november 2008 examination - The Malaysian Institute Of Certified ...

november 2008 examination - The Malaysian Institute Of Certified ...

november 2008 examination - The Malaysian Institute Of Certified ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

August <strong>2008</strong> www.micpa.com.my KDNPP 3809/3/2009

<strong>The</strong> <strong>Malaysian</strong> AccountantAUGUST <strong>2008</strong>EDITORIAL BOARDDatuk Robert Yong Kuen Loke (Chairman)Dato’ Nordin BaharuddinDato’ Hj Maidin Syed AliLoh Lay ChoonNg Kim TuckSee Huey BengSam Soh Siong HoonTan Chin HockChia Kum Cheng (Co-opted)Chong Kian Soon (Co-opted)PRINCIPAL OFFICE BEARERSPresidentDato’ Nordin BaharuddinVice PresidentDato’ Ahmad Johan Mohammad RaslanPRINCIPAL OFFICERSExecutive DirectorFoo Yoke Pin (ypfoo@micpa.com.my)Technical ManagerMelissa Yeoh (melissa.tech@micpa.com.my)Education & Research ManagerJenny Chua (jenny.edu@micpa.com.my)Public Affairs& Communications ManagerVicky Rajaretnam (vic.pr@micpa.com.my)Marketing ManagerEvelyn Lim (evelyn.mktg@micpa.com.my)Examination <strong>Of</strong>ficerLee How Lai (hl.exam@micpa.com.my)Assistant Manager, MembershipSalyasusanti Achom(membership@micpa.com.my)Single Copy: RM7.50Subscription: 6 issuesRM43.50 per annum(including P&P within Malaysia only)<strong>The</strong> <strong>Malaysian</strong> Accountant is publishedby: <strong>The</strong> <strong>Malaysian</strong> <strong>Institute</strong> of<strong>Certified</strong> Public Accountants (3246-U)15, Jalan Medan Tuanku50300 Kuala Lumpur, MalaysiaTel: 03-2698 9622 Fax: 03-2698 9403E-mail: micpa@micpa.com.myWebsite: www.micpa.com.myNote: <strong>The</strong> views expressed in this journal are notnecessarily those of the <strong>Institute</strong> or the Editorial Board.All right reserved; no part of this publication may betransmitted in any form or by any means, electronic,mechanical, photocopying, recording or otherwise,without prior pernission of the <strong>Institute</strong> or the EditorialBoard.Concept & DesignDigibook Sdn BhdReign Associates Sdn BhdPrinterThumbprints Utd Sdn BhdFEATURE page 3PERSPECTIVE 2FEATURES<strong>Malaysian</strong> Tax Updates 3Corporate Governance Analysis in Malaysia 7Overview of Takaful in Malaysia 10Corporate Governance for Takaful 12INSTITUTE NEWSMICPA Turns 50 14Recipient of Anugerah Presiden <strong>2008</strong>:YBhg Tan Sri Dato’ Seri Mohd Hassan Marican 17November <strong>2008</strong> Examination 20May <strong>2008</strong> Examination Results 21Continuing Professional Development (CPD) Programmes 22Career Talks at Secondary Schools 22Career Fairs and Exhibitions 23Collaboration and Career Talks at Universities 24MICPA–BURSA MALAYSIA Business Forum <strong>2008</strong> 24YOUNG CPAYoung CPA Malaysia Symposium <strong>2008</strong>- Charting the Future of Accounting and Finance Professionals 18PROFESSIONAL NEWSMASB Update 26IASB Update 27IFAC Update 30CASE LAW HIGHLIGHTSSee Teow Guan & Ors v Liquidators of Kian Joo Holdings Sdn Bhd(in Liquidation) & Ors 35GLOBAL INSIGHTNews from Down Under 36World News 38LIFESTYLETaiping – A Town of Many Firsts 39

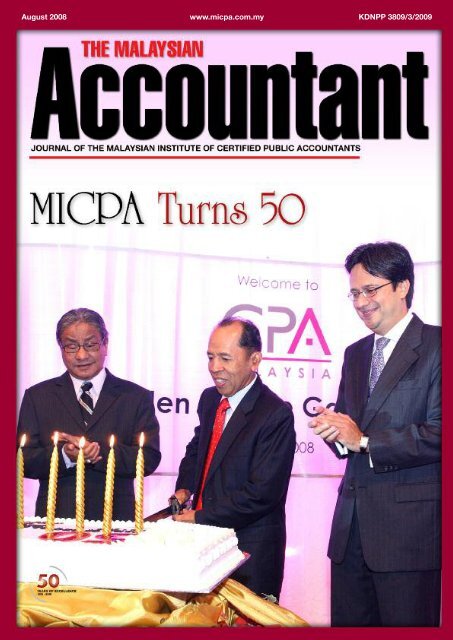

PERSPECTIVEIt was a significant night for the members of the MICPA as they got together to celebratethe <strong>Institute</strong>’s 50th Golden Anniversary on July 26, <strong>2008</strong>. To commemorate the auspiciousoccasion, members of the accounting fraternity attended the Golden Jubilee Gala Dinneraptly themed A Golden Celebration on the Red Carpet.<strong>The</strong> night of fellowship and camaraderie also saw the launch of the <strong>Institute</strong>’s 50thAnniversary Logo by the guest of honour YB Dato’ Hj Hasan bin Malek, Deputy Minister in thePrime Minister’s Department. Several individuals who had made contributions in one way oranother were also acknowledged at the gala night.One of the most significant recognition was accorded to YBhg Tan Sri Dato’ Seri MohdHassan Marican, President and Chief Executive <strong>Of</strong>ficer of Petronas Berhad. <strong>The</strong> Deputy Ministerpresented the Anugerah Presiden <strong>2008</strong> to Tan Sri Hassan who was admitted as a member of theMICPA in 1992. Tan Sri Hassan whose eminent career spans over 35 years has made exceptionalcontributions to society, the accountancy profession and the <strong>Institute</strong>. YBhg Dato’ NordinBaharuddin, the President also honoured the early members of the <strong>Institute</strong> as well as the firstCPA graduate member.Also discussed at great length is the subject of corporate governance. Corporategovernance can be viewed as the financial health tool for management and directors to monitorthe health status of the organisation.In managing an organisation, there must be systematic and procedural ways to ensurethe sustainability and survival of the business in the fast-moving economy coupled with highlycompetitive market forces.Corporate governance is aimed at enhancing accountability, transparency andtrustworthiness. It recognises the role of market forces in the efficient allocation of resources,socio-economic justice and well-being of all through an integrated role of moral values, marketmechanism and good governance.In the local bond market context, the article inside highlights four broad categories of poorcorporate governance: non-compliance of information covenants; related party transactionsand improper payments; misappropriation of funds; and earnings manipulation.This issue also touches on the Young CPA Malaysia Symposium themed Charting theFuture of Accounting and Finance Professionals. <strong>The</strong> symposium was held to address relevantissues in today’s business environment which would help them to capitalise on their careerdevelopment opportunities.Participants were advised to continuously upgrade their knowledge, skills and expertisein order to provide relevant and high quality services to employers and clients. It is importantfor the young CPAs uphold their objectivity, integrity and technical excellence to fulfil the needsof both the local communities and global markets.<strong>The</strong> lifestyle section focuses on a local destination – the unassuming and quiet town ofTaiping, the second largest town in Perak after Ipoh and the wettest town in PeninsularMalaysia. In the 19th century the town had a thriving mining business and was the social focusof the British administration. This former state capital is a pioneer in many fields achievingmany ‘firsts’ in the country. Look inside to find out.2 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my

