Cost-Sharing Options - Empire Blue Cross Blue Shield

Cost-Sharing Options - Empire Blue Cross Blue Shield

Cost-Sharing Options - Empire Blue Cross Blue Shield

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

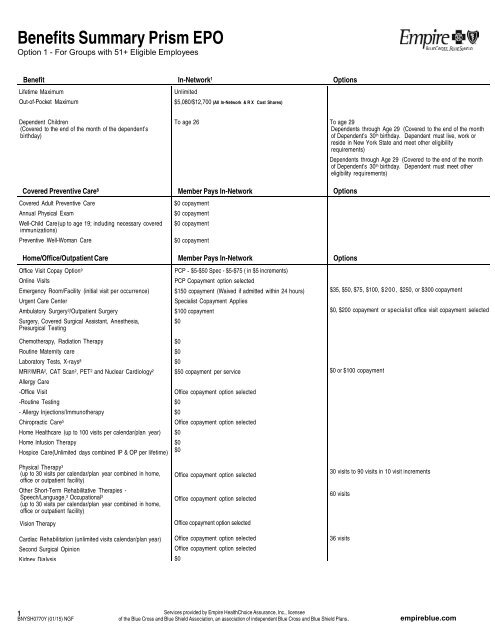

Benefits Summary Prism EPOOption 1 - For Groups with 51+ Eligible EmployeesBenefit In-Network 1 <strong>Options</strong>Lifetime MaximumOut-of-Pocket MaximumUnlimited$5,080/$12,700 (All In-Network & RX <strong>Cost</strong> Shares)Dependent Children(Covered to the end of the month of the dependent’sbirthday)Covered Preventive Care 8Covered Adult Preventive CareAnnual Physical ExamWell-Child Care (up to age 19; including necessary coveredimmunizations)Preventive Well-Woman CareHome/Office/Outpatient CareOffice Visit Copay Option 9Online VisitsEmergency Room/Facility (initial visit per occurrence)Urgent Care CenterAmbulatory Surgery 3 /Outpatient SurgerySurgery, Covered Surgical Assistant, Anesthesia,Presurgical TestingChemotherapy, Radiation TherapyRoutine Maternity careLaboratory Tests, X-rays 8MRI 2 /MRA 2 , CAT Scan 2 , PET 2 and Nuclear Cardiology 2Allergy Care-Office Visit-Routine Testing- Allergy Injections/ImmunotherapyChiropractic Care 5Home Healthcare (up to 100 visits per calendar/plan year)Home Infusion TherapyHospice Care(Unlimited days combined IP & OP per lifetime)Physical Therapy 3(up to 30 visits per calendar/plan year combined in home,office or outpatient facility)Other Short-Term Rehabilitative Therapies -Speech/Language, 3 Occupational 3(up to 30 visits per calendar/plan year combined in home,office or outpatient facility)Vision TherapyCardiac Rehabilitation (unlimited visits calendar/plan year)Second Surgical OpinionKidney DialysisTo age 26Member Pays In-Network$0 copayment$0 copayment$0 copayment$0 copaymentMember Pays In-NetworkPCP - $5-$50 Spec - $5-$75 ( in $5 increments)PCP Copayment option selected$150 copayment (Waived if admitted within 24 hours)Specialist Copayment Applies$100 copayment$0$0$0$0$50 copayment per serviceOffice copayment option selected$0$0Office copayment option selected$0$0$0Office copayment option selectedOffice copayment option selectedOffice copayment option selectedOffice copayment option selectedOffice copayment option selected$0To age 29Dependents through Age 29 (Covered to the end of the monthof Dependent’s 30 th birthday. Dependent must live, work orreside in New York State and meet other eligibilityrequirements)Dependents through Age 29 (Covered to the end of the monthof Dependent’s 30 th birthday. Dependent must meet othereligibility requirements)<strong>Options</strong><strong>Options</strong>$35, $50, $75, $100, $200, $250, or $300 copayment$0, $200 copayment or specialist office visit copayment selected$0 or $100 copayment30 visits to 90 visits in 10 visit increments60 visits36 visits1BNYSH0770Y (01/15) NGFServices provided by <strong>Empire</strong> HealthChoice Assurance, Inc., licenseeof the <strong>Blue</strong> <strong>Cross</strong> and <strong>Blue</strong> <strong>Shield</strong> Association, an association of independent <strong>Blue</strong> <strong>Cross</strong> and <strong>Blue</strong> <strong>Shield</strong> Plans.empireblue.com

