2013 Event Brochure - Limra

2013 Event Brochure - Limra

2013 Event Brochure - Limra

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

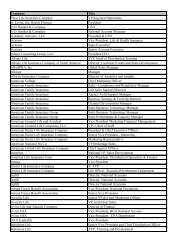

Program OverviewThe schedule of presentations and workshops is specifically designed to allow attendees to choose from any of the workshops and/or presentations, regardless of their primary focus.Marketing WorkshopsResearch WorkshopsWednesday, May 292:30 to 3:45 p.m.1. Imagine LIFE’s Possibilities (Grand Harbor Ballroom North) u2. The LGBT Financial Experience — Myths, Realities, and Waysto Engage (Asbury A) uWednesday, May 294:00 to 5:00 p.m.3. Effective Segmentation Strategies...Do You Have the Right Potion? (Grand Harbor Ballroom North) u4. The Circle of Life...Product Launches (Salon 5–6) u5. Mapping Your Customer’s Journey (Asbury A) u6. Consumers & Producers: Can They Be Social? (Salon 7–8) uThursday, May 308:00 to 10:00 a.m.Joint General Sessions (Grand Harbor Ballroom North)Marketing to Make a Difference and Keep Good GoingNew Word Order — The Language of RiskThursday, May 3010:30 to 11:30 a.m.7. Take a Drive on The Marketing Test Track (Salon 5–6) u8. Marketing and Compliance — Making Opposites Attract! (Grand Harbor Ballroom North) u9. Mirror, Mirror, How Do I Find...? (Asbury A) u10. Generation Next: The Future of American Small Businesses (Salon 7–8) uThursday, May 3011:30 a.m. to 12:45 p.m.Luncheon & Guest Speaker (Grand Harbor Ballroom South)Disney’s Approach to Leadership ExcellenceThursday, May 301:00 to 2:00 p.m.11. So Happy Together — Channel Collaboration for Cross Sales (Salon 5–6) u12. Marketing in 3D (Grand Harbor Ballroom North) u13. Understanding and Engaging the Young Affluent Market (Asbury A) u14. Innovating the Front End of Product Design (Salon 7–8) uThursday, May 302:15 to 3:15 p.m.15. The New Frontier: Digital Marketing (Grand Harbor Ballroom North) u16. Planning for Healthcare and Long Term Care in Retirement:It Shouldn’t Be a Rollercoaster Ride (Salon 5–6) u17. Navigating the Hispanic and Chinese Markets (Salon 7–8) u18. Enter the Twilight Zone — A Panel Discussion on the Use ofDifferent CSAT Measures (Asbury A) uThursday, May 303:45 to 4:45 p.m.Joint General Session (Grand Harbor Ballroom North)The Gen Savvy Insurer — Connecting in a New Age of UncertaintyFriday, May 318:00 to 9:15 a.m.19. The Not So Small World of Multi-Cultural Marketing (Grand HarborBallroom North) u20. Moving Beyond “Nice to Know” (Asbury A) uFriday, May 319:45 to 11:30 a.m.Joint General Sessions (Grand Harbor Ballroom North)The View From Big Media — What’s Happening to Consumers, to Media, and to AdvertisingIf the Magic Begins Here, Where Does the Buck Stop?u Marketing Strategies u Research Strategies u Markets u Marketing Communications2

Marketing & Research ConferenceThe Magic Begins HereWednesday, May 29Meet and Greet — 2:00 to 2:30 p.m.Grand Harbor Ballroom SouthJoin us as the conference begins to meet and greet peers whileyou share ideas and common experiences.Opening Sessions — 2:30 to 3:45 p.m.Grand Harbor Ballroom North1. Imagine LIFE’s PossibilitiesCome hear from the foremost non-profit foundation forthe promotion and education of life insurance, the LIFEFoundation. As part of the presentation, one of their mostactive industry partners will demonstrate how they leveragethe materials in their own company. Finally, they’ll previewthe free marketing tools available to member companies,helping them stretch their budgets while maximizingmarketing messages.Matt Derrick, Senior Vice President, Programs & Marketing,the LIFE Foundation; Marvin Feldman, CLU, ChFC, Presidentand CEO, the LIFE Foundation; Jaimee Niles, Vice President,Industry Communications, the LIFE Foundation; Kathleen Rubin,Manager – Campaign Management, INS-MKTG – Marketing& Communications, New York Life Insurance Company;Moderator: Leah White, FIC, FLMI, Marketing Associate,Modern Woodmen of AmericaAsbury A2. The LGBT Financial Experience — Myths, Realities,and Ways to EngageWhile much attention has been focused on the buying powerof the LGBT (Lesbian, Gay, Bisexual and Transgender)community, little information has been made available aboutthe financial experience of the LGBT community. Thisworkshop will present an in-depth, nuanced understandingof the current financial landscape for LGBT Americans,including challenges and concerns of the community as awhole, same-sex couples, and LGBT parents.Pat Brzozowski, CPCU, CLU, Diversity Director, AgencyDistribution, Prudential; Josh Stoffregen, Director, GlobalCommunications and President, EAGLES (Employee Associationof Gay Men, Lesbians, Bisexuals, and Transgender), Prudential;Presenter and Moderator: Louis DiCesari, Director, GlobalStrategic Research, PrudentialRefreshment Break — 3:45 to 4:00 p.m.Grand Harbor Ballroom SouthConcurrent Workshops — 4:00 to 5:00 p.m.Grand Harbor Ballroom North3. Effective Segmentation Strategies…Do You Have the Right Potion?• Learn how to use predictive modeling to makeyour marketing more effective.• Target the right clients with the right message.• See the potential that Psychographic data canadd to your marketing efforts.• Learn how marketing is taking advantage of thepower of data.Matt Kramer, Director, Insurance Analytics, AcxiomCorporation; Moderator: John P. Steber, VicePresident, Life Marketing & Communications,AXA Equitable Life Insurance CompanySalon 5–64. The Circle of Life…Product LaunchesCome hear how an award-winning companyredesigned their product launch process, taking itfrom one product a year to 16! And they do this allon time, within budget, and without unexpectedsurprises along the way. In this session you’ll gettips to ensuring success from ideation through thefirst sale and they’ll share marketing plans, taskchecklists and the success and challenges they’veexperienced along the way.Kimberly Anderson, FIC, CLTC, LTCP, Manager,Life Product Research and Consulting, MinnesotaLife Insurance Company; Jake Jones, FSA, SeniorAssociate Actuary, Minnesota Life InsuranceCompany; Moderator: Garry Voith, CLU, LLIF,Vice President – Corporate Marketing andCommunications, Baltimore Life Insurance CompanyMarketing Workshops in “blue” printResearch Workshops in “green” print3

Marketing & Research ConferenceConcurrent Workshops — 4:00 to 5:00 p.m.(continued)Asbury A5. Mapping Your Customer’s JourneyJoin us as we discuss the latest trends in CustomerJourney Mapping, as well as the benefits andchallenges. We will review:• Best practices in developing customer journeymapping.• How companies use these maps to improve theircustomers’ experience, including a majorinsurance carrier.• Success metrics for mapping, such as improvedretention and expense reduction.Glenn Staada, Vice President, Radius Global MarketResearch; Dana Tucker, Director, The Americas,CAO, Customer Centricity Program Management,MetLife; Co-moderators: Kate Borgatti, Director,Market Research, MetLife; Samantha Chow, Directorof Research, New York Life DirectSalon 7–86. Consumers & Producers: Can They BeSocial?In this workshop we will share the results of newresearch on both consumers’ and producers’ use ofsocial media.• Are consumers and producers on the sameFacebook page?• Are consumers using social media to learn aboutyour products?• Are producers LinkedIn to consumers togenerate leads?• Can relationships be built a Tweet at a time?• What are the latest developments in companypractices?• How are producers successfully using socialmedia?Lisa Schneider, Research Director, Greenwald &Associates; Todd Silverhart, Ph.D., Director ofInsurance Research, LIMRA; Moderator: AudreyBlair-Gentry, Manager, Market Research &Development, Western & Southern Financial GroupThursday, May 30Continental Breakfast — 7:00 to 8:00 a.m.Grand Harbor Ballroom SouthJoint General Sessions — 8:00 to 10:00 a.m.Grand Harbor Ballroom NorthMarketing to Make a Difference and KeepGood GoingAngie KyleSenior Vice President and Chief MarketingOfficer, Insurance GroupNew York Life Insurance CompanyUnderstanding what makes your company specialis one thing, but conveying these ideas through marketingstrategies that effectively reach consumers is something elsealtogether. Angie Kyle will describe how New York Life collectedinsights and articulated a clear brand position. Hear how thecompany is changing the way it presents itself to agents,employees, clients and the public at large and why these changesare essential to New York Life’s mission of helping clientsperpetuate the good in their lives.New Word Order — The Language of RiskGary DeMossManaging DirectorInvescoThe largest ongoing study ever done on thelanguage of financial services has just finishedits 2012 research on risk communications.Join Gary DeMoss as he discusses the words to use (protectingassets) and words to lose (minimizing losses) in makinginvestment risks understandable and actionable for today’sconsumers. Gary will also share a new research-based, doctorpatientcommunication process to make investment riskspersonal, credible and beneficial. Take back these findings toimprove consumer connections in your organization.Refreshment Break — 10:00 to 10:30 a.m.Grand Harbor Ballroom SouthLIMRA Reception — 6:00 to 7:00 p.m.Grand Harbor Ballroom South4

