Prospects for medicinal herbs - Bad Request

Prospects for medicinal herbs - Bad Request

Prospects for medicinal herbs - Bad Request

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

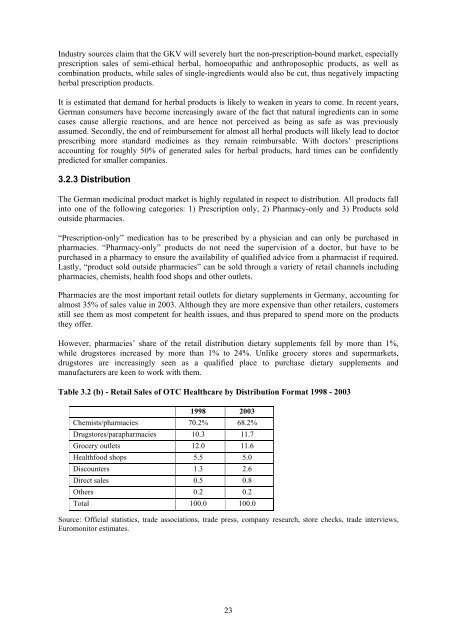

Industry sources claim that the GKV will severely hurt the non-prescription-bound market, especiallyprescription sales of semi-ethical herbal, homoeopathic and anthroposophic products, as well ascombination products, while sales of single-ingredients would also be cut, thus negatively impactingherbal prescription products.It is estimated that demand <strong>for</strong> herbal products is likely to weaken in years to come. In recent years,German consumers have become increasingly aware of the fact that natural ingredients can in somecases cause allergic reactions, and are hence not perceived as being as safe as was previouslyassumed. Secondly, the end of reimbursement <strong>for</strong> almost all herbal products will likely lead to doctorprescribing more standard medicines as they remain reimbursable. With doctors’ prescriptionsaccounting <strong>for</strong> roughly 50% of generated sales <strong>for</strong> herbal products, hard times can be confidentlypredicted <strong>for</strong> smaller companies.3.2.3 DistributionThe German <strong>medicinal</strong> product market is highly regulated in respect to distribution. All products fallinto one of the following categories: 1) Prescription only, 2) Pharmacy-only and 3) Products soldoutside pharmacies.“Prescription-only” medication has to be prescribed by a physician and can only be purchased inpharmacies. “Pharmacy-only” products do not need the supervision of a doctor, but have to bepurchased in a pharmacy to ensure the availability of qualified advice from a pharmacist if required.Lastly, “product sold outside pharmacies” can be sold through a variety of retail channels includingpharmacies, chemists, health food shops and other outlets.Pharmacies are the most important retail outlets <strong>for</strong> dietary supplements in Germany, accounting <strong>for</strong>almost 35% of sales value in 2003. Although they are more expensive than other retailers, customersstill see them as most competent <strong>for</strong> health issues, and thus prepared to spend more on the productsthey offer.However, pharmacies’ share of the retail distribution dietary supplements fell by more than 1%,while drugstores increased by more than 1% to 24%. Unlike grocery stores and supermarkets,drugstores are increasingly seen as a qualified place to purchase dietary supplements andmanufacturers are keen to work with them.Table 3.2 (b) - Retail Sales of OTC Healthcare by Distribution Format 1998 - 20031998 2003Chemists/pharmacies 70.2% 68.2%Drugstores/parapharmacies 10.3 11.7Grocery outlets 12.0 11.6Healthfood shops 5.5 5.0Discounters 1.3 2.6Direct sales 0.5 0.8Others 0.2 0.2Total 100.0 100.0Source: Official statistics, trade associations, trade press, company research, store checks, trade interviews,Euromonitor estimates.23