PDF, 1.6 Mb - Shareholders and investors - EDF

PDF, 1.6 Mb - Shareholders and investors - EDF

PDF, 1.6 Mb - Shareholders and investors - EDF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

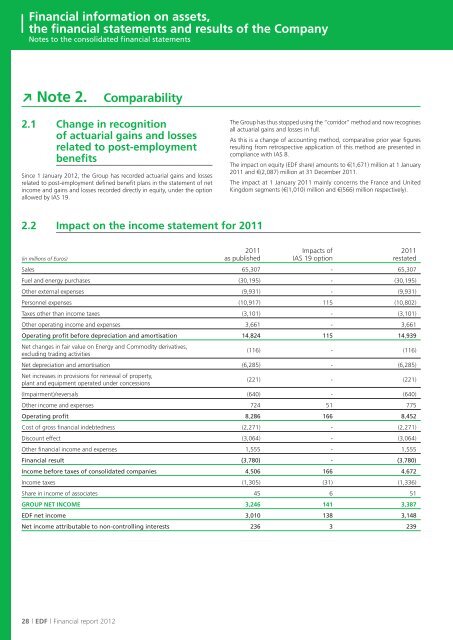

Financial information on assets,the financial statements <strong>and</strong> results of the CompanyNotes to the consolidated financial statementsj Note 2.Comparability2.1 Change in recognitionof actuarial gains <strong>and</strong> lossesrelated to post-employmentbenefitsSince 1 January 2012, the Group has recorded actuarial gains <strong>and</strong> lossesrelated to post-employment defined benefit plans in the statement of netincome <strong>and</strong> gains <strong>and</strong> losses recorded directly in equity, under the optionallowed by IAS 19.The Group has thus stopped using the “corridor” method <strong>and</strong> now recognisesall actuarial gains <strong>and</strong> losses in full.As this is a change of accounting method, comparative prior year figuresresulting from retrospective application of this method are presented incompliance with IAS 8.The impact on equity (<strong>EDF</strong> share) amounts to €(1,671) million at 1 January2011 <strong>and</strong> €(2,087) million at 31 December 2011.The impact at 1 January 2011 mainly concerns the France <strong>and</strong> UnitedKingdom segments (€(1,010) million <strong>and</strong> €(566) million respectively).2.2 Impact on the income statement for 2011(in millions of Euros)2011as publishedImpacts ofIAS 19 option2011restatedSales 65,307 - 65,307Fuel <strong>and</strong> energy purchases (30,195) - (30,195)Other external expenses (9,931) - (9,931)Personnel expenses (10,917) 115 (10,802)Taxes other than income taxes (3,101) - (3,101)Other operating income <strong>and</strong> expenses 3,661 - 3,661Operating profit before depreciation <strong>and</strong> amortisation 14,824 115 14,939Net changes in fair value on Energy <strong>and</strong> Commodity derivatives,excluding trading activities(116) - (116)Net depreciation <strong>and</strong> amortisation (6,285) - (6,285)Net increases in provisions for renewal of property,plant <strong>and</strong> equipment operated under concessions(221) - (221)(Impairment)/reversals (640) - (640)Other income <strong>and</strong> expenses 724 51 775Operating profit 8,286 166 8,452Cost of gross financial indebtedness (2,271) - (2,271)Discount effect (3,064) - (3,064)Other financial income <strong>and</strong> expenses 1,555 - 1,555Financial result (3,780) - (3,780)Income before taxes of consolidated companies 4,506 166 4,672Income taxes (1,305) (31) (1,336)Share in income of associates 45 6 51GROUP NET INCOME 3,246 141 3,387<strong>EDF</strong> net income 3,010 138 3,148Net income attributable to non-controlling interests 236 3 23928 l <strong>EDF</strong> l Financial report 2012