Marketing & Research ConferenceConcurrent Workshops— 10:30 to 11:30 a.m.Salon 5–67. Take a Drive on The Marketing Test TrackTake a drive on the “Test Track” and share your newmarketing idea, concept or program with fellow marketers.All workshop participants will present ideas (2-3 minutes)in small groups and provide feedback to other drivers.To participate, you must have pre-registered for one ofthe groups below:a. Share an idea for a new product launch.b. New marketing tactics that would enhance yourcompany’s cross-selling approach.c. Lead-generation or prospecting idea that would enhancea current program or form the foundation for a newinitiative.Jeff Hornstein, MBA, Effective Leadership Program, Universityof Chicago, Booth School of Business, President, TheSpeaker’s Choice; Moderators: Mark Bermes, CLU, ChFC,LLIF, FLMI, Director, Marketing Services, Mutual Trust FinancialGroup; Christopher Campbell, Vice President, Marketing,Bankers Life & Casualty Company; Shari Ruecker, ChFC,CLU, CMA, FLMI, Director, New Business Development,Allstate Financial; Garry H. Voith, CLU, LLIF, Vice President –Corporate Marketing and Communications, Baltimore LifeInsurance CompanyGrand Harbor Ballroom North8. Marketing and Compliance — Making OppositesAttract!Understanding each other’s point of view and theguiding principles of a compliance review are the keyfor developing compelling marketing messages.• Learn from examples of successful partnership howyou can create communications that are impactfuland compliant.• Understand how a well-designed compliance processhelps reduce review time and minimizes contentiousdiscussion.Aaron Blaney, Manager, Individual Financial Services,Marketing Operations, Mutual of Omaha; Christine Curtis,Director, Product & Advertising Compliance, Mutual ofOmaha; Moderator: Reinhold Beutler, Assistant VicePresident, Marketing, MetLifeAsbury A9. Mirror, Mirror, How Do I Find…?To fully understand your marketplace, you mustunderstand your competitors. While there isn’t amagical mirror, we will share what market expertsuse to discover, store, and disseminate competitiveinformation.Richard Skyba, Director of Product & Marketing,LifeMap Assurance Company; Katrina Tuke, FLMI,AIRC, Product Manager, LifeMap Assurance Company;Moderator: Natalie Barenthin, Senior MarketingResearch Analyst, Anthem LifeSalon 7–810. Generation Next: The Future of AmericanSmall BusinessesJoin us for a truly engaging talk from Thomas Tseng,Principal and Co-Founder of New AmericanDimensions, LLC to hear more about:• The three primary demographic forces shaping thesocial and cultural landscape of the U.S. right now.• The role multicultural small businesses play inchanging the dialogue about business, markets,and entrepreneurship.• How the Second Generation is pushing new trendsamong small businesses into the mainstream.• Case studies and examples to highlight howinsurance marketers should re-orient theirperspective and approach towards the U.S. smallbusiness landscape.Gene Lanzoni, Assistant Vice President, MarketIntelligence, The Guardian Life Insurance Company ofAmerica; Thomas Tseng, Principal & Co-Founder,New American Dimensions, LLC; Moderator: ChristinaBoris, Senior Analyst, Market Intelligence, TheGuardian Life Insurance Company of America5

Marketing & Research ConferenceLuncheon & Guest Speaker— 11:30 a.m. to 12:45 p.m.Grand Harbor Ballroom SouthDisney’s Approach to Leadership ExcellenceDisney InstituteToday’s successful leaders provide a clear vision, create astructure for executing work, and engage people in thepurpose of the organization. Walt Disney himself was afirm believer in this inspirational style of leadershipand taught it to the leaders who succeeded him. In thisexciting session you will:• Learn how to effectively communicate your visionand examine personal methods for inspiring otherstoward the achievement of goals.• Examine the strategies Disney leaders employ to keeptheir teams engaged in their work.• Explore day-to-day behaviors that will assist inmaking a long-lasting impact on the peoplearound you.• Develop action steps that will help you influencechange in your organization and develop yourindividual leadership behaviors.Break—12:45 to 1:00 p.m.Concurrent Workshops — 1:00 to 2:00 p.m.Salon 5–611. So Happy Together — ChannelCollaboration for Cross SalesChannel collaboration is becoming a competitiveadvantage as companies leverage all their resourcesto drive greater overall results.• See how one major company built a crosschannelcollaboration program to drive lifeinsurance sales and support its agents.• Learn the “do’s and don’ts” of building supportfor collaboration and implementing an effectivetest.• Get concrete tactical ideas and practical advicefor building collaborative programs.Chris McNett, Director – Agency Sales & Operations,Allstate Insurance Company; Moderator: ShariRuecker, ChFC, CLU, CMA, FLMI, Director, NewBusiness Development, Allstate FinancialGrand Harbor Ballroom North12. Marketing in 3DIn a world of information overload, attracting the consumerand producer requires a multi-pronged approach.• Hear about a consumer case study highlighting aneMarketing approach with Social Media execution.• Hear about a producer case study highlighting amarketing approach that helps the producer developan emotional connection with their clients.• Discover ways to build brand and product awarenesswhile connecting with the local community and yourproducers.Ariel Reppert, Senior Consultant, Brand Marketing,Nationwide Financial; Travis Schraffenberger, Assistant VicePresident, New Client Acquisition, Western & Southern Life;Moderator: Cinda Siegel, Senior Consultant, Brand Marketing,Nationwide FinancialAsbury A13. Understanding and Engaging the YoungAffluent MarketInterested in learning more about the young affluent marketand their attitudes and perceptions about life insurance?• Hear “hot off the press” research results from ZeldisResearch that explore the attitudes and perceptions ofthis hard to target, but valuable market segment.• Find out how a Canadian carrier is using research,insights and customer data to target this market.Fred Gaudios, Senior Project Director, Zeldis ResearchAssociates; Alf Goodall, Vice President, Sales, Retail WealthManagement, Canada Life, Great-West Life and London Life;Moderator: Kathy Yocham, Marketing Strategy Manager,The StandardSalon 7–814. Innovating the Front End of Product DesignSpending time in creative discovery with potentialcustomers early in the product design cycle yieldspowerful insights for product development.• Hear a powerful approach to create virtual and livediscovery spaces that effectively engage a broad rangeof people.• Gain specific customer insights and hear how theseinsights influence product design.Kevin Grygiel, Vice President Business Development,Imaginatik; Elisa O’Donnell, Vice President – InnovationSolutions, Imaginatik; Moderator: Michael Myhrom, Director,Research, Analysis and Consulting, Thrivent Financial forLutheransRefreshment Break — 2:00 to 2:15 p.m.Grand Harbor Ballroom South6

