The High Idiosyncratic Volatility Low Return Puzzle

The High Idiosyncratic Volatility Low Return Puzzle

The High Idiosyncratic Volatility Low Return Puzzle

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

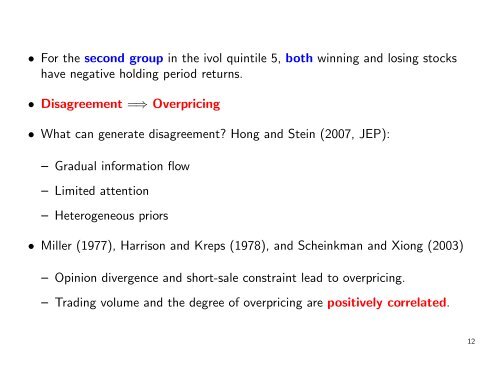

• For the second group in the ivol quintile 5, both winning and losing stockshave negative holding period returns.• Disagreement =⇒ Overpricing• What can generate disagreement? Hong and Stein (2007, JEP):– Gradual information flow– Limited attention– Heterogeneous priors• Miller (1977), Harrison and Kreps (1978), and Scheinkman and Xiong (2003)– Opinion divergence and short-sale constraint lead to overpricing.– Trading volume and the degree of overpricing are positively correlated.12