Malaysia

Malaysia

Malaysia

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

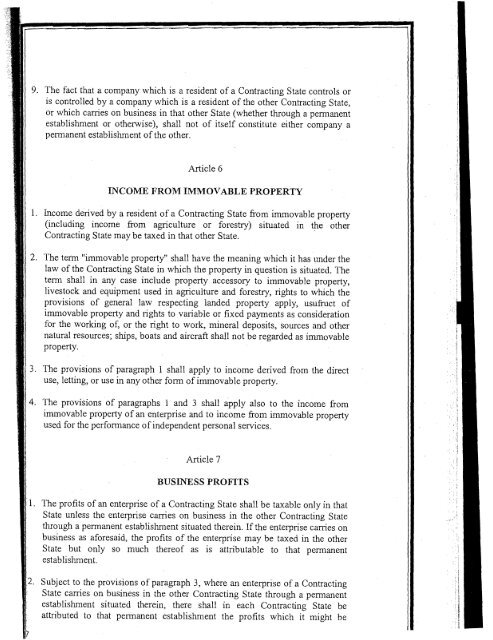

9. The fact that a company which is a resident of a Contracting State controls oris controlled by a company which is a resident of the other Contracting State,or which carries on business in that other State (whether through a permanentestablishment or otherwise), shall not of itself constitute either company apermanent establishment ofthe other.Article 6INCOME FROM IMMOVABLE PROPERTY1. Income derived by a resident of a Contracting State from immovable property(including income from agriculture or forestry) situated in the otherContracting State may be taxed in that other State.2. The term "immovable property" shall have the meaning which it has under thelaw of the Contracting State in which the property in question is situated. Theterm shall in any case include property accessory to immovable property,livestock and equipment used in agriculture and forestry, rights to which theprovisions of general law respecting landed property apply, usufruct ofimmovable property and rights to variable or fixed payments as considerationfor the working of, or the right to work, mineral deposits, sources and othernatural resources; ships, boats and aircraft shall not be regarded as immovableproperty.3. The provisions of paragraph 1 shall apply to income derived from the directuse, letting, or use in any other form of immovable property.4. The provisions of paragraphs 1 and 3 shall apply also to the income fromimmovable property of an enterprise and to income from immovable propertyused for the performance of independent personal services.Article 7BUSINESS PROFITS1. The profits of an enterprise of a Contracting State shall be taxable only in thatState unless the enterprise carries on business in the other Contracting Statethrough a permanent establishment situated therein. If the enterprise carries onbusiness as aforesaid, the profits of the enterprise may be taxed in the otherState but only so much thereof as is attributable to that permanentestablishment.2. Subject to the provisions of paragraph 3, where an enterprise of a ContractingState carries on business in the other Contracting State through a permanentestablishment situated therein, there shall in each Contracting State beattributed to that permanent establishment the profits which it might be