Annual Report 2011 Australian Grand Prix Corporation

Annual Report 2011 Australian Grand Prix Corporation

Annual Report 2011 Australian Grand Prix Corporation

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

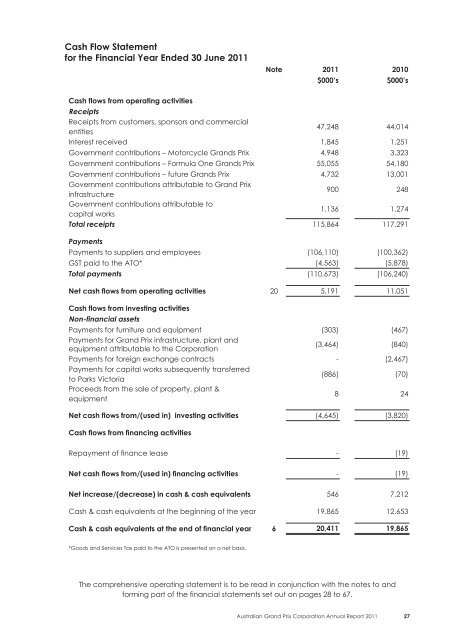

Cash Flow Statementfor the Financial Year Ended 30 June <strong>2011</strong>Note <strong>2011</strong> 2010$000’s$000’sCash flows from operating activitiesReceiptsReceipts from customers, sponsors and commercialentities47,248 44,014Interest received 1,845 1,251Government contributions – Motorcycle <strong>Grand</strong>s <strong>Prix</strong> 4,948 3,323Government contributions – Formula One <strong>Grand</strong>s <strong>Prix</strong> 55,055 54,180Government contributions – future <strong>Grand</strong>s <strong>Prix</strong> 4,732 13,001Government contributions attributable to <strong>Grand</strong> <strong>Prix</strong>infrastructure900 248Government contributions attributable tocapital works1,136 1,274Total receipts 115,864 117,291PaymentsPayments to suppliers and employees (106,110) (100,362)GST paid to the ATO* (4,563) (5,878)Total payments (110,673) (106,240)Net cash flows from operating activities 20 5,191 11,051Cash flows from investing activitiesNon-financial assetsPayments for furniture and equipment (303) (467)Payments for <strong>Grand</strong> <strong>Prix</strong> infrastructure, plant andequipment attributable to the <strong>Corporation</strong>(3,464) (840)Payments for foreign exchange contracts - (2,467)Payments for capital works subsequently transferredto Parks Victoria(886) (70)Proceeds from the sale of property, plant &equipment8 24Net cash flows from/(used in) investing activities (4,645) (3,820)Cash flows from financing activitiesRepayment of finance lease - (19)Net cash flows from/(used in) financing activities - (19)Net increase/(decrease) in cash & cash equivalents 546 7,212Cash & cash equivalents at the beginning of the year 19,865 12,653Cash & cash equivalents at the end of financial year 6 20,411 19,865*Goods and Services Tax paid to the ATO is presented on a net basis.The comprehensive operating statement is to be read in conjunction with the notes to andforming part of the financial statements set out on pages 28 to 67.<strong>Australian</strong> <strong>Grand</strong> <strong>Prix</strong> <strong>Corporation</strong> <strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 27