Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

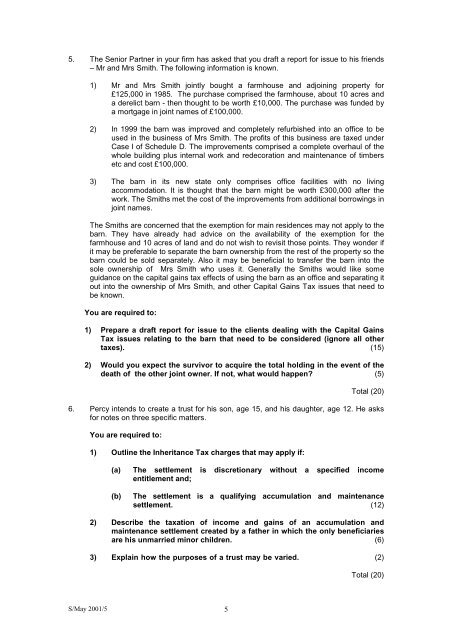

5. The Senior Partner in your firm has asked that you draft a report for issue to his friends– Mr and Mrs Smith. The following information is known.1) Mr and Mrs Smith jointly bought a farmhouse and adjoining property for£125,000 in 1985. The purchase comprised the farmhouse, about 10 acres anda derelict barn - then thought to be worth £10,000. The purchase was funded bya mortgage in joint names of £100,000.2) In 1999 the barn was improved and completely refurbished into an office to beused in the business of Mrs Smith. The profits of this business are taxed underCase I of Schedule D. The improvements comprised a complete overhaul of thewhole building plus internal work and redecoration and maintenance of timbersetc and cost £100,000.3) The barn in its new state only comprises office facilities with no livingaccommodation. It is thought that the barn might be worth £300,000 after thework. The Smiths met the cost of the improvements from additional borrowings injoint names.The Smiths are concerned that the exemption for main residences may not apply to thebarn. They have already had advice on the availability of the exemption for thefarmhouse and 10 acres of land and do not wish to revisit those points. They wonder ifit may be preferable to separate the barn ownership from the rest of the property so thebarn could be sold separately. Also it may be beneficial to transfer the barn into thesole ownership of Mrs Smith who uses it. Generally the Smiths would like someguidance on the capital gains tax effects of using the barn as an office and separating itout into the ownership of Mrs Smith, and other Capital Gains Tax issues that need tobe known.You are required to:1) Prepare a draft report for issue to the clients dealing with the Capital GainsTax issues relating to the barn that need to be considered (ignore all othertaxes). (15)2) Would you expect the survivor to acquire the total holding in the event of thedeath of the other joint owner. If not, what would happen? (5)Total (20)6. Percy intends to create a trust for his son, age 15, and his daughter, age 12. He asksfor notes on three specific matters.You are required to:1) Outline the Inheritance Tax charges that may apply if:(a) The settlement is discretionary without a specified incomeentitlement and;(b)The settlement is a qualifying accumulation and maintenancesettlement. (12)2) Describe the taxation of income and gains of an accumulation andmaintenance settlement created by a father in which the only beneficiariesare his unmarried minor children. (6)3) Explain how the purposes of a trust may be varied. (2)Total (20)S/<strong>May</strong> <strong>2001</strong>/5 5