Financial Inclusion amongst New Migrants in Northern Ireland - ICAR

Financial Inclusion amongst New Migrants in Northern Ireland - ICAR

Financial Inclusion amongst New Migrants in Northern Ireland - ICAR

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

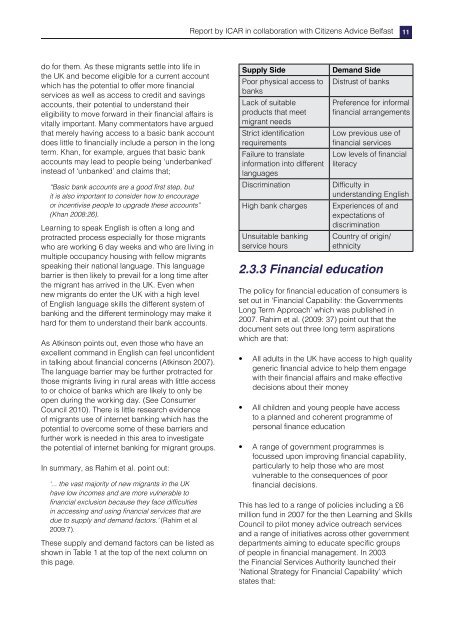

Report by <strong>ICAR</strong> <strong>in</strong> collaboration with Citizens Advice Belfast 11do for them. As these migrants settle <strong>in</strong>to life <strong>in</strong>the UK and become eligible for a current accountwhich has the potential to offer more f<strong>in</strong>ancialservices as well as access to credit and sav<strong>in</strong>gsaccounts, their potential to understand theireligibility to move forward <strong>in</strong> their f<strong>in</strong>ancial affairs isvitally important. Many commentators have arguedthat merely hav<strong>in</strong>g access to a basic bank accountdoes little to f<strong>in</strong>ancially <strong>in</strong>clude a person <strong>in</strong> the longterm. Khan, for example, argues that basic bankaccounts may lead to people be<strong>in</strong>g ‘underbanked’<strong>in</strong>stead of ‘unbanked’ and claims that;“Basic bank accounts are a good first step, butit is also important to consider how to encourageor <strong>in</strong>centivise people to upgrade these accounts”(Khan 2008:26).Learn<strong>in</strong>g to speak English is often a long andprotracted process especially for those migrantswho are work<strong>in</strong>g 6 day weeks and who are liv<strong>in</strong>g <strong>in</strong>multiple occupancy hous<strong>in</strong>g with fellow migrantsspeak<strong>in</strong>g their national language. This languagebarrier is then likely to prevail for a long time afterthe migrant has arrived <strong>in</strong> the UK. Even whennew migrants do enter the UK with a high levelof English language skills the different system ofbank<strong>in</strong>g and the different term<strong>in</strong>ology may make ithard for them to understand their bank accounts.As Atk<strong>in</strong>son po<strong>in</strong>ts out, even those who have anexcellent command <strong>in</strong> English can feel unconfident<strong>in</strong> talk<strong>in</strong>g about f<strong>in</strong>ancial concerns (Atk<strong>in</strong>son 2007).The language barrier may be further protracted forthose migrants liv<strong>in</strong>g <strong>in</strong> rural areas with little accessto or choice of banks which are likely to only beopen dur<strong>in</strong>g the work<strong>in</strong>g day. (See ConsumerCouncil 2010). There is little research evidenceof migrants use of <strong>in</strong>ternet bank<strong>in</strong>g which has thepotential to overcome some of these barriers andfurther work is needed <strong>in</strong> this area to <strong>in</strong>vestigatethe potential of <strong>in</strong>ternet bank<strong>in</strong>g for migrant groups.In summary, as Rahim et al. po<strong>in</strong>t out:‘... the vast majority of new migrants <strong>in</strong> the UKhave low <strong>in</strong>comes and are more vulnerable tof<strong>in</strong>ancial exclusion because they face difficulties<strong>in</strong> access<strong>in</strong>g and us<strong>in</strong>g f<strong>in</strong>ancial services that aredue to supply and demand factors.’ (Rahim et al2009:7).These supply and demand factors can be listed asshown <strong>in</strong> Table 1 at the top of the next column onthis page.Supply SidePoor physical access tobanksLack of suitableproducts that meetmigrant needsStrict identificationrequirementsFailure to translate<strong>in</strong>formation <strong>in</strong>to differentlanguagesDiscrim<strong>in</strong>ationHigh bank chargesUnsuitable bank<strong>in</strong>gservice hoursDemand SideDistrust of banksPreference for <strong>in</strong>formalf<strong>in</strong>ancial arrangementsLow previous use off<strong>in</strong>ancial servicesLow levels of f<strong>in</strong>ancialliteracyDifficulty <strong>in</strong>understand<strong>in</strong>g EnglishExperiences of andexpectations ofdiscrim<strong>in</strong>ationCountry of orig<strong>in</strong>/ethnicity2.3.3 <strong>F<strong>in</strong>ancial</strong> educationThe policy for f<strong>in</strong>ancial education of consumers isset out <strong>in</strong> ‘<strong>F<strong>in</strong>ancial</strong> Capability: the GovernmentsLong Term Approach’ which was published <strong>in</strong>2007. Rahim et al. (2009: 37) po<strong>in</strong>t out that thedocument sets out three long term aspirationswhich are that:• All adults <strong>in</strong> the UK have access to high qualitygeneric f<strong>in</strong>ancial advice to help them engagewith their f<strong>in</strong>ancial affairs and make effectivedecisions about their money• All children and young people have accessto a planned and coherent programme ofpersonal f<strong>in</strong>ance education• A range of government programmes isfocussed upon improv<strong>in</strong>g f<strong>in</strong>ancial capability,particularly to help those who are mostvulnerable to the consequences of poorf<strong>in</strong>ancial decisions.This has led to a range of policies <strong>in</strong>clud<strong>in</strong>g a £6million fund <strong>in</strong> 2007 for the then Learn<strong>in</strong>g and SkillsCouncil to pilot money advice outreach servicesand a range of <strong>in</strong>itiatives across other governmentdepartments aim<strong>in</strong>g to educate specific groupsof people <strong>in</strong> f<strong>in</strong>ancial management. In 2003the <strong>F<strong>in</strong>ancial</strong> Services Authority launched their‘National Strategy for <strong>F<strong>in</strong>ancial</strong> Capability’ whichstates that: