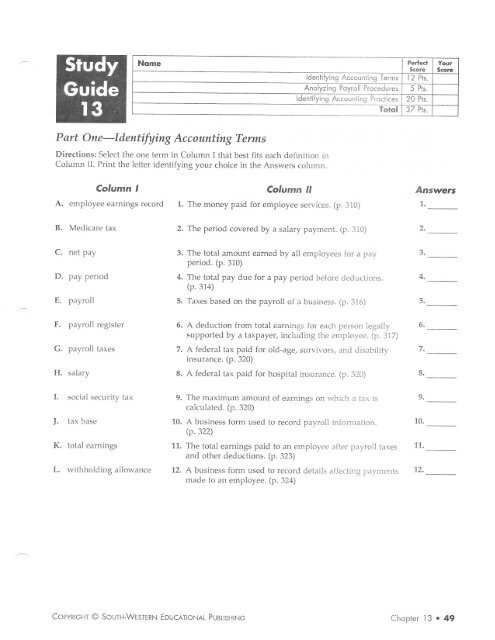

Part One-Iilentifying Accounting Terms

Part One-Iilentifying Accounting Terms

Part One-Iilentifying Accounting Terms

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Nqmedsi,t,ns ic;;;Gs TemAnolyzing Poyroll Proceduresdentib/lng Accounilis Prociicestoroll2 Prs.5 Pts.20 Pk37 tusP art <strong>One</strong>-<strong>Iilentifying</strong> <strong>Accounting</strong> <strong>Terms</strong>Dir€ctions: Select the one term in Column I that best fits each definition inColumn II. Ptint the letter identifying your choice in the Answerc column.Column IA. employee earnints recordColumn ll1. The money paid for employee services. (p. 310)Answers1.B. Medicare taxThe period covered by a salary payment. (p. 310)2,C. nei payD. pay periodE. payroll3.4.5.The total amount eamed by all employees Ior a payperiod. (p.310)The total pay due for a pay period before deductions.(p.31a)Taxes based on the paymll of a business. (p. 316)3.4.5.F. payroll re8isterc. payroll taxesH. salary6.7.8.A deduction from total eamings for each person legallysupported by a taxpayer, including the employee. (p. 317)A federal tax paid lor old-age, survivors, .rnd .tisabilityinsurance. (p. 320)A federal tax paid for hospital insurance. (p. 320)6-7.8.I. social security taxJ. tax baseK, total eamingsL. withholdintaltowance9.10,11.72,The maximum amount of earnings on lvhjch a lax jscalculated. (p. 320)A business form used to recotd payroll information.Q.322)The total earnings paid to an employee nltcr payroll taxesand other deductions. (p. 323)A business form used to record deiails aflecLing paymentsmade to an employee. (p. 324)9-10.11.12.CoPYRTGHT O SoUrH-WESTERN EDUcaloNAt PuBUsHtNG Choprer 13 . 49