via a withholding tax charge. To enhance skills in theIslamic Financial sector to promote Malaysia as an Islamicfinancial hub, an exemption from withholding tax is givento non-resident individuals in respect of income arisingfrom the provision of technical advice, assistance orservices rendered in relation to Islamic Finance as proposedin the <strong>2008</strong> Budget and enacted in the Income Tax(Exemption) (No. 3) Order <strong>2008</strong>. To qualify for thiswithholding tax exemption, the non-resident individualmust be verified by the Malaysia International IslamicFinancial Centre Secretariat as an expert in the field ofIslamic finance. This exemption is in force from September8, 2007 until December 31, 2016.Islamic Fund Management Services<strong>The</strong> exemption from tax on income from the provision ofIslamic fund management services to foreign investors hasbeen widened to the provision of such services to localinvestors pursuant to the Income Tax (Exemption) (No. 6)Order <strong>2008</strong>. <strong>The</strong> exemption is available to licensed<strong>Malaysian</strong> incorporated fund management companies.Accelerated Capital Allowances onSecurity Equipmentthis new provision, the 2007 Order referred to above is nolonger required and has been revoked by the Income Tax(Exemption) (Revocation) Order <strong>2008</strong>. It should be notedthat revocation is effective from the year of assessment 2007.Revocation of Income Tax (AcceleratedCapital Allowance) Renewable EnergyRules (2005)<strong>The</strong> <strong>2008</strong> Budget proposed that companies generatingrenewable energy for their own consumption be granted100% investment tax allowance on their qualifying capitalexpenditure over a period of 5 years. Accordingly, thepreviously available accelerated capital allowances forsuch expenditure will no longer be available. <strong>The</strong>refore the2005 Rules mentioned above have been revoked by thenew Income Tax (Accelerated Capital Allowance)(Renewable Energy) (Revocation) Rules <strong>2008</strong>. Note that theinvestment tax allowance will only be available forapplications made to the <strong>Malaysian</strong> Industrial DevelopmentAuthority (MIDA) up to December 31, 2010.Withholding Tax Exemption forNon-Resident Experts in Islamic FinanceNon-resident consultants who provide technical advice,assistance or services in Malaysia are generally subject totax on the income arising therefrom. <strong>The</strong> tax is imposed<strong>The</strong> Income Tax (Accelerated Capital Allowance) (SecurityControl Equipment or Monitor Equipment) Rules <strong>2008</strong>have been gazetted and are effective for the years ofassessment <strong>2008</strong> to 2012. Accelerated capital allowanceswill be given in respect of specified equipment installed forsecurity in factories and for monitor equipment installed inspecified lorries. An initial allowance of 20% and anannual allowance of 80% will be given in relation to suchequipment. Effectively therefore, the equipment will befully depreciated for tax purposes in the first year.Non-Profit Oriented SchoolsIncome derived by qualifying persons from themanagement of registered non-profit oriented schools willbe exempt from tax pursuant to the Income Tax(Exemption) (No. 5) Order <strong>2008</strong> with effect from the yearof assessment <strong>2008</strong>.Gifts of Personal Computers toEmployees and Payment ofBroadband SubscriptionsPursuant to the Income Tax (Exemption) (No. 4) Order<strong>2008</strong>, employees will not be taxed on gifts of personalcomputers from employers and on the payment by theiremployers of monthly broadband subscription fees(registered in the name of the employer). <strong>The</strong> exemptionapplies from the year of assessment <strong>2008</strong> to 2010. It4 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my

should be noted that hand phones with computer facilitiesare excluded from the exemption. From the employer’sperspective, the cost of providing these benefits will be taxdeductible pursuant to the Income Tax (Deduction for Giftsof New Personal Computers and Monthly BroadbandSubscription fees to Employees) Rules <strong>2008</strong>.Accelerated Agriculture AllowanceQualifying agricultural expenditure incurred on anagricultural project or on a forest plantation project forrubber wood will be eligible for a 100% allowance (subjectto conditions) pursuant to the Income Tax (AcceleratedAgriculture Allowance) (Plantation of Rubber Wood Tree)Rules <strong>2008</strong>.Public Ruling No. 2/<strong>2008</strong> –Reinvestment AllowanceA Public Ruling on Reinvestment Allowance (RA) hasfinally been issued. RA claims have often been the focusof tax audits and it is therefore useful to have a PublicRuling to provide clarification on the IRB’s view of thefollowing:- projects that qualify for RA;- expenditure that qualifies for RA;- the period of eligibility for RA; and- the computation of RA.Taxpayers in the manufacturing and agriculturalsectors should familiarise themselves with Public RulingNo. 2/<strong>2008</strong>.Guidelines on the Income TaxTreatment From Adopting FRS 139 –Financial Instruments: Recognition andMeasurementLabuan <strong>Of</strong>fshore CompaniesElection for Labuan <strong>Of</strong>fshore Companies to beTaxed under the Income Tax Act, 1967 (ITA)<strong>The</strong> <strong>2008</strong> Budget proposed a change in the law allowingLabuan offshore companies (OCs), which have been taxedunder the Labuan <strong>Of</strong>fshore Business Activity Tax Act, 1990(LOBATA) to elect irrevocably to be taxed under the ITA.<strong>The</strong> Finance Act 2007 amended the ITA and LOBATA toallow for this. <strong>The</strong> Labuan <strong>Of</strong>fshore Business Activity Tax(Forms) (Amendment) Regulations <strong>2008</strong> were recentlygazetted, to provide for a prescribed form on which theelection is to be made. In addition, the Inland RevenueBoard has issued guidelines on the tax treatment of OCswhich elect to be taxed under the ITA.Liberalisation of Rules in Relation to Labuan<strong>Of</strong>fshore Companies<strong>The</strong> Labuan <strong>Of</strong>fshore Financial Services Authority (LOFSA)has recently announced a liberalisation in the rulespertaining to OCs. LOFSA has granted a blanket approvalto allow OCs to:i) carry on business with <strong>Malaysian</strong> residents,ii) invest into domestic companies (so long as the holdingdoes not amount to a controlling holding); andiii) wholly own a domestic company to carry on an offshorebusinessIt should be noted however that where approvals arerequired from other regulatory authorities, such as BankNegara Malaysia, the Securities Commission and the ForeignInvestment Committee (FIC), such approvals must still beobtained. Further, LOFSA has issued a notification form whichOCs are required to submit when undertaking (i) – (iii) above.<strong>The</strong> Ministry of Finance (MOF) has issued the aboveguidelines which are applicable to financial institutionsonly and are effective from the year of assessment <strong>2008</strong>.FRS 139 relates to the recognition and measurement offinancial instruments for accounting purposes. Althoughthe effective date for the implementation of FRS 139 hasbeen deferred by the <strong>Malaysian</strong> Accounting StandardsBoard, Bank Negara Malaysia (BNM) has incorporated asignificant portion of the FRS 139 into its reportingrequirements as per the BNM guidelines and directives onfinancial assets and liabilities. <strong>The</strong> purpose behind theMOF’s guidelines is to address the income tax treatmentarising from the adoption of FRS 139 with a view toconverging the accounting and tax treatment of financialassets and liabilities, in particular, the timing of incomerecognition and the deductibility of expenses. <strong>The</strong>guidelines can be obtained from the MOF’s website:www.treasury.gov.my.www.micpa.com.myAugust <strong>2008</strong> | <strong>The</strong> <strong>Malaysian</strong> Accountant |5

Windfall Profit LevyElectricity and oil palm fruit have become prescribed goods for the purposes of the Windfall Profit Levy Act, 1998. <strong>The</strong>impact of this is as follows:ImpactComputation of Windfall Profit Levy (WPL)Electricity:Producers of electricity will be subject to a windfall profit levy (WPL) on a return [Profit (before interest, tax and WPL)on assets (ROA) which exceeds 9% per financial year. – (9% of fixed assets)] x 30%WPL is payable pursuant to the Windfall Profit Levy (Electricity) Order <strong>2008</strong>.Oil Palm fruit: i) For Peninsular Malaysia:Plantation companies/oil palm fruit producers who own oil palm holdings which WPL = (Monthly average national price ofin aggregate are not less than 100 acres are subject to a WPL in respect ofcrude palm oil – RM2,000) x 0.03 x monthly totaloil palm fruit produced.production of oil palm fruit in metric tonnesWPL is payable pursuant to the Windfall Profit Levy (Oil Palm Fruit) Order <strong>2008</strong>. ii) For Sabah and Sarawak:WPL = (Monthly average national price ofcrude palm oil – RM2,000) x 0.015 x monthly totalproduction of oil palm fruit in metric tonnesOther Gazette OrdersSeveral other Gazette Orders have been recently issuedincluding the following:- Income Tax (Deduction of Tax on the Distribution ofIncome of a Family Fund, Family Re-Takaful Fund orGeneral Fund) Rules <strong>2008</strong>- Income Tax (Set-<strong>Of</strong>f for Tax Charged on ActuarialSurplus) Rules <strong>2008</strong>Indirect TaxService TaxWith effect from July 1, <strong>2008</strong>, the annual sales turnoverthreshold for restaurants (excluding those located inhotels) has increased from RM300,000 to RM3 million,pursuant to the Service Tax (Amendment) Regulations<strong>2008</strong>. This means that service tax cannot be imposed by arestaurant (other than one located in a hotel) unless itsturnover within a twelve-month period exceeds RM3 million.Extension of Time to AppealTaxpayers who seek to appeal against a decision of theDirector General of Customs may do so by filing aprescribed form, Form A within 30 days from the date ofwritten notification of such decision. In the case where itis inevitable that an appeal needs to be filed out of time,the taxpayer may apply for an extension of time underRegulation 3 of the Customs (Appeal Tribunal) Regulations2007. <strong>The</strong> Customs Appeal Tribunal has issued guidelineson such applications (for an extension of time to fileappeals). Essentially, the application can be made by wayof a letter to the Director General of Customs or hisrepresentative indicating the reasons for the failure to filethe appeal within the stipulated time frame. <strong>The</strong> saidapplication must be sent by way of Registered Post or bypersonal service. (Applications sent by personal servicewould need to be acknowledged by the Customs officer).Double Tax AgreementsMalaysia and Qatar signed a double tax agreement (DTA)on July 3, <strong>2008</strong>. <strong>The</strong> details of the DTA will be reportedwhen this information is available.Conclusion<strong>The</strong> above summarises the tax developments in Malaysiaover the last few months. It is important that reference bemade to the relevant legislation, guidelines and publicrulings to ensure a clear understanding of the changes. Asindicated at the outset, the 2009 Budget Proposals have notbeen announced at the time of writing this article, andclearly, we can expect several tax proposals. It is hopedthat the proposals will take account of the increased costsof doing business and rising costs of living affecting<strong>Malaysian</strong>s as a whole.Renuka Bhupalan is a Director at TAXAND MALAYSIASdn Bhd which is part of the TAXAND network of independenttax consulting firms in 44 jurisdictions. She can be contactedat rb@taxand.com.my. <strong>The</strong> views expressed are the personalviews of the writer.<strong>The</strong> Analysis of the 2009 Budget Proposals will bepublished in the October <strong>2008</strong> issue of <strong>The</strong> <strong>Malaysian</strong> Accountant.6 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my

