T000002446_FileName_Tender document - ET ... - Bharat Petroleum

T000002446_FileName_Tender document - ET ... - Bharat Petroleum

T000002446_FileName_Tender document - ET ... - Bharat Petroleum

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

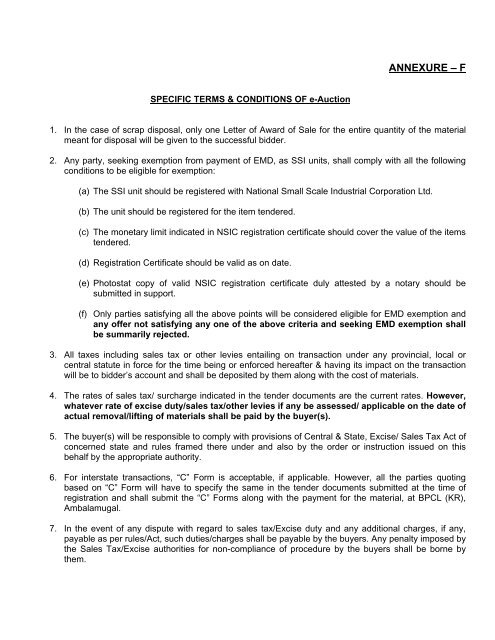

ANNEXURE – FSPECIFIC TERMS & CONDITIONS OF e-Auction1. In the case of scrap disposal, only one Letter of Award of Sale for the entire quantity of the materialmeant for disposal will be given to the successful bidder.2. Any party, seeking exemption from payment of EMD, as SSI units, shall comply with all the followingconditions to be eligible for exemption:(a) The SSI unit should be registered with National Small Scale Industrial Corporation Ltd.(b) The unit should be registered for the item tendered.(c) The monetary limit indicated in NSIC registration certificate should cover the value of the itemstendered.(d) Registration Certificate should be valid as on date.(e) Photostat copy of valid NSIC registration certificate duly attested by a notary should besubmitted in support.(f) Only parties satisfying all the above points will be considered eligible for EMD exemption andany offer not satisfying any one of the above criteria and seeking EMD exemption shallbe summarily rejected.3. All taxes including sales tax or other levies entailing on transaction under any provincial, local orcentral statute in force for the time being or enforced hereafter & having its impact on the transactionwill be to bidder’s account and shall be deposited by them along with the cost of materials.4. The rates of sales tax/ surcharge indicated in the tender <strong>document</strong>s are the current rates. However,whatever rate of excise duty/sales tax/other levies if any be assessed/ applicable on the date ofactual removal/lifting of materials shall be paid by the buyer(s).5. The buyer(s) will be responsible to comply with provisions of Central & State, Excise/ Sales Tax Act ofconcerned state and rules framed there under and also by the order or instruction issued on thisbehalf by the appropriate authority.6. For interstate transactions, “C” Form is acceptable, if applicable. However, all the parties quotingbased on “C” Form will have to specify the same in the tender <strong>document</strong>s submitted at the time ofregistration and shall submit the “C” Forms along with the payment for the material, at BPCL (KR),Ambalamugal.7. In the event of any dispute with regard to sales tax/Excise duty and any additional charges, if any,payable as per rules/Act, such duties/charges shall be payable by the buyers. Any penalty imposed bythe Sales Tax/Excise authorities for non-compliance of procedure by the buyers shall be borne bythem.