DAWOOD LAWRENCEPUR LIMITED - Lahore Stock Exchange

DAWOOD LAWRENCEPUR LIMITED - Lahore Stock Exchange

DAWOOD LAWRENCEPUR LIMITED - Lahore Stock Exchange

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

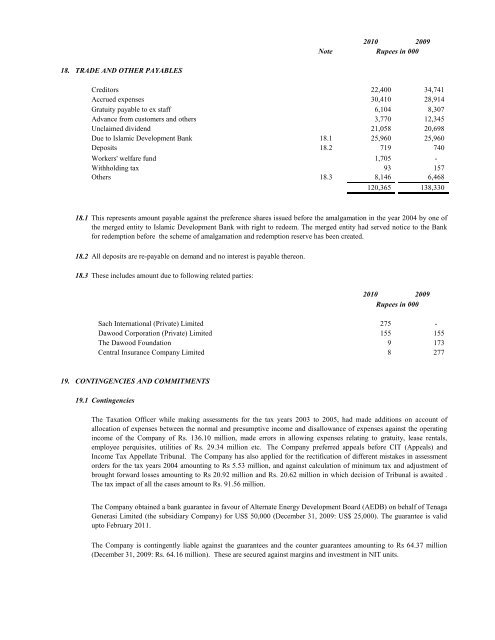

Note2010 2009Rupees in 00018. TRADE AND OTHER PAYABLESCreditors 22,400 34,741Accrued expenses 30,410 28,914Gratuity payable to ex staff 6,104 8,307Advance from customers and others 3,770 12,345Unclaimed dividend 21,058 20,698Due to Islamic Development Bank 18.1 25,960 25,960Deposits 18.2 719 740Workers' welfare fund 1,705 -Withholding tax 93 157Others 18.3 8,146 6,468120,365 138,33018.1This represents amount payable against the preference shares issued before the amalgamation in the year 2004 by one ofthe merged entity to Islamic Development Bank with right to redeem. The merged entity had served notice to the Bankfor redemption before the scheme of amalgamation and redemption reserve has been created.18.2All deposits are re-payable on demand and no interest is payable thereon.18.3 These includes amount due to following related parties:2010 2009Rupees in 000Sach International (Private) Limited 275 -Dawood Corporation (Private) Limited 155 155The Dawood Foundation 9 173Central Insurance Company Limited 8 27719. CONTINGENCIES AND COMMITMENTS19.1 ContingenciesThe Taxation Officer while making assessments for the tax years 2003 to 2005, had made additions on account ofallocation of expenses between the normal and presumptive income and disallowance of expenses against the operatingincome of the Company of Rs. 136.10 million, made errors in allowing expenses relating to gratuity, lease rentals,employee perquisites, utilities of Rs. 29.34 million etc. The Company preferred appeals before CIT (Appeals) andIncome Tax Appellate Tribunal. The Company has also applied for the rectification of different mistakes in assessmentorders for the tax years 2004 amounting to Rs 5.53 million, and against calculation of minimum tax and adjustment ofbrought forward losses amounting to Rs 20.92 million and Rs. 20.62 million in which decision of Tribunal is awaited .The tax impact of all the cases amount to Rs. 91.56 million.The Company obtained a bank guarantee in favour of Alternate Energy Development Board (AEDB) on behalf of TenagaGenerasi Limited (the subsidiary Company) for US$ 50,000 (December 31, 2009: US$ 25,000). The guarantee is validupto February 2011.The Company is contingently liable against the guarantees and the counter guarantees amounting to Rs 64.37 million(December 31, 2009: Rs. 64.16 million). These are secured against margins and investment in NIT units.