FEATURECorporate Governance Analysisin MalaysiaBY RHB RESEARCHGood corporate governance is always ablessing to investors, which heightens inimportance given the difficulty in aligningthe interest of shareholders withbondholders.As an example, company owners may think abusiness venture that could yield an expected return oninvestment (ROI) of 20% is appealing despite a failure rateof 70%. However, from the standpoint of bond investors,incremental benefits from taking excessive risk will mostlyaccrue to equity owners at the expense of lenders.In this case, strict financing covenants are an optionthat bondholders can use to protect themselves incurtailing moral hazard and reducing chances of businessowners from taking advantage of this asymmetric rewardprofile.In other instances, a complicated ownership structureand “poison pill” for corporate takeovers may help equityowners obtain a firm grip of company ownership. However,such practices may impede corporate takeovers, indulgepoor management and prejudice the interest of creditors.In the local bond market context, we highlight four broadcategories of poor corporate governance: non-complianceof information covenants; related party transactions andimproper payments; misappropriation of funds; andearnings manipulation.We offer some suggestions for investors to search fornascent signs of deteriorating corporate governance andearnings quality, including a company’s timelydissemination of information, growing related partytransactions, to be watchful for purposes and use of bondproceeds and potential signs of earnings manipulation.Broad corporate governanceissues in MalaysiaAt the root of finance principles, excess funds provided byinvestors feed through businesses which require financing,in exchange for gaining a certain expected rate of returnin future at the expense of sacrificing existing spendingpatterns.However, how can the suppliers of funds be assuredtheir funds will be put into productive projects, rather thanwww.micpa.com.myAugust <strong>2008</strong> | <strong>The</strong> <strong>Malaysian</strong> Accountant |7

just simply help business owners cash out theirshareholdings? This is related to the agency problem,where the overlap of control and ownership causesinappropriate resource allocation.In Malaysia, with the majority of publicly tradedcompanies being either family-owned or controlled bydominant shareholders, the agency problem is not so muchan issue for owner and management, but between thecompany management and the minority shareholders, aswell as other stakeholders. Typically, the interest of ownersand creditors (as well as other stakeholders) may not bealigned due to different incentives and the asymmetricinformation gap regarding company health.<strong>The</strong> situation may be further complicated by thecross-shareholdings of these family-owned shareholders onother closely related companies, and the business dealingsbased on personal and political connections.In the bond market, conflicts of interest can arisewhere the investment bank and bond trustee are all “underone roof”, causing the likelihood of more lenientcompliance requirements from trustee, to the detriment ofbondholders.Given this, a well-established legal infrastructure andstrict enforcement would play a crucial role to safeguardthe interest of company stakeholders, even though it maybe difficult to prove that the act of directors is ultra vires orfraudulent towards minority shareholders and otherstakeholders.Despite being one of the frontrunners with respect tocorporate governance in the region, there are still someother inherent governance issues with our currentownership structures.With some conglomerates and companies in Malaysiahaving the complex and pyramid model for theirownership structure, this has reduced, if not eliminated, thepossibilities of the company being taken over (this alsopartly explains why leveraged buyouts (LBO) are notprevalent in Malaysia), thereby undermining the corporategovernance system, resulting in poor management notbeing punished.Additionally, the pyramid structure helps controllingshareholders draw capital, selectively passed down to lessdesired assets in subsidiaries and adopting discriminativetransfer pricing. Finally, apparently fragmented shareholdingstend to be disguised via indirect shareholdings andnominees, lending subterfuge to linkages pointing to a single,ultimate majority holder.Meanwhile, appointment and removal of a director isdone according to simple majority vote by shareholders;therefore, major shareholders would have a disproportionateinfluence over the proceedings.<strong>The</strong> method of appointing an auditor is similar toappointing a director; therefore, auditor independencecould be weakened due to the influence of dominantshareholders. Some auditors may even collude with themanagement in order to continue providing services to thecompany.We understand that some countries have introducedmandatory rotation of audit firms to protect auditorindependence, though the scheme is not without debateand resistance.Larger minority shareholdings are usually associatedwith a higher turnover of directors and replacement ofmanagers in response to poor performance than thosewithout it. Nonetheless, substantial minority shareholdingsby the institutional investors in the local market areuncommon, thus reducing the opportunity for largeinvestors to act as a disciplining mechanism.Also, creditors like banks and bondholders have verylimited access to the company management and thebusiness operations of the company.For the case of bondholders, any enquiry on thecompany operations and financial conditions may only beallowed via the request through the bond trustee, whichwill inevitably impede the process of timely disseminationof crucial information.In a collaborative study on Malaysia’s corporategovernance disclosures conducted by Standard & Poor’s(S&P) and National University of Singapore in June 2004,the study highlighted that 32% of the top 50 largestcapitalised companies listed then in the exchange had onethirdor less independent directors on their boards,suggesting that third party checks/balances on a companymay still have room for improvement.Furthermore, S&P said that only one out of the topfive best scoring companies had a board with majorityindependent directors, and only two companies gave itsdirectors with independent access to management.Additionally, the study also underlined that the selection of8 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my

a company’s audit, remuneration and nominationcommittees were not really transparent for most of thecompanies.From recent corporate governance cases, there are afew major trends to take note from local bond issuers:Non-compliance of information covenants: A mostcommon trait that problematic companies tend to have.We notice that most troubled companies were slow toprovide timely information on their financial health priorto heading into trouble; hence, it is a nascent sign to spotailing companies;Related party transactions and improper payments:Business dealings based on non-competitive tenders aredetrimental to company profits, and enrich related parties,such as company directors, senior management and theirfamily members. However, improper payments could beeven harder to substantiate, given that these payments donot require separate disclosure like related partytransactions;Misappropriation of funds: Proceeds of the bondissuance may go to purposes not stipulated in thefinancing documents. Also, general borrowing terms, suchas funding for general working capital requirements, maynot help the surveillance or indicate specificity of proceedsused. Besides, a company may finance certain non-corebusinesses using their projected cash flows, which shouldhave been used to meet their financial obligations andother operational funding requirements; andEarnings manipulation: Commonly known as“creative accounting”, where the managementintentionally attempts to alter financial statements tomislead stakeholders about the company’s underlyingperformance for their private gains. Detecting potentialsigns of earnings manipulation are: the volatility and sizeof earnings relative to cash flows; the correlation betweencash flows and accruals; the extent of discretion inaccounting methodology in areas such as accruals, markto-marketpolicies, and depreciation; and the extent ofloss avoidance and income trend management.Investment implications in corporate governance: Poorcorporate governance implies information asymmetry,which creates risk. In modern investment theory, capitalwill flow to an investment till the marginal rate of returnis on par with the opportunity cost of funding, so thatinvestors would not earn excess returns, under theconditions of an efficient market.However, in reality, investors would have to deal withinformation asymmetry — particularly in privately-heldcompanies, where the coverage of media and analysts aresparse and inadequate. Hence, a higher risk premium andthus lower valuation would usually be accorded byinvestors to little known and poorly “governed” companies.Impact of corporate governance on ratings and PDSyields volatility: Corporate governance issues will inevitablydrive ratings and yields volatility, increasing the returnuncertainties. Poor corporate governance has adverselyaffected the rating prospects of companies. Furthermore,in most circumstances, rating downgrades have beenquick and deep, underscoring the severity of poorcorporate governance to investors. <strong>The</strong> major problems ofpoor governance therefore are its lack of calculable risk, itsuncontrollable nature, and disproportionately largenegative impact to a bond’s credit rating. This is unlike,say, the gradual decline in sales due to a slower businesscycle. As such, we opine it is even more important thatindicators of corporate governance quality be givenweighty consideration.Links between business cycle, “name”, sector preferencesand governance: Investors form their decisions based on thecompany track record and sector preference. It should benoted that issues of corporate governance seldom emergeduring a booming economy, given that companies usuallyenjoy thick profit margins and conducive lendingconditions. Consequently, corporate governance recordsduring the Asian Financial Crisis 1997/98 play a central rolefor the “name” (reputational) preference for a company.However, thriving sectors and heavily regulated industriessuch as banks and insurance companies are usually attachedwith lower risk premiums. It is worth mentioning that themerger & acquisitions and tight central bank supervision inthe banking sector has significantly reduced the link betweencomplex conglomerates and banks as well as ownershipconcentration. Hence, some yield premium imputations ofbetter corporate governance have been accorded to bankbonds. In a nutshell, risk aversion comes hand-in-hand withinvestor preference for well-governed companies.Well-governed companies can enhance returns: Corporategovernance is one of the most crucial qualitative factors ininvestment decisions. Numerous international studies havedemonstrated that investment performance is positivelycorrelated with the quality of corporate governance. In aGlobal Investors Opinion survey done in 2002 by Mckinsey,institutional investors mentioned that they would payadditional 22% premium on average to own well-governedcompanies in Asia and Latin America. In the same vein,good corporate governance does not only reward theinvestors, but also benefits the company itself, given itattracts more investors and lenders, thereby reducingborrowing costs (i.e bond yields).This article appeared in <strong>The</strong> Edge Daily on June 30, <strong>2008</strong>and was extracted from the website at www.theedgedaily.comwww.micpa.com.myAugust <strong>2008</strong> | <strong>The</strong> <strong>Malaysian</strong> Accountant |9

