Part One-Iilentifying Accounting Terms

Part One-Iilentifying Accounting Terms

Part One-Iilentifying Accounting Terms

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

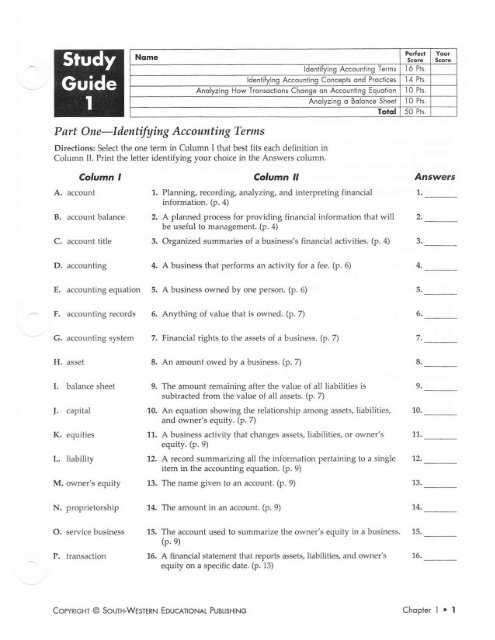

Nsmaldeniiting Accounling Te.msldenrif/ng Accounring Concepb ond Procrice3Anolyzing low Tronsoclron3 Chonge on Accoulring EquoliorAndlyzing d Solonce Sheeilotal0 Ph.0 Pis.50 Plt<strong>Part</strong> <strong>One</strong>-<strong>Iilentifying</strong> <strong>Accounting</strong> <strong>Terms</strong>Dir€ctionr: Select the one term in Column I that best fits each definition inColumn Il. Print the letter identifying your choice in lhe Answers column.B.c.Colvmn Iaccount titleColumn ll1. Plannin& recording, analyzin& and interpretinS financialinformation. (p, 4)A planned process for providing financial information that willbe useful to management. (p. 4)Organized summaries of a business's financial activities. (p. 4)Answers1.2.3.D.accounting4.A business that pe orms an activity for a fee. (p. 6)4.E.accounting equation5.A business owned by one person. (p. 6)5.F.accountint recordsAnything of value that is owned. (p. 7)6.G.accounting system 7.Financial rights to the assets of a business. (p. 7)7.H.An amount owed by a business. (p. 7)8.L balance sheet,. capitalK. equitiesL, liabilityM. owner's equity9. The amount remaining after the value of all liabilities issubtracted frorn the value of all assets. (p. 7)10. An equation showint the relationship among assets, liabilities,and owner's equity. (p. 7)11. A business activity that chantes assets, liabilities, or ownelsequity. (p. 9)12. A rccord summarizing all the information pertainint to a singleitem in the accounting equation. (p. 9)13.The nalne given to an account. (p. 9)9.10.11.12.13.N. proprietoiship14.The amount in an account. (p. 9)'t4.O. service businessThe account used to summa ze the owne/s equity in a business,(P. e)15.P. transactionA financial statement that reports assets, liabilities, and owner'sequity on a sp€cific date. (p. 13)16.coPYRrcHr @ SourH-WEsrErN EoucAitoNAL PususHtNGChopter I . I

<strong>Part</strong> Tu)o-Identifying Accoltlrting Concepts anilPracticesDirectionsr Place a T for True or an I for False in the Answers column toshow whether each of the following statements is true or false-7.2.3.5.6.7.8.9.Accoundnt is the languate of business (p. 4)Keeping personal and business records seParate is an aPplication of the business entityconcept. (p. 6)Assets such as cash and supPlies have value because they can be used to acquire otherassets or be used to operate a business (p. 4The relationship amont assets. liabilities, and owner's equity can be written as anequation. (p. 4The equation is called the accornting equation and does not have to be in balance to becorrect. (p. 4The sum of the assets and liabilities of a business always equals the investment of thebusiness owner. (p. 7)Recording business costs in terms of hours required to complete projects and sales interms of dollaG is an application of the unit of measurement concePt (p. 9)The capital account is an owner's equity account. (p. 9)If two amounts are recorded on the same side of the accounting equation, the equationwill no lonter be in balance. (p. 10)'10.When a company pays insurance Premiums in advance to an insurer, it records thepayment as a liability because the insurer owes tuture coverate (P. 10)11. When items are bought and paid for later this is referred to as buyint on accounf. (p 11\12. when cash is paid on account, a liability is increased (P. 11)13, The Going Concem accountint concePt affects the way {inancial statements areprepared. (p. 13)14. Ori a balance sheet, a single line means that amounts aie to be added or subtracted. (p 14)Answers1.3.4.5.6.7-8.9.10.11.12.13.14.2 . Study Guide CENTURY 2l AccouNnNG, 7TH EDlrloN

Nqme<strong>Part</strong> Thrce-Analyzing Hozt Transactions Chargean Accouating EquationDirections: For each of the following tnnsactions, elect tlle two accountsin the accounting equation that are changed. Decide if each account isincreased or decreased. Place a "+" in the column if the account is increased.Place a "-" in the column if the account b decreas€d,fransolctiont1-2. Received cash from owner as an investmmt. (p. 9)3-4. Paid cash for supplies. (p. 10)fi. Paid cash for insuance. (p. 10)7-€. Bought supplies on account from Lint Music Supplies. (p. 11)9-10. Paid .ash on account to Lint Music Supplies. (p, 11)a--2,345--5,7-A-9-10.Cash 'SupplieeA$€ts = Liabilities + Ownefs EquityPrepaidInsurance+ B. Trevifro, CapitalCopyRrcHt @ SouIH-WESTERN ED!rcaroNA! PUBUSH|NG Chopter I o 3

<strong>Part</strong> Four-Analyzing a Balance SheetDitfttions: The parts of the balance sheet below are identified with capitalletters. For each of the Iollowing items, decide which part is being described.Print the lette! identifying your choice in the Answers coluftn.Ac EF-r}{-GHAntwers1. The botal amormt oI equity in the business. (p. 14)2 The label Assets. (p. 14)3, The total amount owned by the business. (p. 14)4 The name of the businese. (p. 14)5. The Liabilities s€ction. (p. 14)5. The name and date of the report. (p, 14)7. The AsseE s€ction. (p. 14)8. The amount of owner's equity, (p. 14)9. The label Owner's Equity. (p. 14)10. The label Uabilities. (p. 14)1.4.6,7.8,9.10.4 . Srudy GuldeCENTURY 2l AccoumNc, ZTH EDmoN

Nqmoldenriryine Accounling Tsrmsdenli$/ing Accounling Concepls ond ProcticesAnolyzing How Tronsoclions Chdnge on <strong>Accounting</strong> EquolionAnolyzing o Bolonce SheelT15 Prs.12 Pts.40 Pts.Pmt <strong>One</strong>-lilentifying <strong>Accounting</strong> <strong>Terms</strong>Directions: Select the one term in Column I thal best fits each definition inCotumn IL Print the letter identifying your choice in the Answers columnColumn IColumn llA. expense 1. An increase in owner's equity resulting fuom the oPemtion of abusiness. (p 26)B. revenue 2. A sale for which cash will be received at a later date (P. 26)C. sale on account 3. A decrease in owner's equity rcsultint from the oPeration of abusiness. (P. 27)D. withdrawals 4, Assets taken out of a business for the owner's Personal use (P.28)Answers1.2.3.4.copyRrcHT @ SoLf,H-WESTERN EDUCATIoNAI PUBUSHING Chopter 2 . 5

<strong>Part</strong> Ttno-ldentifying <strong>Accounting</strong> Concepts andPractices Related to Changes That Af{ect Owner'sEquityDir€ctions: Place a T for True or an F for False in the Answers column toshow whether each of the following statements is true or false.1. A transaction for the sale of goods ot services r€sults in an increase in own€r's equity.(p 26)2. When cash is received foi services performed, the asset account Cash is increased andthe owner's equity account is decr€ased. (p. 26)3, Accounts Receivable is a liability account. (p. 26)Answers1-2.3.5.Regardless of when payment is made when se ices are sold, the revenue should berecorded at the time of the sale. (p. 26)A transaction that increases accounts receivable and increases owner's equity is a sale onaccount. (p. 26)4.5.6.Owner's equity is decreased by a sale on account. (p. 26)5.7.When cash is paid for expens€s, the business has less cash; therefore, the asset accountCash is decreased and &e owner's equity account is increased. (p.27)7.8.Cash is increased by expenses. (p. 27)8.9. Recordint an expense hansaction in an accounting equaiion increases liabilities. (p. 27)9-10. Wlen a company makes payments for advertising and charitable contributions, thecompany is paying expenses. (p. 27)11. Vvhen a company receives cash from a customer for a prior sale, the transactiondecreases the cash account balance and increases the accounts r€ceivable balance. (p. 28)12. A withdrawal is a tmnsaction that decreases cash and decreases owner's equity. (p. 28)10,-11.12.13. When cash is paid to the owner for personal use, assets decrease and owner's equitydecreases. (p. 28)14. An owner may withdraw only cash ftom a business; other assets must remain in thebusiness at all times for the accounting equation to be in balance. (p. 28)15. Three transactions that affect owner's equity are receiving cash on account. payin8expenses, and paying for supplies bought on account. (p. 28)13.14,15.6 . $udy Guide CENruRy 2l AccouNTtNG, 7TH EDlTioN

Ndme<strong>Part</strong> Three-Analvzing How Transactions That Alfect Ozoner's EquityChange an Accouitin{ EquafionDirections: For each of the followint transactions, select the two accountsin the accounting equation that are changed. Decide if each account isincreased or decreased. Place a "+" in the column if the account is increased.Place a "-" in the column if the account is decreased.fransacrions1-2. Received cash ftom sales, (p.26)3-4. Sold services on account to Kids Time. (p. 26)5-5. Paid cash for rent. (p. 247-8. Paid cash for telephone bill. (p. 249-10. Received cash on account from Kids Time. (p.28)11-12. Paid cash to owner for personal use, (p. 28)Trans.No.Cash+Accts. Rec.-Kids Time+_ SUpplres+= Liabiliti€s + Owne/s EquityPr€paid Ac.ts. Pay.-LingMusic Supplies+B. Treviflo,CapitalH.H.7-3.9-10.11-12.CopyRtGHT O SoUrH-WESTERN EDUCATIoNAL PUBUSH|NG Choptet 2 . 7

