TECHNOLOGIES TO watch - Consumer Electronics Association

TECHNOLOGIES TO watch - Consumer Electronics Association

TECHNOLOGIES TO watch - Consumer Electronics Association

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

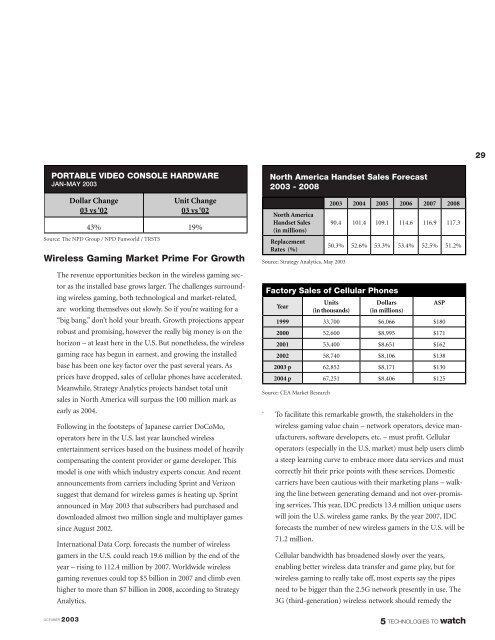

29PORTABLE VIDEO CONSOLE HARDWAREJAN-MAY 2003Wireless Gaming Market Prime For GrowthThe revenue opportunities beckon in the wireless gaming sectoras the installed base grows larger. The challenges surroundingwireless gaming, both technological and market-related,are working themselves out slowly. So if you’re waiting for a“big bang,” don’t hold your breath. Growth projections appearrobust and promising, however the really big money is on thehorizon – at least here in the U.S. But nonetheless, the wirelessgaming race has begun in earnest, and growing the installedbase has been one key factor over the past several years. Asprices have dropped, sales of cellular phones have accelerated.Meanwhile, Strategy Analytics projects handset total unitsales in North America will surpass the 100 million mark asearly as 2004.Following in the footsteps of Japanese carrier DoCoMo,operators here in the U.S. last year launched wirelessentertainment services based on the business model of heavilycompensating the content provider or game developer. Thismodel is one with which industry experts concur. And recentannouncements from carriers including Sprint and Verizonsuggest that demand for wireless games is heating up. Sprintannounced in May 2003 that subscribers had purchased anddownloaded almost two million single and multiplayer gamessince August 2002.International Data Corp. forecasts the number of wirelessgamers in the U.S. could reach 19.6 million by the end of theyear – rising to 112.4 million by 2007. Worldwide wirelessgaming revenues could top $5 billion in 2007 and climb evenhigher to more than $7 billion in 2008, according to StrategyAnalytics.OC<strong>TO</strong>BER 2003Dollar Change03 vs ‘02Unit Change03 vs ‘0243% 19%Source: The NPD Group / NPD Funworld / TRSTS`North America Handset Sales Forecast2003 - 2008North AmericaHandset Sales(in millions)ReplacementRates (%)Source: Strategy Analytics, May 20032003 2004 2005 2006 2007 200890.4 101.4 109.1 114.6 116.9 117.350.3% 52.6% 53.3% 53.4% 52.5% 51.2%Factory Sales of Cellular PhonesYearUnits(in thousands)Dollars(in millions)ASP1999 33,700 $6,066 $1802000 52,600 $8,995 $1712001 53,400 $8,651 $1622002 58,740 $8,106 $1382003 p 62,852 $8,171 $1302004 p 67,251 $8,406 $125Source: CEA Market ResearchTo facilitate this remarkable growth, the stakeholders in thewireless gaming value chain – network operators, device manufacturers,software developers, etc. – must profit. Cellularoperators (especially in the U.S. market) must help users climba steep learning curve to embrace more data services and mustcorrectly hit their price points with these services. Domesticcarriers have been cautious with their marketing plans – walkingthe line between generating demand and not over-promisingservices. This year, IDC predicts 13.4 million unique userswill join the U.S. wireless game ranks. By the year 2007, IDCforecasts the number of new wireless gamers in the U.S. will be71.2 million.Cellular bandwidth has broadened slowly over the years,enabling better wireless data transfer and game play, but forwireless gaming to really take off, most experts say the pipesneed to be bigger than the 2.5G network presently in use. The3G (third-generation) wireless network should remedy the5 <strong>TECHNOLOGIES</strong> <strong>TO</strong> <strong>watch</strong>