Prospects for medicinal herbs - Bad Request

Prospects for medicinal herbs - Bad Request

Prospects for medicinal herbs - Bad Request

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

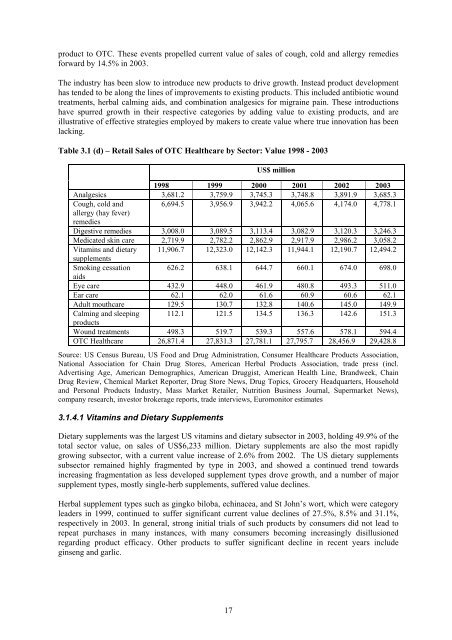

product to OTC. These events propelled current value of sales of cough, cold and allergy remedies<strong>for</strong>ward by 14.5% in 2003.The industry has been slow to introduce new products to drive growth. Instead product developmenthas tended to be along the lines of improvements to existing products. This included antibiotic woundtreatments, herbal calming aids, and combination analgesics <strong>for</strong> migraine pain. These introductionshave spurred growth in their respective categories by adding value to existing products, and areillustrative of effective strategies employed by makers to create value where true innovation has beenlacking.Table 3.1 (d) – Retail Sales of OTC Healthcare by Sector: Value 1998 - 2003US$ million1998 1999 2000 2001 2002 2003Analgesics 3,681.2 3,759.9 3,745.3 3,748.8 3,891.9 3,685.3Cough, cold and 6,694.5 3,956.9 3,942.2 4,065.6 4,174.0 4,778.1allergy (hay fever)remediesDigestive remedies 3,008.0 3,089.5 3,113.4 3,082.9 3,120.3 3,246.3Medicated skin care 2,719.9 2,782.2 2,862.9 2,917.9 2,986.2 3,058.2Vitamins and dietary 11,906.7 12,323.0 12,142.3 11,944.1 12,190.7 12,494.2supplementsSmoking cessation 626.2 638.1 644.7 660.1 674.0 698.0aidsEye care 432.9 448.0 461.9 480.8 493.3 511.0Ear care 62.1 62.0 61.6 60.9 60.6 62.1Adult mouthcare 129.5 130.7 132.8 140.6 145.0 149.9Calming and sleeping 112.1 121.5 134.5 136.3 142.6 151.3productsWound treatments 498.3 519.7 539.3 557.6 578.1 594.4OTC Healthcare 26,871.4 27,831.3 27,781.1 27,795.7 28,456.9 29,428.8Source: US Census Bureau, US Food and Drug Administration, Consumer Healthcare Products Association,National Association <strong>for</strong> Chain Drug Stores, American Herbal Products Association, trade press (incl.Advertising Age, American Demographics, American Druggist, American Health Line, Brandweek, ChainDrug Review, Chemical Market Reporter, Drug Store News, Drug Topics, Grocery Headquarters, Householdand Personal Products Industry, Mass Market Retailer, Nutrition Business Journal, Supermarket News),company research, investor brokerage reports, trade interviews, Euromonitor estimates3.1.4.1 Vitamins and Dietary SupplementsDietary supplements was the largest US vitamins and dietary subsector in 2003, holding 49.9% of thetotal sector value, on sales of US$6,233 million. Dietary supplements are also the most rapidlygrowing subsector, with a current value increase of 2.6% from 2002. The US dietary supplementssubsector remained highly fragmented by type in 2003, and showed a continued trend towardsincreasing fragmentation as less developed supplement types drove growth, and a number of majorsupplement types, mostly single-herb supplements, suffered value declines.Herbal supplement types such as gingko biloba, echinacea, and St John’s wort, which were categoryleaders in 1999, continued to suffer significant current value declines of 27.5%, 8.5% and 31.1%,respectively in 2003. In general, strong initial trials of such products by consumers did not lead torepeat purchases in many instances, with many consumers becoming increasingly disillusionedregarding product efficacy. Other products to suffer significant decline in recent years includeginseng and garlic.17