<strong>Part</strong> Four-Analyzing a Balance SheetDirections: Place a I for True or an F for Fals€ in the Answers column toshow whether each of the following statements is true or false.Answcft1. A balance sheet may be prepared on any date. (p. 30)1.2. The accounts on the left side of the accounting equation are reported on the left side of the 2.balM.e sheet. (p. 30)3, Few business€g ne€d to prepare a balance she€t every day. (p. 30)4. The balance sheet reports the balances oI lhe asset, liability, and owner's equity accounts. 4.(p. 30)5. The heading of a balance sheet contains the name of the business, name of the rcport, and 5.date of the repo . (p.30)6. The a€counts on the left side of the accounting equation include the liabililies and owne/s 6.equity. (p. 30)7. The total of the left side of the balance sheet is equal to the right side, and these totals need 7.not be on the same line. (p. 30)8. Asset accounts are shown on the right side of the balance sheet, (p. 30)9. Owner's equity accounls are presented above liability accounts on the balance sheet. (p.30) 9.8 . $udy Guids CENrurY 2l AccouNnNG, 7TH EoTtoN

Nolnald€nlitins Accounrins TsrmsAnolyzins Tronraclion! inlo o€bil ond Credil Po sldentitins Chonsss in AccounhlolEl5 n..20 Pt5.15 PE.40 Prs.Paft <strong>One</strong>-Identifying <strong>Accounting</strong> <strong>Terms</strong>Dir€ctions: Select the one term in Column I that best fits each definition inColumn II. Print the letter identifying your choice in the Answers column.Colvmn IA. chart of accountsColumn ll1, An accouniing device used to analyze transactions. (p.42)1.AnswersB.credit2. The side of the account that is increased. (p. 42)c.debit3. An amount recorded on the left side. (p. 42)3.D. normal balance4, An amount recorded on the r€ht side. (p. 42)4.E. T account5. A list of accounts used by a business. (p.45)5.CopyRrGHr @ SoUTH-WESIERN EDUCATToNAL PUBUSHTNG Chopter 3 . 9

<strong>Part</strong> Tzoo-Analyzing Ttansactions into Debit nnd Creilit <strong>Part</strong>sDiiections: Analyze each of the followint hansactions into debit and credit parts. Print the letter identifyingyour choice in the proper Answers colururs,Accoun litlesB.c.CashAccounts Receivable-KidsTimeSuppliesD. Prepaid InsuranceE. Accounts Payable-Ling MusicSuppliesF. Barbam Trevino, CapitalG.H.LBarbara Tieviio, DrawingSalesRent ExpenseDebit creditAnswers1-2. Received cash from owner as an investment. (p.45)3-4. Paid cash for supplies. (p. 46)H. Paid cash for insurance. (p. 447-8. Bought supplies on account ftom Lint Music Supplies. (p. 48)9-10. Paid cash on account to Ling Music Supplies. (p. 49)11-12. Re€eived cash lrom sales. (p.51)13-14. Sold services on account to Kids Time. (p.52)15-16. Paid cash for rent. (p. 53)17-18. Received cash on account ftom Kids Time. (p. 54)7.3.5.7.9.11,13.15.17.2.4.6,8.10.12-74.L6-18.19-20.lO . Srudy cuideCENTURY 2l AccouNTtNG, 7rH EDmoN

Nomc<strong>Part</strong> Three-lilentfuing Changes in AccountsDir€ctions: For each of the follov/ing items, select the choice that best compleles the statement. Print the letteridentifyint your choice in the Answers column.1. The values of all things owned (assets) ate on the account equation's (A) left side (B) right 1.side (C) credit side (D) none of these. (p. 40)2, The values of ail equities or claims against the assets (liabilities and owner's equity) are on 2.the account €quation's (A) left side (B) ritht side (C) debit side (D) none of these. (p. 40)3. An amount recorded on the left side of a T account is a (A) debit (B) credit (C) normal 3.balance (D) none of these. (p. 42)4, Arl amount recorded on the right side of a T account is a (A) debit (B) credit (C) normal 4,balance (D) none of lhese. (p. 42)5. The normal balance side of any asset account is the (A) debit side (B) credit side (C) right 5.side (D) none of thcse. (p. 42)6, Th€ normal balance side of any liability account is the (A) debit side (B) credit side (C) left 6.side (D) none of these. (p. 42)- 7. The normal balance side of an owner's capital account is the (A) debit side (B) credit side 7,(C) Ieft side (D) none of these. (p. 42)8. Debits must equal cledits (A) in a T account (ts) on the equation's left side (C) on the 8.equation's right side (D) in all transactions. (p. 45)9, Decreases in an asset account are shown on a T account's (A) debit side (B) credit side 9.(C) balancc side (D) nonc of these. (p. 45)10. Decreases in any Iiability account are shown on a T account's (A) debit side (B) credit side 10.(C) right side (D) none of these. (p. 49)11. Increases in an owner's capital account are shown on a T account's (A) debit side (B) credit 11.side (C) leti side (D) none of these. (p. 51)12. Increases in a revenue ac(ouni are shown on a T accounfs (A) debit side (B) credit side 72,(C) left side (D) none of these. (p. 51)13, The normal balancc side of any revenue account is the (A) debit side (B) credit side (C) left 13.side (D) none of these. (p. 51)14, The normal balance side of any expense account is the (A) debit side (B) credit side (C) right 14.side (D) none of these. (p. 53)15. The normal balance side of an owner's drawint account is the (A) debit side (B) credit side 15.(C) left sidc (D) none oI these. (p. 55)AntwertCopyRrGHT O SoUr+WESTERN EDUCATToNAT PususH NGChopter3rll

Nomaldenlilyins Accounlins T6rmsldenfiting <strong>Accounting</strong> Concsph ond Proctice!Anolyzins o Generol JournolAnolyzing R€.ording Tronrocrion3 in o Gen€'ollourrolTotolll Prsl9 Pts.l0 Pl3.lO Pk50 Pl3.P art <strong>One</strong>-Iilentifu ing <strong>Accounting</strong> <strong>Terms</strong>Directions: S€lect the one term in Column I that best fits each definition inColumn II. Print the letter identifying your choice in the Answers columrLcheckColumn Idouble-entry accountint1.2.Column lIA form for recordint transactions in chronolodcal order.(P.64)Recordint transactions in a joumal. (p. 614)Answars1.entryteneml rournalinvoicejoumaljoumalizingreceiptsource document3,4.5.6.7.8.10.11.Information for each transaction recorded in a journal.(P 66)A joumal with two amount columns in which all kinds oIentries can be recorded. (p. 66)The recording oI debit and credit parts of a transaction.(p. 66)A business paper from which infomation is obtained Ior ajoumal entry. (p. 66)A business form ordering a bank to pay cash from a bankaccount. (p. 67)A form descdbing the goods or services sold, the quantity,and the price. (p. 67)An invoice used as a sou(e docrment for recording a saleon account. (p. 57)A business fom $vintreceived. (p. 68)written acknowledtment for €ashA fom on which a brief message is written describing atransaction. (p. 68)3.4.5.6-8.10.11,CoPYRTGHT O SourH-\ /EsrERN EDUcaloNAt PususHtNG Chopler 4 r 13

<strong>Part</strong> Two-Identifuing <strong>Accounting</strong> Concepts anilPtacticesDirections: Place a T for True or an F for False in the Answers column toshow whether each of the followint statements is true or false.Transactions are recorded in a journal in one place and in order by date. (p. 66)Antwers1.For each transaction in a joumal, both debit and credit parts are rccorded. (P. 66)3.4-Examples of source documents include checks. sales invoices, memonndums, andletters. (p. 56)The source document for cash payments is a sales invoice. (p. 67)3.4.5.6.The objective evid€nce accounting concept requires that there be proof that a tmnsactiondid occur. (p. 68)A calculator tape is the source document for daily sales. (p. 68)5.6.7.A check is an example of a source document when items are paid in cash. (p. 70)7.8,The year is written only once on a joumal page. (p. 69)8.9.The month is w tten once for each transaction on a joumal page. (p. 69)9.10.Joumal entries have three parts: date, debit part, and credit part. (p. 69)10.11,The source document used when supplies are bought on account is a memomndum.|p.73)13-12- The source document used when supplies bought on account are paid Ior is a check.1,3.@.741The abbreviation foi the source document cnic latot lape is CT . (p . 76)11.12.14.The abbreviation for the source document sales inuice ]s SI. (p.77)14.15.The source document used when cash is received from sales is a calculator tape. (p. 76)15.16.Decreases in the owner's capital account are recorded as crcdits, (p. 78)16.77.A teneral joumal page is complete when there is insufficient space to record any morcentries. (p. 82)Each journal entry requires at least two lines. (p. 82)77.18.19.In correctrng an errcr in accountint work, simply draw a line throuth the incorrect itemarld write the correct item above the canceled item. (p. 84)19,14 . Study Guide CENTURY 2l AccouNTrNG, 7rH EDlTloN

Ndme<strong>Part</strong> Tlree-Analyzing a General lounalDirectionB: The columns of the joumal below are identified with capitalIetters. For each of the following items, decide which column is beingdescribed- Print the letter identifying your choice in the Answe$ column.GENERATIOURNAL1.Write the year for the first entry on a joumal page. (p. 69)Answert1-2-Write the name of the month for the first entry. (p. 69)2.3.Write the day of the month for an entry. (p. 69)3.4.Write the title of the account to be debited. (p. 69)4-5.Wdte the source document number for an entry. (p. 69)5.6.Write the title of the account to be credited. (p. 69)6.7.Write the credit amount when cash is received from the owner as an investment. (p. 59)7.8.Write the debit amount when cash is received from sales. (p. 76)8.Wdte the amount crcdited to Sales. (p. 76)9.10.Write the amount debited to Rent Expense. (p. 78)10.CopyRlGHT @ SourH'wEsrERN EDUCAToNAL PUBLTSH|NG Chopler 4 r 15

<strong>Part</strong> Four-Analyzing Recorling Transactions ifl aGenernl lournalDircctions: For each of the following items, select the one choice that bestcompletes the statement. Print the letter identifyint your choice in the1. Pr€parint a source document for each transaction is an application of the accounting 1.concept (A) Business Entity (B) Unit oI Measurement (C) Objective Evidence (D) CoingConcem. (p. 66)2. A general joumal entry includes (A) the debit and credit parts of a transaction (B) the date 2.debit, and credit parts of a transaction (C) the date, debit, crediL and source document(D) none of the above. (p. 69)3. The entry to record receipt of cash from the owner as an investment is (A) debit Capital, 3.credit Cash (B) debit Cash, credit Capital (C) debit Cash, credit Accounts Payable (D) noneof the above. (p. 69)4. The account debited when cash is paid for supplies is (A) Supplies (B) Cash (C) Supplies 4,Expense (D) none of the above. (p. 70)5. When cash is paid for insurance, (A) the piepaid insumnce account is decreased (B) the 5.prepaid insurance account is credited (C) the balance of the prepaid insurance account isincreased (D) none of the above. (p. 72)6. When supplies are boutht on account, the account debited is (A) Cash (B) Supplies 6.(C) Capital (D) none of the above. (p. 73)7. The source document for a payment of cash for the electdc bill ii (A) a receipt (B) a check 7.(C) a memo(andum (D) any of the above. (p. 78)8. If there is only one blank line remaining on a journal page, (A) the joumal entry is split 8.(B) a new account is opened (C) a new page is started (D) none of the above. (p. 82)9. If an enor is discovered in a general joumal entry, (A) cancel the error by drawint a neat 9.line through lhe error (B) correct the entry by writing the correct item above the cancelederror (C) do not erase the inconect item (D) all of the above. (p. 84)10. Words in accounting are (A) wdtten in full when space permits (B) abbreviated wherever 10.possible (C) printed rather than written (D) none of the above. (p. 84)Antwers16 . Study cuide CENTURY 2l AccouNTrNG, hH EDlrloN

P aft <strong>One</strong>-ldentifying <strong>Accounting</strong> <strong>Terms</strong>ldenlitying Acco'rnling Term3ldenrifying A.counling Concepls ond Proclic63ldenritying Accounling ConcsplsAnolyzins Posting from o Journol lo o G€nerol L€dgerDirections: S€l€ct the one term in Column I that best fits each definition inColumn IL Print ihe letter identifying your choice in the Answers column.Column IA. account numberColumn ll1. A group of accounts. (p.94tor6l8 Pts.l6 Pls.t0 fh.l6 Pts.50 Pt3Anwrart1.B. correcting enlryC. file maintenance2.3-A ledger that contains all accounts needed to prepare financialstatements. (p. 94The number assigned to an account. (p. 942.3.D. general ledgerThe procedure for arranSing accounts in a Seneral ledger,assitning account numbers, and keeping records current. (P- 98)4.E. ledgerWritint an account title and number on the headint of anaccount. (p. 99)5.F. opening anTransferring information from a journal entry to a ledger account.(p. 101)6.G, postint7.Determinint that the amount of cash agrees with the balance ofthe cash account in the accounting records. (p. 109)7.H. proving cash8.A joumal entry made to corect an error in the ledger. (p. 109)8.copyRrcHr @ SoUTH.WESTERN EDUcaToNAL PUBUSH]NG Chopbr 5 . 17

P art Tu)o-lilentifying <strong>Accounting</strong> Concepts anilPracticesDirections: Place a T for True or an F for False in the Answers column toshow whether each of the followinS statements is true or false.1. Because an account form has columns for the debit and credit baiance of an a€count, itis often referred to as the balance-ruled account form. (p.96)Antwert1.2. The asset division accounts for Encore Music are numbered in the 100s. (p. 97)3.The cash account is the first asset account and is numbered 110. (p. 97)3.4.9.10.The second division of Encore Music's chart of accounts is the owner's equity division.(p. e7)5. The firsi digit of account numbers for accounts in the owner's equity ledger division is3. (p.97')6. The last two digits jn a 3-digit account number indicate the tenerat ledger division ofthe account. (p. 97)7. When addinS a new expense account between accounts numbered 510 and 520, the newaccount is assigned the account number 515. (p. 98)8. Encore Music arrantes expense accounts in chronological order in its general ledg€r.(p. e8)The two steps for opening an account are writing the account title and recording thebalance. (p. 99)Each amount in the Debit and Credit columns in a general joumal is posted to theaccount written in the Account Title column. (p. 101)11. The posting reference should always be recorded in the joumal's Post. Ref. columnbefore amounts are recorded in the ledger. (p. 101)12 The only reason for the Post. Ref. columns of the joumal and general ledger is to indicatewhich entries in the joumal still need to be posted if postint is interupted. (p. 101)13. The steps for posting are to write the date, joumal page number, amount, and balance.(p. 101)14, If the previous account balance and the current entry posted to an account are bothdebits, the new account balance is a debit, (p. 103)15. When all posting is completed, the joumal's Post. Ref. column is completely filled.(p. 104)16. Cash is proved by comparing the cash balance shown in the checkbook with the cashbalance in the g€neral ledger cash account. (p. 109)4.5.6.7,8.9.10.11.72-13.14.15.16,18 . srudy Guide CENTURY 2l AccouNTrNG, ZTH EDmoN

NomeP art Thre e-<strong>Iilentifying</strong> Acc ounting C onceptsDircctionB: Place a check mark in the proper Answers column to showwhethet each of the folowing statements is best described as a debit or acredit.1. Normal balance of Cash, (p. 101)AnswersDtDir crcditz Nomal balance of owner's capital account. (p. 102)3. Account balance colurm in which the account balance is tecorded when the onlyently is a credit. (p. 102)4. Balanae column in the capital account after an initial investment is posted. (p. 102)5. Normal balance of Supplies. (p. f03)5. Column in the accounts payable account in which an entry for supplies bought onaccount is posted. (p. 103)7. Account balance column in which the new account balance is recorded when theprevious balance is a debit of $500.00 and the currcnt entry is a credit of $200.00. (p. 103)8. Normal balanc€ of Sales. (p. 108)9. Normal balance of Rent Expense. (p. 108)10. Balance column in the cash account which is compaEd with the checkbook to provecash. (p. 109)CopyRtGHT @ SouftWEsrERN EDucatoNAt PususHtNG Chopbr 5 . 19

<strong>Part</strong> Four-Analyzing Posting ftom a loumal to aGenerul LeilgerDirections: In the journal below, some items are identified with capitalletters. In the general ledger accounts, locations to which items are postedare identified with numbers. For each number in a general ledger account,s€lect the letter in the toumal that will be posted to the account. Print theletter idenhfyint your choice in the Answers coluinn. (pp. 101-103)GENERAI IOURNALBoldNumbersin bdgerAccountt1.Answatt-.""-"" 110 7-8.

ldenfi tins Accountins Term3AnolyzinE Tronsoclion5 in o Corh Conlrol Systenldenlitins A..ounling Concepls ond ProclicesTorcll2 Prs.I2 Pls.20 Pk<strong>Part</strong> <strong>One</strong>-ldentifu ing <strong>Accounting</strong> <strong>Terms</strong>Directions: Select the one term in Colurnn I that best fits each de(inition inColumn II. Print the letter identifying your choice in the Answers column.Column IColvmn llB.bank statement 1, A bank account from which paFnents can be ordered by adepositor. (p. 120)blank endorsem€ntC. checking accountD. debit card2, A signature or stamp on the back of a check, transferringownership. (p. 121)3, An endorsement coniistint only of the endorser's siSnature.(p. 121)4. An endorsement indicating a new owner of a check. (p. 121)Answers1.3.4.E. dishonored checkF. electronic fundstransferG. endorsementH, petty cash5. An endorsement restricting further transfer of a check'sownership. (p. 121)5. A €heck with a future date on it. (p. 122)8.A report of deposits, withdravr'als, and bank balances sent to adepositor by a bank. (p. 125)A check that a banl refuses to pay. (p. 130)5.6.7.8.I. petty cash slipJ. posldated checkK. rcstrictiveL. special10.11.72-A computerized cash payments system that uses electrcnicimpulses to transfer tunds. (p. 132)A bank card that, when making purchaset automaticauy deductsthe amount of the purchase from the checking account of thecardholder. (p. 133)An amount of cash kept on hand arld used for makint smallpayments. (p. 135)A fom showing proof of a petty cash payment. (p. 136)9.10.11.12.CopyRlGHr @ SoUTH-WESTERN EDUCAT|QNAL PUBLTSHTNGChopler 6 . 2l

<strong>Part</strong> Tztso-Analyzirrg Transactions in a CashColttrol SvsternDirections: Analyze each of the following hansactions inio debit and creditparts. Print the letters identifyint your choices in the proper Answerscolumns,Account liltesA. CashB. Petty CashC. Accounts Receivable-B. johrconD. SuppliesE. Accounts Payable-Super SuppliesF. MiscellaneousExpensefransacrions1-2. Received bank statement showing bank service charge. (p. 128)AnswersDebi, Credit1- 2.H, Received notice fiom a bank of a dishonored check from B. Johnson.(p. 131) 3. 4.H. Paid cash on account to Sup€r Supplies usint EFT. (p. 132)7-8. Purchased supplies using a debit card. (p. 133)7. 8-F10. Paid cash to establish a petty cash fund. (p. 135)9. 10.11-12. Paid cash to replenish a petty cash tund: $12.00, supplies; $3.50, 11. _ 72.miscellaneous expense. (p. 137)22 . Study Guide CENTURY 2l AccouNTrNG, 7TH EDlTloN