Benefits Summary Prism EPOOption 1 - For Groups with 51+ Eligible Employees*Per admission/maximum per calendar/plan year is 2.5x copayment selected.Benefit In-Network 1 <strong>Options</strong>Inpatient Care 3 Member Pays In-Network <strong>Options</strong>Inpatient Hospital (As many days as medically necessary;semiprivate room and board)Surgery, Covered Surgical Assistant, AnesthesiaPhysical Therapy, Physical Medicine, or Rehabilitation (30days per calendar/plan year)Skilled Nursing Facility (up to 60 days per calendar/plan year)$200 copayment per admission*$0Inpatient copayment option selected$100 copayment per admission*1) $100 - $1,000 copayment* in$100 increments per admit*2) $100 - $1,000 copayment in $100 increments per day for amaximum of 3 or 5 days per admit*30 to 90 days in10 day increments90 or 120 daysMental Health Member Pays In-Network <strong>Options</strong>Outpatient Visits in OfficeOutpatient Visits in a FacilityInpatient Care 4(As many days as medically necessary; semiprivate roomand board)PCP Copayment option selected$0Inpatient copayment option selectedAlcohol/Substance Abuse Member Pays In-Network <strong>Options</strong>Outpatient Visits in OfficeOutpatient Visits in a FacilityPCP Copayment option selected$0Inpatient Detoxification 4(As many days as medically necessary; semiprivate roomand board)Inpatient Rehabilitation 4Inpatient copayment option selectedInpatient copayment option selectedOtherMedical SuppliesDurable Medical Equipment 2Member Pays In-Network$050% coinsurance 10Prosthetics and Orthotics 250% coinsurance 10Hearing Aids (Both Ears) – Once every 1,2,or 3 years (includesRider availablebatteries, supplies, maintenance, and fittings)<strong>Options</strong>1) 20% coinsurance 10 , or 2) Covered in Full1) 20% coinsurance 10 , or 2) Covered in FullHearing Aid Rider - $0Ambulance (Land/Air ambulance)Reimbursement for gym membershipPrescription Drugs 6$0Rider availableRider available$50 - $500, increments of $251) Up to $200, $300, $400, $600, $900 annual reimbursementper contract; 50 visits required semi annually. Reimbursed up tohalf for the first 6 months and up to half for the second 6months.2) Up to $200, $300, $400, $600, $900 annual reimbursementper contract (No visit requirement).Retail Program: (Tier 1/Tier 2/Tier 3)1) $10/$25/$50; Deductible options:$0, $50, $100, $250, $5002) $10/$35/$70 Deductible <strong>Options</strong>:$0, $50, $100, $250, $5003) Generic $10; Brand 50%; no deductible4) $15 Generic only, no deductible – 50% coverage formandated brands (without a generic equivalent)For Rx <strong>Options</strong> 1 & 2, Deductible does not apply to Tier 1 Genericdrugs.Mail-Order Program 7 :<strong>Options</strong> 1-2: Drug deductible, if any, is waived for mail order.<strong>Options</strong> 1-4: Prescriptions filled through mail order require only2 copayments for a 3-month supply.Option 3: Brand - 40% coinsuranceVision CareContact <strong>Empire</strong> to learn more about the options available.2BNYSH0770Y (01/15) NGFServices provided by <strong>Empire</strong> HealthChoice Assurance, Inc., licenseeof the <strong>Blue</strong> <strong>Cross</strong> and <strong>Blue</strong> <strong>Shield</strong> Association, an association of independent <strong>Blue</strong> <strong>Cross</strong> and <strong>Blue</strong> <strong>Shield</strong> Plans.empireblue.com

