King Island Council Annual Report 2011-2012 (1921 kb)

King Island Council Annual Report 2011-2012 (1921 kb)

King Island Council Annual Report 2011-2012 (1921 kb)

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

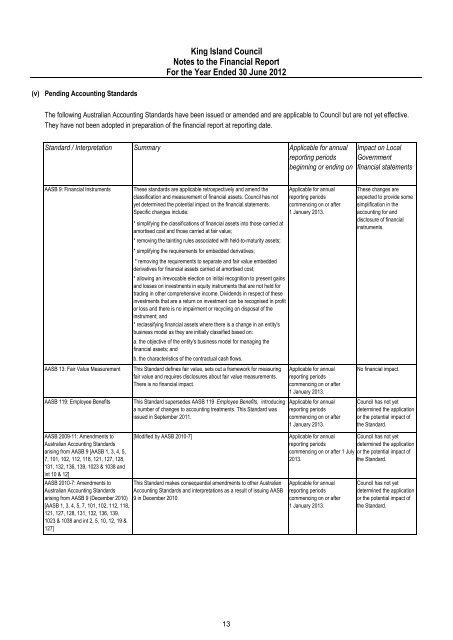

<strong>King</strong> <strong>Island</strong> <strong>Council</strong>Notes to the Financial <strong>Report</strong>For the Year Ended 30 June <strong>2012</strong>(v)Pending Accounting StandardsThe following Australian Accounting Standards have been issued or amended and are applicable to <strong>Council</strong> but are not yet effective.They have not been adopted in preparation of the financial report at reporting date.Standard / Interpretation Summary Applicable for annualreporting periodsbeginning or ending onImpact on LocalGovernmentfinancial statementsAASB 9: Financial InstrumentsAASB 13: Fair Value MeasurementAASB 119: Employee BenefitsThese standards are applicable retrospectively and amend theclassification and measurement of financial assets. <strong>Council</strong> has notyet determined the potential impact on the financial statements.Specific changes include:* simplifying the classifications of financial assets into those carried atamortised cost and those carried at fair value;* removing the tainting rules associated with held-to-maturity assets;* simplifying the requirements for embedded derivatives;* removing the requirements to separate and fair value embeddedderivatives for financial assets carried at amortised cost;* allowing an irrevocable election on initial recognition to present gainsand losses on investments in equity instruments that are not held fortrading in other comprehensive income. Dividends in respect of theseinvestments that are a return on investment can be recognised in profitor loss and there is no impairment or recycling on disposal of theinstrument; and* reclassifying financial assets where there is a change in an entity'sbusiness model as they are initially classified based on:a. the objective of the entity's business model for managing thefinancial assets; andb. the characteristics of the contractual cash flows.This Standard defines fair value, sets out a framework for measuringfair value and requires disclosures about fair value measurements.There is no financial impact.This Standard supersedes AASB 119 Employee Benefits, introducinga number of changes to accounting treatments. This Standard wasissued in September <strong>2011</strong>.Applicable for annualreporting periodscommencing on or after1 January 2013.Applicable for annualreporting periodscommencing on or after1 January 2013.Applicable for annualreporting periodscommencing on or after1 January 2013.These changes areexpected to provide somesimplification in theaccounting for anddisclosure of financialinstruments.No financial impact.<strong>Council</strong> has not yetdetermined the applicationor the potential impact ofthe Standard.AASB 2009-11: Amendments toAustralian Accounting Standardsarising from AASB 9 [AASB 1, 3, 4, 5,7, 101, 102, 112, 118, 121, 127, 128,131, 132, 136, 139, 1023 & 1038 andint 10 & 12]AASB 2010-7: Amendments toAustralian Accounting Standardsarising from AASB 9 (December 2010)[AASB 1, 3, 4, 5, 7, 101, 102, 112, 118,121, 127, 128, 131, 132, 136, 139,1023 & 1038 and int 2, 5, 10, 12, 19 &127][Modified by AASB 2010-7]This Standard makes consequential amendments to other AustralianAccounting Standards and interpretations as a result of issuing AASB9 in December 2010.Applicable for annual <strong>Council</strong> has not yetreporting periodsdetermined the applicationcommencing on or after 1 July or the potential impact of2013.the Standard.Applicable for annualreporting periodscommencing on or after1 January 2013.<strong>Council</strong> has not yetdetermined the applicationor the potential impact ofthe Standard.13