44-46 princesstreet.pdf - Culverwell Property Consultants

44-46 princesstreet.pdf - Culverwell Property Consultants

44-46 princesstreet.pdf - Culverwell Property Consultants

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

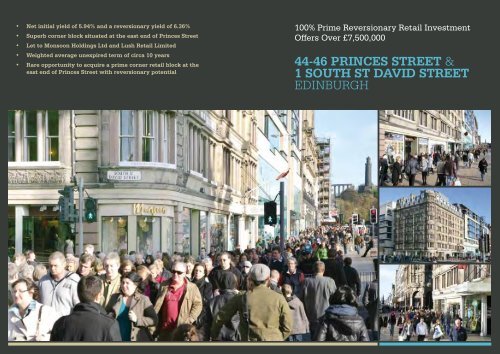

• Net initial yield of 5.94% and a reversionary yield of 6.36%• Superb corner block situated at the east end of Princes Street• Let to Monsoon Holdings Ltd and Lush Retail Limited• Weighted average unexpired term of circa 10 years• Rare opportunity to acquire a prime corner retail block at theeast end of Princes Street with reversionary potential100% Prime Reversionary Retail InvestmentOffers Over £7,500,000<strong>44</strong>-<strong>46</strong> PRINCES STREET &1 SOUTH ST DAVID STREETEDINBURGH

<strong>44</strong>-<strong>46</strong> PRINCES STREET & 1 SOUTH ST DAVID STREET EDINBURGHCOMELY BANKG R A N G EC R I C K E TC L U BR AEBURN P LA CEGLENOGLE R O ADWater of LeithH E NDERSON R O WBRANDON S TFETTES R OWEYRE PLACEBROUGHTON R DRODNEY S TREETEAST C LAREMONT S TE A S T L ONDON S TU NION S T R E ETCLocationEdinburgh is the capital city of Scotland, located approximately400 miles north of London and 45 miles east of Glasgow.Road communications are excellent with the M90 located tothe north, the M8 and M9 to the west and the A1 trunk road tothe south which provide links to all major cities in the UK. Thecity is well served by the rail network, with direct and frequentservices to London (Euston and Kings Cross) and Glasgow withfastest journey times of approximately 4 hour 50 minutes and51 minutes respectively. Edinburgh also benefits from one ofBritain’s fastest growing airports, providing both domestic andinternational flights.Edinburgh is one of the most popular tourist destinations withinEurope hosting over 4.8 million visitors per year and is secondonly to London in terms of international visitors to UK cities.CORSTORPHINE ROADQUEENSFERRY ROADMURRAYFIELDRUGBYSTADIUMROSEBURN TERRACECRAIGLEITH PARKRAVELSTON TERRACEWEST APPROACH ROADGORGIE ROADSLATEFORD ROADSituationThe premises occupy a 100% prime retail location onEdinburgh’s principal retailing thoroughfare. The property issituated in a prominent corner block at the junction of South StDavid Street and Princes Street. Occupiers in the near vicinityinclude TopShop/TopMan, H&M, Optical Express, Swatch andJenners Department Store.DescriptionORCHARD B RAEQ U EENSFERRY RDThe subject property forms a parade of three prime retailunits providing ground and basement accommodation.45 Princes Street /1 South St David Street and <strong>46</strong> Princes Streetlet to Monsoon Holdings Limited have been combined to formone retail unit (held over two leases). Internally, the unitsprovide sales on ground floor with ancillary sales/ storage/staffaccommodation in the basement.<strong>44</strong> Princes Street, Edinburgh (Lush) comprise a retail unitproviding ground floor sales accommodation and basementstorage/staff accommodation.HaymarketStation45 Princes Street/1 South St David Street, Edinburgh(Accessorize) comprises a retail unit with a frontage to bothPrinces Street and South St David Street, providing groundfloor sales accommodation with basement storage/staffaccommodation. The store effectively forms an ‘L’ shape around<strong>46</strong> Princes Street.MAITLAND STMORRISON STQUEENSFERRY STFOUNTAINBRIDGESHANDWICK PL<strong>46</strong> Princes Street, Edinburgh (Monsoon Holdings) comprisesa corner retail unit with a return frontage onto South St DavidStreet providing ground floor sales accommodation andbasement sales and staff/storage accommodation. The unit hasa large sales staircase between the ground and basement levelswhich is situated towards the front of the shop.ANGLE PARK TERRACEL E ARMONTH AVEDALRY ROADCHESTER STREETDUNDEE STPOLWARTH GARDENSPOLWARTH TERRD E A N P A RK C R ES CENTWEST APPROACH ROADMERCHISTON AVENUEMELVILLE STTORPHICHEN STGROVE STVIEWFORTHGLOUCESTER LANECHARLOTTESQUAREL OTHIAN R OADSEMPLE STGILMORE PLACEST STEPH E N STPONTON STBRUNTSFIELD PLACEC IRCU S L A N EH ERIOT ROWC A S T L E S TCASTLE TERRBREAD STS T V I N CENT S TC UMBERLAND STGREAT KING STH OWE STPRINCES STREETNORTHUMBERLAND S TQ UEEN STREETF R E D E R I C K S TG EORGE S TREETROSE S TREETEdinburgh CastleLADY LAWSON STTram RouteD UNDAS STWEST PORTH A N O V E R S TH I L L S T T H I S T L E S T T H I S T L E STLAURISTON P LAC ET HE M O U NDGRASSMARKETST ANDREWThe SubjectsSQUAREBusStationWaverleyStationHIGH STREETBROUGHTON S TST JAMESCENTREPRINCES STREETCHAMBERS STREETThe premises occupy MEADOWS 100%prime retail location onBRUNTSFIELDEdinburgh’s principal retailingLINKSthoroughfareGEORGE IV BRIDGEMELVILLE DRIVEY O RK PLACENORTH BRIDGECHAMBERS STREETNICOLSON STREET

