full article - Kirby Lester

full article - Kirby Lester

full article - Kirby Lester

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

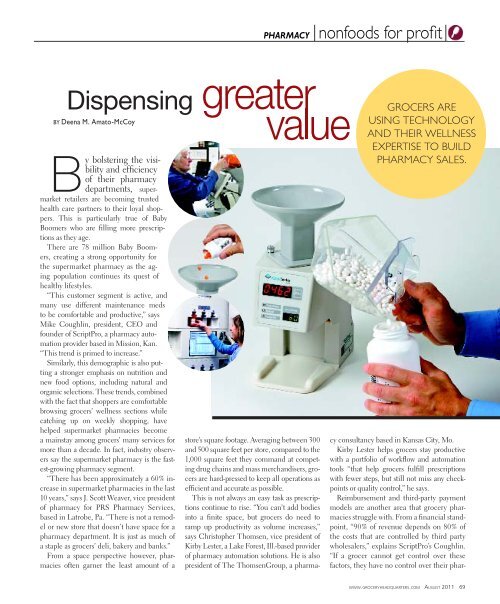

pharmacynonfoods for profitDispensingBy Deena M. Amato-McCoyBy bolstering the visibilityand efficiencyof their pharmacydepartments, supermarketretailers are becoming trustedhealth care partners to their loyal shoppers.This is particularly true of BabyBoomers who are filling more prescriptionsas they age.There are 78 million Baby Boomers,creating a strong opportunity forthe supermarket pharmacy as the agingpopulation continues its quest ofhealthy lifestyles.“This customer segment is active, andmany use different maintenance medsto be comfortable and productive,” saysMike Coughlin, president, CEO andfounder of ScriptPro, a pharmacy automationprovider based in Mission, Kan.“This trend is primed to increase.”Similarly, this demographic is also puttinga stronger emphasis on nutrition andnew food options, including natural andorganic selections. These trends, combinedwith the fact that shoppers are comfortablebrowsing grocers’ wellness sections whilecatching up on weekly shopping, havehelped supermarket pharmacies becomea mainstay among grocers’ many services formore than a decade. In fact, industry observerssay the supermarket pharmacy is the fastest-growingpharmacy segment.“There has been approximately a 60% increasein supermarket pharmacies in the last10 years,” says J. Scott Weaver, vice presidentof pharmacy for PRS Pharmacy Services,based in Latrobe, Pa. “There is not a remodelor new store that doesn’t have space for apharmacy department. It is just as much ofa staple as grocers’ deli, bakery and banks.”From a space perspective however, pharmaciesoften garner the least amount of aGrocers areusing technologyand their wellnessexpertise to buildpharmacy sales.store’s square footage. Averaging between 300and 500 square feet per store, compared to the1,000 square feet they command at competingdrug chains and mass merchandisers, grocersare hard-pressed to keep all operations asefficient and accurate as possible.This is not always an easy task as prescriptionscontinue to rise. “You can’t add bodiesinto a finite space, but grocers do need toramp up productivity as volume increases,”says Christopher Thomsen, vice president of<strong>Kirby</strong> <strong>Lester</strong>, a Lake Forest, Ill.-based providerof pharmacy automation solutions. He is alsopresident of The ThomsenGroup, a pharmacyconsultancy based in Kansas City, Mo.<strong>Kirby</strong> <strong>Lester</strong> helps grocers stay productivewith a portfolio of workflow and automationtools “that help grocers fulfill prescriptionswith fewer steps, but still not miss any checkpointsor quality control,” he says.Reimbursement and third-party paymentmodels are another area that grocery pharmaciesstruggle with. From a financial standpoint,“90% of revenue depends on 80% ofthe costs that are controlled by third partywholesalers,” explains ScriptPro’s Coughlin.“If a grocer cannot get control over thesefactors, they have no control over their phar- www.groceryheadquarters.com August 2011 69

nonfoods for profit pharmacymacy operation at all.”For example, if 90% of pharmacy revenuecomes through a pharmacy benefit manager,or the third-party company that determinesco-pays and reimbursements, and 80% bywholesalers, “there is no chance of makinga profit,” he says. “If a grocer is not watchingtheir pharmacy’s money, no one else is either.”To make matters worse, observers say thereare specific areas that are sure to trip up lessreimbursement-savvy retailers. They say retailersare often supporting their partners’unbalanced contracts. The second challengeis retailers often misunderstand the jargon ofa contract, and get stung by hidden costs thatcontracts do not clearly spell out.“These are all reasons for grocery pharmaciesto watch the Ps and Qs,” explains Coughlin.“Without knowledge of how to handlethese issues, not only are they being impactedby hidden costs, they could also be leavingmoney on the table.”Clearly, the reimbursement game is a complexone. ScriptPro officials say grocers canstay competitive with its Third Party ManagementSystem (TPMS), an automated solutionthat catalogs and evaluates all aspects ofcontracts, third-party billing, and collectionof third-party prescription reimbursements.“The solution provides exception reports sogrocers have a systematic way to conduct reimbursements,”says Coughlin.The TPMS pulls data each night from grocerypartners. Data reveals all transactionsconducted for the day, as well as third-partycontracts that were applied to each transaction.“Our solution guides the grocer abouthow to evaluate the third party contract,rate them and compare them with othercontracts,” he says. “It also helps the grocerbalance sales results against all contracts andreveals discrepancies to follow up on.”Changing the gameOne major opportunity for supermarketsto boost the value of their pharmacies is tomerge the relevance of their health and wellnesssections and create a healthy living destinationwithin the store. “Grocers are alreadyexperts at promoting their fresh foods andstore-level nutritionists’ services. Now theyneed to train pharmacists to use this knowledgewhen serving shoppers,” says Thomsen.70 August 2011 www.groceryheadquarters.com