Benefits Summary Prism EPOOption 1 - For Groups with 51+ Eligible Employees1A network provider must deliver all care, except in emergencies. There is no out-of-network option for this product.2For services received from an <strong>Empire</strong> network provider, the provider must precertify services or services may be denied. <strong>Empire</strong>'s network providers cannot bill members except forcopayments or coinsurance for covered services. Outside <strong>Empire</strong>'s network area, you must obtain precertification from <strong>Empire</strong>'s Medical Management Program for non-emergency servicesfrom in-network <strong>Blue</strong>Card ® PPO providers (with the exception of MRI, MRA, PET, CAT and Nuclear Cardiology services, which do not require precertification for services rendered from innetwork<strong>Blue</strong>Card ® PPO providers outside of <strong>Empire</strong>'s network area).3You are responsible for obtaining precertification from <strong>Empire</strong>’s Medical Management Program for these services. Your provider may call for you, but you will be responsible for penaltiesapplied if precertification is not obtained. For ambulatory surgery, please call the toll-free number on your member ID card to determine exactly what outpatient services require precertification.4You are responsible for obtaining precertification from <strong>Empire</strong>’s Behavioral Healthcare Management Program. Your provider may call for you, but you will be responsible for penalties applied ifprecertification is not obtained.5<strong>Empire</strong>'s network provider must obtain authorization for clinical/medical necessity for in-network services, or services may be denied: <strong>Empire</strong> network providers cannot bill members except forcopayments or coinsurance for covered services. Authorization is not required for services rendered from in-network <strong>Blue</strong>Card ® PPO providers outside of <strong>Empire</strong>'s network area.6All of the prescription drug plan options listed on this Benefits Summary, except option 4, meet the Centers for Medicare and Medicaid Services (CMS) standard for Creditable Coverage underthe Medicare Modernization Act of 2003.7To receive a 90-day supply of prescription drugs through <strong>Empire</strong>’s Mail-Order Program, the prescription must be written specifically for a 90-day supply.8Preventive care benefits not subject to copay, deductible and coinsurance; when provided In-Network include: mammography screenings, cervical cancer screenings, colorectal cancerscreenings, prostate cancer screenings, hypercholesterolemia screenings, diabetes screenings for pregnant women, bone density testing, annual physical examinations and annual obstetricand gynecological examinations. May also include other services as required under State and Federal Law. May be subject to age and frequency limits9AThe following practitioners receive the lower (primary) copay for services provided in an office: family, general & nurse practitioners, internists, pediatricians, obstetricians, gynecologists,gerontologists, osteopaths, certified nurse midwife, preventive medicine, chiropractor & physical, occupational & speech therapists. The higher specialist copay will apply for all other providers unlessspecified otherwise, and for services received in an outpatient facility for physical, occupational, speech and cardiac rehab therapies.9BThe following practitioners receive the lower (primary) copay for services provided in an office: family, general & nurse practitioners, internists, pediatricians, obstetricians, gynecologists, certifiednurse midwife, and preventive medicine. The higher (specialist) copay will apply for all other specialists when a copay is required.10The benefit option selected for DME must also be selected as the benefit option for Prosthetics/Orthotics.11Plan year may be selected when a Prescription Drug Program with deductible is selected.IMPORTANT NOTE: This is a benefits summary only and is subject to the terms, conditions and limitations and exclusions set forth in your Certificate of Coverage, Schedule ofBenefits, and any additional Riders or Contracts your group has purchased. Be sure to consult your benefit Contract or Certificate for full details about your coverage. To the extentthere is a conflict between this Summary and your benefit Contract or Certificate, the terms of the Contract or Certificate will control. Failure to comply with <strong>Empire</strong>’s MedicalManagement or Behavioral Healthcare Management Program requirements could result in benefit reductions.This summary of benefits has been updated to comply with federal and state requirements, including applicable provisions of the recently enacted federal health care reform laws.As we receive additional guidance and clarification on the new health care reform laws from the U.S. Department of Health and Human Services, Department of Labor and InternalRevenue Service, we may be required to make additional changes to this summary of benefits.Included are preventive care services that meet the requirements of federal and state law, including certain screenings, immunizations and physician visits.3BNYSH0770Y (01/15) NGFServices provided by <strong>Empire</strong> HealthChoice Assurance, Inc., licenseeof the <strong>Blue</strong> <strong>Cross</strong> and <strong>Blue</strong> <strong>Shield</strong> Association, an association of independent <strong>Blue</strong> <strong>Cross</strong> and <strong>Blue</strong> <strong>Shield</strong> Plans.empireblue.com