MICRO AND SMALL ENTERPRISES IN LEBANON

MICRO AND SMALL ENTERPRISES IN LEBANON

MICRO AND SMALL ENTERPRISES IN LEBANON

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

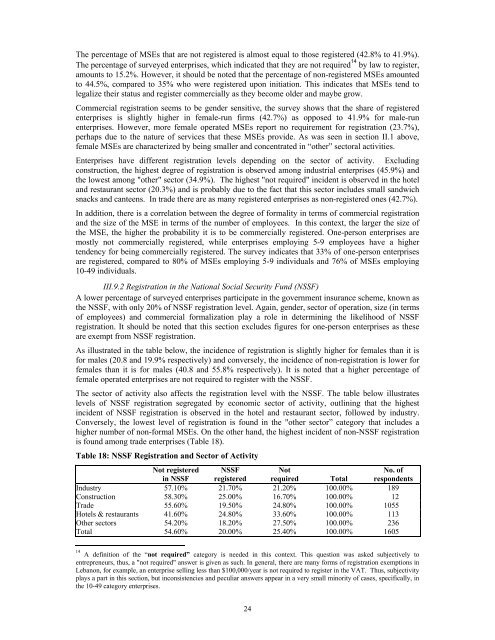

The percentage of MSEs that are not registered is almost equal to those registered (42.8% to 41.9%).The percentage of surveyed enterprises, which indicated that they are not required 14 by law to register,amounts to 15.2%. However, it should be noted that the percentage of non-registered MSEs amountedto 44.5%, compared to 35% who were registered upon initiation. This indicates that MSEs tend tolegalize their status and register commercially as they become older and maybe grow.Commercial registration seems to be gender sensitive, the survey shows that the share of registeredenterprises is slightly higher in female-run firms (42.7%) as opposed to 41.9% for male-runenterprises. However, more female operated MSEs report no requirement for registration (23.7%),perhaps due to the nature of services that these MSEs provide. As was seen in section II.1 above,female MSEs are characterized by being smaller and concentrated in “other” sectoral activities.Enterprises have different registration levels depending on the sector of activity. Excludingconstruction, the highest degree of registration is observed among industrial enterprises (45.9%) andthe lowest among "other" sector (34.9%). The highest "not required" incident is observed in the hoteland restaurant sector (20.3%) and is probably due to the fact that this sector includes small sandwichsnacks and canteens. In trade there are as many registered enterprises as non-registered ones (42.7%).In addition, there is a correlation between the degree of formality in terms of commercial registrationand the size of the MSE in terms of the number of employees. In this context, the larger the size ofthe MSE, the higher the probability it is to be commercially registered. One-person enterprises aremostly not commercially registered, while enterprises employing 5-9 employees have a highertendency for being commercially registered. The survey indicates that 33% of one-person enterprisesare registered, compared to 80% of MSEs employing 5-9 individuals and 76% of MSEs employing10-49 individuals.III.9.2 Registration in the National Social Security Fund (NSSF)A lower percentage of surveyed enterprises participate in the government insurance scheme, known asthe NSSF, with only 20% of NSSF registration level. Again, gender, sector of operation, size (in termsof employees) and commercial formalization play a role in determining the likelihood of NSSFregistration. It should be noted that this section excludes figures for one-person enterprises as theseare exempt from NSSF registration.As illustrated in the table below, the incidence of registration is slightly higher for females than it isfor males (20.8 and 19.9% respectively) and conversely, the incidence of non-registration is lower forfemales than it is for males (40.8 and 55.8% respectively). It is noted that a higher percentage offemale operated enterprises are not required to register with the NSSF.The sector of activity also affects the registration level with the NSSF. The table below illustrateslevels of NSSF registration segregated by economic sector of activity, outlining that the highestincident of NSSF registration is observed in the hotel and restaurant sector, followed by industry.Conversely, the lowest level of registration is found in the "other sector” category that includes ahigher number of non-formal MSEs. On the other hand, the highest incident of non-NSSF registrationis found among trade enterprises (Table 18).Table 18: NSSF Registration and Sector of ActivityNot registeredin NSSFNSSFregisteredNotrequired TotalNo. ofrespondentsIndustry 57.10% 21.70% 21.20% 100.00% 189Construction 58.30% 25.00% 16.70% 100.00% 12Trade 55.60% 19.50% 24.80% 100.00% 1055Hotels & restaurants 41.60% 24.80% 33.60% 100.00% 113Other sectors 54.20% 18.20% 27.50% 100.00% 236Total 54.60% 20.00% 25.40% 100.00% 160514A definition of the “not required” category is needed in this context. This question was asked subjectively toentrepreneurs, thus, a "not required" answer is given as such. In general, there are many forms of registration exemptions inLebanon, for example, an enterprise selling less than $100,000/year is not required to register in the VAT. Thus, subjectivityplays a part in this section, but inconsistencies and peculiar answers appear in a very small minority of cases, specifically, inthe 10-49 category enterprises.24