nonfoods for profit pharmacyMaking pharmacies visibleIf grocers can encourage more shoppers to pass the pharmacy, they have a betterchance of building the department’s patient base. This is challenging however,when many store-level pharmacies are often hidden away in the back of the store,out of the path of regular foot traffic.Industry observers suggest using different marketing methods, such as traditionaland digital signage, to remind shoppers to visit. As shoppers grow morecomfortable with the Internet and Web-enabled consumer devices however,supermarket retailers are deploying wellness-inspired customer-facing technologyto boost pharmacy traffic.Options include telepharmacy stations that use teleconferencing services forshoppers to drop off prescriptions at store level, or wellness-based kiosks thatcreate a wellness destination. While many retailers still associate early versions ofkiosks with big footprints and slow software, new compact solutions rely on wirelessconnections that can be monitored and updated remotely.The EyeSite kiosk from Duluth, Ga.-based SoloHealth, for example, is a free,touch-screen self-service vision test kiosk that is focused on total eye health. Usinga combination of interactive health screening software and health care informationshared by the consumer, EyeSite takes various screenings.An integrated analytics engine evaluates patient statistics, including the consumer’sage, ethnicity and potential risk factors. It then creates individualized reportson vision and eye health status and allows shoppers to set up appointmentswith local eye care professionals.Currently, there are 100 units in use across the retail industry. Based on the500,000 users so far, 25% hadnever had an eye exam, accordingto SoloHealth officials.“Half of all eye diseases are controllable,yet 30 million Americansare candidates for vision loss ifthey do not get the right exam,”says Bart Foster, SoloHealth’sCEO and founder.Grocers can also use the deviceto boost their overall wellnessdepartments, drive traffic totheir pharmacy departments, andcross-promote and increase categorysales of optical products andrelated categories.Progressive chains such as United Supermarketsand Bi-Lo have dieticians on staffwho can educate shoppers on the properdiet and foods they need to naturally controlhealth issues including high blood pressureand cholesterol levels, for example.At the center of this process is for pharmacyand store managers to partner on how to expandthe wellness department, placing thepharmacy at the core. This includes trainingthe pharmacist to be more knowledgeableabout all attributes of wellness merchandise—includingthose in both the medicaland traditional food categories.“Now it is time for the pharmacist to helpprovide other patient care services, similarto independent pharmacies,” Thomsen says.“They need to step out from behind thecounter and provide immunizations, medicationtherapy management services, healthscreenings, and health clinics that featurenurse practitioners and physicians assistants.They already have an advantage by focusingon nutrition and wellness. Now the storemanager needs to get involved and couple itall together.”The other approach to mirroring the valuethat independents provide is to know the customer.This goes beyond remembering theirname or ailment. The only for retailers to interactwith shoppers is to “get their hands ondata to better understand how to deliver morewellness options,” says L. Preston Hale, nationalmanager, strategic accounts for QS/1,a Spartanburg, S.C.-based provider of pharmacymanagement software.“With insight into a patient’s purchase history,grocers have the opportunity to work withphysicians to enhance patient care,” he says.“It builds loyalty with the shopper and developsa closer physician-patient relationship.”Since grocers are synonymous with loyaltyprograms, supermarket retailers are managinghigh volumes of customer and transactiondata in the retail industry. Hanks says QS/1 ishelping grocers harness this data to enhancecompliance and improve patient outcomes.Grocers integrate their loyalty shopper andprescription database, as well as their InteractiveVoice Response system, to QS/1’s NRxPharmacy Management System. It analyzeswhen loyalty shoppers’ scripts are due for fulfillment,and NRx sends an automated messageto activate the workflow application.“By querying the pharmacy system onwhich loyalty patients’ scripts are due nextThursday for example, the software deliversthe results, and an automated IVR messageis generated, reminding shoppers their scriptis due Thursday, and asks would you like usto fill it,” Hale explains. “If they respond yes,the message is sent through workflow andfulfilled through our automated InstantFillsystem. Workflow keeps all compliance andreimbursement points in check, and the orderis fulfilled and ready for the patient.” c72 August 2011 www.groceryheadquarters.com