FEATUREOverview of Takaful inMalaysia<strong>The</strong> concept of takaful (Islamic insurance) wasfirst introduced in Malaysia in 1985 when thefirst takaful operator was established to fulfilthe need of the general public to be protectedbased on the Islamic principles. <strong>The</strong> legal basis for theestablishment of takaful operators was the Takaful Actwhich came into effect in 1984.Insurance as a concept does not contradict thepractices and requirements of Shariah. In essence,insurance is synonymous to a system of mutual help.However, Muslim jurists are of the opinion that theoperation of conventional insurance does not conform tothe rules and requirements of Shariah as it involves theelements of uncertainty (Gharar) in the contract ofinsurance, gambling (Maisir) as the consequences of thepresence of uncertainty and interest (riba) in its investmentactivities.Takaful is an insurance concept in Shariah wherebya group of participants mutually agree among themselvesto guarantee each other against a defined loss or damagethat may inflict upon any of them by contributing astabarru’ or donation in the takaful funds. It emphasisesunity and co-operation among participants. Takaful is nota new concept as it had been practised by the Muhajirin ofMecca and the Ansar of Medina following the hijra of theProphet over 1400 years ago.Tabarru’ is the agreement by a participant torelinquish as donation, a certain proportion of the takafulcontribution that he agrees or undertakes to pay, thusenabling him to fulfil his obligation of mutual help andjoint guarantee should any of his fellow participants suffera defined loss. <strong>The</strong> concept of tabarru’ eliminates theelement of uncertainty in the takaful contract. <strong>The</strong> sharingof profit or surplus that may emerge from the operations oftakaful is made only after the obligation of assisting thefellow participants has been fulfilled. Thus, the operationof takaful may be envisaged as a profit sharing businessventure between the takaful operator and the individualmembers of a group of participants.Takaful operations are regulated and supervised byBNM since 1988 with the appointment of the BNMGovernor as the Director-General of Takaful. In October1995, the ASEAN Takaful Group (ATG), a grouping oftakaful operators in Brunei, Indonesia, Malaysia andSingapore was formed to enhance mutual co-operationand to facilitate the exchange of business among takafuloperators in ASEAN. In 1997, the <strong>Malaysian</strong> takafulindustry took a leap forward with the formation of ASEANRetakaful International (L) Ltd. (ARIL) as an offshoreretakaful company in Labuan. <strong>The</strong> establishment of ARILwas to create a vehicle for more dynamic retakafulexchanges among ATG members and provides additionalretakaful capacity to further reduce their dependence onconventional reinsurance.Types of business<strong>The</strong> takaful businesses carried on by the <strong>Malaysian</strong> takafuloperators are broadly divided into family takaful business(Islamic "life" insurance) and general takaful business(Islamic general insurance).10 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my

Muslim jurists are of the opinionthat the operation ofconventional insurance does notconform to the rules andrequirements of Shariah as itinvolves the elements ofuncertainty (Gharar) in thecontract of insurance, gambling(Maisir) as the consequences ofthe presence of uncertainty andinterest (riba) in its investmentactivities.Family Takaful BusinessIn general, a family takaful plan is a combination of longterminvestment and mutual financial assistance scheme.<strong>The</strong> objectives of this plan are: -• to save regularly over a fixed period of time;• to earn investment returns in accordance with Islamicprinciples; and• to obtain coverage in the event of death prior tomaturity from a mutual aid scheme.Each contribution paid by the participant is divided andcredited into two separate accounts, namely: -• <strong>The</strong> Participants' Special Account (PSA)A certain proportion of the contribution is creditedinto the PSA on the basis of tabarru'. <strong>The</strong> amountdepends on the age of the participant and the coverperiod.• <strong>The</strong> Participants' Account (PA)<strong>The</strong> balance goes into the PA which is meant forsavings and investments only.Examples of covers available under family takaful businessare as follows: -• Individual family takaful plans;• Takaful mortgage plans;• Takaful plans for education;• Group takaful plans; and• Health/Medical takaful.General Takaful Business<strong>The</strong> general takaful scheme is purely for mutual financialhelp on a short-term basis, usually 12 months to compensateits participants for any material loss, damage or destructionthat any of them might suffer arising from a misfortunethat might inflict upon his properties or belongings. <strong>The</strong>contribution that a participant pays into the generaltakaful fund is wholly on the basis of tabarru'. If at the endof the period of takaful, there is a net surplus in the generaltakaful fund, the same shall be shared between theparticipant and the operator in accordance with theprinciple of al-Mudharabah, provided that the participanthas not incurred any claim and/or not received anybenefits under the general takaful certificate.<strong>The</strong> various types of general takaful scheme providedby the takaful operators include: -• Fire Takaful Scheme;• Motor Takaful Scheme;• Accident/Miscellaneous Takaful Scheme;• Marine Takaful Scheme; and• Engineering Takaful Scheme.Family Takaful:Individual planGroup planAnnuity- Mortgage- Health- Education- Travel- Family plan- Waqaf- Group family- Group medical- Employees Provident Fund- RetirementGeneral Takaful:MotorFireMarine, aviation and transitMiscellaneous Includes:- Personal accident- Workmen corporation- Liability- Engineering- House ownersRegistered Takaful Operators• CIMB Aviva Takaful Berhad• Hong Leong Tokio Marine Takaful Berhad• HSBC Amanah Takaful (Malaysia) Berhad• MAA Takaful Berhad• Prudential BSN Takaful Berhad• Syarikat Takaful Malaysia Berhad• Takaful Ikhlas Sdn Berhad• Takaful Nasional Sdn BerhadThis article is extracted from Bank Negara Malaysia’swebsite at www.bnm.com.mywww.micpa.com.myAugust <strong>2008</strong> | <strong>The</strong> <strong>Malaysian</strong> Accountant |11

FEATURECorporate Governancefor TakafulBY SAIFUL BAHRI SARONIIn managing an organisation, there must besystematic and procedural ways to ensure thesustainability and survival of the business in the fastmovingeconomy coupled with highly competitivemarket forces. Corporate governance is aimed atenhancing accountability, transparency and trustworthiness.<strong>The</strong>se values are paramount in Takaful operations as wellas Islamic financial transactions on a bigger scale.Corporate governance is about the way in which theboard of a company oversees the running of the firm by itsmanagers, and how board members are in turnaccountable to shareholders, stakeholders and thecompany.It recognises the role of market forces in the efficientallocation of resource, socio-economic justice and wellbeingof all through an integrated role of moral values,market mechanism and good governance. <strong>The</strong> salientdifferences between conventional insurance and Takafuloperator are:1. Moral values: Moral uplift aims to change thebehavior, tastes and preferences of individuals, andthereby complements the price mechanism inpromoting general well-being.2. Hereafter effect: <strong>The</strong> concept of Hereafter iscompletely ignored in the conventional practice, butis greatly emphasised in Takaful.3. Misconception of wealth maximisation: In theconventional sense, this is to serve our self-interestthrough wealth maximisation. In Takaful operations,it is not confined to serving one’s self-interest in thisworld alone, but also extended to the Hereafterthrough faithful compliance with moral values thathelp rein in self-interest so as to promote socialinterest.4. Ethics and values<strong>The</strong> conventional practice lacks the fact that ethicsand values carry into the day-to-day businessactivities. In Takaful, all resources at the disposal ofthe organisation are a trust from God, and everyindividual in the organisation will be accountablebefore Him. <strong>The</strong>re is no other option but to use themin keeping with the terms of trust. <strong>The</strong>se terms aredefined by beliefs and moral values.<strong>The</strong> relationship between Islam and economicscannot be underemphasised as there should be a balancebetween materialistic notion and religious, moral andhumanistic frame of action. Takaful operation is a branchof Islamic economics that serves the need of the public.ISLAMShariahPractices &ActivitiesMan to GodRelationshipISLAMAqidahFaith & BeliefIslamic qualitiesMan to ManRelationshipISLAMMoralities & EthicAkhlaqTo do that, Takaful must possess and practice such Islamicqualities in its transaction and dealing with itsstakeholders. <strong>The</strong>se qualities are found in the corporategovernance structure which will guide Takaful companiesto attain the highest level of integrity and trustworthinessin the financial market. In a nutshell, Takaful companiesare a branch of Islamic economics (Muamalat), which is anoffshoot of Islam itself as illustrated on the left.Corporate governance is an important facet ofTakaful business philosophy. To put it simply, corporationsmust exercise greater accountability when undertakingtheir business operations, both to their shareholders andthe public. It is in fact a systematic framework that providesa blueprint for Takaful companies to manage themselvesin the best interests of the shareholders and to manage risksin an increasingly competitive global economy. <strong>The</strong>Islamic concept of corporate governance stresses threemain areas: accountability, transparency and trustworthiness.<strong>The</strong> diagram below illustrates the concept of Islamiccorporate governance.Islamic financial transactions have essentiallyembraced the concept of corporate governance. More oftenthan not, we need a mechanism that would guide Islamiccorporations to fully embrace the importance of corporateISLAMPracticalActivitiesEconomicActivitiesSocialActivities12 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my

governance.<strong>The</strong> Takaful industry is still fairly new and requirestremendous effort from the regulatory bodies and marketparticipants to cooperate and implement good governancein their day-to-day operations.What corporate governance entailsCorporate governance can be viewed as the financialhealth tool for management and directors to monitor thehealth status of the organisation. In a way, it guides us tostay on course to remain healthy for a long time. This leadsto enhancing corporate governance (appreciation,adoption, implementation and control), which involvescollective responsibility among the regulatory agencies,professional bodies, corporate leaders as well as investorsand shareholders.<strong>The</strong> board of directors is entrusted with the conductand daily management of business activities andcommercial feasibility of the venture by using the availableassets. Directors are, therefore, subjected to higherstandards not only in the technical efficiency of operations,but also the implementation of an efficient managementsystem through the use of “best practices” developed fromhigh ethical values.A good governance system should consist of a systemof structure, operating, controlling, and monitoring acompany to achieve the following objectives:1. Fulfilling long-term strategic goals, buildingshareholders’ value by establishing a dominantmarket share and being a leader in a chosen sphere.2. Considering and caring for the needs of theenvironment and local community, including theeconomic and cultural interaction.3. Maintaining excellent relationship with customersand suppliers in terms of quality of service provided,considerate ordering and account settlementprocedures.4. Maintaining compliance with all legal and regulatoryrequirements under which the company operates.Islamic Corporate Governance FrameworkTransparencyAccountabilityTakafulOperatorTrustworthyCorporate governance isaimed at enhancingaccountability, transparencyand trustworthiness. <strong>The</strong>sevalues are paramount inTakaful operations as well asIslamic financial transactionson a bigger scale.Management should be concerned with managingthe organisation in a highly ethical way and “governance”is about seeing that it runs properly.A careful observation of corporate governance asdescribed would easily reveal that the central element isprimarily and essentially man. In short, corporategovernance is basically about the moral and ethicaldimensions of managing a company’s business.Thus this drives us to believe that man tends to beswayed from the “desired” action. To ensure that this canbe aligned with the objective and purpose of this individualin the organisation, we need to adopt a system whichwould self-correct each “intended” action. Corporategovernance will pull everyone in the organisation to bemore objective and committed in managing theorganisation in a manner that will exhibit effectivenessand efficiency.Takaful companies deal with intangible products andrequire a great deal of transparency to their prospects andclients.Responsibility and amanahAs part of the list of items in corporate governance,trustworthiness creates a long-lasting relationship betweenthe company and clients. Consequently, there should notbe any misappropriation or mismanagement of funds inTakaful operations or other types of operations for thatmatter.Islam also looks into the essence of responsibility, theconcept of work, dedication to work and vicegerency ortrusteeship. This gives Islamic corporate governance verycomprehensive coverage. And Takaful operators are notexempted from such governance.Saiful Bahri Saroni is senior vice-president/chief actuary ofTakaful Ikhlas Sdn Bhd. Email: ikhlascare@takaful-ikhlas.com.myor visit www.takaful-ikhlas.com.myThis article first appeared in March <strong>2008</strong> in the MIFMonthly Takaful Supplement. Produced with kind permission.www.micpa.com.myAugust <strong>2008</strong> | <strong>The</strong> <strong>Malaysian</strong> Accountant |13

INSTITUTE NEWSMICPA Turns50<strong>The</strong> MICPA turned 50 Golden Years onSaturday, July 26, <strong>2008</strong>. To commemoratethe momentous occasion, the <strong>Institute</strong>’sGolden Jubilee Gala Dinner with the theme AGolden Celebration on the Red Carpet washeld at Mandarin Oriental Kuala Lumpur.This event was graced by YB Dato’ Hj Hasan bin Malek,Deputy Minister in the Prime Minister’s Department who alsolaunched the <strong>Institute</strong>’s 50th Anniversary Logo. Over 600members, invited guests and staff of the Secretariat attendedthe dinner.<strong>The</strong> Deputy Minister presented Anugerah Presiden <strong>2008</strong>to a member who has made exceptional contributions tosociety, the accountancy profession and the <strong>Institute</strong> whichcan be emulated by others. YBhg Tan Sri Dato’ Seri MohdHassan Marican, President and Chief Executive <strong>Of</strong>ficer ofPetronas, was the recipient of Anugerah Presiden <strong>2008</strong>. AFellow of the <strong>Institute</strong> of Chartered Accountants in Englandand Wales (ICAEW), Tan Sri Hassan was admitted as a memberof MICPA in February 1992. He is also a member of the<strong>Malaysian</strong> <strong>Institute</strong> of Accountants (MIA). Tan Sri has builta distinguished and eminent career spanning a period ofover 35 years, both in the United Kingdom and in Malaysia.In his acceptance speech, YBhg Tan Sri Dato’ Seri MohdHassan Marican expressed that he was indeed honoured tohave been accorded the MICPA’s Anugerah Presiden on the14 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my

occasion of the <strong>Institute</strong>’s 50th Golden Jubilee. He said “to berecognised by your own fraternity” makes it very special.<strong>The</strong> President, YBhg Dato’ Nordin Baharuddinpresented a Memento and a Certificate of HonourableMention to Mr Ong Boon Bah in recognition of hismembership with the <strong>Institute</strong> for the past 49 years from dateof admission, May 2, 1959. <strong>The</strong> other recipient was Mr LimSean Teck who was admitted as a member on July 18, 1959.<strong>The</strong> <strong>Institute</strong> also recognised the First CPA Graduate Member,Mr Lim Yew Chan who sat for the CPA <strong>examination</strong> inDecember 1965 and was admitted as a member on June 25,1966.<strong>The</strong> most important asset of any organisation is its staff.<strong>The</strong> President also presented “Long Service Award” to twoSecretariat Staff, Ms Irene Ng, PA to the Executive Directorand Encik Ruslan A Hamits, <strong>Of</strong>fice Guard in recognition oftheir loyalty, diligence and dedicated service with the <strong>Institute</strong>for over 10 years.Entertainer, Amy Mastura, wooed the audience with arendition of popular songs and aptly started off with“Celebration”. She also managed to interact with theaudience and successfully persuaded the Vice President, YBhgDato’ Ahmad Johan Mohammad Raslan and CouncilMember, Mr Sam Soh Siong Hoon for a sing-along.Accountants are not boring after all!All in all, it was a pleasant and enjoyable evening.www.micpa.com.myAugust <strong>2008</strong> | <strong>The</strong> <strong>Malaysian</strong> Accountant |15

INSTITUTE NEWSRECIPIENT OF ANUGERAH PRESIDEN <strong>2008</strong>YBhg Tan Sri Dato’ SeriMohd Hassan MaricanYBhg Tan Sri Dato’ Seri Mohd Hassan Maricanwas born on October 18, 1952 in Sungai Petani,Kedah. He received his early education fromSekolah Rendah Ibrahim in Sungai Petani andlater continued his secondary education at the MalayCollege Kuala Kangsar, Perak.Tan Sri Hassan left for London in 1972 to join theaccounting firm Touche Ross & Co, as an article clerk beforequalifying as a Chartered Accountant in 1978, and becamethe first Asian to have been appointed as an AuditManager in the firm. He returned to Malaysia in 1980 andjoined Tetuan Hanafiah Raslan & Mohamad / Touche Ross& Co, Public Accountants as Audit Manager and becamea Partner of the firm a year later.A Fellow of the <strong>Institute</strong> of Chartered Accountants inEngland and Wales (ICAEW), Tan Sri Hassan was admittedas a member of MICPA in February 1992 (MembershipNo.2523). He is also a member of the <strong>Malaysian</strong> <strong>Institute</strong>of Accountants (MIA).In 1989, Tan Sri Hassan was “called” to serve theNational Oil Corporation PETRONAS as Senior Vice-President, Finance. He was appointed President and ChiefExecutive <strong>Of</strong>ficer of PETRONAS in February 1995.Tan Sri Hassan is a member of the PETRONAS Boardof Directors, and is Chairman of two public listedcompanies under the Group, namely PETRONAS GasBerhad and MISC Berhad.Beyond PETRONAS, Tan Sri Hassan is a boardmember of the Central Bank of Malaysia and a member ofthe board of Malaysia-Thailand Joint Authority. He is alsoa member of the International Investment Council for theRepublic of South Africa established by President ThaboMbeki. Tan Sri Hassan is also a board member of the WorldEconomic Forum’s Partnering Against Corruption Initiativeas well as a member of the WEF’s Council of 100 Leaders.Tan Sri Hassan has received numerous awards,among them are the Panglima Setia Mahkota (PSM) in1997 carrying the title Tan Sri, the Bintang Darjah SeriPaduka Mahkota Terengganu (SPMT) in 1996 and DarjahSultan Mahmud Terengganu Yang Amat Terpuji (DSMT) in1992, both carrying the title Dato’, the Panglima NegaraBintang Sarawak (PNBS) in 2003 which carries the titleDato Sri, and the Darjah Seri Setia DiRaja Kedah (SSDK)this year which carries the title Dato’ Seri.<strong>The</strong> French Government has awarded him the“Commandeur De La Legion D’ Honneur” in 2000 and theVietnamese Government has awarded him the “FriendshipMedal” in 2001. University of Malaya awarded him withan Honorary Doctorate in Engineering in 2001 andUniversiti Teknologi Mara awarded him with an HonoraryDoctorate in Corporate Governance in 2006. <strong>The</strong>conferment of these fine honours speaks well of hiscontribution to the country as well as internationally.PETRONAS is committed to Corporate SocialResponsibility and has contributed generously to MICPA’sevents as well as having a strong commitment towards the16 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my

