Does portfolio manager ownership affect fund performance ... - LTA

Does portfolio manager ownership affect fund performance ... - LTA

Does portfolio manager ownership affect fund performance ... - LTA

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

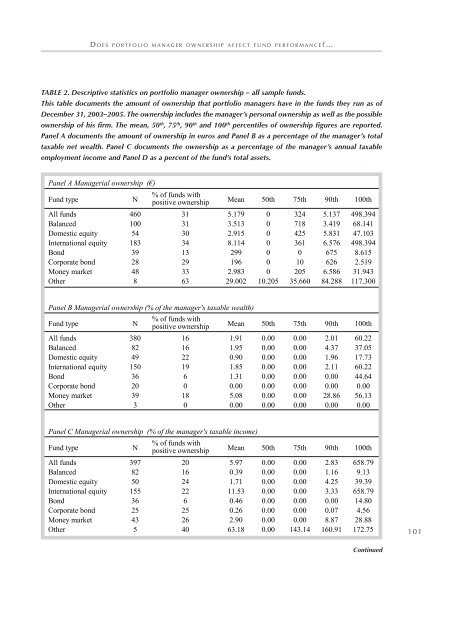

D o e s p o r t f o l i o m a n a g e r o w n e r s h i p a f f e c t f u n d p e r f o r m a n c e ? …Table 2. Descriptive statistics on <strong>portfolio</strong> <strong>manager</strong> <strong>ownership</strong> – all sample <strong>fund</strong>s.This table documents the amount of <strong>ownership</strong> that <strong>portfolio</strong> <strong>manager</strong>s have in the <strong>fund</strong>s they run as ofDecember 31, 2003–2005. The <strong>ownership</strong> includes the <strong>manager</strong>’s personal <strong>ownership</strong> as well as the possible<strong>ownership</strong> of his firm. The mean, 50 th , 75 th , 90 th and 100 th percentiles of <strong>ownership</strong> figures are reported.Panel A documents the amount of <strong>ownership</strong> in euros and Panel B as a percentage of the <strong>manager</strong>’s totaltaxable net wealth. Panel C documents the <strong>ownership</strong> as a percentage of the <strong>manager</strong>’s annual taxableemployment income and Panel D as a percent of the <strong>fund</strong>’s total assets.Panel A Managerial <strong>ownership</strong> (€)Fund typeN% of <strong>fund</strong>s withpositive <strong>ownership</strong> Mean 50th 75th 90th 100thAll <strong>fund</strong>s 460 31 5.179 0 324 5.137 498.394Balanced 100 31 3.513 0 718 3.419 68.141Domestic equity 54 30 2.915 0 425 5.831 47.103International equity 183 34 8.114 0 361 6.576 498.394Bond 39 13 299 0 0 675 8.615Corporate bond 28 29 196 0 10 626 2.519Money market 48 33 2.983 0 205 6.586 31.943Other 8 63 29.002 10.205 35.660 84.288 117.300Panel B Managerial <strong>ownership</strong> (% of the <strong>manager</strong>'s taxable wealth)Fund typeN% of <strong>fund</strong>s withpositive <strong>ownership</strong> Mean 50th 75th 90th 100thAll <strong>fund</strong>s 380 16 1.91 0.00 0.00 2.01 60.22Balanced 82 16 1.95 0.00 0.00 4.37 37.05Domestic equity 49 22 0.90 0.00 0.00 1.96 17.73International equity 150 19 1.85 0.00 0.00 2.11 60.22Bond 36 6 1.31 0.00 0.00 0.00 44.64Corporate bond 20 0 0.00 0.00 0.00 0.00 0.00Money market 39 18 5.08 0.00 0.00 28.86 56.13Other 3 0 0.00 0.00 0.00 0.00 0.00Panel C Managerial <strong>ownership</strong> (% of the <strong>manager</strong>'s taxable income)Fund typeN% of <strong>fund</strong>s withpositive <strong>ownership</strong> Mean 50th 75th 90th 100thAll <strong>fund</strong>s 397 20 5.97 0.00 0.00 2.83 658.79Balanced 82 16 0.39 0.00 0.00 1.16 9.13Domestic equity 50 24 1.71 0.00 0.00 4.25 39.39International equity 155 22 11.53 0.00 0.00 3.33 658.79Bond 36 6 0.46 0.00 0.00 0.00 14.80Corporate bond 25 25 0.26 0.00 0.00 0.07 4.56Money market 43 26 2.90 0.00 0.00 8.87 28.88Other 5 40 63.18 0.00 143.14 160.91 172.751 0 1Panel D Managerial <strong>ownership</strong> (% of the <strong>fund</strong>'s total assets)Fund typeNContinued% of <strong>fund</strong>s withpositive <strong>ownership</strong> Mean 50th 75th 90th 100thAll <strong>fund</strong>s 460 31 0.05 0.00 0.00 0.02 4.71Balanced 100 31 0.04 0.00 0.00 0.04 1.26Domestic equity 54 30 0.01 0.00 0.00 0.03 0.31International equity 183 34 0.08 0.00 0.00 0.02 4.71Bond 39 13 0.00 0.00 0.00 0.00 0.02