Civic Exchange Annual Report 2005-2006: The Air We Breathe

Civic Exchange Annual Report 2005-2006: The Air We Breathe

Civic Exchange Annual Report 2005-2006: The Air We Breathe

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

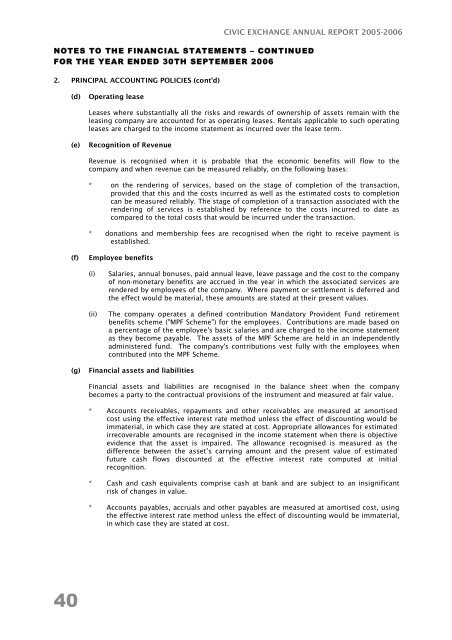

CIVIC EXCHANGE ANNUAL REPORT <strong>2005</strong>-<strong>2006</strong>NOTES TO THE FINANCIAL STATEMENTS – CONTINUEDFOR THE YEAR ENDED 30TH SEPTEMBER <strong>2006</strong>2. PRINCIPAL ACCOUNTING POLICIES (cont’d)(d)Operating leaseLeases where substantially all the risks and rewards of ownership of assets remain with theleasing company are accounted for as operating leases. Rentals applicable to such operatingleases are charged to the income statement as incurred over the lease term.(e)Recognition of RevenueRevenue is recognised when it is probable that the economic benefits will flow to thecompany and when revenue can be measured reliably, on the following bases:* on the rendering of services, based on the stage of completion of the transaction,provided that this and the costs incurred as well as the estimated costs to completioncan be measured reliably. <strong>The</strong> stage of completion of a transaction associated with therendering of services is established by reference to the costs incurred to date ascompared to the total costs that would be incurred under the transaction.* donations and membership fees are recognised when the right to receive payment isestablished.(f)Employee benefits(i)(ii)Salaries, annual bonuses, paid annual leave, leave passage and the cost to the companyof non-monetary benefits are accrued in the year in which the associated services arerendered by employees of the company. Where payment or settlement is deferred andthe effect would be material, these amounts are stated at their present values.<strong>The</strong> company operates a defined contribution Mandatory Provident Fund retirementbenefits scheme ("MPF Scheme") for the employees. Contributions are made based ona percentage of the employee's basic salaries and are charged to the income statementas they become payable. <strong>The</strong> assets of the MPF Scheme are held in an independentlyadministered fund. <strong>The</strong> company's contributions vest fully with the employees whencontributed into the MPF Scheme.(g)Financial assets and liabilitiesFinancial assets and liabilities are recognised in the balance sheet when the companybecomes a party to the contractual provisions of the instrument and measured at fair value.* Accounts receivables, repayments and other receivables are measured at amortisedcost using the effective interest rate method unless the effect of discounting would beimmaterial, in which case they are stated at cost. Appropriate allowances for estimatedirrecoverable amounts are recognised in the income statement when there is objectiveevidence that the asset is impaired. <strong>The</strong> allowance recognised is measured as thedifference between the asset’s carrying amount and the present value of estimatedfuture cash flows discounted at the effective interest rate computed at initialrecognition.* Cash and cash equivalents comprise cash at bank and are subject to an insignificantrisk of changes in value.* Accounts payables, accruals and other payables are measured at amortised cost, usingthe effective interest rate method unless the effect of discounting would be immaterial,in which case they are stated at cost.40