accountancy profession. This is clearly demonstrated byPETRONAS’ commitment and support in offeringscholarships to students to undertake the MICPA’s CPA<strong>examination</strong>s. Practical training is an integral part of the<strong>Institute</strong>’s CPA programme apart from passing the CPA<strong>examination</strong>. Recognising the fact that supervised trainingis important, PETRONAS has registered as an ApprovedTraining Organisation (ATO) of the <strong>Institute</strong>, where underthe Stream II training, employees of PETRONAS mayundertake the CPA <strong>examination</strong>s prior to the start ofpractical training or during the training period under thesupervision of a member of MICPA or approvedprofessional body.PETRONAS was also a Gold sponsor for the MICPA-Bursa Malaysia Business Forum 2007.Ladies and Gentlemen, sincerely, I can think of noother better person to receive Anugerah Presiden <strong>2008</strong>.ACCEPTANCE SPEECH BYYBHG TAN SRI DATO’SERI MOHD HASSANMARICANI am indeed honoured to have been accorded the MICPA’sAnugerah Presiden on the occasion of the <strong>Institute</strong>’s 50thGolden Jubilee. To be recognised by your own fraternity makesit very special. Awards of this nature go beyond individualrecognition. To me, this award is an acknowledgement ofthe overall success and achievement of PETRONAS in itscontributions to the nation, to society and to thedevelopment of the profession. Working with professionalbodies, including MICPA, PETRONAS has over the years,developed more than 1,600 accountants and we continueto train accountants both in Malaysia and overseas throughvarious programmes. Hence, on behalf of PETRONAS andmyself, I humbly and sincerely accept this award.As a national body of <strong>Certified</strong> Public Accountants,MICPA has made significant contributions to thedevelopment of the modern profession in this countryover a relatively short span of 50 years. <strong>The</strong> <strong>Institute</strong> hascome a long way since its relatively modest beginningsin 1958 with 20 founding members.Members of the <strong>Institute</strong> play an active role in boththe private and public sectors including the academia.We can take pride that we have a representative in theCabinet. Today, about 37% of our members are femaleand increasing, and about 40% are below the age of 40.I would like to congratulate the <strong>Institute</strong> for itssuccess. It is my hope that it will continue to maintainits reputation as a premier accounting body, both inMalaysia and overseas. I would also like to call upon theyoung members to actively participate in the affairs ofthe <strong>Institute</strong> to take it to greater heights.It has been some years since I left the profession. Inthat time, the profession has evolved into globalbusinesses through mergers and consolidations. Today,the Big Four amongst the professional firms are nodifferent to the super-majors in the oil industry, wieldinghuge influence.Indeed, the profession today does much more thanaudit. We challenge people and organisations, clientsand colleagues, to think and act differently, to provideclarity and rigour, to help create and sustain prosperity.As leaders and advisors to major businesses, we have aresponsibility and a role to play in fostering change. Wenow live in an age of increased accountability wherepublic expectations are high and we need to be able todemonstrate that as a profession, we are both relevantand a powerful force for change. This requires us to becompetent, responsible and uphold a strong sense ofethics and integrity. While professional firms today aremulti-million dollar businesses, we must continue to actobjectively especially in the face of intense pressures.Some thoughts especially for the young practitioners.You can shape your own character by how you handleyourself. Are you going to hold to your principles or areyou going to rationalise away little deviations from thoseprinciples? Will you sacrifice your principles for yourown ambition? And will you put the firm and yourcolleagues at risk for personal benefits? <strong>The</strong>se are simplequestions and it is so easy to cross that line. But believeme, you cross it once, you will never come back.Finally, on behalf of PETRONAS and myself, Iwould like to once again express my sincere appreciationto the <strong>Malaysian</strong> <strong>Institute</strong> of <strong>Certified</strong> Public Accountantsfor this great honour.Thank you.www.micpa.com.myAugust <strong>2008</strong> | <strong>The</strong> <strong>Malaysian</strong> Accountant |17

YOUNG CPAYoung CPA MalaysiaSymposium <strong>2008</strong>Charting the Future of Accounting and Finance ProfessionalsOn August 6, <strong>2008</strong> the Young CPA MalaysiaSymposium <strong>2008</strong> with the theme Charting theFuture of Accounting and Finance Professionalswas held at the Sime Darby ConventionCentre. <strong>The</strong> Symposium was specially designed to addresspertinent issues in today’s business environment and toprovide young accounting and finance professionals withcritical understanding of the changing financial regulatorylandscape and emerging trends across the profession. Thiswould further help them to capitalise on their careerdevelopment opportunities.<strong>The</strong> Symposium, attended by over 70 participantscommenced with a welcome address by the Chairman ofthe Young CPA Group, Encik Abdul Halim Md Lassim. Hehighlighted the importance of acquiring soft skills intoday’s challenging environment as young businessprofessionals progressively advance into managementpositions.<strong>The</strong> President of the <strong>Institute</strong>, YBhg Dato’ NordinBaharuddin delivered the Keynote Address and officiallydeclared open the Symposium. In his address, Dato’Nordin advised participants to continually upgrade theirknowledge, skills and expertise in order to provide relevantand high quality services to employers and clients. He alsoencouraged participants to facilitate entrepreneurship,create value, manage risk and rationalise complexity tomeet the needs of both the local communities and globalmarkets. He urged young CPAs to uphold their objectivity,integrity and technical excellence in whatever capacitiesthey may be serving.After the formalities were over, a panel of highlyexperienced business professionals led discussions andshared their knowledge, experiences and best practiceswith participants in the following 4 Sessions.<strong>The</strong> first Session, “Reflection on the Past Years ofFinancial Regulatory Reform and Corporate Failures – Impactson Next Generation Accountants and Finance Managers”, waspresented by Mr Ong Ching Chuan, Senior ExecutiveDirector at PricewaterhouseCoopers. He deliberated on thechanging external business environments and its directimpact on the role and career aspirations of accountingand finance professionals. <strong>The</strong> session was moderated byEncik Ahmad Shahrul Hj Mohamed, a member of MICPA’sYoung CPA Group and a Partner at Khairuddin Hasyudeen& Razi<strong>The</strong> second Session was on “Employment Trends – <strong>The</strong>Specialities and Skills in Demand”, which was delivered by MrKok Ghee, Senior Manager, Group Business System atJobStreet.com. He provided an insight on the specialitiesand skills in demand and the current recruitment andretention strategies of various organisations in response tothe changes in the business environment.18 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my

Session three was on “Working Abroad – <strong>The</strong> Myths,Traps and Tips”. Two CPA members, Ms Soh Eng Hooi,Executive Director of Moore Stephens AC and En MohdMuazzam Mohamed, Executive Director, IT AdvisoryServices at KPMG shared their experiences withparticipants on working abroad. Sessions two and threewere moderated by Encik Abdul Halim Md Lassim,<strong>The</strong> last session was a Roundtable Discussion on“Charting the Future of Accounting & Finance Professionals”.This interactive session between the panellists andparticipants facilitated an exchange of ideas. <strong>The</strong>panellists concurred that young accounting and financeprofessionals must embrace the right skills to be successfulin a changing profession.For young accounting and finance professionals, thesymposium was a step forward in their careers. It providedan opportunity for participants to garner first-handknowledge on a wide array of issues in today’s globalisedenvironment.When approached for comments, most participantsagreed that the event was both timely and relevant, inview of the changing business environment and the needto address the challenges with the relevant knowledge,skills and attitudes.INSTITUTE NEWSMAY <strong>2008</strong> EXAMINATIONPerformance in Individual SubjectsPARTAdvanced StageExaminationSUBJECTModule CAdvanced TaxationPASSED%57.5CPA STUDENTSFAILED%42.5Module DAdvanced Financial ReportingModule EAdvanced Auditing & Assurance15.457.684.642.4Advanced Taxation(Shamsir Jasani Grant Thornton Gold Medal)Module FAdvanced Business Management& Integrative Case StudyWinners of Subject Prizes24.4NG YI SHEUE (MISS) (2/760S)75.6Advanced Auditing & Assurance WONG SHENG HUEI (1/7395)(Ernst & Young Gold Medal)Presentation of <strong>2008</strong> MICPA Excellence Awards, ExaminationCertificates, Prizes, Membership and Practising CertificatesWe are pleased to inform that the Presentationof <strong>2008</strong> MICPA Excellence Awards,Examination Certificates, Prizes, Membershipand Practising Certificates will be held onSaturday, October 25, <strong>2008</strong> at 10:00 a.m. to 12:30 p.m. at PacificBallroom, Best Western Premier Seri Pacific Kuala Lumpur.<strong>The</strong> presentation ceremony will be officiated by YB DatukIr Hj Idris bin Hj Haron, Deputy Minister of Higher Education I.All registered students of the <strong>Institute</strong> who havecompleted the Advanced Stage Examination in November2007 or May <strong>2008</strong>, shall wear graduation gowns at thePresentation Ceremony. Please note that the closing datefor registration and gown rental is Friday, October 17, <strong>2008</strong>.Late entries will not be entertained.<strong>The</strong> administrative details and registration form forthe Presentation Ceremony are available on the studentwebsite www.micpa.com.myFor further information, please contact the PublicAffairs & Communications Manager on Tel: 03-2698 9622or e-mail: vic.pr@micpa.com.mywww.micpa.com.myAugust <strong>2008</strong> | <strong>The</strong> <strong>Malaysian</strong> Accountant |19

