cjdrmYyk fo'ofo|ky;] Hkksiky cjdrmYyk fo'ofo|ky - Barkatullah ...

cjdrmYyk fo'ofo|ky;] Hkksiky cjdrmYyk fo'ofo|ky - Barkatullah ...

cjdrmYyk fo'ofo|ky;] Hkksiky cjdrmYyk fo'ofo|ky - Barkatullah ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

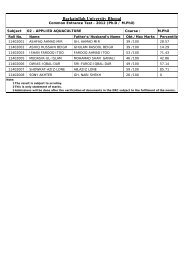

Nature and type of accountsSpecial classes of customers- lunatics, minor, partnership, corporations, localauthoritiesBanking duty to customersConsumer protection: banking as service7. Negotiable InstrumentsMeaning and kindsTransfer and negotiationsHolder and holder in due coursePresentment and paymentLiabilities of parties8. Lending by BankingGood lending to poor massesSecurities for advancesKinds and their merits and demeritsRepayment of loans: rate of interest protection against penaltyDefault and recoveryDebt recovery tribunal9. Recent Trends of Banking System in IndiaNew technologyInformation technologyAutomation and legal aspectsAutomatic teller machine and use of InternetSmart cardUse of expert systemCredit cards10. Reforms in Indian Banking LawRecommendations of committees: a reviewSelected bibliography1. Basu, A Review of Current Banking Theory and Practise (1998) MacMillan2. M. Hapgood (ed.), Pagets’ Law of Banking (1989) Butterworths, London3. R. Goode, Commercial Law, (1995) Penguin, London4. Rose Cranston, principles of Banking Law (1947) Oxford5. L.C. Goyle, The Law of Banking and Bankers (1995) Eastern20

![cjdrmYyk fo'ofo|ky;] Hkksiky cjdrmYyk fo'ofo|ky - Barkatullah ...](https://img.yumpu.com/50831007/20/500x640/cjdrmyyk-foofo-ky-hkksiky-cjdrmyyk-foofo-ky-barkatullah-.jpg)

![cjdrmYyk fo'ofo|ky;] Hkksiky cjdrmYyk fo'ofo|ky;] Hkksiky - Barkatullah ...](https://img.yumpu.com/46923562/1/190x245/cjdrmyyk-foofo-ky-hkksiky-cjdrmyyk-foofo-ky-hkksiky-barkatullah-.jpg?quality=85)