Marketing & Research ConferenceConcurrent Workshops — 2:15 to 3:15 p.m.Grand Harbor Ballroom North15. The New Frontier: Digital MarketingLearn how to leverage your budget dollars by reusing yourmarketing message across the digital frontier.• The environment is shifting and your marketingmessage is now more integrated than ever.• Hear how one company is minimizing their cost andmaximizing their reach by utilizing the latest digitaltools.• From branding to recruiting, networking and sales, howare each of these areas connected through social media?Marie Politis, Vice President, Online Experience, MassMutual;Moderator: Amy Samplatsky, CLU, Assistant Vice President,Competitive Insight & Positioning, MassMutualSalon 5–616. Planning for Healthcare and Long Term Care inRetirement: It Shouldn’t Be a Rollercoaster RideMost people nearing retirement are very nervous about theimpact that healthcare and long-term care expenses willhave on their retirement plans. We’ll examine how:• Planning for healthcare and LTC expenses can fit intoa clients retirement plan.• We can help agents/advisors prepare for theseconversations.• One carrier found a solution to this dilemma.Shawn Britt, CLU, Director, Advanced Consulting Group,Nationwide Financial; Moderator: Bill Skowronnek, SecondVice President, Corporate Marketing & Communications,Munich American Reassurance CompanySalon 7–817. Navigating the Hispanic and Chinese MarketsLearn how to leverage multicultural insights to build asuccessful campaign for the Hispanic and Chinese markets.• Take away key tips (do’s and don’ts) of marketing lifeinsurance to Hispanic and Chinese prospects.• Discover hot-off-the-press attitudinal and behavioralresults from LIMRA’s U.S. Hispanic market study.• Hear how a Canadian insurer successfully engages theChinese population.Nilufer Ahmed, Ph.D., Senior Research Director, MarketsResearch, LIMRA; Cathy Hiscott, CFP, CHS, Director, FieldManagement/New Advisor Value Proposition, LondonLife Insurance Company; Moderator: Rita Lepore, SeniorResearch Analyst, London Life, Great-West Life, and CanadaLifeAsbury A18. Enter the Twilight Zone — A Panel Discussionon the Use of Different CSAT MeasuresEver wonder what the best measure of CustomerSatisfaction (CSAT) is and how other companies usedifferent measures?• Learn about the top CSAT measures and what thedifferences are.• Hear how other companies are using thesedifferent types of measures.• “Ask the experts” to better understand how thesemeasures can help your company.Tony Cabrera, Corporate Vice President, MemberServices, New York Life Direct; Kenia Collins, Director,Market Intelligence, Research Management, MetLife;Jessica Greenstein, Market Research Analyst, ThriventFinancial for Lutherans; Co-moderators: SamanthaChow, Director of Research, New York Life Direct;Michael Myhrom, Director, Research, Analysis andConsulting, Thrivent Financial for LutheransRefreshment Break & Exhibitor Magic— 3:15 to 3:45 p.m.Grand Harbor Ballroom SouthParticipate in our game to win prizes from this year’sconference exhibitors and obtain valuable product andservice information.Joint General Session — 3:45 to 4:45 p.m.Grand Harbor Ballroom NorthThe Gen Savvy Insurer — Connecting in a NewAge of UncertaintyCam MarstonPresidentGenerational InsightsFor decades, financial services have focusedon demographic groups that are nowmoving into and past retirement, such asthe Matures and older Baby Boomers. These groupsapproached investment and financial services throughthe traditional and customary advisor-client relationshipsthat have defined the industry for some time. Now, newgenerations who have different economic and culturalexperiences from their parents and grandparents aremoving into age ranges that make them the primemarkets for insurance, retirement planning, and otherfinancial services. Learn how to connect with thesenewer generations to develop long-lasting, profitablerelationships.Free Evening to Enjoy Disney7