NOVEMBER <strong>2008</strong> EXAMINATIONTIME TABLEProfessional Stage ExaminationDATE MORNING AFTERNOON(9:00 a.m. – 12:00 noon) (2:00 p.m. – 5:00 p.m.)Monday (November 24) Financial Accounting and Taxation Financial ReportingTuesday (November 25) Business and Company Law Auditing and AssuranceWednesday (November 26) Management Information and Control Business Finance & ManagementAdvanced Stage ExaminationDATE TIME EXAMINATION PAPERMonday (November 24) 9:00 a.m. – 12:00 noon Advanced TaxationTuesday (November 25) 9:00 a.m. – 12:30 p.m. Advanced Financial ReportingWednesday (November 26) 9:00 a.m. – 12:30 p.m. Advanced Auditing & AssuranceThursday (November 27)Advanced Business Management& Integrative Case Study9:30 a.m. – 11:30 a.m. Part A - Integrative Case Study[8:45 a.m. – 9:30 a.m. (Reading Time)]12:30 p.m. – 2:30 p.m. Part B - Advanced BusinessManagementAdmitting ExaminationBye-Law 34(1)(f) [formerly bye-law 33(d)] Examination CandidatesDATE TIME EXAMINATION PAPERMonday (November 24) 9:00 a.m. – 12:00 noon <strong>Malaysian</strong> TaxationTuesday (November 25) 9:00 a.m. – 12:00 noon Regulatory & Financial ReportingFramework of Malaysia20 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my

MAY <strong>2008</strong> EXAMINATION RESULTSCPA STUDENTSList of Successful Candidates<strong>The</strong> President and Council of <strong>The</strong> <strong>Malaysian</strong> <strong>Institute</strong> of <strong>Certified</strong> Public Accountantscongratulate successful candidates in the May <strong>2008</strong> Examination.<strong>The</strong> following candidates passed Module C to thesatisfaction of the Examination Committee:CANDIDATEDZULFIQAR AZLI B AYUB @ ABDUL RAHIMDZULFIQRI AZLI B AYUB @ ABDUL RAHIMEE MENG WANGEMY IRLIANA BT KAMARUZZAMAN (CIK)FOONG YIN TENG (MISS)IZNI FAUZAN BT ZULKIFLY (CIK)LEONG SIN NEE (MISS)MEGAT MOHAMED NAQUIYUDDIN B SONARIMOHD AIZUDDIN BIN OMARMOHD FAIZAL B MOHD FARIDMOHD FUAD RUSHDY BIN MOHAMED RASHIDMOHD NIZAM B ABDULLAHMOHD SHAIPUL BARKHIYAH B MASORMOHD ZULFAHMI BIN HUSSAINMUHAMMAD ADHWA B ISMAILNG YI SHEUE (MISS)NOOR FARALINA BT MOHD FAIRUZ (CIK)SHAH NIZAM B MAHD RASIDSHARIFAH MARINI SYED AHMAD LABIB (CIK)TAN CHEE HEANTANG SOO LEE (MISS)TEH SUET GHOON (MISS)WAN NURAINA ZAHRA BT HJ WAN NAFI (CIK)CANDIDATEAHLAM NABIHAH BINTI MOHD SAFIE (CIK)ANIS NADIA BINTI CHE MUSTAFAR (CIK)MD HENDREE BIN JOHARING PEI LING (MISS)NUR AMIZA BINTI AMAN (CIK)ROSEDALIANA BINTI ABDUL RAHIM (CIK)PRINCIPAL/STREAMStream II (S)Stream II (S)Stream II (S)Stream II (S)Stream II (S)Stream II (S)Stream II (S)Stream II (S)Stream II (S)Stream II (S)Ho Yuet Mee/Stream IStream II (S)Stream II (S)Stream II (S)Stream II (S)Stream II (S)Stream II (S)Stream II (S)Stream IIStream II (S)Stream II (S)Habibah Abdul/Stream IStream II (S)<strong>The</strong> following candidates passed Module D to thesatisfaction of the Examination Committee:PRINCIPAL/STREAMShirley Goh/Stream ITeoh Soo Hock/Stream ILee Yoke Khai, Gary/Stream ITan Soo Yan/Stream IStream IIStream II (S)<strong>The</strong> following candidates passed Module E to thesatisfaction of the Examination Committee:CANDIDATEPRINCIPAL/STREAMALIYAH HANIM BINTI ABD HALIM (CIK)Lee Tuck Heng/Stream IENG YUH YUN (MISS)Datuk Tan Kim Leong/Stream IGAN SEK LING (MISS)Habibah Abdul/Stream IGOH CHEE YONGSiew Chin Kiang/Stream IKHOR SEW LIN, SERENE (MISS)George Koshy/Stream ILEW CHUI HOONG (MISS)Loh Kok Leong//Stream ING LING ZTE (MISS)Ooi Lip Aun, Eric/Stream INISHA NOR BINTI NOOR HASAN (CIK)Ooi Lip Aun, Eric/Stream IONG YUN LING (MISS)George Koshy/Stream ISU SIEW LING (MISS)Eric Ooi Lip Aun/Stream ISUHAIRI BIN JAWATeoh Soo Hock/Stream ISUM MEE JIUN (MISS)Dato' Gregory Wong Guang Seng/Stream ISUZIELA BINTI ABU YAMIN (CIK)Ooi Lip Aun, Eric/Stream ITAN BEE HWA (MISS)TEOH KHENG KOKTEOH WEE TONGWONG SHENG HUEIYAN WAI MEI (MISS)ZEID BIN ABDUL RAZAKChan Kam Chiew/Stream INg Swee Weng/Stream INg Swee Weng/Stream IChoong Mei Ling/Stream ISeow Yoo Lin/Stream IYap Seng Chong/Stream I<strong>The</strong> following candidates passed Module F to thesatisfaction of the Examination Committee:CANDIDATEPRINCIPAL/STREAMCHOO MING YEE (MISS)Pushpanathan a/l SA Kanagarayar//Stream IFADZILAH BINTI MOHAMED (CIK)Abdullah Abu Samah/Stream ILEE YIH HONGLee Yoke Khai, Gary//Stream ING AI LIN (MISS)Tan Hock Hin/Stream INORHAIDA BINTI YAHAYA (CIK)Ooi Lip Aun, Eric//Stream IONG SIOU HWEE (MISS)See Huey Beng/Stream IPHANG SOON YEOWShirley Goh/Stream ISYAHRUL NAZRI BIN MOHD SAI'ON Sivadasan s/o Narayana Nair/Stream ITAN SZE MEI (MISS)Ooi Lip Aun, Eric//Stream ITONG SHEAU WEI (MISS)Shirley Goh/Stream IYEAP KOH SIN (MISS)Lee Tuck Heng/Stream I<strong>The</strong> following candidate passed Business &Company Law as a single subject:CANDIDATEAHMAD FAZRIL B MOHD FAUZIPRINCIPAL/STREAMStream II<strong>The</strong> following candidates completed the AdvancedStage Examination to the satisfaction of theExamination Committee:CANDIDATEPRINCIPAL/STREAMCHOO MING YEE (MISS)Pushpanathan a/l SA Kanagarayar//Stream IFADZILAH BINTI MOHAMED (CIK)Abdullah Abu Samah/Stream ILEE YIH HONGLee Yoke Khai, Gary//Stream ING AI LIN (MISS)Tan Hock Hin/Stream INORHAIDA BINTI YAHAYA (CIK)Ooi Lip Aun, Eric//Stream IONG SIOU HWEE (MISS)See Huey Beng/Stream IPHANG SOON YEOWShirley Goh/Stream ISYAHRUL NAZRI BIN MOHD SAI'ON Sivadasan s/o Narayana Nair/Stream ITAN SZE MEI (MISS)Ooi Lip Aun, Eric//Stream ITONG SHEAU WEI (MISS)Shirley Goh/Stream IYEAP KOH SIN (MISS)Lee Tuck Heng/Stream I<strong>The</strong> following candidates passed Regulatory &Financial Reporting Framework of Malaysia to thesatisfaction of the Examination Committee:CANDIDATEAFFENDI BIN RASHDISIA YEAK HONGwww.micpa.com.myAugust <strong>2008</strong> | <strong>The</strong> <strong>Malaysian</strong> Accountant |21

