the manulife advantage fund and gif select - Repsource - Manulife ...

the manulife advantage fund and gif select - Repsource - Manulife ...

the manulife advantage fund and gif select - Repsource - Manulife ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

THE MANULIFE ADVANTAGE FUND AND GIF SELECTThe <strong>Manulife</strong> AdvantageFund within a GIF Select Contractprovides <strong>the</strong> following key benefits:HIGHLY COMPETITIVE RATEPays a higher rate of interest than most savingsaccounts or money market <strong>fund</strong>s <strong>and</strong> interest isearned on every dollarInterest rate is equal to <strong>the</strong> posted rate of <strong>the</strong><strong>Manulife</strong> Bank Advantage Account variable rateNO FEESThe MER is waived on this Fund <strong>and</strong> <strong>the</strong>re areno monthly feesThe Fund is available in 0% front-end loadEASY ACCESS TO FUNDSThe money invested is always available*No term-length requiredELIGIBLE FOR ALL PLAN TYPESAvailable as non-registered <strong>and</strong> all registeredtax typesIdeal as a short-term investmentINSURANCE FEATURESEstate protectionThe potential for creditor protectionTips for using <strong>the</strong> <strong>Manulife</strong>Advantage FundA SHORT-TERM SAVINGS VEHICLEThe full balance will receive <strong>the</strong> variable interest rateof <strong>the</strong> <strong>Manulife</strong> Advantage Fund. Investing with a0% front-end load, no fees are charged when <strong>the</strong>money is withdrawn. Plus, a trailer rate of 0.25%will be paid on <strong>fund</strong>s invested at 0%.A GIC ALTERNATIVEThe <strong>Manulife</strong> Advantage Fund interest rate is variable, sowhen it goes up, your client benefits by <strong>the</strong> rising rate –<strong>the</strong> rate is not fixed <strong>and</strong> <strong>the</strong> <strong>fund</strong>s are accessible at anytime.* Plus, this interest-bearing investment can be heldin <strong>the</strong> same contract as o<strong>the</strong>r <strong>fund</strong>s.A MONEY MARKET FUND ALTERNATIVEThe MER is waived on <strong>the</strong> <strong>Manulife</strong> Advantage Fundplus it can offer a potentially higher rate of interest,making it a possible alternative to a Money Market Fund.LOOKING TO PARK $ FOR 90 DAYS OR LESS?If purchasing this type of <strong>fund</strong> as a ‘parking spot’ whereswitch instructions will be received within 90 days,consider using <strong>the</strong> <strong>Manulife</strong> DCA Advantage Fundinstead as it pays 5% gross commission (DSC) ondeposits. Assets must be switched out of <strong>the</strong> DCAAdvantage Fund within 12 months or less.* Fees may apply depending on sales charge option

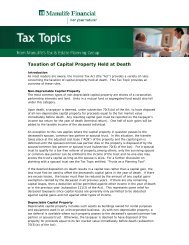

Minimum investmentCompensationHolding requirementsRate of return (interest rate)<strong>Manulife</strong> DCA Advantage Fund$5,000 for IncomePlus Series*$5,000 for InvestmentPlus$5,000 for EstatePlusEquity CompDSC – 5% with 0.50% trailerNot for long term investmentCan only be held for 90 days without submittingswitch instructionsVariable rate of <strong>the</strong> <strong>Manulife</strong> Bank AdvantageAccount – MER waived<strong>Manulife</strong> Advantage Fund$5,000 for IncomePlus Series*$500 for InvestmentPlus$5,000 for EstatePlusMoney Market CompDSC – 1% with 0.15% trailerCan be held indefinitelyVariable rate of <strong>the</strong> <strong>Manulife</strong> Bank AdvantageAccount – MER waived* Initial minimum requirements per Series must also be met.Note: Switches between <strong>the</strong> <strong>Manulife</strong> DCA Advantage <strong>and</strong> <strong>the</strong> <strong>Manulife</strong> Advantage Fund are not allowed.GIF SELECT SALES CHARGE OPTIONS (%)Fund CategoryRedemption made during<strong>the</strong> first 7 years following<strong>the</strong> date of depositBack-end option redemptionfees as a percentage oforiginal deposit amountLow-load option fees asa percentage of originaldeposit amountFront-end option<strong>Manulife</strong>Advantage Fund<strong>Manulife</strong> DCAAdvantage Fundyear 1 1.50 1.00 0 - 5year 2 1.50 0.50year 3 1.50 0.50year 4* 1.00 0year 5 1.00 0year 6 1.00 0year 7 0.50 0year 8 <strong>and</strong> subsequent years 0year 1 5.50 2.50 0 - 5year 2 5.00 2.00year 3 5.00 1.50year 4* 4.00 0year 5 4.00 0year 6 3.00 0year 7 2.00 0year 8 <strong>and</strong> subsequent years 0 0*For Low-load <strong>fund</strong>s, <strong>the</strong> amount is 0% from <strong>the</strong> beginning of year 4 <strong>and</strong> all subsequent yearsFor more information, contact your <strong>Manulife</strong>Investments Sales Team.www.<strong>manulife</strong>investments.caFOR ADVISOR USE ONLYThe Manufacturers Life Insurance Company (<strong>Manulife</strong> Financial) is <strong>the</strong> sole issuer <strong>and</strong> guarantor of <strong>the</strong> <strong>Manulife</strong> GIF Select insurance contract which offers <strong>the</strong> IncomePlusbenefit. <strong>Manulife</strong> Investments is <strong>the</strong> br<strong>and</strong> name identifying <strong>the</strong> personal wealth management lines of business offered by <strong>Manulife</strong> Financial <strong>and</strong> its subsidiaries in Canada.GIF Select, <strong>Manulife</strong>, IncomePlus <strong>and</strong> <strong>the</strong> block design are registered servicemarks <strong>and</strong> trademarks of The Manufacturers Life Insurance Company <strong>and</strong> are used by it <strong>and</strong> itsaffiliates including <strong>Manulife</strong> Financial Corporation.MK2035E 06/10