- Page 1 and 2:

Towardsa unified system ofZakat acc

- Page 3 and 4:

ACKNOWLEDGEMENTSIN THE NAME OF ALLA

- Page 5 and 6:

PAGINATION ERROR INORIGINALTHESIS

- Page 7 and 8:

ContentsPageDeclarationiDedicationi

- Page 9 and 10:

4.4.1.1 Zakat on pastoral animals 1

- Page 11 and 12:

6.2.5 The percentage of Zakat thats

- Page 13 and 14:

List of tablesPageTable 2.1 Economi

- Page 15 and 16:

GLOSSARY OF TERMSFai property acqui

- Page 17 and 18:

ChapteroneIntroduction

- Page 19 and 20:

interest investment model, where th

- Page 21 and 22:

egulating Zakat has been employed a

- Page 23 and 24:

four countries due to the limitatio

- Page 25 and 26:

Co-operation Council, location, cli

- Page 27 and 28:

Chapter seven summarises thefinding

- Page 29 and 30:

ChaptertwoGeneral background to the

- Page 31 and 32:

in the following section, various f

- Page 33 and 34:

have an oil-based economy. Its oil

- Page 35 and 36:

anking and investment institutions

- Page 37 and 38:

2.1.2 KuwaitKuwait is situated at t

- Page 39 and 40:

2.1.2.2 Social, Cultural and politi

- Page 41 and 42:

Saudi Arabia is a monarchy, with st

- Page 43 and 44:

In addition, Saudi Arabia is also p

- Page 45 and 46:

important to the everyday life of S

- Page 47 and 48:

and the city of Abu Dhabi is the ce

- Page 49 and 50:

2.1.4.2 Social, Cultural and politi

- Page 51 and 52:

The Omani economy mainly depends on

- Page 53 and 54:

In recent years, the government has

- Page 55 and 56:

sv2ýJbbQr N m N n O h CC o O n h O

- Page 57 and 58:

11 percent in 1995. In Kuwait, the

- Page 59 and 60:

general. All countries, except Qata

- Page 61 and 62:

with, they all share the same faith

- Page 63 and 64:

" Agreement on linking the electric

- Page 65 and 66:

2.4 An example of Zakat regulationA

- Page 67 and 68:

offices throughout the Saudi Kingdo

- Page 69 and 70:

future is uncertain. In trying to s

- Page 71 and 72:

ChapterthreePrinciples of Islamic E

- Page 73 and 74:

and equitable distribution of incom

- Page 75 and 76:

has two main sources: primary and s

- Page 77 and 78:

Although various Islamic schools an

- Page 79 and 80:

Muslim countries such as Pakistan a

- Page 81 and 82:

This definition also suffers from s

- Page 83 and 84:

elationship that a human being must

- Page 85 and 86:

The search for lawful wealth is reg

- Page 87 and 88:

from place to place and from time t

- Page 89 and 90:

Movement towards greater economic a

- Page 91 and 92:

3.4.5 Freedom of ownership and acti

- Page 93 and 94:

Public ownership is also recognised

- Page 95 and 96:

ates in his Code and suggested the

- Page 97 and 98:

These last verses clearly show that

- Page 99 and 100:

orrower for the period of time the

- Page 101 and 102:

choose and what maximises their uti

- Page 103 and 104:

eliminated at the outset in Islam.

- Page 105 and 106:

aspect of self-interest he or she s

- Page 107 and 108:

it can be said that an Islamic gove

- Page 109 and 110:

certain circumstances not. to cance

- Page 111 and 112:

3.9 Islamic Economics in Practice.A

- Page 113 and 114:

deficit for many years. Pakistan an

- Page 115 and 116:

It was argued that the goal of well

- Page 117 and 118:

economic activities, social and eco

- Page 119 and 120:

ChapterfourZakat and its position i

- Page 121 and 122:

Although these methods are currentl

- Page 123 and 124:

4.1.1 Goals of ZakatMany Muslim sch

- Page 125 and 126:

them to contribute positively to th

- Page 127 and 128:

een distributed to non-profit Musli

- Page 129 and 130:

sectors of the Sunni Islamic sect,

- Page 131 and 132:

