DAWOOD LAWRENCEPUR LIMITED - Lahore Stock Exchange

DAWOOD LAWRENCEPUR LIMITED - Lahore Stock Exchange

DAWOOD LAWRENCEPUR LIMITED - Lahore Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

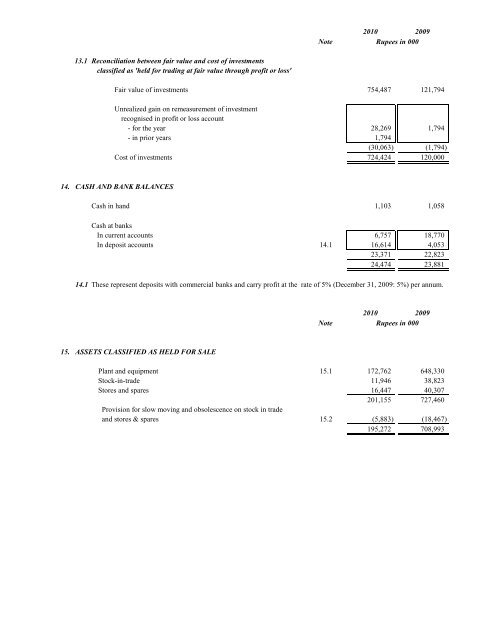

Note2010 2009Rupees in 00013.1 Reconciliation between fair value and cost of investmentsclassified as 'held for trading at fair value through profit or loss'Fair value of investments 754,487 121,794Unrealized gain on remeasurement of investmentrecognised in profit or loss account- for the year 28,269 1,794- in prior years 1,794(30,063) (1,794)Cost of investments 724,424 120,00014. CASH AND BANK BALANCESCash in hand 1,103 1,058Cash at banksIn current accounts 6,757 18,770In deposit accounts 14.1 16,614 4,05323,371 22,82324,474 23,88114.1These represent deposits with commercial banks and carry profit at the rate of 5% (December 31, 2009: 5%) per annum.Note2010 2009Rupees in 00015. ASSETS CLASSIFIED AS HELD FOR SALEPlant and equipment 15.1 172,762 648,330<strong>Stock</strong>-in-trade 11,946 38,823Stores and spares 16,447 40,307201,155 727,460Under Of Provision for slow moving and obsolescence on stock tradeFair For These Assessment all prior Clausevalue fair financial non-currentandvalues year The176 have project ofisstoresthe hasof statements amount been&all liabilities been the has Secondsparesother finalized for rearranged beenfinancial were which the set Schedule upwherever atup fair authorized to instruments asset values financial the tocould have for premises the necessaryissue be are year Incomebeen exchanged, considered 1999-2000 ofTax Salfi to facilitate Ordinance, Textiletaken __________________ ator book (assessment approximate liability comparison.Mills 1979 Limitedvalues15.2settled the profit whoyear these their bybetween the 2000-2001). book are are andthe gainsBoard not values(5,883)knowledgeable considered of solederived as Returns Directors they consumer to materiallybyare(18,467)willingthe ofLong term deposit Addition Disposal Finance These Deferred advances does against tof taxation plant not leased raw carry have and arising material machinery any been rate due obtained to of represent timing return. during from The difference transfer the following fair year buyers value toinclude has non-financial town of been procure itassets Rs.216,680/- has computed been raw institutions material taken completion under (1997-Rs.1,823,391/-)for book under the the of liability value following term ordered asofmethod.itgoods.lease. is terms short total not the for195,272 708,993