Marketing & Research ConferenceFriday, May 31Continental Breakfast — 7:00 to 8:00 a.m.Grand Harbor Ballroom SouthConcurrent Workshops — 8:00 to 9:15 a.m.Grand Harbor Ballroom North19. The Not So Small World of Multi-CulturalMarketingCome hear directly from producers representingdifferent channels, who serve in the multi-culturalmarkets. Learn how they developed their businessto meet unique, specific needs of their customerbase and how marketing played into their success.Find out:• What the underlying motivations are for thesecustomers segments to purchase life insurance.• What marketing messages & support are neededto reach customers and how this differs fromtraditional markets.• What carriers can do to grow sales and supportproducers serving these markets.Judy Hsiao, Executive Vice Chair, World FinancialGroup; Quincy Shehaden, Bankers Life & Casualty;Co-moderators: Shari Ruecker, ChFC, CLU, CMA,FLMI, Director, New Business Development, AllstateFinancial; Ralph Perricone, FLMI, Vice President,Marketing Analysis, Individual Life Insurance,Prudential Insurance Company of AmericaAsbury A20. Moving Beyond “Nice to Know”Move your presentation of market researchfrom “that’s nice to know” to “wow, we can dosomething with that!” You will have an all-accesspass to Sr. Leaders, so bring your questions.They will also share tips and techniques that willgrab their attention and result in positive actionsbased on your research.Dennis Catanzano, CLU, CPA, ChFC, Senior VicePresident, Strategy, Lincoln Financial; Sean Downey,CIM, FCSI, Director, Individual Strategy & Planning,London Life; Barbara Ernst, Vice President ofMarketing, Prudential; Richard Skyba, Director ofProduct & Marketing, LifeMap Assurance Company;Moderator: CrisDee Plambeck, Director, MarketSolutions, Lincoln FinancialRefreshment Break & Exhibitor Raffle — 9:15 to 9:45 a.m.Grand Harbor Ballroom SouthJoint General Sessions — 9:45 to 11:30 a.m.Grand Harbor Ballroom NorthThe View from Big Media — What’s Happening toConsumers, to Media, and to AdvertisingScot SafonExecutive Vice PresidentCNN WorldwideGeneral ManagerCNN’s HLN NetworkScot Safon takes a very personal look at the current (and possiblefuture) state of media and advertising. After working in mediaand marketing management for nearly 30 years, Safon thoughthe had seen it all, but what is happening now leaves him (nearly)speechless. His presentation will look at the changing world ofconsumerism, advertising, technology and media — and what itmight mean for anyone who wants to engage anybody aboutanything going forward.If the Magic Begins Here, Where Does the Buck Stop?Robert Baranoff, FLMI, LLIFSenior Vice President,Member Benefits, LIMRACorporate Secretary, LL Global, Inc.If researchers ask the right questions and explorethe right issues, and marketers use the findingswisely and creatively, the results can indeed be magic. In fact,it’s imperative that they do so. It’s the responsibility of marketersand researchers to identify unfulfilled needs and desires andcreate new solutions. Only when marketing and research workhand-in-hand will consumers reap the most rewarding benefits.In this session, we will explore some of the latest LIMRAresearch, what it means, and how marketers might use it.Adjournment — 11:30 a.m.8

General Session Speaker BiographiesRobert M. Baranoff, FLMI, LLIFSenior Vice President, Member Benefits, LIMRACorporate Secretary, LL Global, Inc.Baranoff is responsible for LIMRA’s global research program,including monitoring industry results and tracking thestrategic issues. He also oversees the association’s researchcommunication initiatives and is responsible for relationswith the LIMRA, LOMA, and LL Global Board of Directors.Baranoff is a frequent speaker at industry forums and is theauthor of many articles and papers. In 1999 he was namedcorporate vice president of strategic research, and became thehead of LIMRA’s North American research program in 2000.Baranoff assumed his current member benefits responsibilitiesin 2005 and then added the title of Corporate Secretary in 2007.Gary DeMossManaging DirectorInvescoDeMoss is among financial services’ most sought-afterspeakers. His engaging style, enthusiasm and depth of industryknowledge have won over diverse audiences of all sizes.DeMoss’s impact as a speaker stems directly from his experienceand knowledge in financial services where he has been on thefront lines helping advisors learn the science and art of moreeffective client interactions.Angie KyleSenior Vice Presidentand Chief Marketing Officer, Insurance GroupNew York Life Insurance CompanyKyle is responsible for market strategy and execution to drivegrowth for the company’s insurance portfolio. Her team alsodevelops branding campaigns, communication strategies andmarketing programs to equip agents to meet sales objectivesand recruiting targets. Since joining New York Life in 2009,Kyle has led various product, marketing and communicationdivisions. Her career in financial services included productdevelopment and marketing leadership roles with TIAA-CREF,Bank of America and Wachovia.Cam MarstonPresidentGenerational InsightsMarston is the leading expert on the impact ofgenerational change and its impact on the marketplace.As an author, columnist, blogger, and lecturer, he impartsa clear understanding of how generational demographicsare changing the landscape of business. Marston andhis firm, Generational Insights, have provided researchand consultation on generational issues to hundreds ofcompanies and professional groups, ranging from smallbusinesses to multinational corporations, as well as majorprofessional associations, for over 16 years.Scot SafonExecutive Vice President, CNN WorldwideGeneral Manager, CNN’s HLN NetworkSafon is responsible for the management of the HLNtelevision and digital brands. Prior to running HLN,he served as CNN Worldwide’s Chief MarketingOfficer, overseeing marketing, promotion and brandingcampaigns on behalf of all CNN US, CNN International,CNN.com and HLN content and news coverage.Prior to joining CNN in late 2002, Safon was seniorvice president of marketing for Turner NetworkTelevision (TNT). Before joining TNT, he was in thead agency world, handling campaigns for the CBSTelevision Network, working on campaigns for CBSSports, CBS News and CBS International.9