4.3.2 WealthThe teachings of the pr

- Page 133 and 134:

Islam without regard to any debt on

- Page 135 and 136:

4.3.2.4 The passage of a yearThe pa

- Page 137 and 138:

oken bones, or gouged eyes (Joan, 1

- Page 139 and 140:

the total amount becomes due. The d

- Page 141 and 142:

example,today is the date that Zaka

- Page 143 and 144:

this item should be considered as p

- Page 145 and 146:

Prophet's obligations. The amount o

- Page 147 and 148:

4.4.4.2 Starting point of Zakat dut

- Page 149 and 150:

such as income earned from practisi

- Page 151 and 152:

There is a widely known view of Mal

- Page 153 and 154:

amount (2.5 percent). In Saudi Arab

- Page 155 and 156:

4.5.2 Department of General IncomeE

- Page 157 and 158:

He further describes some condition

- Page 159 and 160:

year. Zakat is payable on both the

- Page 161 and 162:

through proper channels of the Prop

- Page 163 and 164:

therefore, make a list of the avera

- Page 165 and 166:

unrealised profits should be net of

- Page 167 and 168:

Balance Sheet 31-12-19X230-12-XXX13

- Page 169 and 170:

literature behind the selection of

- Page 171 and 172:

Zakat system supposedly to be appli

- Page 173 and 174:

ChapterfiveResearchmethodology5.0 I

- Page 175 and 176:

5.2 Research questions5.2.1 Zakat p

- Page 177 and 178:

distribution to those deserving it

- Page 179 and 180:

egulation, 1988). Companies, using

- Page 181 and 182:

5.2.5 Zakat regulationRegulating Za

- Page 183 and 184:

capital owners (Article 70).The mea

- Page 185 and 186:

authorities and securities regulato

- Page 187 and 188:

5.2.8 Variations in accounting meas

- Page 189 and 190:

applicability to part of the capita

- Page 191 and 192:

then they must be discounted since

- Page 193 and 194:

as well as with the standard for th

- Page 195 and 196:

5.2.10 Percentage of ZakatWhen Zaka

- Page 197 and 198:

5.2.12 Zakat location in the annual

- Page 199 and 200:

Zakat payer are added to the profit

- Page 201 and 202:

ich. This is what Islam stands agai

- Page 203 and 204:

eing to make it Islamic, strong, gr

- Page 205 and 206:

the present study would have been p

- Page 207 and 208:

a wide geographical area, involving

- Page 209 and 210:

The fifth and last part sought the

- Page 211 and 212:

academics, government officials, in

- Page 213 and 214:

Kuwait. Some individual investors c

- Page 215 and 216:

out of 80 (31 percent) and the Unit

- Page 217 and 218:

important, or agree to disagree. Th

- Page 219 and 220:

KW=12LNNk2 I+ 1) j=1Ellýj-3(N + 1)

- Page 221 and 222:

ChaptersixStatisticalanalysisofthes

- Page 223 and 224:

analysis of respondents background

- Page 225 and 226:

Education and age are not the only

- Page 227 and 228:

years. Twenty-three percent reveale

- Page 229 and 230:

6.2 Major results6.2.1 Zakat paymen

- Page 231 and 232:

Al-Sultan (1997) who argued that Mu

- Page 233 and 234:

Department of Zakat, but not to the

- Page 235 and 236:

ox. It is highly likely that the re

- Page 237 and 238:

to the national banks where the mea

- Page 239 and 240:

difference in means is highly insig

- Page 241 and 242:

collect and distribute only 1.25 pe

- Page 243 and 244:

The ranking of institutions' means

- Page 245 and 246:

Firstly, occupation seems to affect

- Page 247 and 248:

It was, however, roughly find two f

- Page 249 and 250:

collection), as the chi-square stat

- Page 251 and 252:

financial statements such as profit

- Page 253 and 254:

like to be on the safe side as far

- Page 255 and 256:

It is uncontested that the degree o

- Page 257 and 258:

espondentsseem to share some doubt

- Page 259 and 260:

score to themselves on the suggesti

- Page 261 and 262:

statistics were not significant at

- Page 263 and 264:

