The Nigerian Accountant 2012 October/December Edition

The Nigerian Accountant 2012 October/December Edition

The Nigerian Accountant 2012 October/December Edition

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

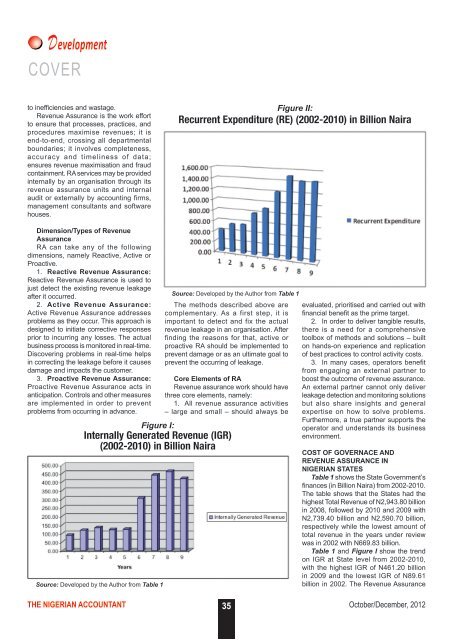

DevelopmentCOVERto inefficiencies and wastage.Revenue Assurance is the work effortto ensure that processes, practices, andprocedures maximise revenues; it isend-to-end, crossing all departmentalboundaries; it involves completeness,accuracy and timeliness of data;ensures revenue maximisation and fraudcontainment. RA services may be providedinternally by an organisation through itsrevenue assurance units and internalaudit or externally by accounting firms,management consultants and softwarehouses.Figure II:Recurrent Expenditure (RE) (2002-2010) in Billion NairaDimension/Types of RevenueAssuranceRA can take any of the followingdimensions, namely Reactive, Active orProactive.1. Reactive Revenue Assurance:Reactive Revenue Assurance is used tojust detect the existing revenue leakageafter it occurred.2. Active Revenue Assurance:Active Revenue Assurance addressesproblems as they occur. This approach isdesigned to initiate corrective responsesprior to incurring any losses. <strong>The</strong> actualbusiness process is monitored in real-time.Discovering problems in real-time helpsin correcting the leakage before it causesdamage and impacts the customer.3. Proactive Revenue Assurance:Proactive Revenue Assurance acts inanticipation. Controls and other measuresare implemented in order to preventproblems from occurring in advance.Source: Developed by the Author from Table 1Source: Developed by the Author from Table 1<strong>The</strong> methods described above arecomplementary. As a first step, it isimportant to detect and fix the actualrevenue leakage in an organisation. Afterfinding the reasons for that, active orproactive RA should be implemented toprevent damage or as an ultimate goal toprevent the occurring of leakage.Core Elements of RARevenue assurance work should havethree core elements, namely:1. All revenue assurance activities– large and small – should always beFigure I:Internally Generated Revenue (IGR)(2002-2010) in Billion Nairaevaluated, prioritised and carried out withfinancial benefit as the prime target.2. In order to deliver tangible results,there is a need for a comprehensivetoolbox of methods and solutions – builton hands-on experience and replicationof best practices to control activity costs.3. In many cases, operators benefitfrom engaging an external partner toboost the outcome of revenue assurance.An external partner cannot only deliverleakage detection and monitoring solutionsbut also share insights and generalexpertise on how to solve problems.Furthermore, a true partner supports theoperator and understands its businessenvironment.COST OF GOVERNACE ANDREVENUE ASSURANCE INNIGERIAN STATESTable 1 shows the State Government’sfinances (in Billion Naira) from 2002-2010.<strong>The</strong> table shows that the States had thehighest Total Revenue of N2,943.80 billionin 2008, followed by 2010 and 2009 withN2,739.40 billion and N2,590.70 billion,respectively while the lowest amount oftotal revenue in the years under reviewwas in 2002 with N669.83 billion.Table 1 and Figure I show the trendon IGR at State level from 2002-2010,with the highest IGR of N461.20 billionin 2009 and the lowest IGR of N89.61billion in 2002. <strong>The</strong> Revenue AssuranceTHE NIGERIAN ACCOUNTANT 35<strong>October</strong>/<strong>December</strong>, <strong>2012</strong>