PDF, 1.6 Mb - Shareholders and investors - EDF

PDF, 1.6 Mb - Shareholders and investors - EDF

PDF, 1.6 Mb - Shareholders and investors - EDF

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

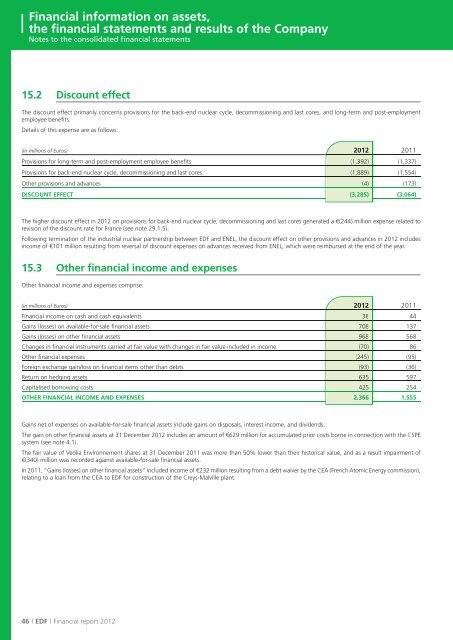

Financial information on assets,the financial statements <strong>and</strong> results of the CompanyNotes to the consolidated financial statements15.2 Discount effectThe discount effect primarily concerns provisions for the back-end nuclear cycle, decommissioning <strong>and</strong> last cores, <strong>and</strong> long-term <strong>and</strong> post-employmentemployee benefits.Details of this expense are as follows:(in millions of Euros) 2012 2011Provisions for long-term <strong>and</strong> post-employment employee benefits (1,392)(1,337)Provisions for back-end nuclear cycle, decommissioning <strong>and</strong> last cores (1,889)(1,554)Other provisions <strong>and</strong> advances (4)(173)DISCOUNT EFFECT (3,285)(3,064)The higher discount effect in 2012 on provisions for back-end nuclear cycle, decommissioning <strong>and</strong> last cores generated a €(244) million expense related torevision of the discount rate for France (see note 29.1.5).Following termination of the industrial nuclear partnership between <strong>EDF</strong> <strong>and</strong> ENEL, the discount effect on other provisions <strong>and</strong> advances in 2012 includesincome of €101 million resulting from reversal of discount expenses on advances received from ENEL, which were reimbursed at the end of the year.15.3 Other financial income <strong>and</strong> expensesOther financial income <strong>and</strong> expenses comprise:(in millions of Euros) 2012 2011Financial income on cash <strong>and</strong> cash equivalents 3844Gains (losses) on available-for-sale financial assets 708137Gains (losses) on other financial assets 968568Changes in financial instruments carried at fair value with changes in fair value included in income (70)86Other financial expenses (245)(95)Foreign exchange gain/loss on financial items other than debts (93)(36)Return on hedging assets 635597Capitalised borrowing costs 425254OTHER FINANCIAL INCOME AND EXPENSES 2,3661,555Gains net of expenses on available-for-sale financial assets include gains on disposals, interest income, <strong>and</strong> dividends.The gain on other financial assets at 31 December 2012 includes an amount of €629 million for accumulated prior costs borne in connection with the CSPEsystem (see note 4.1).The fair value of Veolia Environnement shares at 31 December 2011 was more than 50% lower than their historical value, <strong>and</strong> as a result impairment of€(340) million was recorded against available-for-sale financial assets.In 2011, “Gains (losses) on other financial assets” included income of €232 million resulting from a debt waiver by the CEA (French Atomic Energy commission),relating to a loan from the CEA to <strong>EDF</strong> for construction of the Creys-Malville plant.46 l <strong>EDF</strong> l Financial report 2012