INSTITUTE NEWSContinuing Professional Development(CPD) Programmes<strong>The</strong> <strong>Institute</strong> organised the following CPDprogrammes in the months of July - August <strong>2008</strong>:A one-day Workshop on Recent Case Laws and TaxDevelopments on July 2, <strong>2008</strong>. <strong>The</strong> objective of theworkshop was to provide participants with an in-depthunderstanding of the tax changes and developmentsbrought about by the decisions made to the recent caselaws. Mr Harvinder Singh, Managing Partner of Harvey &Associates led discussions.A one-day Workshop on Accounting for Constructionand Property Development Activities (FRS 111, FRS 1232004 andFRS 2012004) on July 14, <strong>2008</strong> at the Legend Hotel KualaLumpur. <strong>The</strong> workshop aimed to discuss the importantaspects of these FRSs and to highlight the major areas ofdifficulty in measuring and recognising revenue and costsassociated with construction contracts and propertydevelopment activities. Ms Lim Geok Heng, a freelancetechnical and training consultant led the discussions.A two-day Workshop on A Practical Guide to Auditingon July 28 & 29, <strong>2008</strong> at the Legend Hotel, Kuala Lumpur.<strong>The</strong> objective of the workshop is to equip participants withthe technical knowledge and skills in conducting an auditof financial statements in accordance with internationalstandards on auditing, which have been adopted forapplication in Malaysia.A one-day Workshop on Understanding FinancialStatements for Directors and Senior Management on July 17,<strong>2008</strong> at the Legend Hotel, Kuala Lumpur. Ms Ng Mi Li, MrOng Ching Chuan and Ms Yee Chai Yun led participants toconsider how to manage shareholders’ expectations,knowing how the financials will be reported, and thecommunication of the financial information thereof.Participants also received a checklist of questions theyshould consider asking executive management indischarging their duties, particularly, pertaining to thefinancial information.Career Talks at Secondary Schools<strong>The</strong> <strong>Institute</strong> continued in its efforts to presentscheduled career talks at secondary schools toForms 4, 5 and 6 students undertaking theprinciples of accounting subject. For the month of July, the<strong>Institute</strong> presented a talk on Career in Accountancy to:70 students at SMK TTDI Jaya, Shah Alam onTuesday, July 1, <strong>2008</strong>;120 students at SMK Alam Megah 2, Shah Alam onWednesday, July 2, <strong>2008</strong>;120 students at SMK Sultan Abdul Samad onThursday, July 3, <strong>2008</strong>;160 students at SMK Seafield, Subang Jaya onTuesday, July 8, <strong>2008</strong>; and70 students at SMK Bandar Utama on Wednesday,July 16, <strong>2008</strong>.22 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my

Career Fairs and Exhibitions<strong>The</strong> <strong>Institute</strong> continued with its on-going efforts toembark on a more aggressive marketing strategyto position the CPA and CFiA as the designatedchoice. In this respect, the <strong>Institute</strong> participates regularlyin career fairs and exhibitions across the country to promoteaccountancy as a career choice and in particular to creategreater awareness of the CPA Malaysia and CFiA qualification.For the months of July – August <strong>2008</strong>, the <strong>Institute</strong>participated in the following career fairs and exhibitions:Universiti Malaya Interaction Week<strong>The</strong> Accounting Club of Universiti Malaya organisedInteraction Week <strong>2008</strong> with the theme “Dream IgnitesPassion, Passion Creates Reality” from July 18–19, <strong>2008</strong>.<strong>The</strong> MICPA was a sponsor for the event and presented aCareer Talk to UM accounting students on Saturday, July19, <strong>2008</strong>. <strong>The</strong> talk was presented by Dr Veerinderjeet Singh,Council Member of MICPA. CPA Ambassadors, Mr TiowWei Sheng and Mr Lim Chu Guan also shared with thestudents their experiences as a CPA.Accountancy & Career Education Fair (ACEF) <strong>2008</strong><strong>The</strong> <strong>Malaysian</strong> <strong>Institute</strong> of Accountants (MIA) organisedthe Accountancy & Career Education Fair (ACEF) <strong>2008</strong> on July26 & 27, <strong>2008</strong> at the Sunway Pyramid Convention Centre.<strong>The</strong> MICPA participated in the fair as part of the accountancypavilion.IIUMInternational Islamic Universiti Malaysia - Exhibitionon Job Market and Career Week <strong>2008</strong><strong>The</strong> MICPA participated as an Exhibitor in the Exhibition onJob Market and Career Week <strong>2008</strong> held in conjunction withIIUM E-Fest <strong>2008</strong> from July 14-18, <strong>2008</strong> at the CulturalActivity Centre at IIUM. <strong>The</strong> objective was to increaseawareness and profile the CPA Malaysia qualification toIIUM students. Other exhibitors included professionalbodies, banking institutions and Government agencies.CPA firm HLB Ler Lum also shared the booth space withMICPA to undertake recruitment of students.ACEF <strong>2008</strong>Universiti Kebangsaan Malaysia – Accountancy Week <strong>2008</strong><strong>The</strong> MICPA participated as an Exhibitor in UKM’s AccountancyWeek <strong>2008</strong> with the theme “Profesion Perakaunan MenjulangKemerdekaan, Mengharungi Cabaran”, which was heldfrom August 13 – 20, <strong>2008</strong>. <strong>The</strong> MICPA was also a sponsorfor the event.UMUKMwww.micpa.com.myAugust <strong>2008</strong> | <strong>The</strong> <strong>Malaysian</strong> Accountant |23

INSTITUTE NEWSCollaboration and Career Talks at UniversitiesAs part of the <strong>Institute</strong>’s efforts to foster closercollaboration with the universities in a positive andmutually beneficial manner, the <strong>Institute</strong> hasscheduled meetings with the Deans of the Faculty ofAccountancy of the various public universities. <strong>The</strong> aim isto promote the CPA Malaysia and CFiA qualification toaccountancy students as well as lecturers.<strong>The</strong> <strong>Institute</strong>’s Executive Director, Mr Foo Yoke Pinwas kept busy presenting Career Talks at the followinguniversities in the months of July - August <strong>2008</strong>. <strong>The</strong> visitswere also a platform for the <strong>Institute</strong> to have discussionswith the academic staff.Universiti Kebangsaan MalaysiaJuly 28, <strong>2008</strong>: Career Talk to 200 accountancy students;Universiti Putra MalaysiaJuly 31, <strong>2008</strong>: Career Talk to 200 accountancy students.CPA ambassador, Mr Tiow Wei Sheng was also present toshare his experiences as a CPA with the accountingstudents;Universiti Utara MalaysiaAugust 7, <strong>2008</strong>: Career Talk to 300 accountancy students.At the same talk, YBhg Datin Fadzillah Saad, Councilmember of MICPA also presented a talk on the CFiAqualification to UUM lecturers; andUniversiti Sains MalaysiaAugust 8, <strong>2008</strong>: Talk on the CFiA qualification to USM lecturers.MICPA–BURSA MALAYSIABusiness Forum <strong>2008</strong><strong>The</strong> 5th MICPA-Bursa Malaysia Business Forum<strong>2008</strong> will be held on October 20 & 21, <strong>2008</strong> at theShangri-La Hotel Kuala Lumpur. Featuring thetheme, Reinventing for Success, the Business Forumwill provide an invaluable platform for the exchange of ideasand experiences on the strategies and measures undertakento promote reinvention and to strengthen the growth ofbusinesses in light of the changing landscape and trends ofglobal business.<strong>The</strong> Organising Committee has invited YB Senator TanSri Datuk Amirsham A. Aziz, Minister in the Prime Minister’sDepartment, to deliver the Opening Keynote Address, as wellas, speakers and panelists comprising prominent corporateleaders, senior Government officers, business professionalsand capital market regulators, including to lead discussions inthe plenary sessions over the two-days.Target participants for the MICPA-Bursa MalaysiaBusiness Forum <strong>2008</strong> are company directors, CEOs, CFOs,senior Government officers, fund managers, investmentadvisers and business professionals.For further information on the MICPA-Bursa MalaysiaBusiness Forum <strong>2008</strong>, please contact Ms Evelyn Lim,Marketing Manager at Tel: 03-2698 9622 or e-mail:bizforum08@micpa.com.my<strong>The</strong> plenary sessions will include the following topics:Day 1Session 1: Global Business Trends: ThreatsAnd OpportunitiesSession 2: Corporate Governance:Where Are We Going?Session 3: Creating Value After ListingDay 2Session 4: Managing Risk in a ChallengingEnvironmentSession 5: <strong>The</strong> Environment: Truth Be ToldSession 6: Investment Opportunities in theMiddle East and Africa24 | <strong>The</strong> <strong>Malaysian</strong> Accountant | August <strong>2008</strong> www.micpa.com.my