CommitteesThe Marketing CommitteeChairRobert J. Ellwanger Jr., CLU, ChFC, FLMI, LLIFNew York Life Insurance CompanyVice ChairMark L. Bermes, CLU, ChFC, FLMI, LLIFMutual Trust Financial GroupMembersKimberly T. Anderson, FIC, LTCP, CLTCMinnesota Life Insurance CompanyReinhold E. BeutlerMetLifeChristopher CampbellBankers Life and Casualty CompanyScott C. CampbellAmerican National Property and Casualty (Missouri)David ClausonSecurity Benefit LifeJames J. DeLuca, LLIF, CICWestern & Southern Financial GroupCarrie R. HaubensakMutual of Omaha Insurance CompanyRalph Perricone, FLMIPrudential Insurance Company of AmericaShari M. Ruecker, ChFC, CLU, CMA, FLMIAllstate FinancialAmy G. Samplatsky, CLUMassMutual Life Insurance CompanyTeri L. SchultzProtective Life Insurance CompanyCinda K. SiegelNationwide FinancialBill SkowronnekMunich American Reassurance CompanyJohn P. SteberAXA Equitable Life Insurance CompanyGarry H. Voith, CLU, LLIFBaltimore Life Insurance CompanyLeah G. W. White, FIC, FLMIModern Woodmen of AmericaStaff RepresentativeDonna M. EricsonLIMRAMarketing Research Conference CommitteeChairKate BorgattiMetLifeCo-Vice ChairsLouis DiCesariPrudentialRobert A. LeghornING Life Insurance and Annuity CompanyMembersNatalie Y. BarenthinAnthem LifeElizabeth BellProtective LifeAudrey Blair-GentryWestern & Southern Financial GroupChristina BorisThe Guardian Life Insurance Company of AmericaSamantha K. ChowNew York Life DirectSarah J. EhlingerPrincipal Financial GroupStacey M. FabricantPenn MutualRita LeporeLondon Life, Great-West Life, and Canada LifeHope C. McManusThe Hartford Financial GroupLinda Jane Brannon Myers, FLMI, HIA, MHP, ICA, ASCAmeritas GroupMichael M. MyhromThrivent Financial for LutheransCrisDee M. PlambeckLincoln FinancialErik M. SwansonOxford Life InsuranceKathleen YochamThe StandardStaff RepresentativeKimberly A. LandryLIMRA10

Antitrust Policy and CautionEach person attending this function must be mindful of the constraints imposed by federal and state antitrust laws.The people here today represent companies that are in direct business competition with one another. LIMRA’s purposeis to provide a forum for the free exchange of ideas on the designated topics of our meetings. It is not the purpose ofthese meetings to reach any agreement that could have anticompetitive effects.Individuals must keep in mind that a violation of the antitrust laws may subject them to substantial fines and a jail term.You can avoid problems by following simple guidelines:1. Stick to the published agenda. Informal or “rump” sessions should not be held.2. Be cautious about discussions involving pricing, premiums, benefits to be offered or terminated, and who should orshould not be covered. The Justice Department views these types of discussions with concern and suspicion. Nevertake a poll of people’s positions or make a collective agreement on these issues.3. Always retain your right to make an independent judgment on behalf of your company.LIMRA is dedicated to the purpose of assisting all of its members to achieve their competitive potential.Badge Colors for Attendees at the<strong>2013</strong> Marketing & Research ConferenceBlue — LIMRA member company attendeesGreen — LIMRA StaffOrange — Nonmember insurance company attendeesBlack — GuestDisney’s Yacht & Beach Club Resort11

005741-0413 (562-60-0-MP7)Thank You to Our Sponsors and Exhibitors