The High Idiosyncratic Volatility Low Return Puzzle

The High Idiosyncratic Volatility Low Return Puzzle

The High Idiosyncratic Volatility Low Return Puzzle

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

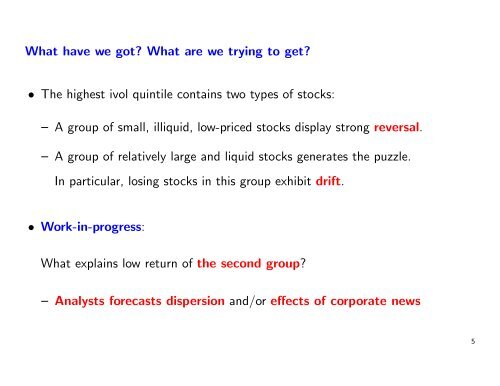

What have we got? What are we trying to get?• <strong>The</strong> highest ivol quintile contains two types of stocks:– A group of small, illiquid, low-priced stocks display strong reversal.– A group of relatively large and liquid stocks generates the puzzle.In particular, losing stocks in this group exhibit drift.• Work-in-progress:What explains low return of the second group?– Analysts forecasts dispersion and/or effects of corporate news5