TRetailing in EdinburghEdinburgh City Centre provides approx 2,090,000 sqft of retailfloor space. The core shopping area includes Princes Street,George Street, St James Centre and Princes Mall.Princes Street is Edinburgh’s principal retailing thoroughfare.The prime pitch in Princes Street stretches from the junctionwith Frederick Street in the west to South Saint Andrew Streetin the east. A number of streets feed off Princes Street andprovide access to Rose Street and George Street, the lattercatering for more upmarket retailers. At the eastern end ofthis retailing pitch is Multrees Walk which is anchored byHarvey Nichols and also home to a number of high end qualityretailers. Multrees Walk provides one of the main links intothe St James Centre which caters for the more mass marketretailer. Henderson Global Investors have outline planningpermission for the redevelopment of the St James Centre whichis set to replace the existing 1970s scheme and provide a newSt James Quarter from Multrees Walk to east Princes Street.The redevelopment will transform the site with a new landmarkmixed use development comprising a world class retail offerwhich will effectively double the amount of retail space to over1 million sqft, up to 126 apartments, a 211 bedroom hotel, acinema and a 55 bedroom aparthotel.Princes Street is currently undergoing significant investmentthanks to a £500 million tram system being installed, which is setto run through the heart of Edinburgh. It will also provide a directconnection between Edinburgh Airport in the west and Newhavenin the east. The tram system is set to be operational in 2013.<strong>Culverwell</strong> 22/10/2010ATIOND)&BAR & RESTAURANTEETEXITVACANTOUTLETLOADINGDOMEROSE STREETSOUTH LANETHE WORKS6361 - 6210OFFICEFOPPM & SJENNERSM & SNAT WESTTHE ABBOTSFORDROSE STREET NORTH LANERECORDINGS & BAR(2 RETAILFLOORS)(PEDESTRIANS & ACCESS ONLYEXCEPT LOADING UNTIL 10.30AM)ROMANES & PATERSONEXITVARIETYSTORE&DEPARTMENT STOREOVER(3 RETAIL FLOORS)VARIETY STOREENT7PUBLIC HOUSE &RESTAURANTMARKS & SPENCER BASEMENTBANK54 - 6083THE BARBERSHOP ATJENNERSHAIRRI2BARENT TO HOTELRAMADA JARVIS HOTELSGRAPEMOUNT ROYAL HOTEL53CONVENIENCE STOREENTRANCSAINSBURYS LOCAL(6 RETAIL FLOORS)9 - 10DEPARTMENT STOREJENNERS47 - 53PRINCES STREETThree prime retail units providing groundand basement accommodationEdinburgh - Princes StreetSOUTH ST DAVID STREETVACANTOUTLET821 919ENT15 11 5CLOSEDTHEPRIDEOFSCOTLANDGIFTS&CLOVACANTOUTLETVACANTOUTLETTAXICLOSEDENTRANCEVACANTPUBLIC HOUSELADIES WEARLADIES ACCESSORIESMONSOONACCESSORIZELUSHPMEUSE LANE<strong>46</strong>45HLTH&BEA(70) (ESTIMATED)ENTRANCE<strong>44</strong>OFFICEJEWELLER43SWATCH423 - 7KERBSIDEST ANDREW SQUARECLOSEDH & MCLOTHINGSTORE(3 RETAIL FLOORS)4117(2 RETAIL FLOORS)OPTICIAN(BUSES TAXIS & CYCLES ONLYEXCEPT 8.00PM - 7.00AM)TILESCAFEBARBAR & RESTAURANTOPTICAL EXPRESS2ENTRANCEBARCLAYSBANKSAIGON SAIGONCHINESE RESTAURANTKOOKAILADIESWEARNEW LOOKJOBCENTRE PLUSMCDONALDSCHARLIE MILLER THE BURGHHAIRDRESSINGTOPSHOP1 - 2LADIESWEAR&TOPMAN18ENTRANCEMENS WEAR(3 RETAIL FLOORS)1412ENTRANCE108LADIES WEARU1U27 - U28GLENEAGLESTLAND4219T BANKSOUTH ST ANDREW STREET15 - 17U2VACANTOUTLET(2 RETAIL FLOORS)ARDEN11ESTATE AGENT9 7WALKWAYXILE3 - 552VACANTOUTLETU25 - U26MENSWEARRETFLRS)ENTRANCEENTRANCECARPHONEWAREHOUSETELEPHONESBAKERGREGGSPUBLIC HOUSEFAST FOODRESTAURANT450(2 RETAILFLOORS)25LADIES WEAR & GIFTSPRINCES MALLU24REGISHAIR45 metresVODAFONETELTHEWHISKYSHOPOFF LICJOY6WEST REWHITTARDTEA & COFFEEMERCHANT2438 - 4823TELEPHONESORIGICLOTHINSTS