Secondly, Gulf countries have not y

- Page 265 and 266:

Table 6.13(b)Reasons behind low lev

- Page 267 and 268:

Alms (Zakat) are for the poor, the

- Page 269 and 270:

Table 6.14(b) Appointment and pay f

- Page 271 and 272:

five out of seven items, suggesting

- Page 273 and 274:

discussed earlier remains unchanged

- Page 275 and 276:

4.61. The opinion of accounting fir

- Page 277 and 278:

6.5 SummaryThis chapter has empiric

- Page 279 and 280:

ChaptersevenSummaries,conclusionand

- Page 281 and 282:

7.1.2 Chapter twoThis chapter provi

- Page 283 and 284:

(profit) with the borrower. Any dea

- Page 285 and 286:

countries, Zakat is paid by all tho

- Page 287 and 288:

Another advantage is the accumulati

- Page 289 and 290:

This survey reveals that almost 40

- Page 291 and 292: of the total Zakat amount due. Over

- Page 293 and 294: Most respondents prefer a partnersh

- Page 295 and 296: measurement and disclosure of Zakat

- Page 297 and 298: measurement be re-defined in such a

- Page 299 and 300: " Non-monetary elements, which incl

- Page 301 and 302: Table 7.1A sample of the recommende

- Page 303 and 304: 7.3.2.2 AllowancesThe treatment of

- Page 305 and 306: Zakat at 1.5 percent of the base ra

- Page 307 and 308: Traditionally, Zakat was paid to th

- Page 309 and 310: eason why the survey study covered

- Page 311 and 312: should be set up to at least discus

- Page 313 and 314: BIBLIOGRAPHYAbbas, F. 1988. "Anivar

- Page 315 and 316: Al-Shafi'i,al-Imam, 1987. al-Shafii

- Page 317 and 318: Gambling T. and Abdel Karim, R. 199

- Page 319 and 320: Kuran, T. 1992. The Economic system

- Page 321 and 322: Taylor, T. W., and Evans, J. W. 198

- Page 323 and 324: CARDIFF BUSINESS SCHOOLDirectorProf

- Page 325 and 326: S2. If the answer to question 1 is

- Page 327 and 328: 2. To what extent do you agree or d

- Page 329 and 330: i" iii. 5. ijp'ji ý)ij;; -iK.d. 9.

- Page 331 and 332: cycL. oll o: ri >ý_='°9 tMýa5l1

- Page 333 and 334: G, i7'1 °ßi1 5'° C, .. c ýSý y

- Page 335 and 336: e:;.-. roUS pL Ll LLAI L; 111 CIA:

- Page 337 and 338: " Royal Decrees and Orders "

- Page 339 and 340: ZAKAT REGULATIONS (1)Article I: The

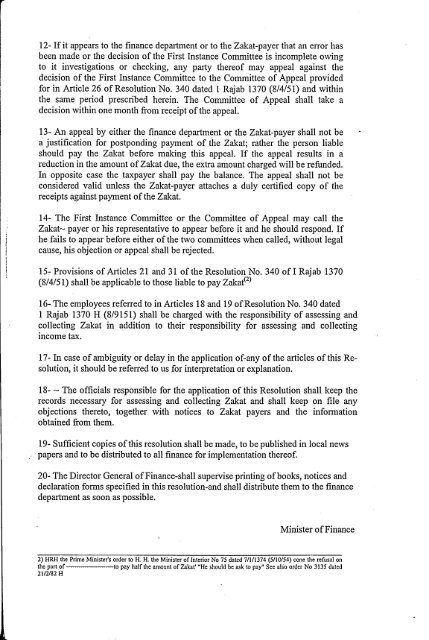

- Page 341: 7- For those who do not keep reliab

- Page 345 and 346: No. 1 7/2/28/577Date: 14/3/1376 H19

- Page 347 and 348: Royal OrderTo: Mohammed Sorour -Riy

- Page 349 and 350: No. 6115/1(1)Date: 5/1/1383 H.With

- Page 351 and 352: 'Zakat & Income Tax Department Bran

- Page 353 and 354: Kingdom of Saudi Arabia.Ministry of

- Page 355 and 356: Ministry of Finance & National Econ