Nome<strong>Part</strong> Three-lilentifuing <strong>Accounting</strong> Concepts and PracticesDirections: Place a T for True or an F for False in the Answers column to showwhether €ach of the following statements is true or false.1, Because cash transactions occut more frequently than other transactions, the chances formaking recording errors affecting cash are less. (p. 118)2. When a deposit is made in a bank account, the bank issues a receipt. (p. 120)Answers-t-2.There are four t)?es of endorsements commonly used: blank, special, original, andrestdctive. (p. 121)A check with a blank endorsement can be cashed by anyone who has the check. (p. 121)3.4.5.When writing a check, the first step is to prepare the check stub. (p. 122)5.7.Most bank do not look at the date the check is written and will withdraw money ftom thedepositor's account anytime. (p. 122)The amount of a check is written twice on each check. (p- 122)7.8.A check ihat contains errors must be marked with the wod VOID and another check mustbe written. (p. 123)9.10.11.12.13.An outstanding check is one that has been issued but not yet reported on a bank statementby the bank. (p. 125)An important aspe€t of cash control is verifying that the information on a bank statementand a checkbook are in agreement. (p. 126)Banks deduct service charges from customers' checking ac€ounts without requiringcustomers to write a check for the amount. (p. 127)Not only do banks charge a fee for handling a dishonored check, but they also deduct theamount of the check from the account as well. (p. 130)The joumal entry for a payment on account using electronic funds transfer is exactly thecdme r< s hen the pavment i, made by (hect. rp. ll2)9.10.11.12,13.a4.The source documeni for an electronic funds ttansfer is a memorandum. (p. 132)14.15.The source doclrment for a debit card pu(hase is a memorandum. (p. 133)15.16.17.18.Encore Music maintains a petty cash fund fol making large cash payments wiihout writingchecks. (p. 135)Usin8 a petty cash fund usually decreases the number of checks that have to be wdtten.(p. 13s)A memorandum is the source document for the entry to record establishing a petty cashft1nd. (p. 135)19. Anytime a payment is made from the petty cash fund, a petry cash slip is preparedshowing proof of a petty cash payment. (p. 136)16,17.18.19.20. When the petty cash fund is reptenished, the balance of the petty cash account increases.(p. 137)CopyRtGHr (O SoUTH,WESTERN EDUcaIoNAL pususHtNc20.chopier 6 . 23

Ncmcldentilying Accounrins <strong>Terms</strong>Anolyzing Accounl;ns Proclices R€lolsd lo o Wo* She€tAnolyzi.g rhe Prepororion ol o Triol Bolonco on o Work ShatAnolyzing Adiusiments ond Exbndins Account Bolonc€' on o Wo'k SherlorolPaft <strong>One</strong>-ldentifuing <strong>Accounting</strong> <strong>Terms</strong>Directions: Select the one ierm in Column I that best fits each definition inColumn II. Print the letter identifying your choice in the Answers column-Column IA. adjuslmentsB. fiscal period1.C. income stat€ment 3.D. net incomeE. net lossF. trial balance4-G. $'ork sheet 7.Column llThe lentth of time for which a business summarizes and reportsfinancial information. (p. 150)A columnar accounting form used to summarize the teneral ledterinformation needed to prcpare financial statements. (p. 150)A proof of the equality of debits and credits ir a general ledter.(p. 1s1)Changes recorded on a work sheet to update Seneral ledteraccounts at the end of a fiscal period. (p. 154)A financial statement showing the rcvenue arld expenses for a fiscalperiod. (p. 160)The difference between total revenue and total expenses when totalrevenue is geater. (p. 161)The difference between total revenue and total expenses when totalexpenses is Sreater. (p. 162)17 Ptsl6 Ph.l6 Pts.56 Pl3.AnswerS1.3.4-5.6-7.CopyRrcHT O SoUrH-WESTERN EDUcaToNAL PUBLTSHTNG Chople( 7 . 25

<strong>Part</strong> Tuo-Analyzilg <strong>Accounting</strong> Practices Relateilto a Work SheetDirections: Place a T for True or an F for False in the Answe6 column toshow whether each of the following statements is hue or false.1. The accounting concept Consistent Reporting is beint applied when a word processing 1.service business reports rcvenue per page one year and revenue per hour the next year.(p.1a8)Answers2. An accounting period is also known as a fiscal period. (p. 150)2.3. Journals. ledgers, and work sheets arc considered permanent records. (p. 150)4. All general ledger account titles are listed on a trial balance In the same order as listed 4.on the chart of accounts. (p. 151)5. The four questions asked when analyzrnt an adiustment are Why? Where? When? and 5.How? (p. 155)5. The two accounts affected by the adjustm€nt for supplies are Supplies and Supplies 6,Expense. (p. 155)7. The two accounts affected by the adiustment for insurance arc Prepaid Insurance 7.Expense and Insurance. (p. 156)8. Totalng and rulint the Adjustments columns of a work sheet is necessary to prove the 8.equality of debits and credits. (p. 1549. Two financial statements are prepared from the information on the work sheet. (p. 159) 9.10. Net income on a work sheet is calculated by subtracting the Income Statement Credit 10.column total from the Income Statement Debit column total. (p. 151)11. If errors are found on a work sheet, they rnust be erased and corrected before any 11.turther work is completed. (p. 164)12. When two column totals are not in balance on the work sheet, the difference between 12.the two totals is calculated and checked. (p. 1&)13. If the difference beh,r'een the totals of Debit and Credit columns on a work sheet can be 13.evenly divided by 9, then the error is most likely in addition. (p. l€l)14, If there are errors in the work sheefs Trial Balance columns, it rnitht be because not all L4.teneral ledger account balances were copied in the Trial Balance column correctly.(P. 165)15. Erors in general ledger accounts should never be elased. (p. 166)15.15. Most errors occur in doing arithmetic. (p. 166)16,17. Usint a calculator will help prevent eIIoIs in accounting records, but not all erlols are '17.due to inaorrect calaulations. (p. 167)26 . Study Guide CENTURY 2l AccouNnNG, 7TH EDmoN

<strong>Part</strong> Three-Analy,zing the prcpa.ration of a TrialBalance on a Work SlieetDirections: For each account title listed below, decide whether the accountbalance is recorded in theTrial Balance DebitorTrial Balance Credit column.Place check mark in the proper Answers column identiffng_ayour choice.(p. 1s1)1, Cashlriol BalanceDeUt Credi,2, Petty Cash3. Accounts Receivable-Lawrence Roofing4. Supplies5. Prepaid Insurance6. Accounts Payable-Simpson's Supplies7. Sophia Cruse, Capital8. Sophia Cruse, DmwinS9. Income Summary10. Sales11, Advertisint Expense12. Insurance Expense13. MiscellaJleous Expense14. Rent Expense15, Supplies Expense16. Utilities ExpenseCopyRrGHr @ SoUTH-WESTERN EDUcaloNAt puBLtsHrNGChopler 7 t 27

<strong>Part</strong> Four-An aluzing Adiustments and ExtendingAccount Balancei on-a Work SheetDirections: Foi each account listed below, determine in which work sheetcolumn(s) an amount typically will be written, Place a aheck mark in theproper Answers column to show your answer'1. Cashlncome BatanceAdiuttmcnts Sralement SheetDebii Credit Dcbir c/€dir Debit Credit(p. t55-ts6) (p. t6O) (P. ts9)2. Petty Cash3. Accounts Receivable-Lawrence Roofing4, Supplies5. Prepaid lnsurance6. Accounts Payable-Simpson's SUPP)ies7. Sophia Cruse, Capital8. Sophia Cruse, Drawing9. lncome Summary10. Sales11. Advertisint Expense12. Insumnce Expense13. Miscellaneous Expense14. Rent Expense15. Supplies Expense16. Utilities Expense28 . $udy Guide CENTURY 2l AccouNTrNG, 7IH EDI-IIoN

Anolyzing on lncome Slotemenling lncome StofementPnrt <strong>One</strong>-Iilenffiing <strong>Accounting</strong> Concepts and Practices1. A component percentage is the percentage relationship b€tween one financial statementitem and the total that includes that item. (p. 178)2. The Adequate Disclosure accounting concept is applied when financial statements containall information necessary to understand a business's financial condition. (p. 174)4.5.6.7.9.An income statement reports information over a period of time, indicatmg the financialpro$ess of a business in eaming a net income or a net loss. (p. 176)Th€ Matchint Expens€s with Revenue accounting concept is applied when the revmue eamedand the expenses incuffed to eam that revenue are reported in ihe same fucal period. (p. 176)Information needed to preparc an income statement comes fuom the trial balance columnsand the income statement columns of a work sheet. (p. 176)The income statement for a service business has five sections: headin& revenue, expenses,net income or loss, and capital. (p. 175)The work sheet is used to assist in prepa ng the tevenue, expenses, and net incomes€ctions of an income statement. (p. 176)Only revenue accounts and expense accounts are used in preparing the income statement.(p.1.76)The net income on arl income statement is verified by checking the balance sheer. (p. 177)10. Single lin€s ruled across an amount column of an income statement indicate that amountsare to be added. (p. 177)11. Component percentages on an income statement are calculated by dividing sales and totalexpenses by net income. (p. 178)12. All companies should have a total expenses component percentage that is not more than80.0%. (p. 178)13. lvhen a busin€ss has two different sources of revenue, a separate income statement shouldbe prepared for each kind of revenue. (p. 179)14. An amount writien in parentheses on a financial statement indicates an estimate. (p. 179)15. A balance sheet reports financial information on a specific date and includes the assets,liabilities, and owne/s equity. (p. 181)15. A balance sheet reports information about the elements of the accounthg equation. (p. 182)17. The owner's capital amount rcported on a balance sheet is calculated as: capital accountbalance plus drawing account balance, less net income. (p. 183)1a. The position of the total asset line is determined after the equities section js prepared. (p. 183)19. Double lines are ruled across the balance sheet columns to show that the colurnn totalshave been verified as correct. (p. 183)20. The owner's equity section of a balance sheet may report diffetent kinds of details aboutowner's equit, depending on the need of the business. (p. 184)AnswersDirections: Place a T for True or an F for False in the Answers column to showwhether each of the followint statements is true or faise-1.3.4.5.6.9.10.11_13.14-15.16.17.18.19.20.CopyRtGHr @ SoUTH-WESTERN EDUCATToNAL PUBUSH|NG Chopler 8 . 29

<strong>Part</strong> Tztso-Analyzing nn Incoflxe StatemerrtDirections: The parts of the income statement below are identified withcapital letiers. Decide the lo.ation of each of the fotlowing items P nt theletter identifying your choice in the Answers colurnn.cDE I NGHILloPAnswers@p. !76-178)30 . study Guide CENTURY 2l AccouNTrNG, 7IH EDlTloN1. Date of the income statement.1.2. The amount of net income or net loss.3, Business name.4. Expense account balances.3.4.5, Expense account titles-5. Heading of expense section.7. Heading of revenue section.6.7-8. Net income or net loss comPonent Percentage.9.10.11.Revenue account title,Sales component percentage.Statement name.10,11.12. Total amount of revenue.13. Total expenses component percentate.14. Words Nef hcome or Ner loss.15. words Total Expefises.72-13.L4.15.