100% Prime Reversionary Retail InvestmentAccommodationWe have measured the subject premises in accordance with the RICS Code of Measuring Practice 2007 (Sixth Edition) and would estimate that the subjectsextend to the following areas and dimensions:Address Tenant Net Frontage Shop Depth Floor Sqft Sqm Total Reduced Area(30 ft Zones)<strong>44</strong> Princes Street, Edinburgh Lush 13ft 1”(3.98m)45 Princes Street, Edinburgh&Monsoon/Accessorize15ft 5”(4.7m)61ft 8”(18.8m)40ft(12.16m)Ground floorBasementTotalGround floorBasementTotal6283841,01257540898358.3435.6794.0153.4137.9091.32528 sqft (49.05 sqm)550 sqft (51.09 sqm)1 South St David Street, EdinburghMonsoon/Accessorize23ft 9”(7.24m)38ft 5”(11.72m)Ground floorTotal1,0881,088101.07101.07*828 sqft (73.29 sqm)<strong>46</strong> Princes Street, Edinburgh Monsoon/Accessorize **26ft 9”(8.15m)41ft 1”(12.53m)Ground floorBasementTotal9361,6192,55586.95150.4237.36***1,006 sqft (93.<strong>46</strong> sqm)*A reduced area of 789 sqft is stated in the Lease. ** Return frontage onto 1 South David Street of 41ft 1” (12.53m). *** Includes end allowance of 5% for return frontage.Tenancy ScheduleAddress Tenant LeaseStartLeaseExpiryNext RentReviewRent (Zone A/ sqft) ERV (Zone A/sqft) Comments<strong>44</strong> Princes Street Lush Retail Limited t/a Lush 01-10-98 30-09-23 29-09-13 £115,000 (£217/sqft) £113,520 (£215/sqft) FRI Lease45 Princes Street /1 South St David StreetMonsoon Holdings Limited t/aAccessorize29-09-97 28-09-22 29-09-12 £167,500 *(£210/sqft) £174,795 (£215/sqft) FRI Lease. The Lease provides two options asto how to value the property at review. The firstoption is to value the two shops to a ‘marketvalue’. The second option is to value 45 PrincesStreet to a ‘market value’ and in respect of 1South St David Street a formula is stated in theLease to derive a ‘market value’ based on areduced area of 789 sqft.<strong>46</strong> Princes Street Monsoon Holdings Limited t/aMonsoon08-10-90 07-10-15 28-08-10 £188,500 (£187.37/sqft) £216,300 (£215/sqft) FRI Lease. Review outstanding. Notice served.The review will be left for the purchaser tonegotiate. There has been no negotiations withthe tenant in respect of this matter.Total £471,000 £504,615* A Zone A rate of £210/sqft was agreed at the last review.

