Statement of accounts 2006-07

Statement of accounts 2006-07

Statement of accounts 2006-07

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

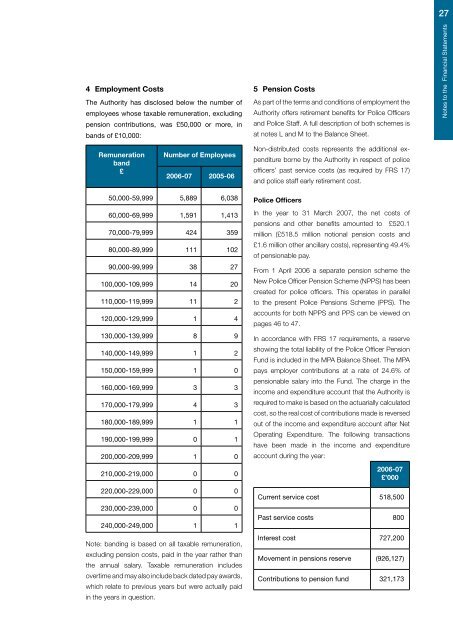

4 Employment CostsThe Authority has disclosed below the number <strong>of</strong>employees whose taxable remuneration, excludingpension contributions, was £50,000 or more, inbands <strong>of</strong> £10,000:5 Pension CostsAs part <strong>of</strong> the terms and conditions <strong>of</strong> employment theAuthority <strong>of</strong>fers retirement benefits for Police Officersand Police Staff. A full description <strong>of</strong> both schemes isat notes L and M to the Balance Sheet.27Notes to the Financial <strong>Statement</strong>sRemunerationband£Number <strong>of</strong> Employees<strong>2006</strong>-<strong>07</strong> 2005-06Non-distributed costs represents the additional expenditureborne by the Authority in respect <strong>of</strong> police<strong>of</strong>ficers’ past service costs (as required by FRS 17)and police staff early retirement cost.50,000-59,999 5,889 6,03860,000-69,999 1,591 1,41370,000-79,999 424 35980,000-89,999 111 10290,000-99,999 38 27100,000-109,999 14 20110,000-119,999 11 2120,000-129,999 1 4130,000-139,999 8 9140,000-149,999 1 2150,000-159,999 1 0160,000-169,999 3 3170,000-179,999 4 3180,000-189,999 1 1190,000-199,999 0 1200,000-209,999 1 0210,000-219,000 0 0220,000-229,000 0 0230,000-239,000 0 0240,000-249,000 1 1Note: banding is based on all taxable remuneration,excluding pension costs, paid in the year rather thanthe annual salary. Taxable remuneration includesovertime and may also include back dated pay awards,which relate to previous years but were actually paidin the years in question.Police OfficersIn the year to 31 March 20<strong>07</strong>, the net costs <strong>of</strong>pensions and other benefits amounted to £520.1million (£518.5 million notional pension costs and£1.6 million other ancillary costs), representing 49.4%<strong>of</strong> pensionable pay.From 1 April <strong>2006</strong> a separate pension scheme theNew Police Officer Pension Scheme (NPPS) has beencreated for police <strong>of</strong>ficers. This operates in parallelto the present Police Pensions Scheme (PPS). The<strong>accounts</strong> for both NPPS and PPS can be viewed onpages 46 to 47.In accordance with FRS 17 requirements, a reserveshowing the total liability <strong>of</strong> the Police Officer PensionFund is included in the MPA Balance Sheet. The MPApays employer contributions at a rate <strong>of</strong> 24.6% <strong>of</strong>pensionable salary into the Fund. The charge in theincome and expenditure account that the Authority isrequired to make is based on the actuarially calculatedcost, so the real cost <strong>of</strong> contributions made is reversedout <strong>of</strong> the income and expenditure account after NetOperating Expenditure. The following transactionshave been made in the income and expenditureaccount during the year:<strong>2006</strong>-<strong>07</strong>£’000Current service cost 518,500Past service costs 800Interest cost 727,200Movement in pensions reserve (926,127)Contributions to pension fund 321,173

![Appendix 1 [PDF]](https://img.yumpu.com/51078997/1/184x260/appendix-1-pdf.jpg?quality=85)

![Transcript of this meeting [PDF]](https://img.yumpu.com/50087310/1/184x260/transcript-of-this-meeting-pdf.jpg?quality=85)

![Street drinking in Hounslow [PDF]](https://img.yumpu.com/49411456/1/184x260/street-drinking-in-hounslow-pdf.jpg?quality=85)