Nome<strong>Part</strong> Thtee-Analyzing Income Statement ProceiluresDirections: For each of the following items, select th€ choice that bestcompletes the statement. Print the letter identifying your choice in the1. The date on a monthly income statement prepared on July 31 is written as (A) For 1.Month Ended July 31, 20-- (B) )uly 31, 20-- (C) 2G--, Iuly 31 (D) none of the above.(p.176)2. Infomation needed to prepare an income statement's revenue section is obtained from a 2.work sheet's Account Title €olurnn and (A) Income Statement Debit column (B) IncomeStatement Credii colurnn (C) Balance Sheet Debit column (D) Balance Sheet Creditcolumrl. (p. 1743. Information needed to prepare an income statement's expense section is obtained frcm a 3.work sheet's Account Title column and (A) Income Statement Debit column (B) IncomeStatement Credit column (C) Balance Sheet Debit column (D) Balance Sheet Creditcolumn. (p. 1744. The amount of net income calculated on an income statement is corect if (A) it is the 4.same as net income shown on the work sheet (B) debits equal credits (C) it is the sameas the balance sheet (D) none of the above. (p. U7)5. The formula for calculatinS the net income component percentage is (A) net income 5,divided by total sales equals net income component percentage (B) total sales divided bytotal expenses equals net income component percentage (C) total sales minus totalexpenses divided by net income equals total net ncome percentage (D) none of theabove. (p. 178)AnswersCopyRrcHT @ SoUrH-WESTERN EDUCAToNAT PUBLTSH|NGChopter 8 . 3l

<strong>Part</strong> <strong>One</strong>-Iilentifuing <strong>Accounting</strong> Tennsldentiting <strong>Accounting</strong> TehrAnolyzing Accounrs Aff€cied by Adiustins ond Closins EniriesAnolyzing Accounl, After Closing Entries Are PostedAnolyzing Adiuting oid Closing Enlrie3loiolDirections: Select the one term in Column I that best fits each definition in Columnll. Print the letter identifying your choice in the Answers column.45 Pts.Colvmn IA. accollnting cycleB. adjusiing entries2.C. closinS entricsD. pcrmanent accounts 4.E. post-closing trial balance 5.F. temporary accountsColumn IIJournal entries recorded to update general l€dger accountsat the end of a fiscal period. (p. 192)Accounts uscd to accumulaie information from one fiscalperiod to the next. (p. 198)Accounts used to accumulate information until it istransferred to the owner's capital ac€ount. (p. 197)lournal entries used to prepare temporary accounts for an€w fiscal period. (p. 197)A trial balance prepared after the closjng entries are postedQ.20nThe series of accounling a€tivities included in recordingfinancial information for a fiscai period. (p. 208)Answers1.2.3.4.5.6,CoPYRTGHT O SoUTH-WESTERN EDUcaroNAt PUBUsHiNG Chopbr 9 . 33

<strong>Part</strong> Tzto-Analyzing Accounts Alfected byAtljusting anil Closiig EntiesDirectione: Use the parhal chart of accounts given below. For each adjustingor closing entry descriM, decide which accounts are debited and €redited.Write the account rmbers identifying your choice in the proper Answerscolumn,Account fitlcAcct,IVo.Supplies 150Prepaid Insurance 1@Barbara Trevino, Capital 310Bafuara Trevino, Drawing 320lncomesummary 330Sales 410Adverdsing Expense 510Insuranae Expens€ 520Supplies Expense 5501-2. Adjusting entry fror Supplies. (p. 194)Aaaoun]t Io BeDebtt€d Creditqd7. 2.3-4. Adjustiry entry for Prepaid Insurance. (p. 195)3. 4-tr. Closing entry for Sales. (p. 199)5. 6.7-8. Closing entry for all expense accounts. (p. 200)7. A.F10, Closing entry fo! Income Summary with a net income. (p. 201)9. 10.11-12. Closing entry for lncome Summary with a net loss. (p. 201)11. 12-1H4. Closing entry lor owner's drawint account. (p. 202)13. 14-34 . Study Guide CENTURY 2I AccoUNnNc, ZTH EDmoN

Ncmc<strong>Part</strong> Three-Anahlzing Accounts Afier ClosingEntries Are PostuA @,207)Directions: For each account listed below, decide whether the account willnormally appear on a post-closing trial balance, Place a check mark in theproper Answers coluinn to show your answer.1. Accounts Receivable-J. lfidAppcart oa o Pot -Closing friol Bolancc1.YatNoZ Supplies Expens€2-3. Sales3.4, Miscellaneous Expense4.5- Prepaid Insurance5.5. Petty Cash6,7. Accounts Payable-AA Supplies7,8. Rent Expense8.9. Susan Ruft Drawing9.10. Supplies10,11. Cash11.12. Advertisint Expense12.13. Insurance Expense13.14. Susan Ruft Capital7L15. Inaoine Summary15.16. Utilities Expense16,CopyRrGHT @ SounrWEsrERN EDUcaroNAl PuBusHrNG Chopter 9 . 35

<strong>Part</strong> Four-Analyzing Adjusting and Closilg EntiesDirections: For each of the following items, select the choice that bestcompletes the statement. Print the l€tier ideniilying your choice in the1. Which accounting concept applies when a work sheet is prepared at the end of each 1.fiscal cycle to summarize the general ledger information needed to prepare financialstatements? (A) Business Entity (B) <strong>Accounting</strong> Period Cycle (C) Adequate Disclosure(D) Consistent Reporting. (p. 192)2. Which accounling concept applies when expenses are reported in the same fiscal period 2.that they are used to produce revenue? (A) Business Entity (B) Coing Concem(C) Matching Expenses with Revenue (D) Adequate Disclosure. (p. 194)3. Information needed for journalizing the adjusting enhies is obtarned from the 3.(A) gencral ledter account Balance columns (B) income statement (C) work sheet'sAdjustments columns (D) balance sheet. (p. 194)4. After adjusting entries are posted, lhe supplies account balance will be equal to (A) the 4.value of supplies used during the fiscal period (B) tbe value of the supplies on hand atthe end of the fiscal period (C) zero (D) none of these. (p. 194)5. When revenue is treaterthan total expenses, resulting in a net income, the income 5.summary account has a (A) debit balance (B) credit balance (C) normal debit balance(D) normal credit balance. (p. 198)6. Information needed for recordinS the closing entries is obtained ftom the (A) general 6.ledger accounts' Debit Balance columns (B) work sheet's Income Statement and BalanceSheet columns (C) balance she€t (D) income statement. (p. 198)7. lncome summary is (A) ar asset account (B) a liability account (C) a temporary account 7-(D) a permanent account. (p. 199)L After the closing entries are posted, the owner's capital account balance should be the 8.same as (A) shown on the balance sheet for the fiscal period (B) shown in the worksheet's Balance Sheet Debit colurnn (C) shown in the work sheet's Balance Sheet Creditcolumn (D) shown in the work sheet's Income Statement Debit column. (p. 202)9. The accounts listed on a post-closint trial balance are (A) thos€ that have balances after 9.the closing entries are posted (B) all general ledger accounts (C) those that have nobalan(es after adjusting and closing entries (D) those that appear in the work she€t'sTrial Balance columns. (p. 204Answets36 . Srudy Guido CENTURY 2l AccouNnNG, 7TH EDmoN

Ncrneldentiting Accounri.s <strong>Terms</strong>Anolyzinq PwchoserAnolyzins Tronsoctions R*orded in Speciol JournolsAnolyzing Accounring Conceprsl6 Pls.8 Pts30 Pk3 Pts.57 PtsP art <strong>One</strong>-lilentifu ing Acc ounthtg TennsDirections: Select the one term in Column I that best fits each definition in Columnll. Print the letter identifying your choice in the Answers column.Column Icash payments journal1.Column llA business in which two or more persons combinetheir assets and skills. (p. 220)Answers1.B.cosi of merchandiseEach member of a partnership. (p. 220)2.c.general amount column3,A business that purchases and sells goods. (p. 222)3,D.E.F.G.H.l.t.K.L.M.N.o.P.markupmerchandisemerchandising businesspartnerpartnershippurchase invoicepurhascs journalretail m€rchandising business 11.special amount columnspecial journaiterms of salewholesale merchandisingbusiness4.5.5-7.8.9.12.10-13-14-15.15.A merchandisint business that sells to those who useor consume the toods. (p. 222)Goods that a merchandising business purchases to sell.(p.222)A business that buys and resells merchandise to retailmerchandisint businesses. (p. 222)A journal used to record only one kind of transaction.@.223)The price a business pays for goods it p rchases toscll. (p. 223)The amount added to the cost of merchandise toestablish ihe selling price. (p. 223)A business from r,r'hich mcrchandise is purchased orsupplies or other assets are bought. (p. 223)A spe€ial journal used to reco.d only purchases ofmerchandise on account. (p. 224)A Journal amount column headed with an accounttitle. (p. 224)An invoice used as a source documcnt for recording apurchase on account transaction. (p. 225)An agreement between a buyer and a seller aboutpayment for merchandise. (p.225)A special joumal used to record only cash paymenttransactions. (p. 229)A journal amount column that is not headed with anaccount title. (p. 229)4.5.6.7.8.9.10.11.12.13.74.15.16.CoPYRTGHT @ SoUIH-WESTERN EDUcaToNAT PLJBtLsHTNG Chopi€r l0 . 37

