000_GMM Directors Report-Pg-1-18.indd - GMM Pfaudler Ltd

000_GMM Directors Report-Pg-1-18.indd - GMM Pfaudler Ltd

000_GMM Directors Report-Pg-1-18.indd - GMM Pfaudler Ltd

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

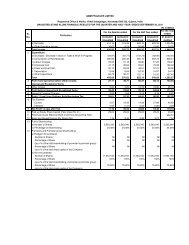

Liabilities that cannot be allocated between the segments are shown as part of unallocated corporate assets and liabilitiesrespectively. Income/Expenses relating to the enterprise as a whole and not allocable on a reasonable basis to business segmentsare reflected as unallocated corporate income/expenses.3. CHANGE IN ACCOUNTING POLICYThe Company has changed its accounting policy for revenue recognition for large contracts, from recognition on completion basisto recognition on percentage of completion basis, with effect from April 1, 2009.Large contracts for said purpose are contracts exceeding Rupee equivalent of USD 1 million at the time of order receipt and thecontract term is at least six months from contract signing through product delivery.This change has neither resulted in any change in revenue nor on profits for the year ended March 31, 2010.4. INVESTMENTSThe Company has purchased and sold the following investments during the year:Name of the investment Current year Previous yearNo of Units Amount No of Units Amount` ‘<strong>000</strong> ` ‘<strong>000</strong>Birla Freedom Fund - Dividend Cash Option 240,616 5,<strong>000</strong>,<strong>000</strong> – –DSP Black Rock Tiger Fund Dividend Pay 317,420 5,<strong>000</strong>,<strong>000</strong> – –HDFC Top 200 Fund - Dividend 187,037 7,125,<strong>000</strong> – –DSP Black Rock Top 100 Equity Fund 328,515 6,<strong>000</strong>,<strong>000</strong> – –5. SUNDRY DEBTORSSundry Debtors include the following amount due from a subsidiary company:Name of Company Maximum Balance As at 31.03.10 As at 31.03.09Mavag AG 3,705 3,705 1,3336. LOANS AND ADVANCESa. Advances to subsidiariesMaximum BalanceCurrent YearPrevious Yearduring the yearKaramsad Investments <strong>Ltd</strong>. 12,350 12,350 12,364Karamsad Holding <strong>Ltd</strong>. 250 250 1,403<strong>GMM</strong> Mavag AG 153,790 145,775 153,790` ‘<strong>000</strong>b. Deposits include earnest deposit of ` 961 thousand (Previous year ` 961 thousand) paid to Skyline Millars Limited (formerlyMillars India Limited) and ` 10,703 thousand (Previous year ` 9,411 thousand) to Ready Mix Concrete Limited, being companiesin which two directors of the Company are interested. Deposits given are for use of factory sheds under the lease agreements.7. CURRENT LIABILITIESDisclosure of sundry creditors under current liabilities is based on the information available with the company regarding the statusof the suppliers as defined under the “Micro, Small and Medium Enterprises Development Act, 2006”. Amount overdue as on March31, 2010 to Micro, Small and Medium Enterprises on account of principal amount together with interest, aggregate to ` Nil (Previousyear – ` Nil)The information regarding micro, small and medium enterprises have been determined to the extent such parties have been identifiedon the basis of information available with the Company, which has been relied upon by the auditors.37