Part One-Iilentifying Accounting Terms

Part One-Iilentifying Accounting Terms

Part One-Iilentifying Accounting Terms

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

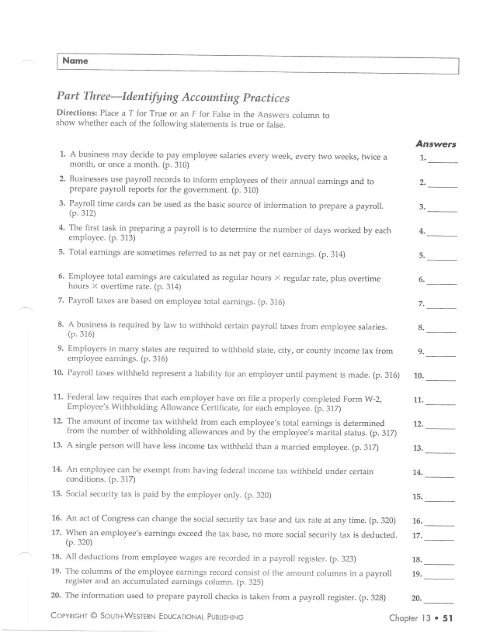

<strong>Part</strong> Three-Iilentifuing <strong>Accounting</strong> placticesDir€ctioN: Place a T for True or an F for False in the Answeis colunn toshow whethei each of the lollowint statements is true or false.1. A business may decide to pay employee salaries every weeL every two weeks, twice amonth, or once a month. (p. 310)2. Businesses use payroll records to inform employees of iheir annual eamints and toprepare payroll repots for the government. (p. 310)3. Payroll time cards can be used as the basic source of information to prepare a payroll.(P 312)4. The Iirst task in preparing a payroll is ro determjne the number of days worked by eachemployee. (p. 313)5. Total eanings are sometimes referred to as net pay or nei eamings. (p. 314)6.7.8.9.Employ€e total eamings are cal€ulated as retular hours x regular rate, plus overtimehours x overtime rate (p. 314)Payroll taxes are based on employee total earnings. (p. 316)A business is required by law to withhold certain payroll taxes from employee salaiies.(p.316)Employers in many staies are required to withhold state, city, or county income tax fromemployee earnings. (p. 316)Answers1.2.3.4-5.6.7._8.9.10.Payroll taxes withleld represent a liability for an employer uniit payment is made_ (p. 315)10.11.12,13,Federal law requires that each employer have on file a properly completed Form W-2,Employee's Withholding Allowance Cerrificate foi each employee. (p. 317)The amount of income tax withleld from each employee,s total earnings is determinedfrom the number of withholding allowances and by the emptoyee,s marital stat.r". 1p. :rZ;A single person will have less income tax withheld rhan a marded employ€€. (p. 317)1,1.13.14.An employee can be exempt from having federal income tax withheld under certainconditions. (p. 317)14.15.Social security tax is paid by the employer only. (p. 320)15.16. Aj1 act of Congress can €hange the social security iax base and tax rate at any time. (p. 320)17. When an employee's eamings exceed the iax base, no more social security tax is deducted.(p. 320)18. All deductions from employee waSes are recorded in a payroit retister. (p. 323)19. The columns of the employee eamings record consist of the amount columns in a payrollregister and an accumulated earnings column. (p. 32S)20. The information used to prepare payroll checks js taken from a payrolt register. (p. 328)16.17.18.19.20.CopyRrGHT @ SourH-WEsTERN EDUCAT|oNAL puBUsHtNGChoprer 13 . 5l