Patt Tw o-Analy zing PurchasesDir€ctions: Place a I for True or an I for False in the Answers column toshow whether each of the following statements is true or false.2.3.The selling price of merchandise must be greater than the cost of merchandise for abusiness to make a profit. (p. 223)The cost account Purchases is used only to record the value of merchandise purchased.$.22atThe purchases joumal js used to record all on account transactions. (p. 224)Answqrs1.3.4.A purchas€ invoice usually lists only the total co6t of the merchandis€. (p. 225)4.5.A purchase on account transaction incrcases the balance of the purchases account andincreases the balance of the accounts payable account. (p. 226)A cash purchase transaction decreases the balance of the cash account. (p. 230)5.6,7.8.A cash payment on account hansaction increases the accounts payable account balanceand decreases the cash account balance. (p, 231)A partner miSht take merchandise out of the business for peEonal us€. (p. 242)7.8.38 r $udy Guide CENTURY 2l AccouNrNG, 7TH EDmoN

<strong>Part</strong> Three-Analtl zing Transactions Recorded inSpecial lournnls - -Directions: In Anrwers Column l, prinl lhe abbreviation for the journal inwhich each transaction is to be recorded. In Answer Columns 2 and 3, prinlthe letters identifying the account titles to be debited and credited for;achtransaction.P Purchases Joumal; c General Joumal; Cp Cash payments JoumalAccoun fttlesfrqnsscrionsA. Accounts 1-2-3. Purchased merchandise on account. (p. 226)Payable7tournql2IrebitCrcdiiB. Advertising 4-5-6. Purchased merchandise for cash. (p. 230)ExpenseC. Booker]ackory 7+-9. Paid cash for office supplies. (p. 230)DrawingD. Cash 10-11-12. Paid cash on account. (p. 231)E. Miscellaneous 13-14-15. Paid cash for advertising. (p. 232)ExpenseF. Petty Cash 15-17-18, Paid cash for telephone. (p. 232)G. Purchases 19-20-21. Paid cash to rcplenish the petty cash fundr officesupplies; store supplies, adverrisin& and miscelaneous. (p. 234)H. Supplies- 22-23-24. Wlk,l.a lackson, partner, withdrew cash forOfficeSupplies-Storepersonal use. (p. 235)25-26-27. Boutht store supplies on account. (p. 241)J.K.UtilitiesExpensewilmaJackon,Drawint28-29-30. Booker Jackson, partner, withdrew merchandisefor personal use. (p. 242)CopyRrcHr @ SoUTH-WESTERN EDUCATIoNAT puBllsH/NG Chopter l0 . 39

Pafi F our-Anahl zing AccountirlS CoflceqtsDirections: For each of the following items, select the choice that best€ompletes th€ statement. Print the letter identifying your choice in theAnswers column.1. Keepint the reports and financial records of a business seParate from the Personal 1'recordJof the partners is an aPPlication of the accountint concept (A) Going Concern(B) Business Entity (C) Historical Cost (D) Objective Evidence. (p 220)2. A business expectint to make money and continue in business indelinitely i5 aPPlyint 2'the accountint concePt (A) Business Entity (B) Going Concem (C) Objective Evidence(D) Historical Cost. (P 222)3. Recording the actual amount paid for merchandise or other items bought is anapplicati;n of the accounting concePt (A) Business Entity (B) Objective Evidence (C)Historicat Cost (D) Going Concern. (P. 224)Answers40 . Study Guide CENTURY 2l AccouNnNG. 7TH EDrIloN

lden tins Accounrins TemsAnoJyzing Soles ond Cosh R4eipt,Usins Column5 in o Soles lor:rnql ond o Cosh R€ceipt, JournolTorqll0 Pts.18 Ph34 Pl3P art <strong>One</strong>-<strong>Iilentifying</strong> <strong>Accounting</strong> <strong>Terms</strong>Directions: Select the term in Coiumn I that best fits each definition in Column II.Print the ietter identifying your choice in the Answers column.B.Column Icash receipts journal 1.cash sale 2.Column llAntwertA person or business io whom merchandise or seFices are sold, 1.(p.2521A tax on sale of merchandise or services. (p. 252)C.D.credit card sale 3.customer 4.A special journal used to record only sales of merchandise onaccount transactions. (p. 255)A sale in which cash is received for ihe total amouni of the saleat the time of the transaction. (p. 259)3.4.sales journal 5.A sale in which a credit card is used for the total amount of thesale at the time of the transaction. (p. 259)5.F.sales tax 6.A special Journal used to record only cash receipt tmnsactions.(P.259)6.CoPYR|GHT O souTH-wEsrERN EDUcATtoNAi PuBtsHtNG Chopter 11 . 4r

<strong>Part</strong> Tzt:o-Analqzing Sales anil Cash ReceiptsDir€ctions: Place a T for Tiue or an F for False in the Answers column toshow whether each of the following statements is true or falseAnswert1. Sales tax rates are usually stated as a Percentate of sales (P. 252)L.2. Different accounting procedures are used for different sales tax rates (P. 252)3.The amount of sales tax collected is a liabitity (P 252)3.4.A sale of merchandise increases the revenue of a business. (p. 254)4,5,6.Recordint revenue at the time of the sale is an apPlication of the accounting 'onceptObjective Evidence. (P. 254)A sale on account is also known as a charge sale. (p. 254)5.6.7-A sales invoice is also known as a sales sliP. (p. 255)7.8.The rcvenue account Sales has a debit balance. (P.256)8.Accounts Receivable is an asset account with a normal credit balance (P 255)9.10.The account Sales Tax Payable is increased by a credit. (p 256)'10.42 . study Guide CENTURY 2l AccouNTrNG, 7rH EDlTloN

P^art Three-Using Columns in a Sales lournal and aCash Receipts loirnalDirections: The colurnns of the sales jourMl and the cash receipts joumalbelow are identified wirh capital tefters. For each item below;de;ide inwhich column each of the following items should be recorded_ pdnt theletter identifying your choice in the Answers column.SALES JOURNALA B c D le l'lCASH RECEIPTS ]OURNATI IJ, l" ll^ ( l'1 lalTransaction: Sold merchandise on accouni. (p. 256)1. Date2. Customer name3. Sales invoice number4. Debit amount5. Credit amount6. Credit amountTransaction: Recorded cash and cr€dit card sales. (p. 260)7. Date8. Check mark (to show that no account title needs to be written)9. Cash register tape number10. Check mark (to show that no individual amounts on this line need to be post€d)11, Debit amouni12. Credit amount13. Credit amounrTransaciion: Received cash on ac€ount. (p. 261)14. Date15. Customer name16. Receipt number17. Debit amount18. Credit amountCopyRtGHT O SoUTH,WESTERN EDUcaTtoNAL PususHtNGAnswers1.2.4.5,6.7.8.9.10.11.12,13.'14.15.15.77.18.Chopler ll r 43

ldenlifying Accounling TermtAnolyzins o Jou.nol ond L€dqertAnolyzing Posling ond Subsidiory ledoersTotol15 Pk10 Ph3l Ph.<strong>Part</strong> <strong>One</strong>-Identifying <strong>Accounting</strong> <strong>Terms</strong>Directions: Select the term in Column I that best fits each definition inColumn IL Print the letter identifying your choice in the Anslvers column.Colvmn IA. accounts payable ledger 1.B.c.D.E.accounts rcceivableledgercontrollint accountschedule of accountspayableschedule o( accountsreceivableF. subsidiary ledter 5-Colvmn llA ledger that is summarized in a sintle genenl ledgeraccount. (p. 272)A subsidiary ledger containint only accounts for vendors frcmwhom items are purchased or boutht on account. (p. 272)A subsidiary ledger containing only accounts for chargecustomers. (p. 272)An account in a teneral lcdger that summarizes allaccounts in a subsidiary led.Ber. (p.272)A listing of vendor accounts, account balances, andtotal amounts due all vendors. (p. 281)A listing of customer accounts, account balances, and totalamount due from all customers. (p. 289)Answers7.2-3.4-CoPYRTGHT @ SoUTH-WESTERN EDUcATIoNAt Pus!sHrNG Chopier l2 . 45

<strong>Part</strong> Two-Analyzirg a f ournal anil LedgersDir€ctions: Place a T for True or an F for False in the Answers column toshow whether each of the following statements is true or false1. When usint an accounts receivable ledter, the total amount due from all customcrs is 1.summarized in a single general ledger account. (p. 272)2. A change in the balance of a vendor account also changes the balance of the controllinS 2.account Accounts Payable. (p.274)3. The account form for a vendot has a Credit Balance column because accounls payable 3.are liabilities and liabilities have normal credit balances. (p. 275)4. Each transaction in a purchases journal i5 posted individually to a vendor account in the 4-accounts payable ledger. (p. 276)5. A schedule of accounts payable is prepared before all entries m a joumal are posted. 5.(P 281)6. Each cash receipt on account from a customer is posted as a crcdit to an account in the 6.accounts receivable led*t. (p.28n7, The accounts receivable ledger is proved by completing a trial balance. (p. 289) 7-8. Amounts recorded in teneral amount columns are posted individually to the general 8.ledger account named in the Account Title column. (p. 292)9. <strong>One</strong> of the monthly totals of a sales joumal is posted as a credit to Accounts Receivable. 9.(p.296)10. The total amount of the purchases joumal is posted in two general lcdter accounts- 10.Purchases and Accounts Payable. (p. 297)11. The totals of the General columns of a cash receipts journal are usually posted only at 11.the end of a month. (p. 299)12, The best order to post special ioumalsreceipts, and (5) cash payments. (p. 301)is (l) sales, (2) purchases, (3) general, (4) cash 12.13. Frequency of posting to the general ledger is determined by how many accounts are in 13.the chart of accounts. (p. 301)14. It is usually necessary to have up-to-date balances in the general ledger at all times. 1.4,(p- 301)15. Posting does not have to be done at the end of the month. (p. 301) 15.46 . Srudy Guide CENTURY 2l AccouNrNG, ZrH EDrTroN