Offers Over £7,500,000TenureHeritable (Scottish equivalent of English Freehold).CovenantMonsoon/AccessorizeMonsoon/Accessorize is a design led retailer operating twohighly successful chains – Monsoon and Accessorize. Monsoonwas founded in 1972 and their original focus was on clotheswith an ethnic origin. In May 1999 Monsoon launched its firstshop in Kings Road, London and since then has expandedrapidly from its London base. Today there are over 400 Monsoonand Accessorize stores throughout the UK. Additionally theinternational side now has over 600 outlets in 54 countriesincluding Austria, Brazil, China, Denmark and France amongstmany others.Monsoon Holdings Limited have a Dun & Bradstreet rating of 3A2representing a lower than average risk of business failure. Forthe financial year ending 29 August 2009 they reported a profit inexcess of £79 million and a tangible net worth of £8,069,434.Excellent rental growthprospects underpinned bystrong occupational demandLushLush is a handmade cosmetics company established in 1994 inPoole, Dorset. Lush produces and sells a variety of handmadeproducts, including face masks, soaps, bath bombs, bubblebars, hand and body lotions and hair treatments. Lush arean international retailer with over 600 stores in 43 countriesincluding over 90 stores in the UK.Lush Retail Limited have a Dun & Bradstreet rating of N3. Forthe financial year ending 30 June 2009, they reported a turnoverin excess of £40 million, with a loss of £3,349,268.Lush Retail Limited is a wholly owned subsidiary of Lush Limited(Parent Company). Lush Limited has a Dun & Bradstreet ratingof 3A1, representing a minimum risk of business failure. For thefinancial year ending 30 June 2009 they reported sales turnoverin excess of £21 million, a profit of £6,140,537 and a net worth inexcess of £11.2 million.ERVThe eastern end of Princes Street has become the preferredlocation for retailers seeking representation on the streetbecause of the predominance of the major stores in this areatogether with proximity to both covered shopping centres, StJames Centre and Princes Mall. Additionally, the main transporthubs of Waverley Train Station and Edinburgh Bus Stationare located in the east end of Princes Street. The proposedredevelopment of the St James Centre will only further improvethe east end of Princes Street.In our opinion, the subject properties have a total estimatedrental value of £504,615 pa which equates to a Zone A rate of£215 per sqft. Evidence includes the adjacent unit let to Swatch(42 Princes Street) which is passing off a rent at or around £230per sqft Zone A and a sub-letting to Scribbler (80 Princes Street)at circa £220 per sqft Zone A. Additionally, Vodafone are underoffer on 24/25 Princes Street at a rent which equates to over£210 per sqft Zone A. This is an inferior retailing pitch where theprevious rental tone was set at or around £165 per sqft Zone A.In the medium term, we anticipate excellent rental growth prospectsunderpinned by strong occupational demand and an ever increasingimportance of the east end of Princes Street as a retail destination.MonsoonAccessorizeLush

Investment Evidence<strong>Property</strong> Transaction Price Yield Date133-137 Buchanan Street, Glasgow Investment sale £21.2 million 5.36% August 201062-66 George Street, Edinburgh Investment sale £6.103 million 6% August 201063-65 George Street, Edinburgh Investment sale £10.4 million 5.71% July 201055-59 Buchanan Street, Glasgow Investment sale £16.5 million 4.87% 2nd Quarter 2010ProposalWe are instructed to seek offers in excess of SEVEN MILLIONFIVE HUNDRED THOUSAND POUNDS (£7,500,000) exclusiveof VAT for our client’s heritable interest subject to and with thebenefit of the existing leases.A purchase at this level would show an attractive net initialyield of 5.94% and a reversionary yield of 6.36%, allowing forpurchasers costs of 5.75%.VATOur clients have elected to waive exemption for VAT andaccordingly VAT will be payable on the purchase price, althoughthe property may be sold as a TOGC.Legal CostsEach party will be responsible for their own legal costs incurredin connection with the transaction.Viewing & Further InformationPlease contact the sole selling agent:Cathal Keane<strong>Culverwell</strong>68-70 George StreetEdinburgh EH2 2LTTel: 0131 226 6611Fax: 0131 226 6622Email: cathal@culverwell.co.ukDisclaimer<strong>Culverwell</strong> for themselves and for the vendors or lessors of this property whose agents they are give notice that: (i) the particulars are set out as a general outline only for the guidance of intendingpurchasers or lessees, and do not constitute, nor constitute part of, an offer or contract; (ii) all descriptions, dimension, references to condition and necessary permissions for use and occupation, and otherdetails are given without responsibility and any intending purchasers or tenants shall not rely on them as statements or representations of fact but must satisfy themselves by inspection or otherwise asto the correctness of each of them and are advised to do so; (iii) no person in the employment of <strong>Culverwell</strong> has any authority to give representation or warranty whatever in relation to this property; (iv) allprices, rents and premiums quoted are exclusive of VAT at current rate.Date of publication: November 2010.