page 197:

20 APPENDICESPARTNERSHIP TAX RETURN

- Page 200 and 201:

20 APPENDICESPARTNERSHIP TAX RETURN

- Page 202 and 203:

20 APPENDICESPARTNERSHIP TAX RETURN

- Page 204 and 205:

20 APPENDICESPARTNERSHIP TAX RETURN

- Page 206 and 207:

20 APPENDICESTRUST TAX RETURNTrust

- Page 208 and 209:

20 APPENDICESTRUST TAX RETURN (CONT

- Page 210 and 211:

20 APPENDICESTRUST TAX RETURN (CONT

- Page 212 and 213:

20 APPENDICESTRUST TAX RETURN (CONT

- Page 214 and 215:

20 APPENDICESTRUST TAX RETURN (CONT

- Page 216 and 217:

20 APPENDICESTRUST TAX RETURN (CONT

- Page 218 and 219:

20 APPENDICESTRUST TAX RETURN (CONT

- Page 220 and 221:

20 APPENDICESTRUST TAX RETURN (CONT

- Page 222 and 223:

20 APPENDICESFRINGE BENEFITS TAX RE

- Page 224 and 225:

20 APPENDICESFRINGE BENEFITS TAX RE

- Page 226 and 227:

20 APPENDICESGST ANNUAL RETURNZ1417

- Page 228 and 229:

20 APPENDICESCAPITAL GAINS TAX SCHE

- Page 230 and 231:

20 APPENDICESCAPITAL GAINS TAX SCHE

- Page 232 and 233:

20 APPENDICESBUSINESS ACTIVITY STAT

- Page 234 and 235:

20 APPENDICESINSTALMENT ACTIVITY ST

- Page 236 and 237:

INDEXAaccommodation and food servic

- Page 238:

INDEXOother services see industryov