<strong>Part</strong> Three-Analqzing Posting anil SubsidiaryLed.gersDirections: For each item below, select the choice that best completes thestatement. Print the leiter identifying your choice in the Answers column.1. When opening a new pate in an accounts payable ledter, (A) Bdance is written in the Item 1.column (B) the ltem column is left blank (C) a number is wrirren in the post. Ref. column(D) none of these. (p. 275)2. Each entry in the purchases journal is an amount that (A) is to be paid to a vendor (B) hasbeen paid to a vendor (C) is io be collected from a cusromer (D) none of these. (p. 276)3. The accounts receivable ledger contains an account for (A) each vendor (B) each customerwho will pay later (C) each cash cusromer (D) none of rhese. (p. 283)Answers4. The total of al1 cusiomer account balances in the accounts r€€eivable ledger equats (A) thebalanc€ in the accounts receivable controlling accouni (B) the balance in the aicot ntspayable controlling account (C) the cash account (D) none of th€se. (p. 2s3)s. Completion of posiing an individual amount from rhe sales journal is indicated by(A) writing the subsidiary ledger account number in ihe post. Ref. column (B) writing rheSeneral ledter account number in the Post. Ref. colunn (C) wdtint the general ledgeiaccount number under the colurnn roial (D) none of rhese. (p.285)6. The separate amounts in the Accounts Receivabie Credit column of a cash receipts journalare (A) not posted (B) posted individually (C) posted only as par of the colu ul total(D) none of these. (p. 287)7. Each account in a general ledger has (A) two amount columns (B) three amount colurrns(C) four amount columns (D) none of these. (p. 291)4.5-6.7-8. Th€ separate amounis in thc General Debit column of a cash pa)'rnents joumal are(A) posted individually (B) posied only as part of the column total (C) not posr€d (D) noneof ihese. (p. 292)9. The special amount coiumn totals of ihe sales journal are posted (A) daily (B) weekly(C) monthly (D) none of these. (p. 296)10. The Accounts Payable Debit €olumn of a cash payments joumat is totaied and (A) postedoften (B) posied at ihe end of a month (C) nor posted (D) none of these. (p. 301)9.10.CoPyc o{ O SoJTF.WE )tLRN FDLC A-toNAr PuBUsHtNo CF,opter 12 . 47

Nqmedsi,t,ns ic;;;Gs TemAnolyzing Poyroll Proceduresdentib/lng Accounilis Prociicestoroll2 Prs.5 Pts.20 Pk37 tusP art <strong>One</strong>-<strong>Iilentifying</strong> <strong>Accounting</strong> <strong>Terms</strong>Dir€ctions: Select the one term in Column I that best fits each definition inColumn II. Ptint the letter identifying your choice in the Answerc column.Column IA. employee earnints recordColumn ll1. The money paid for employee services. (p. 310)Answers1.B. Medicare taxThe period covered by a salary payment. (p. 310)2,C. nei payD. pay periodE. payroll3.4.5.The total amount eamed by all employees Ior a payperiod. (p.310)The total pay due for a pay period before deductions.(p.31a)Taxes based on the paymll of a business. (p. 316)3.4.5.F. payroll re8isterc. payroll taxesH. salary6.7.8.A deduction from total eamings for each person legallysupported by a taxpayer, including the employee. (p. 317)A federal tax paid lor old-age, survivors, .rnd .tisabilityinsurance. (p. 320)A federal tax paid for hospital insurance. (p. 320)6-7.8.I. social security taxJ. tax baseK, total eamingsL. withholdintaltowance9.10,11.72,The maximum amount of earnings on lvhjch a lax jscalculated. (p. 320)A business form used to recotd payroll information.Q.322)The total earnings paid to an employee nltcr payroll taxesand other deductions. (p. 323)A business form used to record deiails aflecLing paymentsmade to an employee. (p. 324)9-10.11.12.CoPYRTGHT O SoUrH-WESTERN EDUcaloNAt PuBUsHtNG Choprer 13 . 49

P art Two-Analyzing P ayroll Pto ceduresDir€ctions: For each of the following items, select the choice that bestcompletes the statement. P nt the letter of your choice in the Answers1. How many hours were worked by an emPloyee who arrived at 8110 a.m and de<strong>Part</strong>edat 12:10 p.m.? (A) 4 hours (B) 5 hours (C) 4 hours and ten minutes (D) none of these'(p. 313)4-How many houls were worked by an emPloyee who arrived at 7:05 a m. and de?artedai 6:05 p.m. with one hour off for lunch? (A) 11 houls (B) 10 hours (C) 12 hours (D) noneof these. (p. 313)Employee retular eamings are calculated as (A) regular hours times rcgular rate(B) lot;l houis divided by regular mte (C) total hours Plus ove ime Iate (D) overtimehouls minus overtime rate. (P. 314)Infomation needed to detemine the employee social secu ty tax withholding for a Payperiod includes (A) total eamints and social secudty tax late (B) total eamings andiccumulated earnings (C) total earnings, number of withholding allowances, and socialsecurity tax rate (D) total eanings, accumulated earnints, and social security tax rateand tax base. (p. 320)A separate payroll checking account is used primarily to (A) simplify the Payrollaccounting system (B) help reduce the cost of PreParint a Payroll (C) eliminateemployeriamings records (D) provide additional protection and control of individualpayroll check. (p. 327)AnEwert7.3.4.5.50 . Sludy Guide CENTURY 2l AccouNTrNG, hH ED[loN

<strong>Part</strong> Three-Iilentifuing <strong>Accounting</strong> placticesDir€ctioN: Place a T for True or an F for False in the Answeis colunn toshow whethei each of the lollowint statements is true or false.1. A business may decide to pay employee salaries every weeL every two weeks, twice amonth, or once a month. (p. 310)2. Businesses use payroll records to inform employees of iheir annual eamints and toprepare payroll repots for the government. (p. 310)3. Payroll time cards can be used as the basic source of information to prepare a payroll.(P 312)4. The Iirst task in preparing a payroll is ro determjne the number of days worked by eachemployee. (p. 313)5. Total eanings are sometimes referred to as net pay or nei eamings. (p. 314)6.7.8.9.Employ€e total eamings are cal€ulated as retular hours x regular rate, plus overtimehours x overtime rate (p. 314)Payroll taxes are based on employee total earnings. (p. 316)A business is required by law to withhold certain payroll taxes from employee salaiies.(p.316)Employers in many staies are required to withhold state, city, or county income tax fromemployee earnings. (p. 316)Answers1.2.3.4-5.6.7._8.9.10.Payroll taxes withleld represent a liability for an employer uniit payment is made_ (p. 315)10.11.12,13,Federal law requires that each employer have on file a properly completed Form W-2,Employee's Withholding Allowance Cerrificate foi each employee. (p. 317)The amount of income tax withleld from each employee,s total earnings is determinedfrom the number of withholding allowances and by the emptoyee,s marital stat.r". 1p. :rZ;A single person will have less income tax withheld rhan a marded employ€€. (p. 317)1,1.13.14.An employee can be exempt from having federal income tax withheld under certainconditions. (p. 317)14.15.Social security tax is paid by the employer only. (p. 320)15.16. Aj1 act of Congress can €hange the social security iax base and tax rate at any time. (p. 320)17. When an employee's eamings exceed the iax base, no more social security tax is deducted.(p. 320)18. All deductions from employee waSes are recorded in a payroit retister. (p. 323)19. The columns of the employee eamings record consist of the amount columns in a payrollregister and an accumulated earnings column. (p. 32S)20. The information used to prepare payroll checks js taken from a payrolt register. (p. 328)16.17.18.19.20.CopyRrGHT @ SourH-WEsTERN EDUCAT|oNAL puBUsHtNGChoprer 13 . 5l

