student loan repayment manual table of contents - Tufts University

student loan repayment manual table of contents - Tufts University

student loan repayment manual table of contents - Tufts University

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

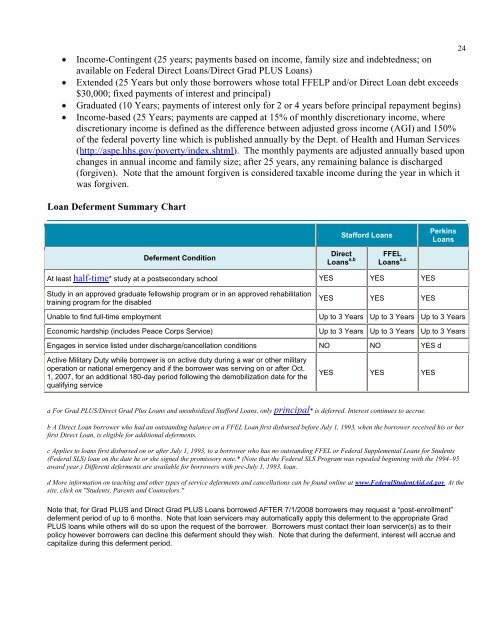

Income-Contingent (25 years; payments based on income, family size and indebtedness; onavailable on Federal Direct Loans/Direct Grad PLUS Loans)Extended (25 Years but only those borrowers whose total FFELP and/or Direct Loan debt exceeds$30,000; fixed payments <strong>of</strong> interest and principal)Graduated (10 Years; payments <strong>of</strong> interest only for 2 or 4 years before principal <strong>repayment</strong> begins)Income-based (25 Years; payments are capped at 15% <strong>of</strong> monthly discretionary income, wherediscretionary income is defined as the difference between adjusted gross income (AGI) and 150%<strong>of</strong> the federal poverty line which is published annually by the Dept. <strong>of</strong> Health and Human Services(http://aspe.hhs.gov/poverty/index.shtml). The monthly payments are adjusted annually based uponchanges in annual income and family size; after 25 years, any remaining balance is discharged(forgiven). Note that the amount forgiven is considered taxable income during the year in which itwas forgiven.Loan Deferment Summary Chart24Stafford LoansPerkinsLoansDeferment ConditionDirectLoans a,bFFELLoans a,cAt least half-time* study at a postsecondary school YES YES YESStudy in an approved graduate fellowship program or in an approved rehabilitationtraining program for the disabledUnable to find full-time employmentEconomic hardship (includes Peace Corps Service)YES YES YESUp to 3 Years Up to 3 Years Up to 3 YearsUp to 3 Years Up to 3 Years Up to 3 YearsEngages in service listed under discharge/cancellation conditions NO NO YES dActive Military Duty while borrower is on active duty during a war or other militaryoperation or national emergency and if the borrower was serving on or after Oct.1, 2007, for an additional 180-day period following the demobilization date for thequalifying serviceYES YES YESa For Grad PLUS/Direct Grad Plus Loans and unsubsidized Stafford Loans, only principal* is deferred. Interest continues to accrue.b A Direct Loan borrower who had an outstanding balance on a FFEL Loan first disbursed before July 1, 1993, when the borrower received his or herfirst Direct Loan, is eligible for additional deferments.c Applies to <strong>loan</strong>s first disbursed on or after July 1, 1993, to a borrower who has no outstanding FFEL or Federal Supplemental Loans for Students(Federal SLS) <strong>loan</strong> on the date he or she signed the promissory note.* (Note that the Federal SLS Program was repealed beginning with the 1994–95award year.) Different deferments are available for borrowers with pre-July 1, 1993, <strong>loan</strong>.d More information on teaching and other types <strong>of</strong> service deferments and cancellations can be found online at www.FederalStudentAid.ed.gov. At thesite, click on "Students, Parents and Counselors."Note that, for Grad PLUS and Direct Grad PLUS Loans borrowed AFTER 7/1/2008 borrowers may request a “post-enrollment”deferment period <strong>of</strong> up to 6 months. Note that <strong>loan</strong> servicers may automatically apply this deferment to the appropriate GradPLUS <strong>loan</strong>s while others will do so upon the request <strong>of</strong> the borrower. Borrowers must contact their <strong>loan</strong> servicer(s) as to theirpolicy however borrowers can decline this deferment should they wish. Note that during the deferment, interest will accrue andcapitalize during this deferment period.