King Island Council Annual Report 2011-2012 (1921 kb)

King Island Council Annual Report 2011-2012 (1921 kb)

King Island Council Annual Report 2011-2012 (1921 kb)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

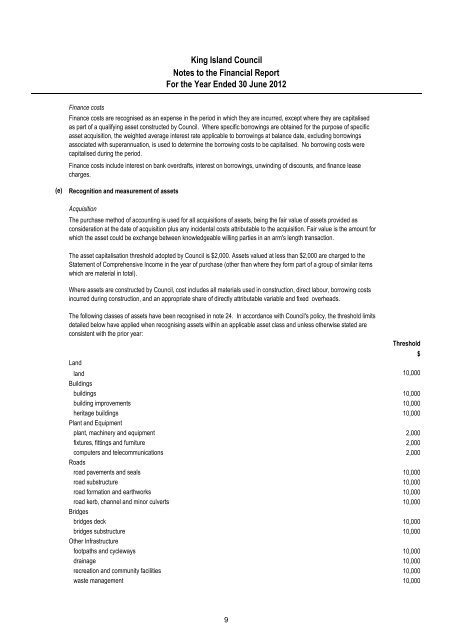

<strong>King</strong> <strong>Island</strong> <strong>Council</strong>Notes to the Financial <strong>Report</strong>For the Year Ended 30 June <strong>2012</strong>Finance costsFinance costs are recognised as an expense in the period in which they are incurred, except where they are capitalisedas part of a qualifying asset constructed by <strong>Council</strong>. Where specific borrowings are obtained for the purpose of specificasset acquisition, the weighted average interest rate applicable to borrowings at balance date, excluding borrowingsassociated with superannuation, is used to determine the borrowing costs to be capitalised. No borrowing costs werecapitalised during the period.Finance costs include interest on bank overdrafts, interest on borrowings, unwinding of discounts, and finance leasecharges.(e)Recognition and measurement of assetsAcquisitionThe purchase method of accounting is used for all acquisitions of assets, being the fair value of assets provided asconsideration at the date of acquisition plus any incidental costs attributable to the acquisition. Fair value is the amount forwhich the asset could be exchange between knowledgeable willing parties in an arm's length transaction.The asset capitalisation threshold adopted by <strong>Council</strong> is $2,000. Assets valued at less than $2,000 are charged to theStatement of Comprehensive Income in the year of purchase (other than where they form part of a group of similar itemswhich are material in total).Where assets are constructed by <strong>Council</strong>, cost includes all materials used in construction, direct labour, borrowing costsincurred during construction, and an appropriate share of directly attributable variable and fixed overheads.The following classes of assets have been recognised in note 24. In accordance with <strong>Council</strong>'s policy, the threshold limitsdetailed below have applied when recognising assets within an applicable asset class and unless otherwise stated areconsistent with the prior year:LandThresholdland 10,000Buildingsbuildings 10,000building improvements 10,000heritage buildings 10,000Plant and Equipmentplant, machinery and equipment 2,000fixtures, fittings and furniture 2,000computers and telecommunications 2,000Roadsroad pavements and seals 10,000road substructure 10,000road formation and earthworks 10,000road kerb, channel and minor culverts 10,000Bridgesbridges deck 10,000bridges substructure 10,000Other Infrastructurefootpaths and cycleways 10,000drainage 10,000recreation and community facilities 10,000waste management 10,000$9