View - Singapore Technologies Engineering

View - Singapore Technologies Engineering

View - Singapore Technologies Engineering

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

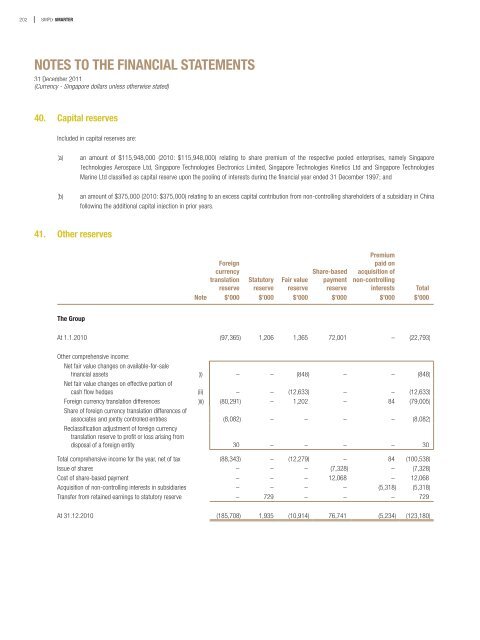

202 SIMPLY SMARTERNOTES TO THE FINANCIAL STATEMENTS31 December 2011(Currency - <strong>Singapore</strong> dollars unless otherwise stated)40. Capital reservesIncluded in capital reserves are:(a)(b)an amount of $115,948,000 (2010: $115,948,000) relating to share premium of the respective pooled enterprises, namely <strong>Singapore</strong><strong>Technologies</strong> Aerospace Ltd, <strong>Singapore</strong> <strong>Technologies</strong> Electronics Limited, <strong>Singapore</strong> <strong>Technologies</strong> Kinetics Ltd and <strong>Singapore</strong> <strong>Technologies</strong>Marine Ltd classified as capital reserve upon the pooling of interests during the financial year ended 31 December 1997; andan amount of $375,000 (2010: $375,000) relating to an excess capital contribution from non-controlling shareholders of a subsidiary in Chinafollowing the additional capital injection in prior years.41. Other reservesForeigncurrencytranslationreservePremiumpaid onacquisition ofnon-controllingStatutoryreserveFair valuereserveShare-basedpaymentreserve interests TotalNote $’000 $’000 $’000 $’000 $’000 $’000The GroupAt 1.1.2010 (97,365) 1,206 1,365 72,001 – (22,793)Other comprehensive income:Net fair value changes on available-for-salefinancial assets (i) – – (848) – – (848)Net fair value changes on effective portion ofcash flow hedges (ii) – – (12,633) – – (12,633)Foreign currency translation differences (iii) (80,291) – 1,202 – 84 (79,005)Share of foreign currency translation differences ofassociates and jointly controlled entities (8,082) – – – – (8,082)Reclassification adjustment of foreign currencytranslation reserve to profit or loss arising fromdisposal of a foreign entity 30 – – – – 30Total comprehensive income for the year, net of tax (88,343) – (12,279) – 84 (100,538)Issue of shares – – – (7,328) – (7,328)Cost of share-based payment – – – 12,068 – 12,068Acquisition of non-controlling interests in subsidiaries – – – – (5,318) (5,318)Transfer from retained earnings to statutory reserve – 729 – – – 729At 31.12.2010 (185,708) 1,935 (10,914) 76,741 (5,234) (123,180)