Anolyzins Poyroll RecordsAnolyzins Tronsoctions Affecling Poy.ollAnolyzing Fom w.2lotqll5 Ph.5 Pts.l0 Pls.30 PkP art <strong>One</strong>-Analyzing Payroll RecorilsDirections: For each of the following items, select the choice that best completesthe statement. Print the letter identifying your choice in the Answers column-1,3.4.5.6.7.9.10.11.'14-12-13.74.All the payroll information needed to prepare a payroll and tax reports is found on (A)Form W-4 and th€ employee earnings record (B) FoIm W-4 and the payroll register (C) thepayroll register and the employee eamings record (D) Form W-4. (p. 338)The payroll journal entry is based on the totals of (A) Earnings Total column, eachdeduction column, and Net Pay column (B) Eamings Total, Eamings Regular, EarningsOv€rtime, and Deductions Total columns (C) Eamings Re$lar Eamings Ov€rtimc, mdDeductions Total columns (D) Eamings Total, Eamings Regular, and Eamings OvertimeTotal columns. (p. 340)The total of the Net Pay column of the payroll register is credited to (A) a revenue account(B) an expense account (C) an asset account (D) a liability account. (p. 341)\,Vhen a semimonthly payroll is paid, the credit to Cash is equal to the (A) total eamings ofall employees (B) total deductions for incom€ tax and social security tax (C) tot.ldeductions (D) net pay of all employees. (p. 341)The Total Eamings column total is joumalized as a debit to (A) Cash (ts) Salary Expense(C) Employ€e lncome Tax Payable (D) Social Security Tax Payable. (p. 3a1)The total of the Federal rncome Tax column of a payroll register is credited io (.4) a revenucaccount (B) an expcnse account (C) a liability account (D) an assei account. (p. 341)A business's payroll taxes for a pay period are debited to (A) an asset account (B) aliability account (c) a revenue account (D) an €xpense account. (p. 344)Payroll taxes that are paid by both the employ€r and the employee arc (A) {ederalunemployment tax and social secu.ity tax (B) federal unemployment tax and Medicare tax(C) social security tax and Medicare tax (D) Iederal income tax, so€ial security t,rx, andMedicare tax. (p. 344)A federal tax uscd for state and federal administrative expenses of the unemploymeniprogram is (A) social security tax (B) Medicare tax (C) federal unemployment tax (D) si.rtcun€mployment tax. (p. 3'16)A statc tax used to pay ben€fits to un€mployed worke$ is (A) social security tax (B)Medicare tax (C) unemployment tax (D) state uncmployment tax. (p. 346)To record the €mployer payroll taxes expense, the followjng accounts are ciedited: (A)Payroll Taxes Expense and Employee Income Tax I'ayable (B) Employee Income TaxPayablc, Social Security Tax Payable, Medi€are Tax Payablc, Un€mployment Tax Payable-Federal, and Unemploym€nt Tax Payable-State (C) Social Sccurity Tax Payablc, MedicdreTax Payable, Unemployment Tax Payable-Federal, a]rd Unemployment Tax PayableState (D) none of these. (p. 347)Each cmployer who withholds income tax, social secu ty tax, and Mcdicare iax fromemployee eamings must furnish each employee an (A) IRS Form W-4 (B) IRS lorm W-2(C) IRS Form w-3 (D) IRS Form 941. (p. 349)Each employer is requiied by larv to repot payroll taxes on an (A) IRS Form w-4 (B) IRSForm 941 (C) IRS Form W-2 (D) IRS Form W-3. (p. 351)To record the total federal tax payment for employee income iax, social security tax, andMedicare tax, the account credited is (A) Cash (B) Employee Income Tax Payable (C) SochlSecurity Tax Payable (D) Medicare Tax Payable. (p. 356)15. Io record the payment of federal unemployment tax, the account d€bitcd is (A) a revenue 15.account (B) an expense account (C) a liability account (D) an asset account. (p. 358)AnswerscopyRLGHr O SouTH-wEsTERN EoucalroNAl PLJBTLSHTNG Chopler 14 o 531.7.

P art Tzo o-Analy zing Ttansactions Affecting P ayr o lIDir€ctions: Analyze each of the following transactions into debit and creditparts. Print the letters identifying your choices in the proper Answerscolurur-A. CashAc.ovnt firtfrcnsocrion1. Paid cash for semimontl y payroll. (p. 342)Dc6ir CrediiB. Employee Income Tax 2. R€corded employer payroll taxes expens€.Payable(p.347)C. Medicare Tax Payable 3- Paid cash fo! liability for employee income ta&social seority tax, and Medicare tax. (p. 356)D. Pa)EolI Taxes Expense 4. Paid cash for federal unemployment taxliability. (p. 3s8)E. Salary Expense 5. Paid cash for state unemployment tax liability.o. 3s8)F. Social Security TaxPayableG. Unemployment TaxPayable-FederalH, Unemployment TaxPayable-State54 . Study Guide CENTURY 2I AccouNrNG, 7TH EDmoN

Pafi Three-Analy zing Fotm W-2Directions: Analyze the Iolloy/ing statements about a Form W-2, Wage andTax Statement. Use the Form W-2 below to answer the specific questionsabout Rick Selby. Place a ? for True or an F for False in the Answeri columnto show wheth€r each of the Iollowing statements is true or Ialse. (p. 349).---- /YEtkelhlb>Ecc

Anolyzins edlusrmenrs on o W;rk-hJ 10 PlsAnolyzins Work Sheet Extenrions34 Pt!.Torql 14 P|s.<strong>Part</strong> <strong>One</strong>-Analyziflg Adjustments on a Work SheetDirections: For each of the Iollowing items, sel€ct the choice that bestcompletes the statem€nt. Print the letter identifying your choice in rhe1. The Merchandise tnventory amount in a work sheet,s Trial Balance Debit columnrcpresents the merchandise inventory (A) ar the end of a fiscat pe od (B) at thebeginning oJ a fiscal period (C) purchased dudng a 6scal peliod (D) available dudnt afiscal period. (p. 376)2. The amount of goods on hand is call€d (A) purchases (B) sates (C) inventory (D)merchandise inventory. (p. 376)3. The amount of goods on hand for sale to customers is called (A) inventory (B) purchases(c) sales (D) merchandise inventory. (p. 376)4. The Income Summary amount in a work sheet,s Adjustments Debit column reptes€ntsthe (A) decrease in Merchandise Invenrory (B) increase in Merchandis€ hvent;ry(C) beginning Merchandise Inventory (D) endinS Merchandir tnventory. (p. j7n5. The two accounts used to adjust the Merchandise Inventory accotrnt are (A) MerchandiseInventory and Suppli€s (B) Merchandise Inventory and purchases (C) Merchandiselnventory ard Incom€ Summary (D) Merchandise Inventory and Sales. (p. 32)6. The Supplies--Office amount in a work sheet,s Trial Balance Debit colunn rcpresmtsthe value of suppiies (A) ai the begirudng of a fiscal period (B) used durins aliscalperiod (C) at the beginninS of a fiscal period plus office supplies bought during thefiscai period (D) bought dudnt a fiscal period. (p. 381)7. Recording expenses in the accouitting period in which the expenses contdbute toeaming revenue is an application of the accomting concept (A) Matchint Expenses withRev€nue (B) Consistent Reporting (C) Hisrodcat Cost (D) Adequate Disclosuie. (p. 3S1)8. The two accounts used to adjust the Office Supplies account are (A) Supplies andPurchases (B) Supplies-OfIice and Income Summary (C) Supplies-Office and SuppliesExpense-Oifice (D) Supplies Exp€nse--{ffice and Income Summary. (p. 381)9. The portion of ihe insurance premiums thar has expired dudng a fiscal period isclassified as (A) a liability (B) an asset (c) an exp€ns€ (D) capital. (p. jsj)10. The two accounts used to adjust the Prcpaid Insurance account aie (A) InsuranceExpense arld lncome Summaty (B) Prepaid Insurance and hrsurance Expense(C) Prepaid Insurance arld Income Summary (D) prepaid Insurance Expense and lncomeSummary. (p. 383)Angtyers1.2-3.4-5.6.7,8.9.10.CopyRGHT O SourH-WEsTERN EDUCAToNAL PuBUsF NG Chopler 15 . 57

Pafi Tzuo-Analyzing Wotk Sheet Extensions(p.386)Directions: Foi €ach accoLrnt listed below, place a check mark in the columnto which amounts are extend€d on a work sheet.Account lilletncome SralcmentDebi, crcditBq,lsnce SheetDehir Crcdit1.2.Accounts PayableAccounts Receivable4,5.6.7,8.9,10.11.Advertising Exp€ns€CashCredit Card Fee ExpenseEmployee lncome Tax PayableHealth Insurance Premiums Payablelncome Summary (ending inventory smauei thanbeginning inv€ntory)lnsurance ExpenseKarl Koehn, CapitalKarI Ko€hn, Drawing72. Medicare Tax Payable13.t4.15.Merchandise InventoryMich€lle Wu, CapitalMichelle Wu, DrawingL6. Miscellaneous Expense17. Payroll Taxes Expense18.t9.Petty CashPrepaid Insurance20. Purchases21. R€nt Expense22. Salary Expens€23. Sales24.Sales Tax Payable25. Social Security Tax Payable25.27.Supplies Expense-OfficeSupplies Exp€nse-Store28. Supplies-OIfice30,31.32.34.Supplies-StoreUnemployment Tax Payable-FederalUnemployment Tax Payable-StateUnited Way Donations PayableU.S. Savings Bonds PayableUt ities Expense58 . Sludy Guide CENTURY 2l AccouNrNG, 7TH EDrTroN

ldenllting <strong>Accounting</strong> Telm5Anolyzrng Accepioble Comporent PercentogesAnolyzins Finonciol Stot"';rnaf"i; 1,4€rchond j'insrBusine$5 Pts8Ph20 PB.Etol 33 PtsP art <strong>One</strong>-Identifu ing <strong>Accounting</strong> <strong>Terms</strong>Directions: S€lect th€ one term in Column I rhat bes! firs each definition inColumn II. Print the letter identifying your choice in the Answers columf[c.Colvmn Icost of merchandisesolddistribution of neigross profit on salesColumn ll1. The total original price of all merchandise sold during a fiscalperiod. (p. 400)2. The revenue remaining after cost of merchandise sold has been 2,deducted. (p. 402)3. A pa*nership finarcial statemenr showing ner income or lossdistribution to partners. (p. 410)Answers1.D. 4. A financial statement that summariz€s the changes in owners, 4.€quity during a Iiscal period. (p. 412)E.suppoiting schedule5. A report preparcd to Sive details aboui an item on a principalfinancial statement. (p. 419)5.CopyRrGHr O SoUTH-WESTERN EDUcATtoNAt puBLsH NG Chopter 16 . 59

<strong>Part</strong> Tza o-Analy zing Acceptable ComponentPercentagesDirections: For each of the income statement comPonent Percentages given,wdte a t1 in th€ Answers .olunn if it is Unacceptable and wdte an /4 in theAnswers column if it is Acceptable. (Pp 40H06)Acceplable Compo4ent PcrccnlqgesSales 100%Cost of merchandise sold Not more than 48.6%Gross profit on sales Not less than 51.4%Total expenses Not morc than 34.9%Net income Not less than 16.5%Answers1. The component percentage for total exPenses is 42.8% thjs yea.r.1.2. The component percentage for cost of merchandise sold is 51.0% this year.2.3. The component percentaSe lor gross Profiton sales is 52.8% thjs year.3.4. The.omponent percentage {or total exPenses is 34.3% this year.4.5. The component percentage for Sross Profit on sales is 51.4% this year.5,6. The component percentage for net income is 120'lo this year.6.7. The component percentage for cost of merchandir sold is 48.ryo this year.7-8. The €omponent percentaS€ for n€t income is 10.4% this year.8.60 . Study Guide CENTURY 2l AccouNnNG, 7TH EDmoN